2022 is quickly becoming historic.

There have only been three worse periods for the market in all of history: the Great Depression, the dot-com bust, and the Global Financial Crisis.

Ominous company. Or is it?

Look, if you’re older and looking to sell your stocks to produce income in retirement, 2022 is a bummer. But for almost everyone else, especially for long-term investors who are actively buying stocks, building wealth and passive income, and trying to achieve financial freedom, this is a gift.

A big reason for this is the way in which price and yield are inversely correlated. Also, all else equal, lower prices result in higher yields. It’s more passive dividend income on the same invested dollar.

For anyone who is looking to one day live off of passive dividend income, this is exactly what you want. You get your hands on more passive dividend income and march toward financial freedom that much faster.

I always see short-term volatility as a long-term opportunity. And I have been taking advantage of this volatility, investing thousands of dollars per month and buying up dividend growth stocks left and right.

There’s one stock, in particular, that I think you should know about.

Today, I want to tell you about a dividend growth that I’ve recently been buying.

Ready? Let’s dig in.

So what’s this under-the-radar dividend growth stock that I’ve recently been buying for the FIRE Fund? It’s Lincoln National Corporation (LNC).

Lincoln National is a financial services company with a market cap of $8 billion. This company provides a range of insurance, annuity, and retirement plan services. I love companies that provide financial services like this. You have an asset-light business model that can generate a lot of recurring revenue without high fixed costs. Revenue can keep going up, yet costs can be easily contained.

It’s a great recipe for long-term growth and returns. How long term is long term? Well, Lincoln National was founded in 1905. Is more than a century of doing business long term enough? I think so. Moreover, there are no signs of stopping. It’s actually the opposite.

The company continues to grow right across the board. It’s not blowing the doors off or anything, but numbers continue to march higher. The company has compounded its revenue at an annual rate of 5.9% over the last decade, while EPS has a CAGR of 5.6% over that time frame.

Now, to be fair, FY 2012 was a great year, and last fiscal year wasn’t. So I think the company is capable of doing better than this. Still, mid-single-digit top-line and bottom-line growth isn’t bad at all.

Now, to be fair, FY 2012 was a great year, and last fiscal year wasn’t. So I think the company is capable of doing better than this. Still, mid-single-digit top-line and bottom-line growth isn’t bad at all.

But here’s what’s really exciting. CFRA is forecasting that Lincoln National will compound its EPS at an annual rate of 21% over the next three years, citing product enhancements, distribution improvements, price hikes, and productivity gains. We invest in where a company is going, not where it’s been.

Well, I like where the company could be going, as CFRA’s forecast would represent a material acceleration in growth for the company. Even if they fall short of this, though, we’re still looking at very strong growth. Along with that strong growth potential comes strong dividend metrics.

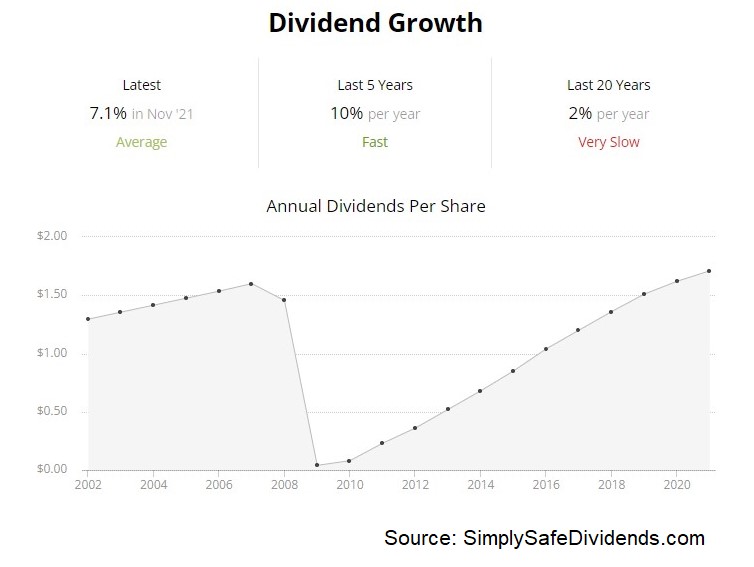

The company has increased its dividend for 13 consecutive years, which is a great start. But the yield of 3.8% might be the star of the show here. With a near-4% yield, you don’t need super high growth in order to make sense of the investment. If they can grow the dividend at a 6% to 7% clip annually, I’d be pretty happy. But I’m even happier.

