We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Blade Air Mobility, Inc. (NASDAQ: BLDE)

Today’s penny stock pick is the air transportation service company, Blade Air Mobility, Inc. (NASDAQ: BLDE).

Blade Air Mobility, Inc. provides air transportation alternatives to congested ground routes in the United States. It provides its services through charter and by-the-seat flights using helicopters, jets, turboprops, and amphibious seaplanes.

Website: https://www.blade.com

Latest 10-k report: https://sec.report/Document/0001779128-21-000025

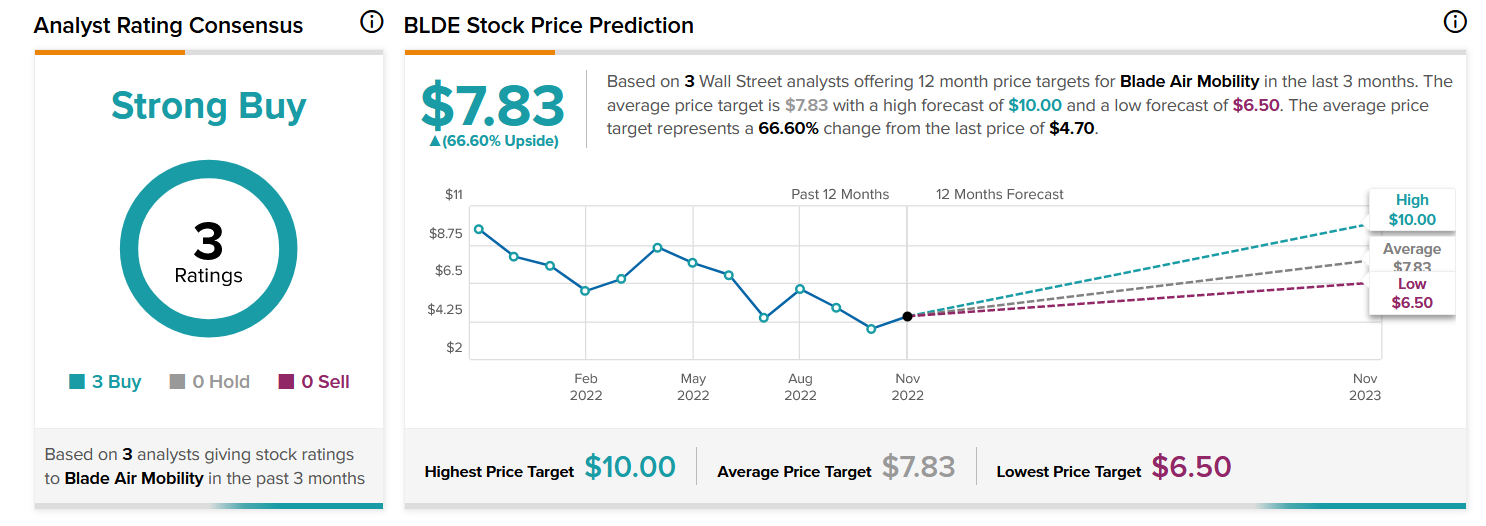

Analyst Consensus: As per TipRanks Analytics, based on 3 Wall Street analysts offering 12-month price targets for BLDE in the last 3 months, the stock has an average price target of $7.83, which is nearly 67% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The company reported solid results for the third quarter ended September 30, 2022. The revenue was up 125% versus the prior year period to $45.7 million. The nine-month period ended September 30, 2022 revenue was up 154% versus the prior year period to $108.0 million.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Falling Wedge Pattern Breakout: The daily chart shows that the stock has been forming a falling wedge pattern for the past several months. These are marked as purple color lines. It has typically taken support at the bottom of the wedge before bouncing back. The stock has currently broken out from the falling wedge pattern. Once the stock breaks out of the falling wedge pattern, it could move higher.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MA: The stock is currently above its 50-day SMA, indicating that the bulls have currently gained control.

#4 Bullish RSI: The RSI is above 50 and moving higher, indicating possible bullishness.

