If you’re old enough to remember the last time an inflationary bonfire savaged the U.S. economy – a time 40 years ago hallmarked by impotent policies and such tepid moves as “Whip Inflation Now” (WIN) buttons – you know full well the deeply personal and economic pain that relentlessly surging prices can cause.

If you’re old enough to remember the last time an inflationary bonfire savaged the U.S. economy – a time 40 years ago hallmarked by impotent policies and such tepid moves as “Whip Inflation Now” (WIN) buttons – you know full well the deeply personal and economic pain that relentlessly surging prices can cause.

But you don’t have to be quite that “tenured” in life to fully experience that personal anguish and financial savagery.

All you have to do is look around.

A stop at the gas pump is a wallet-emptier.

A trip to the grocery store triggers home-refinancing flashbacks.

And a retirement-fund review feels like a rewatch of an old slasher flick.

We get it.

It’s why you’re clipping “luxuries” like those extra streaming services. Cursing the high prices (and purchase limits) of everything from paper towels to cat food.

Rethinking the big family vacation because of soaring fuel prices, zooming airline ticket prices, or gouging hotel rates.

Or sweating out the markets because of how inflation has torpedoed stock prices – and because the long-reliable 60/40 stock-and-bond allocation just doesn’t seem to work anymore.

Inflation is a headwind every company is facing – meaning it affects every stock you own.

Like we said … we get it.

And we saw it coming.

Back in May (2022), Mike Burnick, a senior analyst and editor of the Stock Advantage Report here at TradeSmith warned folks that high inflation was bad … and was here to stay.

He’s been dead-on accurate.

Inflation fell in October. But “fell” is a relative term. It clocked in at 7.7% for the month – still not much lower than the 8.2% reported the month before.

In the face of all the gloom and doom, there are moves you can make. There are inflation-resistant stocks that still can make you money.

Even lots of money.

These companies share some common traits.

These are companies that won’t get kneecapped by micro or macro trends.

That won’t see their profits evaporate like that thin stream of steam from your iron.

Whose execs won’t resort to numbers sleight-of-hand to explain away a lackluster quarter.

These are the companies – the ones with the market muscle and pricing power to resist inflation – that you want to own. These are the stocks you need in your portfolio.

As a free benefit to you, we’ve assembled this “command-center” guide to inflationary markets.

View it as your personal inflation-beating resource: We’ll show you what investments and trades to make – and which ones to avoid.

We’ll share quick tips to spotlight which companies are inflation-resistant, to give you access to the latest inflationary trends, and will give you access to the “right” TradeSmith tools.

We’ll be right there with you – on the front lines in the battle against rising prices.

Let’s get started with two easy tricks to use to zero in on that small group of companies that are truly inflation-resistant.

HOW TO SPOT INFLATION-RESISTANT COMPANIES WITHOUT AN MBA

1. On the income statement, check out profit margins, both operating (or gross) and net. This tells you how much of a company’s top line (sales or revenue) is getting chewed up by surging prices – and how much falls right to the bottom line.

Companies without a lot left over have high fixed operating expenses and thin profit margins, which are vulnerable to getting squeezed by higher costs with inflation on the rise.

2. From the balance sheet, zero in on long-term debt – including leases and other long-term liabilities. Compare it to the company’s shareholders’ equity and how much cash the business generates (from the cash-flow statement).

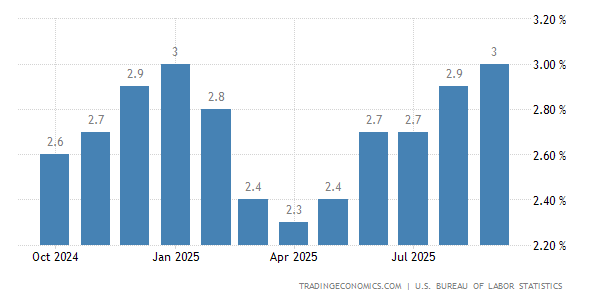

INFLATION TRACKER MONTH TO MONTH

source: tradingeconomics.com

source: tradingeconomics.com

— Keith Kaplan

Yes, right here and right now... in this brutal market. Where even the greatest financial minds of our time are having a hard time making a profit... It's a way you could amplify profits on stocks by as much as 7X - without using options, shorting, or any other gimmicks. I can show you the signal that is A mathematical antidote to fear - even when the market feels like its spinning out of control. Get Access to the #1 Tool that Pinpoints When to Buy a Stock, How Many Shares to Buy, and When to Sell It.

Source: TradeSmith