The 10-year DGR of 20.9% is well in excess of that mark, although more recent dividend increases have been in 6% to 7% range. Circling back around to that aforementioned yield for just a second, though, the 3.8% yield is a full 100 basis points higher than its own five-year average. This stock does not typically offer a yield this high, but this is the kind of gift that 2022 has given us. And with a payout ratio of 25.5%, based on TTM adjusted EPS, this outsized dividend is easily covered.

The 10-year DGR of 20.9% is well in excess of that mark, although more recent dividend increases have been in 6% to 7% range. Circling back around to that aforementioned yield for just a second, though, the 3.8% yield is a full 100 basis points higher than its own five-year average. This stock does not typically offer a yield this high, but this is the kind of gift that 2022 has given us. And with a payout ratio of 25.5%, based on TTM adjusted EPS, this outsized dividend is easily covered.

One of the things to most like about Lincoln National is the core business model. It revolves heavily around insurance. I’ve waxed ecstatic about insurance numerous times before, largely because of the power of the “float”.

This is the low-cost source of capital that accrues as a natural course of doing business, due to the time delay between collecting premiums and paying out on claims. The float is a prime example of making money from other people’s money.

It’s a big part of why Warren Buffett has been so enamored with the insurance space for a large part of his life.

Lincoln National has been ultra cautious with investing its float, with the majority of the portfolio in fixed maturity securities. 97% of the company’s investments are investment-grade rated. It’s worth noting here that rising rates should benefit the firm as they invest new capital into higher-yielding offerings, yet they’ve been putting up respectable numbers without that benefit.

This is just a solid business right across the board.

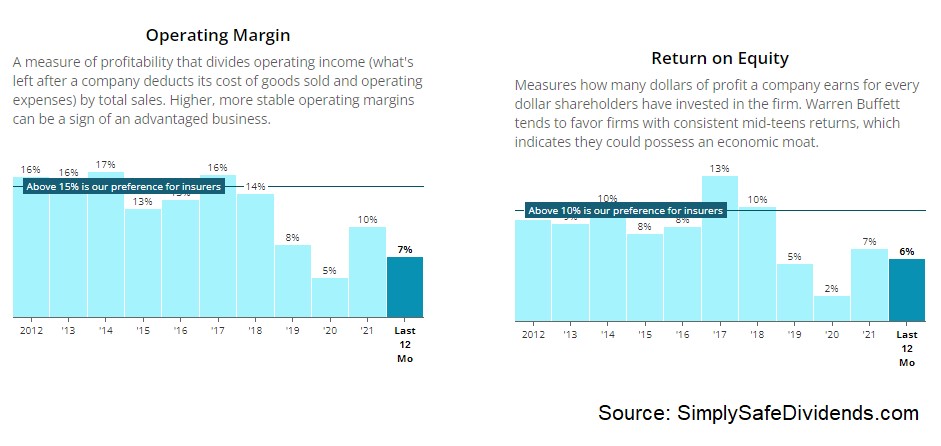

Profitability is really good, considering the industry. Over the last five years, the firm has averaged annual net margin of 7.7% and annual return on equity of 7.4%. We have a rock-solid balance sheet here. The long-term debt/equity ratio is just 0.3. Also, the company has been a prolific repurchaser of its own shares, reducing the outstanding share count by a whopping 34% over the last decade. Best of all? The stock looks cheap.

