Big News

I normally start these articles by discussing my choice for the monthly dividend reinvestment. But this month is special, because a major milestone has been achieved.

The portfolio has now collected more in dividends than it cost to start the portfolio in 2008.

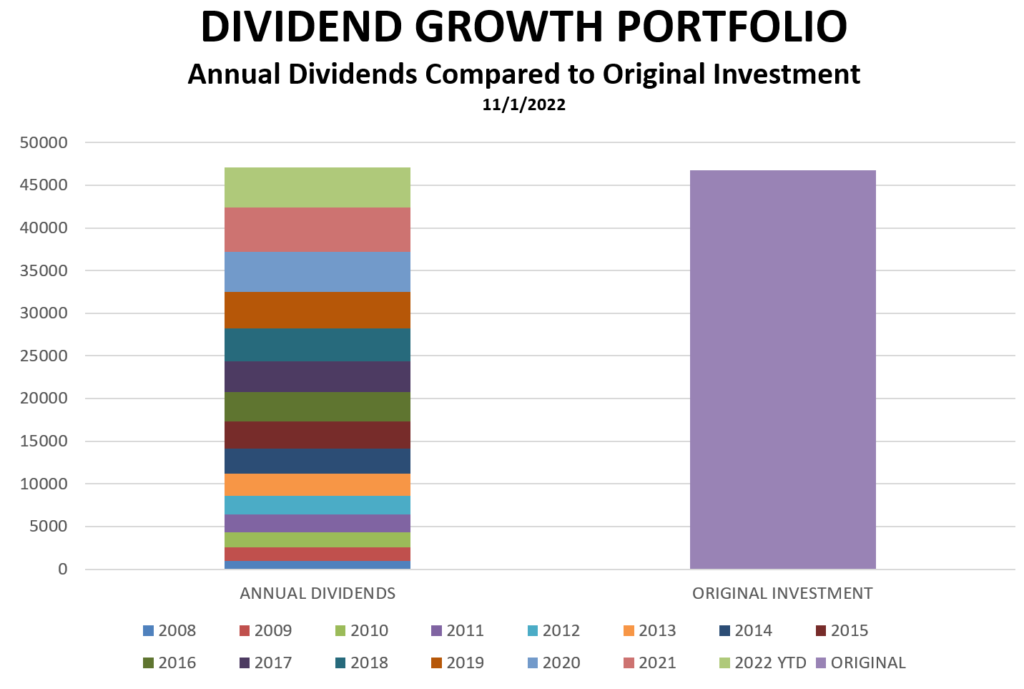

Here’s what that looks like on a graph:

Isn’t that beautiful? Here are a few details about this achievement:

Isn’t that beautiful? Here are a few details about this achievement:

First, it took 14 years + 5 months to reach this milestone. It might have gone faster with higher-yielding stocks, but I mostly stick to stocks in the “sweet spot” of dividend-growth investing – yields of roughly 2.7% to 6% – because they are generally safer and more reliable overall. Reliability and safety are as important to me as sheer speed in growing the dividend stream.

Second, each layer in the left bar – representing a year’s worth of dividends – is taller than the one beneath it, because the dividend stream has grown every year.

