What to Buy?

In my Dividend Growth Portfolio, I reinvest dividends monthly into a stock that I choose. I don’t drip the dividends. Rather I invest them selectively into companies that are particularly attractive.

This year, as last year, I am focusing on the smaller positions in my portfolio, because I want to clean up the low end of my lineup: Either build the smaller positions that I have confidence in for the long term, or toss out those that no longer inspire me.

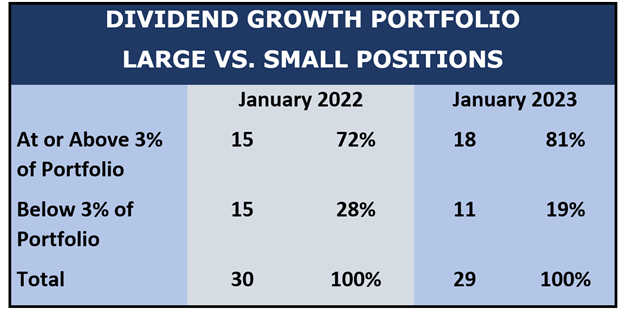

For this focus, I define “small position” as one that takes up less than 3% of my portfolio. This table shows that I did a lot of housecleaning at the low end in 2022:

I reduced the number of small positions from 15 to 11 and lowered their percent of the portfolio from 28% to 19%. I’m very happy with that progress.

I reduced the number of small positions from 15 to 11 and lowered their percent of the portfolio from 28% to 19%. I’m very happy with that progress.

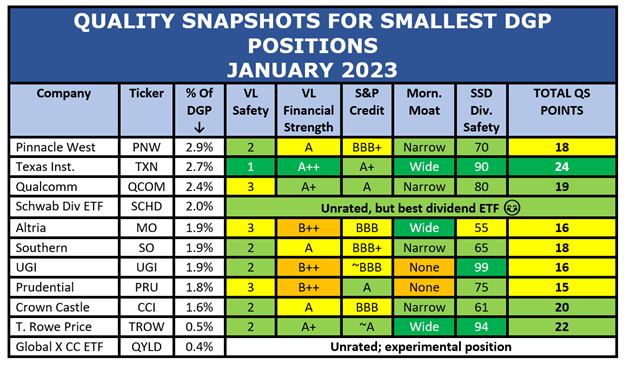

Here are the quality profiles of the remaining small positions:

The arrow at the top of the third column indicates that the table is sorted by position size. Second from the top, Texas Instruments (TXN) jumps out as the highest-quality company in the list: It gets the maximum possible grade in four out of five categories, for a total of 24 out of 25 possible QS points.

The arrow at the top of the third column indicates that the table is sorted by position size. Second from the top, Texas Instruments (TXN) jumps out as the highest-quality company in the list: It gets the maximum possible grade in four out of five categories, for a total of 24 out of 25 possible QS points.

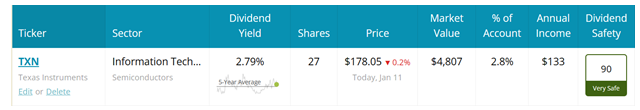

Here is my current position in TXN:

(Source: Simply Safe Dividends)

(Source: Simply Safe Dividends)

I’ve purchased TXN three times, beginning in 2018. I’m not sure, to be honest, why I haven’t built the position more. It’s actually one of my favorite companies.

Is it eligible to build? Its yield is 2.8%, which is about the minimum that I like to get when I add shares to this portfolio.

I also require at least a fair valuation. If you want to see how I figure valuations, click on this video:

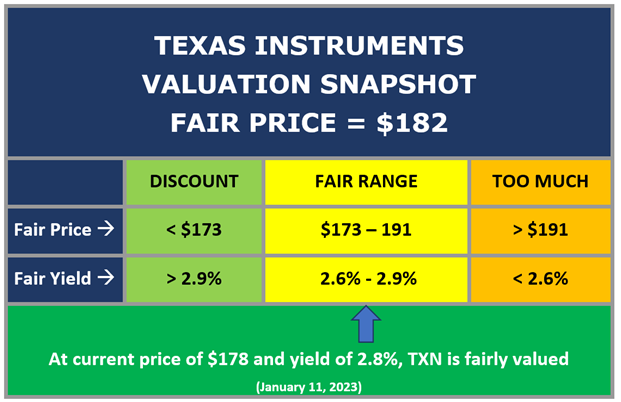

After running the numbers, here is how I value Texas Instruments.

