The US stock market is one of the best long-term wealth generators in the entire world.

After all, most of the world’s most successful companies are from the US.

And if you can own a slice of a terrific business, you’re likely to get terrific returns.

But here’s a secret.

From 1960 on, more than 80% of the S&P 500’s total return came from reinvested dividends.

Dividends are the secret powerhouse of the US stock market.

Growing dividends.

That’s right.

If you invest in businesses that pay growing dividends, you’re liable to do even better than the market as a whole.

That’s because the very businesses actually able to pay growing dividends are only able to do so because they’re producing the growing profit necessary for that.

And it should go without saying that growing profit only comes about from running a great business.

This circular concept is at the heart of dividend growth investing.

You can see hundreds of these businesses by perusing the Dividend Champions, Contenders, and Challengers list.

This list contains pertinent data on 700+ US-listed stocks that have raised dividends each year for at least the last five consecutive years.

I’ve been using the dividend growth investing strategy for more than a decade now, building my FIRE Fund in the process.

That’s my real-money portfolio.

And it produces enough five-figure passive dividend income for me to live off of.

I’ve been living off of dividends for years.

I’ve been living off of dividends for years.

Indeed, I retired in my early 30s.

How?

My Early Retirement Blueprint explains.

Staying true to the tenets of the dividend growth investing has been at the heart of my success.

One of those tenets relates to valuation.

While price is what you pay, it’s value that you ultimately get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

Buying high-quality dividend growth stocks when they’re undervalued should supercharge the US stock market’s immense capabilities to build wealth and passive income over the long run.

Now, spotting undervaluation does require one to first understand valuation.

Good news.

It’s not that difficult.

Fellow contributor Dave Van Knapp has made it even easier, via the introduction of his Lesson 11: Valuation.

Part of an overarching series of “lessons” on dividend growth investing, it provides an easy-to-understand valuation template that can be easily applied to almost any dividend growth stock.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

Tyson Foods, Inc. (TSN)

Tyson Foods, Inc. (TSN)

Tyson Foods, Inc. (TSN) is one of the world’s largest processors and marketers of chicken, beef, and pork.

Founded in 1935, Tyson Foods is now a $22 billion (by market cap) food colossus that employs more than 140,000 people.

While Tyson Foods has sales in over 140 countries worldwide, US sales represents approximately 84% of revenue.

The company operates across the following segments: Beef, 36% of FY 2022 segment sales; Chicken, 31%; Prepared Foods, 17%; Pork, 12%, and International/Other, 4%.

Some of their major brands include: Hillshire Farms, Jimmy Dean, Ball Park, and the eponymous Tyson.

Sales by channel are split across the retail channel (~44%), foodservice channel (~41%), and international channel (~15%).

We have a very simple investment thesis here.

People have to eat.

If you don’t eat, you don’t survive.

Going beyond the basic necessity of it, most people usually want to eat the best food they can get their hands on.

That often leads to proteins.

There is built-in demand present, but this built-in demand is also rising.

That’s because the world is growing wealthier, on average.

When people gain access to more financial resources, they tend to consume more meat.

Simultaneously, our species continues to gain in number.

The global population of humans recently crossed 8 billion.

More people means more base demand for food.

All of this works to the favor of of Tyson Foods, as they’re one of the largest processors of meats in the world.

And that’s exactly what gives them excellent prospects for continued growth across revenue, profit, and the dividend.

Dividend Growth, Growth Rate, Payout Ratio and Yield

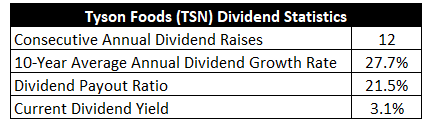

To date, the company has increased its dividend for 12 consecutive years.

The 10-year dividend growth rate of 27.7% is fantastic.

However, more recent dividend increases have been in the mid-single-digit range.

On the other hand, the stock’s current yield of 3.1% is a full 100 basis points higher than its own five-year average.

As dividend growth has slowed, the yield has risen.

As dividend growth has slowed, the yield has risen.

And I don’t see that as an unfair trade-off.

With the payout ratio at only 21.5%, Tyson Foods has a healthy dividend that can be raised at a healthy clip in the years ahead.

I like dividend growth stocks in what I refer to as the “sweet spot” – a yield of between 2.5% and 3.5%, paired with a high-single-digit (or higher) dividend growth rate.

We’re clearly in the sweet spot here, especially if we lean toward the long-term dividend growth track record.

I like these dividend metrics.

Revenue and Earnings Growth

As much as I do like these dividend metrics, though, we’re mostly looking backward here.

However, we investors are risking today’s capital for the rewards of tomorrow.

That’s why I’ll now build out a forward-looking growth trajectory for the business, which will later be put to good use when it comes time to estimate intrinsic value.

I’ll first show you what this company has done over the last decade in terms of its top-line and bottom-line growth.

I’ll then reveal a professional prognostication for near-term profit growth.

Deftly amalgamating the proven past with a future forecast should allow us to develop a reasonable idea as to where the business may be going from here.

Tyson Foods moved up its revenue from $34.4 billion in FY 2013 to $53.3 billion in FY 2022.

That’s a compound annual growth rate of 5%.

Good stuff.

I typically look for a mid-single-digit top-line growth rate from a fairly mature business like this.

Tyson Foods is dead on the mark.

Meanwhile, earnings per share grew from $2.12 to $8.92 over this period, which is a CAGR of 17.3%.

This is remarkable bottom-line growth.

However, much like the dividend growth story we already went over, it’s somewhat misleading.

That’s because very recent bottom-line growth hasn’t been nearly as strong.