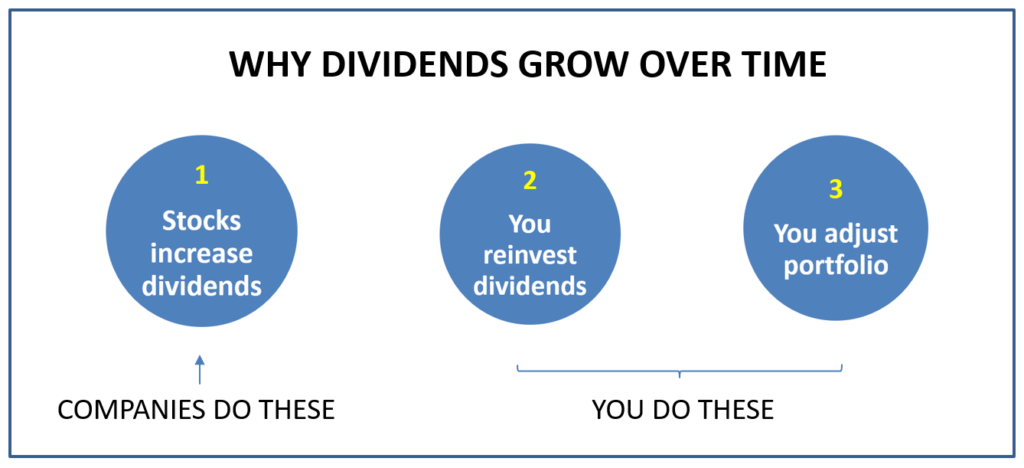

The growth occurs because of the three reasons I always mention:

1. Dividend increases. The companies in the portfolio announce regular raises.

2. Dividend reinvestments. I reinvest the dividends to add new shares, which produce more dividends.

3. Portfolio management. I occasionally make trims and replacements that result in dividend growth.

Through these activities, the portfolio has averaged 10.5% compound annual growth in the dividend stream each year.

Thus, each year’s layer is bigger than the one before it. Mathematically, the dividend stream is compounding, meaning that money is being made on money already earned, and the dividend stream grows at an exponential rate instead of a linear rate.

And finally, because compounding speeds things up over time, it will not take another 14 years to duplicate the original investment again. Per the CAGR (compound annual growth rate) calculator at moneychimp, at 10% per year CAGR, it will only take about 7.3 years to reproduce the original investment again.

November’s Dividend Reinvestment: Crown Castle (CCI)

Now let’s turn to this month’s reinvestment.

All year, I have been focusing on my smallest positions: Deciding which ones to keep, building those up, and discarding a couple that I don’t want any more.

For my November reinvestment, I decided to add shares to a small position that I started earlier this year: Crown Castle (CCI).

Crown Castle is a REIT (real estate investment trust) that owns some of the infrastructure needed to move data. As you probably know, data is growing at a compound rate too, much faster than the income stream in my little portfolio.

Crown Castle bills itself as the nation’s largest provider of shared communications infrastructure. It owns cell towers, short-range small cell nodes, and thousands of miles of fiber. It focuses on the United States, and it has a presence in every major domestic market.