After running the numbers, here is how I value Texas Instruments.

Normally, I like to get stocks at a discount, but for a high quality stock like TXN, I’m willing to pay fair price. Its current price is about $4 cheaper than its fair value.

Normally, I like to get stocks at a discount, but for a high quality stock like TXN, I’m willing to pay fair price. Its current price is about $4 cheaper than its fair value.

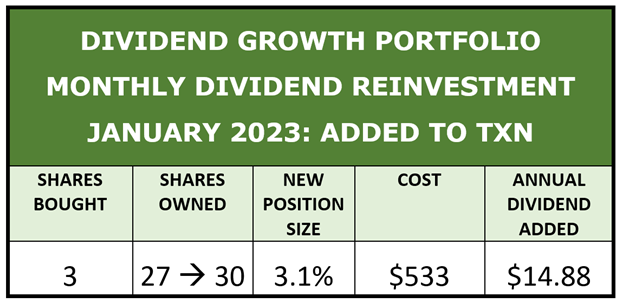

January Dividend Reinvestment: Texas Instruments (TXN)

For the above reasons, I selected Texas Instruments (TXN) for my January reinvestment. Here are the details of my purchase:

Here are a few factoids about this purchase:

Here are a few factoids about this purchase:

- It takes TXN out of the “small position” category. It’s now up to 3.1% of the portfolio.

- TXN just raised its dividend 7.8% with its November payout.

- My new shares will qualify for the next payout, which I expect to be declared later this month and paid in February.

As with several of my recent purchases, this investment is a play on the breathtaking growth of electronic data in all of its forms. TXN occupies a unique place in the chip world: About 80% of its business comes from analog chips.

Analog chips can read or process an analog signal (like temperature) and convert it into a digital signal. Obviously, this capability is necessary in the real world to make digital signal processing possible.

This is how TXN describes itself:

We are a global semiconductor company that designs, manufactures, tests and sells analog and embedded processing chips. Our approximately 80,000 products help over 100,000 customers efficiently manage power, accurately sense and transmit data and provide the core control or processing in their designs….E]ach generation of innovation builds upon the last to make our technology smaller, more efficient, more reliable and more affordable – opening new markets and making it possible for semiconductors to go into electronics everywhere.

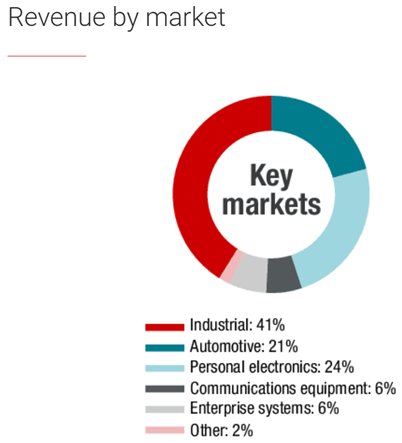

Texas Instruments was founded in 1930 and is headquartered in Dallas. It has 31,000 employees in facilities around the world. Here are the markets into which it sells:

(Source: Texas Instruments)

(Source: Texas Instruments)

I am happy to build out my position in Texas Instruments.

Dividend Growth Portfolio Update

Within the past couple of weeks, I have presented portfolio updates twice – monthly update here and annual review here – so I won’t repeat all of that information in this article.

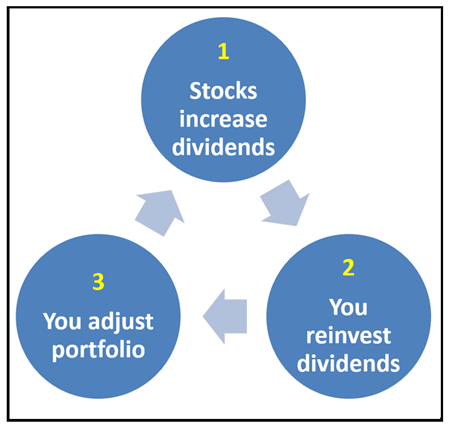

I will remind you that there are three reasons that dividends go up relentlessly in a dividend-growth portfolio.