#5 Bullish Stoch: The %K line of the stochastic is above the %D line, and has also moved higher from oversold levels, indicating possible bullishness.

#6 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This is a possible bullish indication.

#7 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart as well, indicating possible bullishness.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for BLDE is above the price of $4.80.

Target Prices: Our first target is $5.50. If it closes above that level, the second target price is $6.00.

Stop Loss: To limit risk, place a stop loss at $4.40. Note that the stop loss is on a closing basis.

Our target potential upside is 15% to 25%.

For a risk of $0.40, our first target reward is $0.70, and the second target reward is $1.20. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

- The company has a history of net losses. BLDE reported net losses of $40.1 million, $10.2 million, and $10.8 million for the years ended September 30, 2021, 2020, and 2019, respectively.

- Hedge Funds Decreased Holdings by 514.9K Shares Last Quarter.

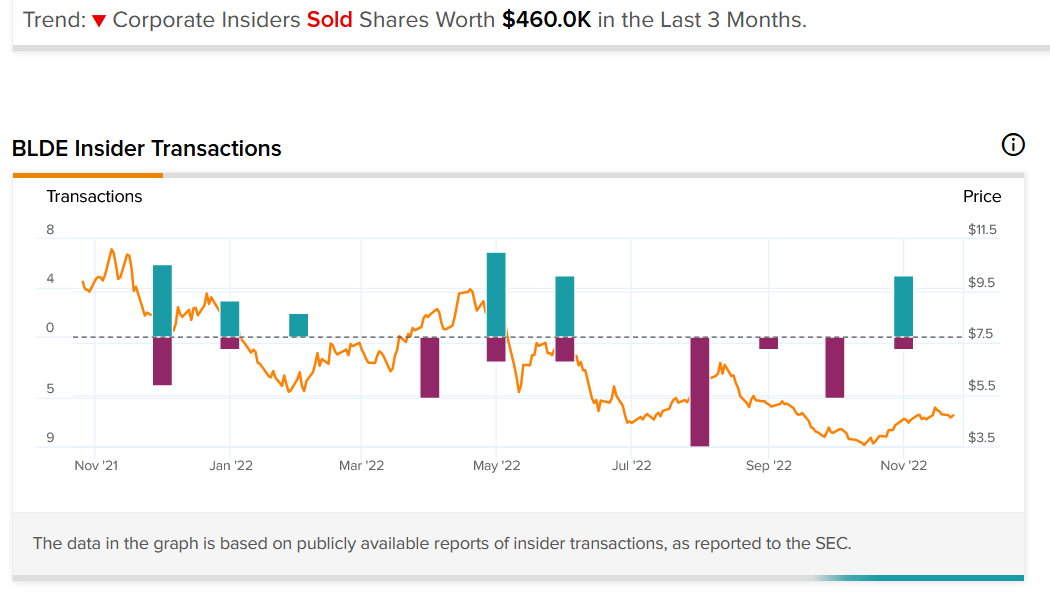

- Corporate Insiders Sold Shares Worth $460.0K in the Last 3 Months.

- On April 1, 2021, Shoreline Aviation, Inc. filed an Amended Complaint in the United States District Court for the Eastern District of New York naming Cynthia L. Herbst, Sound Aircraft Flight Enterprises, Inc., Ryan A. Pilla, Blade Urban Air Mobility, Inc., Robert Wiesenthal, and Melissa Tomkiel as defendants. The case is captioned Shoreline Aviation, Inc. v. Sound Aircraft Flight Enterprises, Inc. et al. The complaint alleges, among other things, claims of misappropriation, violation of the Defend Trade Secrets Act, unfair competition, tortious interference with business relations, constructive trust, tortious interference with contract, and aiding and abetting breach of fiduciary duty.

- Despite being a loss-making company, the executives are being paid significant compensation.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

This stock checks all the boxes. Pays a high dividend (8%), has a record of increasing that yield (an average of 37.5% throughout company history), and is set up perfectly to profit from continued Fed rate hikes. Click here for the name and ticker of the most perfect dividend stock on the market right now.

Source: Trades of the Day