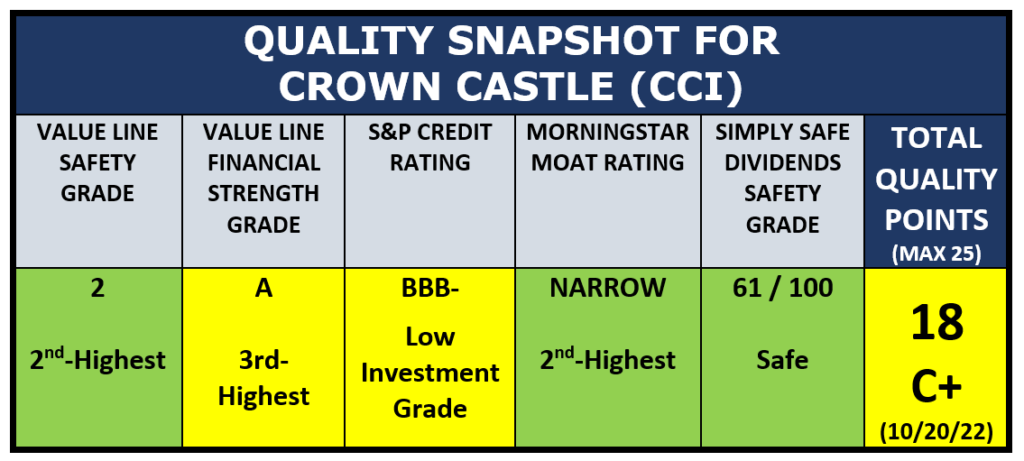

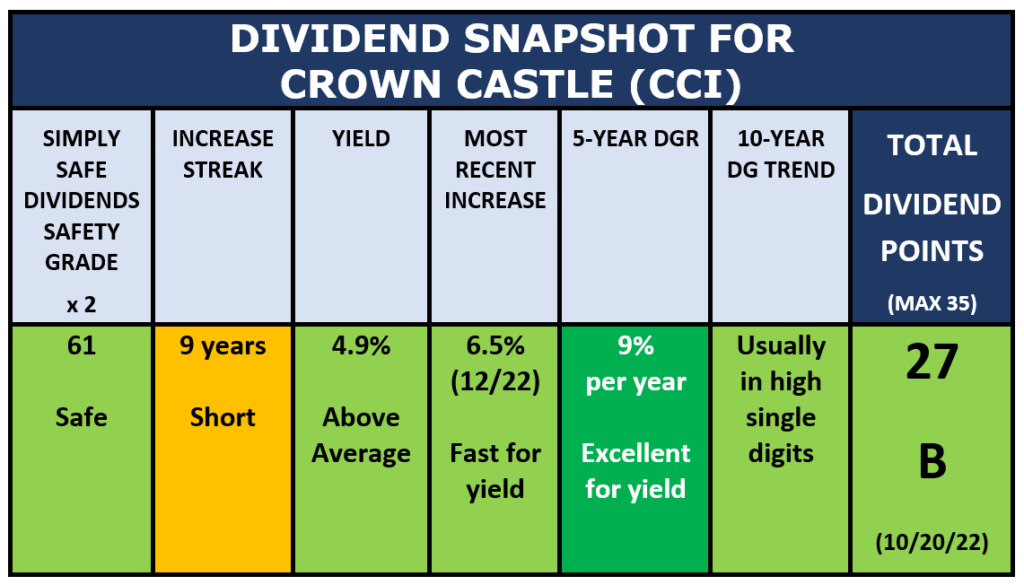

Here are Crown Castle’s Quality and Dividend Snapshots, both updated in late October when I began to investigate adding to the position.

These snapshots tell a nice story. I rate Crown Castle as a solid quality dividend-growth investment. Its Quality Score of 18 places it just one point short of the next higher category.

These snapshots tell a nice story. I rate Crown Castle as a solid quality dividend-growth investment. Its Quality Score of 18 places it just one point short of the next higher category.

CCI’s Dividend Score of 27 is Above Average, with the only non-green category being its short 9-year streak of dividend increases. The company has only been in existence that long. Note that CCI just raised its dividend 6.5%, which is fast for a stock with a yield approaching 5%.

