The new year is a fantastic time to re-evaluate your investing strategy. With the market in a slump, now could be a smart time to buy.

It’s more important than ever, however, to choose your investments wisely. If a recession is on the horizon, some stocks may not be able to recover. But with the right investments, you can invest now at a steep discount and potentially see significant returns when the market rebounds.

While everyone’s investing strategy will differ, there’s one ETF I’m stocking up on in 2023: the Vanguard Growth ETF (VUG).

How a growth ETF can supercharge your savings

A growth ETF is a fund that only includes stocks with the potential for above-average growth. The Vanguard Growth ETF aims to track the performance of the CRSP U.S. Large Cap Growth Index and includes 247 stocks from a variety of industries.

Nearly half of the fund is comprised of stocks from the tech sector, and the largest holdings include Apple, Microsoft, Amazon, and Alphabet. By investing in this ETF, you’LL own a stake in all of these companies.

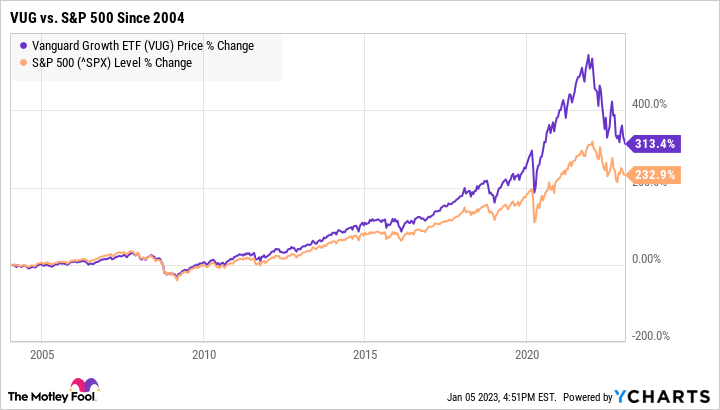

The biggest advantage of growth ETFs is that they’re often able to beat the market. In fact, since the Vanguard Growth ETF was established in 2004, it’s seen returns of more than 313% — compared to the S&P 500‘s roughly 233% return in that time frame.

In other words, if you had invested $10,000 in the Vanguard Growth ETF in 2004, you’d have more than $41,000 today, versus $33,000 with the S&P 500.

In other words, if you had invested $10,000 in the Vanguard Growth ETF in 2004, you’d have more than $41,000 today, versus $33,000 with the S&P 500.

Why now could be a smart time to buy

When the market is in a slump, it can be a daunting time to invest. But right now can actually be a fantastic buying opportunity, as prices are lower than they’ve been in a long time.

The Vanguard Growth ETF is currently priced at around $209 per share, down from roughly $308 per share one year ago. By investing now, you’re buying the same ETF, but at a nearly $100 per-share discount.

Also, when you buy during the downturns, you’re primed to take advantage of the market’s inevitable rebound. For example, say you had invested in this ETF in early 2009, at its lowest point during the Great Recession. Over the following year alone, you would have seen returns of nearly 70%. Within two years, you would have nearly doubled your money.

Of course, nobody can say for certain how this bear market will pan out, and there are no guarantees that this ETF’s future performance will be similar to its past. But by investing during the low points, it’s easier to take advantage of the market’s upswings.

Of course, nobody can say for certain how this bear market will pan out, and there are no guarantees that this ETF’s future performance will be similar to its past. But by investing during the low points, it’s easier to take advantage of the market’s upswings.

Is this the right ETF for you?

Before you buy, there are a few downsides to consider. For one, this fund can be subject to intense short-term volatility.

All stocks will experience short-term slumps. This ETF, however, is heavily weighted toward tech stocks (which are famous for their ups and downs), so you’ll likely see more significant fluctuations.

That’s not necessarily a bad thing, as investing is a long-term game. If you’re willing to hold this investment for several years (if not decades), the short-term volatility likely won’t matter as much. But if the roller coaster of ups and downs would cause you to lose sleep, this ETF may not be the best fit.

That’s not necessarily a bad thing, as investing is a long-term game. If you’re willing to hold this investment for several years (if not decades), the short-term volatility likely won’t matter as much. But if the roller coaster of ups and downs would cause you to lose sleep, this ETF may not be the best fit.

Also, it’s wise to make sure the rest of your portfolio is well-diversified if you choose to invest in this ETF. Growth ETFs often earn higher returns than their more established counterparts, but they’re also riskier. With a balanced portfolio, you can take advantage of these above-average returns, while still limiting your risk.

The Vanguard Growth ETF can be a fantastic addition to your portfolio, and with enough time, it could potentially help you make a lot of money. By understanding the risks and rewards, you can decide whether it’s a good fit for you.

— Katie Brockman

Motley Fool Stock Advisor's average stock pick is up over 350%*, beating the market by an incredible 4-1 margin. Here’s what you get if you join up with us today: Two new stock recommendations each month. A short list of Best Buys Now. Stocks we feel present the most timely buying opportunity, so you know what to focus on today. There's so much more, including a membership-fee-back guarantee. New members can join today for only $99/year.

Source: The Motley Fool