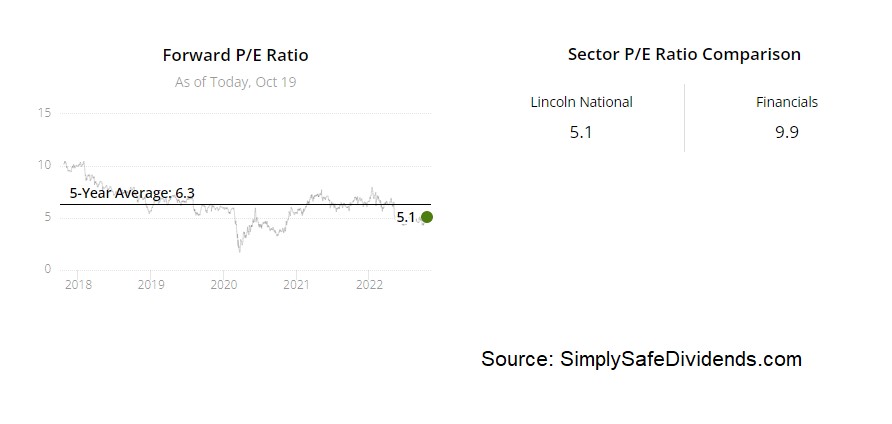

We’re talking about a P/E ratio of 6.9, based on TTM adjusted EPS. The forward P/E ratio is only 5.6. These are jaw-dropping numbers. I understand that this stock typically has an undemanding valuation – the five-year average P/E ratio is 11.6 – but we are in unreal territory here. The company is almost being given away. Adjusted book value is $79.49/share. It’s priced at nearly half of that right now. If CFRA’s near-term EPS growth forecast is anywhere near accurate, the PEG ratio here is somewhere around 0.3. That’s among the lowest I’ve ever seen.

We’re talking about a P/E ratio of 6.9, based on TTM adjusted EPS. The forward P/E ratio is only 5.6. These are jaw-dropping numbers. I understand that this stock typically has an undemanding valuation – the five-year average P/E ratio is 11.6 – but we are in unreal territory here. The company is almost being given away. Adjusted book value is $79.49/share. It’s priced at nearly half of that right now. If CFRA’s near-term EPS growth forecast is anywhere near accurate, the PEG ratio here is somewhere around 0.3. That’s among the lowest I’ve ever seen.

Want additional perspective on how cheap it looks?

Okay. Morningstar doesn’t track this name, but CFRA has a 12-month target price of $54.00 on the stock.

In my view, that’s a pretty conservative take on it, but that’s still 13% upside from the current pricing. And you’re collecting that nice yield along the way. There’s a lot to like about that kind of setup.

Could the stock go lower? Sure. Cheap can always get cheaper. But I see a very asymmetric relationship between downside and upside here, with the potential of the latter far exceeding the potential of the former. The stock is already down 30% YTD, and I think most of the work has already been done in terms of wringing out any possible excess in the valuation.

All of this is why I recently initiated a position in Lincoln National… and continue to buy.

I initiated the FIRE Fund’s position in Lincoln National on September 16th at $47.48 per share. I’ve added to the position since then, with the lowest cost per share coming on September 27th at $43.18 per share.

Of course, I alerted my Patrons over at Patreon about those moves right after they occurred. I plan to continue buying this stock in October and November, dollar-cost averaging my way into the position. And I’ll be alerting my Patrons over at Patreon about those moves and all other moves I’m making.

Of course, I alerted my Patrons over at Patreon about those moves right after they occurred. I plan to continue buying this stock in October and November, dollar-cost averaging my way into the position. And I’ll be alerting my Patrons over at Patreon about those moves and all other moves I’m making.

Is this stock right for your portfolio? As always, that’s up to you. It’s your call. But I think Lincoln National offers much to like and little to dislike for long-term dividend growth investors.

It’s certainly not a business that I’d bet the whole farm on, but the solid fundamentals, near-4% yield, clear commitment to dividend growth, and super low valuation at least warrants an investor’s attention, if not some of their capital.

— Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

This stock checks all the boxes. Pays a high dividend (8%), has a record of increasing that yield (an average of 37.5% throughout company history), and is set up perfectly to profit from continued Fed rate hikes. Click here for the name and ticker of the most perfect dividend stock on the market right now.

Source: Dividends & Income