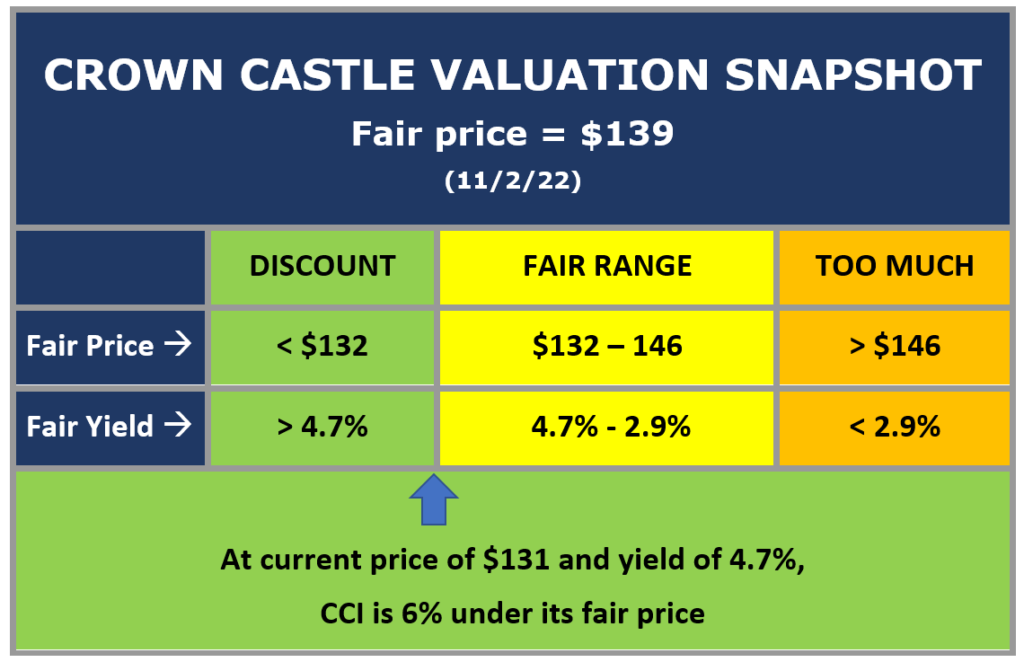

CCI’s price shot up since I prepared the above tables in late October. That caused its yield to fall from 4.9% to 4.7% in a couple of weeks. Nevertheless, I still see Crown Castle as a bit undervalued.

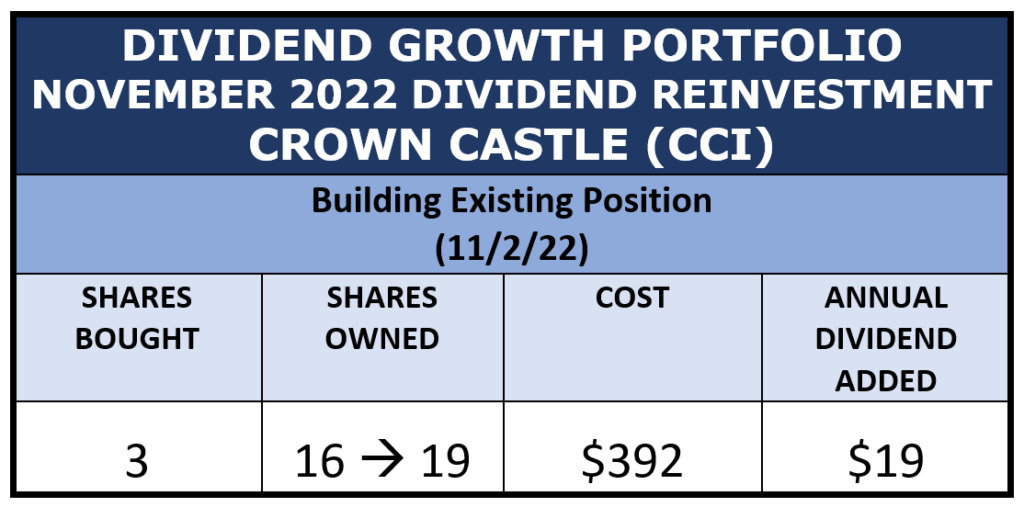

Therefore, I went ahead on November 2 and made this month’s regular dividend reinvestment: I purchased 3 shares of Crown Castle. I would have bought more, but October is a slow month for dividends for my particular holdings.

Therefore, I went ahead on November 2 and made this month’s regular dividend reinvestment: I purchased 3 shares of Crown Castle. I would have bought more, but October is a slow month for dividends for my particular holdings.

Now I own 19 shares of Crown Castle, yielding 4.7% at today’s price. I added about $19 to the annual dividend stream. Because this purchase comes ahead of the ex-dividend date for CCI’s December payout, I will receive that payout on both old and new shares, and it will include the 6.5% dividend increase recently announced.

Now I own 19 shares of Crown Castle, yielding 4.7% at today’s price. I added about $19 to the annual dividend stream. Because this purchase comes ahead of the ex-dividend date for CCI’s December payout, I will receive that payout on both old and new shares, and it will include the 6.5% dividend increase recently announced.

Primary Goal: Generate Reliable, Growing Dividends Every Year

The primary goal for the this portfolio, as stated in its Business Plan, is to…

Build a reliable, steadily increasing stream of dividends over many years that can eventually be used as income for retirement.

As the charts at the beginning of the article show, that goal has been hit every year of the portfolio’s existence.