Tyson Foods produces surprisingly lumpy EPS growth, so the impressiveness (or lack thereof) of its growth largely depends on which period you’re looking at.

The company has been benefiting from outsized margins, particularly on beef, over the last two or so years, but this appears to be reversing course now.

Looking forward, CFRA forecasts that Tyson Foods will compound its EPS at an annual rate of -5% over the next three years.

Negative growth is obviously not something I ever want to see.

However, this isn’t a business that’s in decline.

Instead, it’s simply a normalization of operations.

I don’t necessarily see any problem with that.

This near-term margin compression is central to understanding the stock’s 30% drop in 2022.

The market is a forward-looking mechanism, and it’s trying to price in turbulence and weakness at the business.

CFRA goes on to state: “Operating margins in Beef, Pork, and Prepared Foods have been weakening over the past few quarters due to high input costs and weakening demand. Beef, in particular, saw outsized margins for the better part of 2021, but now we’re seeing Beef margins normalize, which we expect will continue over the next 12 months.”

Management has anticipated this drop in profit and gotten out ahead of it by reducing the size of dividend raises.

If the company were instead to aggressively raise the dividend against the headwinds, that could set investors up for a dividend cut down the road.

Overall, I think Tyson Foods is easily capable of producing high-single-digit dividend growth over the long run, when you average things out through the cycles.

The next year or two will almost certainly be below trend when it comes to dividend raises.

But I see things picking up nicely when looking out into FY 2025 and beyond.

Plus, investors are starting out with an above-average 3.1% yield.

I’m a fan of that setup.

Financial Position

Moving over to the balance sheet, Tyson Foods has a really good financial position.

The long-term debt/equity ratio is 0.4, while the interest coverage ratio is north of 12.

The balance sheet is a strength.

Profitability is another strength, although recent margin expansion is set to reverse course.

Over the last five years, the firm has averaged annual net margin of 5.9% and annual return on equity of 18.5%.

Tyson Foods is operating a simple-to-understand business model that is benefiting from rising demand for proteins.

As long as human beings need to eat in order to survive, which will always be a sure thing, Tyson Foods should make money.

And the company is protected by durable competitive advantages that include economies of scale, an established global distribution network, and brand power.

Of course, there are risks to consider.

Regulation, litigation, and competition are omnipresent risks in every industry.

Tyson Foods is largely a commodity producer, which creates more price taking than price making.

Input costs can be volatile, and these costs have been rising.

Viruses, like flus, are fairly common among animals, and these can cause massive harm to herd or flock health.

A trend toward alternative food products like meatless meats can challenge the business model.

Margin compression is a threat to near-term profit.

Tyson Foods is mostly exposed to the US, but it does have some risks around currency exchange and foreign markets.

Overall, I see these risks as quite acceptable, especially when weighed against the basic need for food.

And with the stock down nearly 40% from its 52-week high, the valuation makes this idea especially compelling right now…

Stock Price Valuation

The stock is trading hands for a P/E ratio of 6.8.

That’s one of the lowest earnings multiples I’m aware of.

This stock never really commands a premium valuation, but this is much lower than usual.

Earnings are set to go backward, but the market is almost pricing in a complete collapse in the business.

For further perspective, we have a sales multiple of 0.4 that is quite a bit below its own five-year average of 0.6.

And the yield, as noted earlier, is significantly higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis.

I factored in a 10% discount rate and a long-term dividend growth rate of 7%.

This rate looks aggressive or conservative, depending on what you’re comparing it to.

The long-term trajectory of Tyson Foods, in terms of both EPS and dividend growth, is far higher than this.

And the payout ratio remains low.

However, the last three dividend raises all came in below 7%.

In addition, EPS is expected to decline over the foreseeable future.

This means that Tyson Foods will be relying on, and expanding, that low payout ratio through this “air pocket”.

I think the next few years could be pretty meager on the dividend increase front, but we could be looking at a nice acceleration in dividend growth once profit fully recovers.

I’m averaging things out through the cycles.

The DDM analysis gives me a fair value of $68.48.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

I believe that I was judicious with my valuation, yet the possible cheapness still shines through.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates TSN as a 5-star stock, with a fair value estimate of $102.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates TSN as a 3-star “HOLD”, with a 12-month target price of $75.00.

I came out low. Averaging the three numbers out gives us a final valuation of $81.83, which would indicate the stock is possibly 35% undervalued.

Bottom line: Tyson Foods, Inc. (TSN) has built-in demand from the basic need for food, and it’s building upon that with rising global demand for proteins. It’s difficult to imagine a future in which Tyson Foods doesn’t make money. With a market-beating yield, a double-digit long-term dividend growth rate, a low payout ratio, more than 10 consecutive years of dividend increases, and the potential that shares are 35% undervalued, long-term dividend growth investors should consider scooping up this name while it’s in the bargain bin.

Bottom line: Tyson Foods, Inc. (TSN) has built-in demand from the basic need for food, and it’s building upon that with rising global demand for proteins. It’s difficult to imagine a future in which Tyson Foods doesn’t make money. With a market-beating yield, a double-digit long-term dividend growth rate, a low payout ratio, more than 10 consecutive years of dividend increases, and the potential that shares are 35% undervalued, long-term dividend growth investors should consider scooping up this name while it’s in the bargain bin.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is TSN’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 99. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, TSN’s dividend appears Very Safe with a very unlikely risk of being cut. Learn more about Dividend Safety Scores here.

After researching income stocks for over 30 years, I've come up with a one of a kind dividend portfolio. With the right 20-30 stocks, you can collect a dividend check every single day the market is open. That's over 260 dividend checks per year. Click here for the names of these 20+ stocks.

Source: Dividends & Income