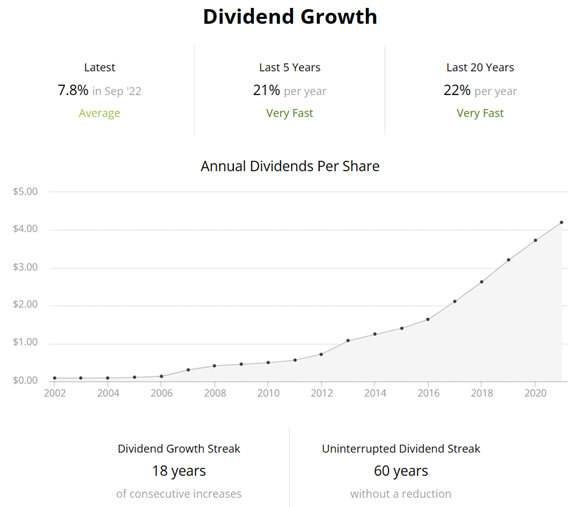

- Stocks raise their dividends. You choose stocks deliberately for their propensity to do this. To use Texas Instruments as an example, here is what its dividend record looks like for the past two decades:

(Source: Simply Safe Dividends)

(Source: Simply Safe Dividends)

- You reinvest dividends. Those reinvestments add more shares. Since dividends are paid per share, that causes your income to go up.

- You adjust your portfolio. Activities like rebalancing, selling out of a stock, and trimming one stock to switch into a higher-yielding stock are all examples of portfolio management that can boost your income.

The purchase of Texas Instruments is my first dividend reinvestment for 2023, so that makes it the first entry in my Reinvestment Tracker for the year.

These small reinvestments add up. The current one added just $15 to the portfolio’s annual dividend run-rate. But by the end of the year – as companies increase their dividends and the monthly investments become larger due to growing income – the year-end total might be on the order of $200 altogether.

These small reinvestments add up. The current one added just $15 to the portfolio’s annual dividend run-rate. But by the end of the year – as companies increase their dividends and the monthly investments become larger due to growing income – the year-end total might be on the order of $200 altogether.

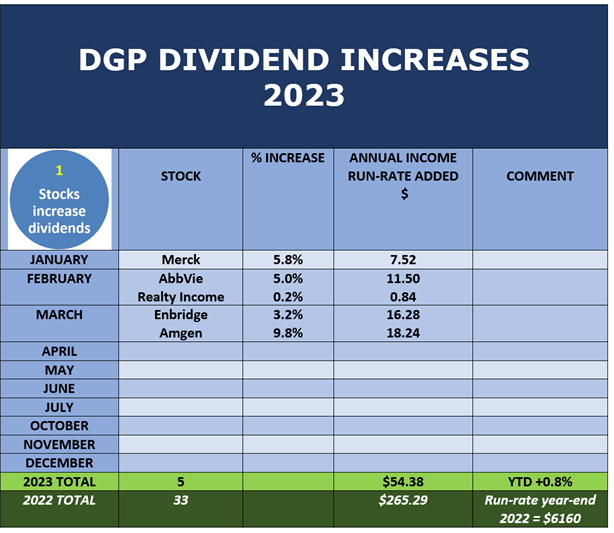

And I can also present my tracker for Reason #1: A few companies have already announced dividend increases to take effect in 2023. So here is my Increase Tracker so far.

Remember, I do not present this portfolio as best or a model for what anyone else should do. I show what I do and why I do it, in the hopes that other investors will find it inspirational and educational for their own purposes.

Remember, I do not present this portfolio as best or a model for what anyone else should do. I show what I do and why I do it, in the hopes that other investors will find it inspirational and educational for their own purposes.

Thanks for reading!

-–Dave Van Knapp

The name of the ONE stock (ticker symbol and all) that has helped over 170,000 people discover how to gain their financial freedom... Learn More.

Source: Dividends & Income