It will be achieved again this year. At current run-rates, 2022’s total dividends will exceed last year’s by more than 10%.

In the first section of this article, I mentioned the three reasons the income stream grows in a dividend-growth portfolio, so I won’t spend much time elaborating on that topic here. But I will include this diagram illustrating what causes compounding.

Compounding is making money on money already earned. The money already earned is the total dividends already collected. I’m not just earning a return on the initial investment; I am also earning a return on the growth from previous years.

Compounding is making money on money already earned. The money already earned is the total dividends already collected. I’m not just earning a return on the initial investment; I am also earning a return on the growth from previous years.

November Portfolio Review

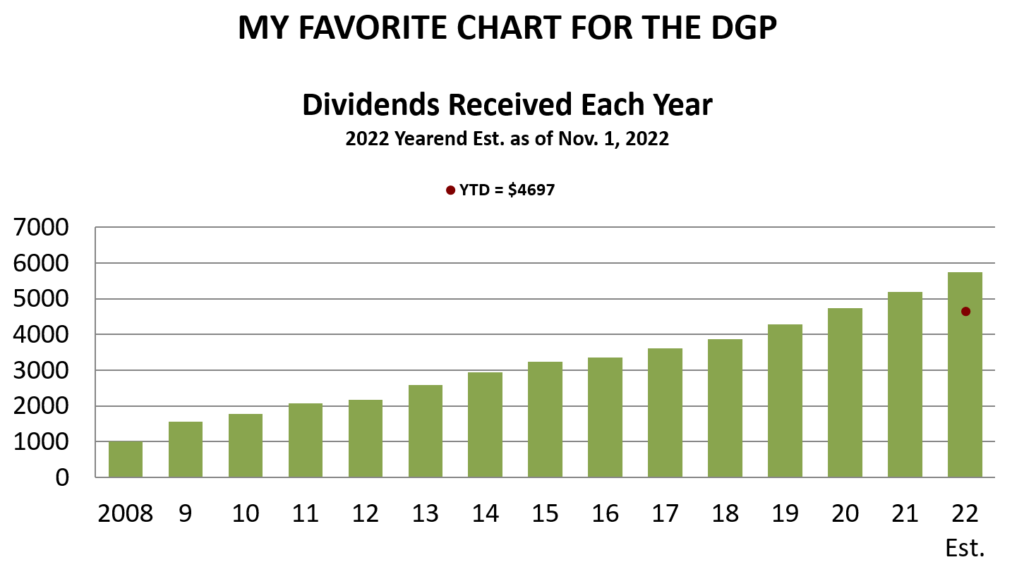

This chart shows the annual growth of dividends in the portfolio. The bars in this chart correspond to the annual layers in the chart at the beginning of the article.

This chart shows the annual growth of dividends in the portfolio. The bars in this chart correspond to the annual layers in the chart at the beginning of the article.

With two months to go in 2022, I now estimate that this year’s dividends will be 10.4% more than last year’s. That’s about the same as the portfolio’s CAGR since 2009 of 10.5% per year.

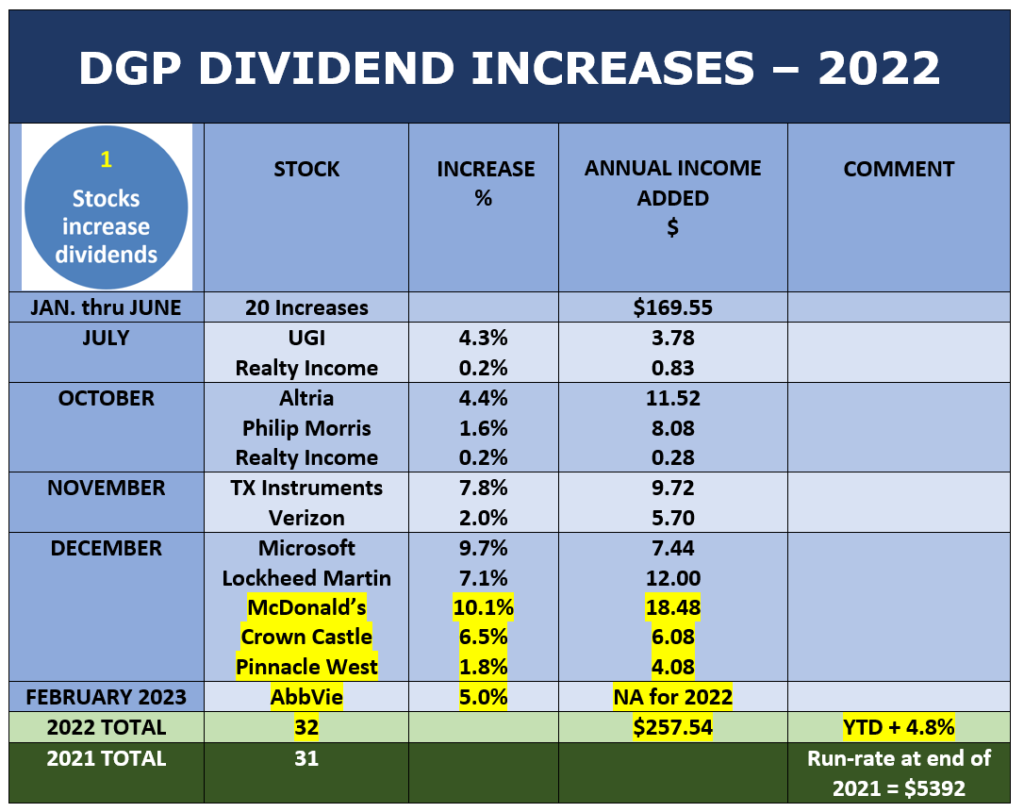

So far this year, 32 increases have been announced, including one that won’t be paid until 2023. I expect a couple more raise announcements before the year ends.

Dividend raises grow the dividend stream. As increases pile up, their impact becomes significant.

The yellow highlights denote dividend increases since the last monthly report plus the updated totals at the bottom.

The yellow highlights denote dividend increases since the last monthly report plus the updated totals at the bottom.

As you can see, 2022’s increases have added 4.8% to the annual dividend run-rate compared to the beginning of the year. Over long time periods, these dividend increases add a great deal to the dollar value of dividends flowing into the portfolio.

Here’s a summary of my reinvestments so far in 2022.

As with dividend increases, the monthly reinvestments pile up and add to the dividend stream. With the November reinvestment, 2022’s reinvestments have added $185, or 3.4%, to the portfolio’s annual dividend run-rate. There is still one more reinvestment to make in December.

As with dividend increases, the monthly reinvestments pile up and add to the dividend stream. With the November reinvestment, 2022’s reinvestments have added $185, or 3.4%, to the portfolio’s annual dividend run-rate. There is still one more reinvestment to make in December.

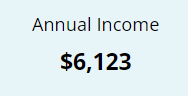

I track the portfolio at Simply Safe Dividends, and this is the annual dividend run-rate after this purchase:

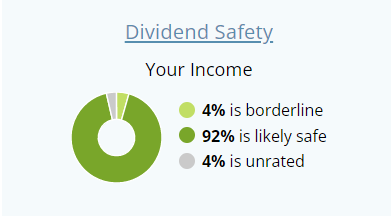

I mentioned earlier that safety and reliability of the income stream are important, and they influence the stocks I select. Here is SSD’s safety summary of the portfolio’s holdings, showing that the income is very safe:

I mentioned earlier that safety and reliability of the income stream are important, and they influence the stocks I select. Here is SSD’s safety summary of the portfolio’s holdings, showing that the income is very safe:

The unrated holdings are the two ETFs in the portfolio; SSD does not rate ETFs at the current time. If you want to see the portfolio as of November 1 (just before the current purchase was made), you can always find it here: Dave Van Knapp’s Dividend Growth Portfolio.

The unrated holdings are the two ETFs in the portfolio; SSD does not rate ETFs at the current time. If you want to see the portfolio as of November 1 (just before the current purchase was made), you can always find it here: Dave Van Knapp’s Dividend Growth Portfolio.

Yields and Returns

The DGP’s yield on cost (YOC) is now 13.1%, which is 1.6% more than at the beginning of the year.

Yield on cost is the portfolio’s yield calculated against the amount I originally invested to create the portfolio ($46,783).

YOC = Dividend Run-Rate ÷ Original Amount Invested

= $6123 ÷ $46,783

= 13.1%

YOC mirrors the dollars in the dividend stream. As they go up, YOC goes up in tandem. In this portfolio, since I never add new outside money, the denominator never changes in the YOC equation.

Yield on cost is what I call a “scoreboard” metric, meaning that it shows how the game has gone up until now. It reflects every dividend increase and every decision I have made since I started the portfolio in 2008.

Achieving that kind of income, starting with my modest original investment, was my aspiration in 2008. It was the reason I started the portfolio.

I hope that these real-world results are inspirational for younger investors who can visualize the possibilities of large amounts of future income generated by modest investments today.

The absence of new outside money makes the DGP a great demonstration of the power of conservative dividend-growth investing. No results are skewed by new capital coming in. Every result traces its roots back to the original portfolio.

Yield on cost is one flavor of yield. Another flavor is current yield, which is the yield from the portfolio right now. It is the starting yield you would get if you duplicated the portfolio today at today’s prices.

Here is the calculation of current yield following this month’s reinvestment:

Current yield = Dividend run-rate ÷ Current value of portfolio

= $6123 ÷ $164,949

= 3.7%

In its 14-year history, the DGP’s current yield has ranged between 3.0% and 4.4%, swinging back and forth as dividends are increased and prices go up and down.

The current yield is in the middle of the historical range. It’s down 0.2% from a month ago, because the value of the portfolio increased by about $13,000 in October. The portfolio value is the denominator in the yield equation, so when it goes up, yield goes down. Most dividend-growth investors do not mind that, because it does not indicate that the income stream itself is going down.

For comparison to the DGP’s 3.7% current yield, the S&P 500’s current yield is 1.7%, and the benchmark 10-year Treasury (fixed income) is 4.1%. (Source)

The is the first time in years that the 10-year Treasury yields more than my portfolio. Of course, the income stream from Treasuries is fixed; it does not go up every year like the income flow from a dividend-growth portfolio. A DG portfolio does not produce fixed income; it produces rising income.

A secondary goal of this portfolio is total return. I want to be competitive with a simple investment in the S&P 500. I’m not trying to beat the index, as total return is not my main focus. But I like to be in the same ballpark.

As of the beginning of November, the total value of the DGP has grown +253% from its inception in June 2008. It started at $46,783. Mid-day on November 2, it is now worth $164,949.

For comparison, if the DGP’s original money had been invested into SPY, the largest ETF that tracks the S&P 500, with dividends reinvested, it would have increased 266% to a total value of $171,226. (Source) The SPY investment would be yielding less than half of the DGP’s current yield (1.7% vs. 3.7% at the beginning of the month).

To see the complete portfolio as of November 1st, click here.

Remember, the DGP is not presented as best. It is not a model portfolio, nor is it tailored to growth, harvesting, or any particular age group. Rather, it is an all-around dividend-growth portfolio that demonstrates in real-life what you can accomplish with the dividend growth strategy. I show what I do and explain why I do it.

-–Dave Van Knapp

Source: Dividends & Income

The best way to earn monthly income is NOT a stock, bond or option... Rather, it's this little-known alternative investment. CLICK HERE TO FIND OUT MORE.

Dividend Growth Portfolio Archive

| Date | Latest Articles |

| 11/8/2022 | I Just Bought More Shares of This Stock |

| 10/6/2022 | I Just Bought More Shares of the Top-Ranked Dividend Growth Fund Schwab’s U.S. Dividend Equity ETF (SCHD) |