Yield on cost divides a stock’s current annual dividend by an investor’s cost basis in the stock.

For example, a 5% yield on cost means that for every $100 originally invested in a stock, an investor is receiving $5 per year in dividends.

If a company raises its dividend after you bought shares, you will enjoy a higher rate of income return on your original investment – your yield on cost rises.

Investors track yield on cost to see the power of dividend growth. It is exciting to see an investment pay for itself with higher dividend income over time!

Let’s take a closer look at how to calculate yield on cost and use it to manage a dividend portfolio.

How to Calculate Yield on Cost

The yield on cost formula is simple:

- Yield on Cost = Annual Dividend Income divided by Cost Basis

To calculate yield on cost for an individual holding, first find the holding’s current annual dividend per share.

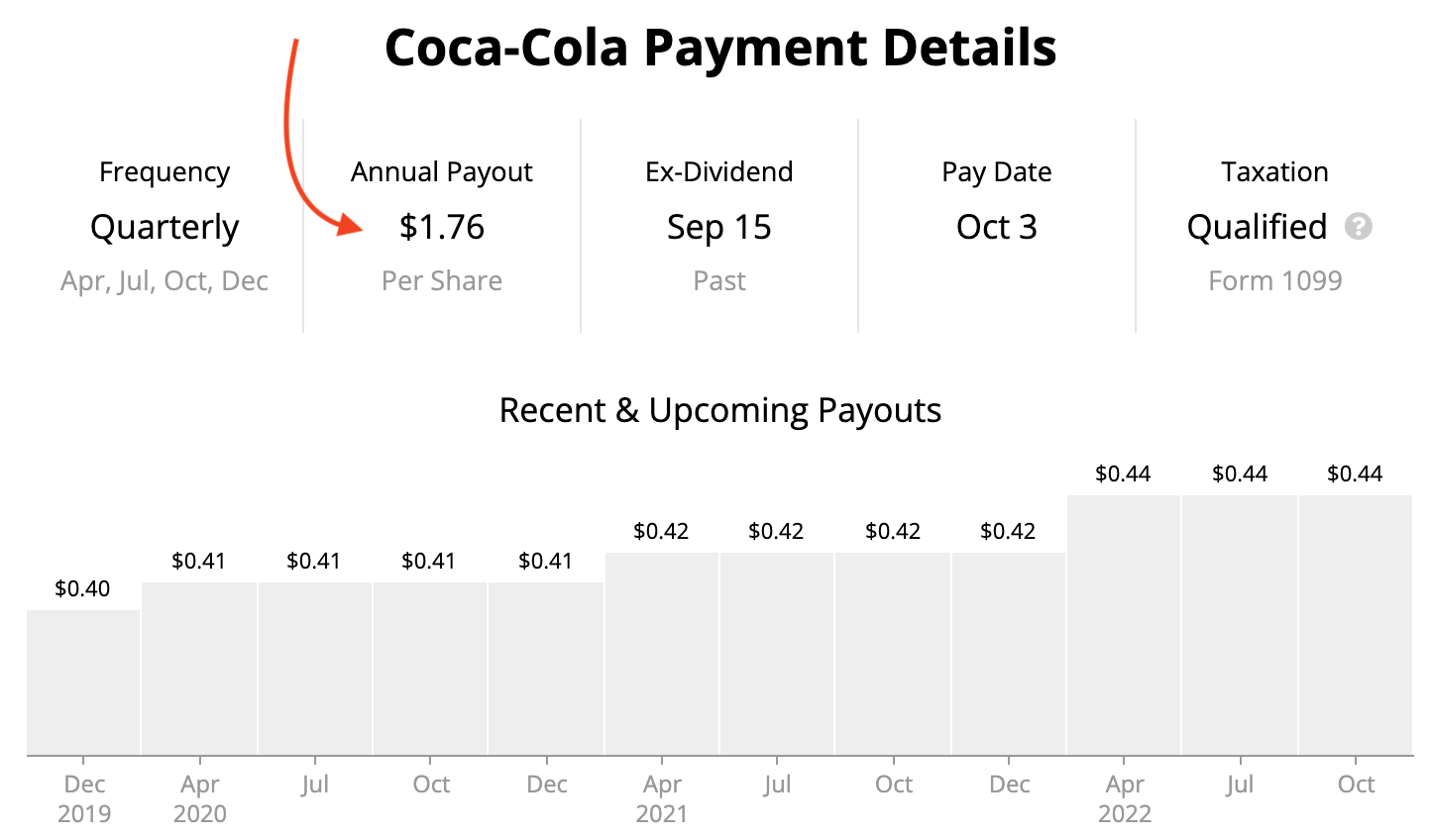

Using Simply Safe Dividends, we can see that Coca-Cola (KO) pays an annual dividend of $1.76 per share.

Source: Simply Safe Dividends

Source: Simply Safe Dividends

A company’s annual dividend then needs to be divided by the investor’s cost basis per share. Cost basis represents the price an investor paid to acquire his or her shares.

Suppose you bought 100 shares of Coca-Cola in 2019 for $5,000. This works out to a cost basis per share of $50 ($5,000 original cost divided by 100 shares purchased).

Dividing Coke’s current $1.76 per share annual dividend by your $50 per share cost basis calculates a yield on cost of 3.52%.

If Coke raised its dividend by 4% to $1.83 per share, your yield on cost would rise to 3.66% ($1.83 per share dividend divided by $50 per share cost basis).

Yield on cost increases when a company raises its dividend and decreases when a company cuts its dividend.

Cost basis information can become complicated as investors make additional purchases of existing holdings through direct purchases or dividend reinvestment plans.

Fortunately, brokers can supply investors with their cost basis information for each of their holdings.

Yield on Cost vs. Dividend Yield

Yield on cost should not be confused with dividend yield.

Dividend yield shows how much dividend income every dollar invested at a stock’s current price will produce, whereas yield on cost shows the rate of dividend income earned based on an stock’s original cost.

Dividend yield fluctuates daily because it divides a company’s annual dividend per share by the stock’s latest share price rather than an investor’s cost basis in the stock.

Share prices do not impact yield on cost. Yield on cost only changes if a company raises or lowers its dividend, or an investor buys or sells shares at a different cost per share.

Using the Coca-Cola example above, suppose shares now trade at $60.

Coke’s $1.76 per share dividend would result in a current dividend yield of 2.93% ($1.76 per share dividend divided by latest stock price of $60).

But your yield on cost would still be 3.52% ($1.76 per share dividend divided by original cost basis of $50 per share), regardless of where Coke’s share price heads from here.

Tracking Your Portfolio’s Dividend Yield on Cost

Trades, dividend reinvestments, and changing dividends throughout the year make tracking a portfolio’s yield on cost challenging.

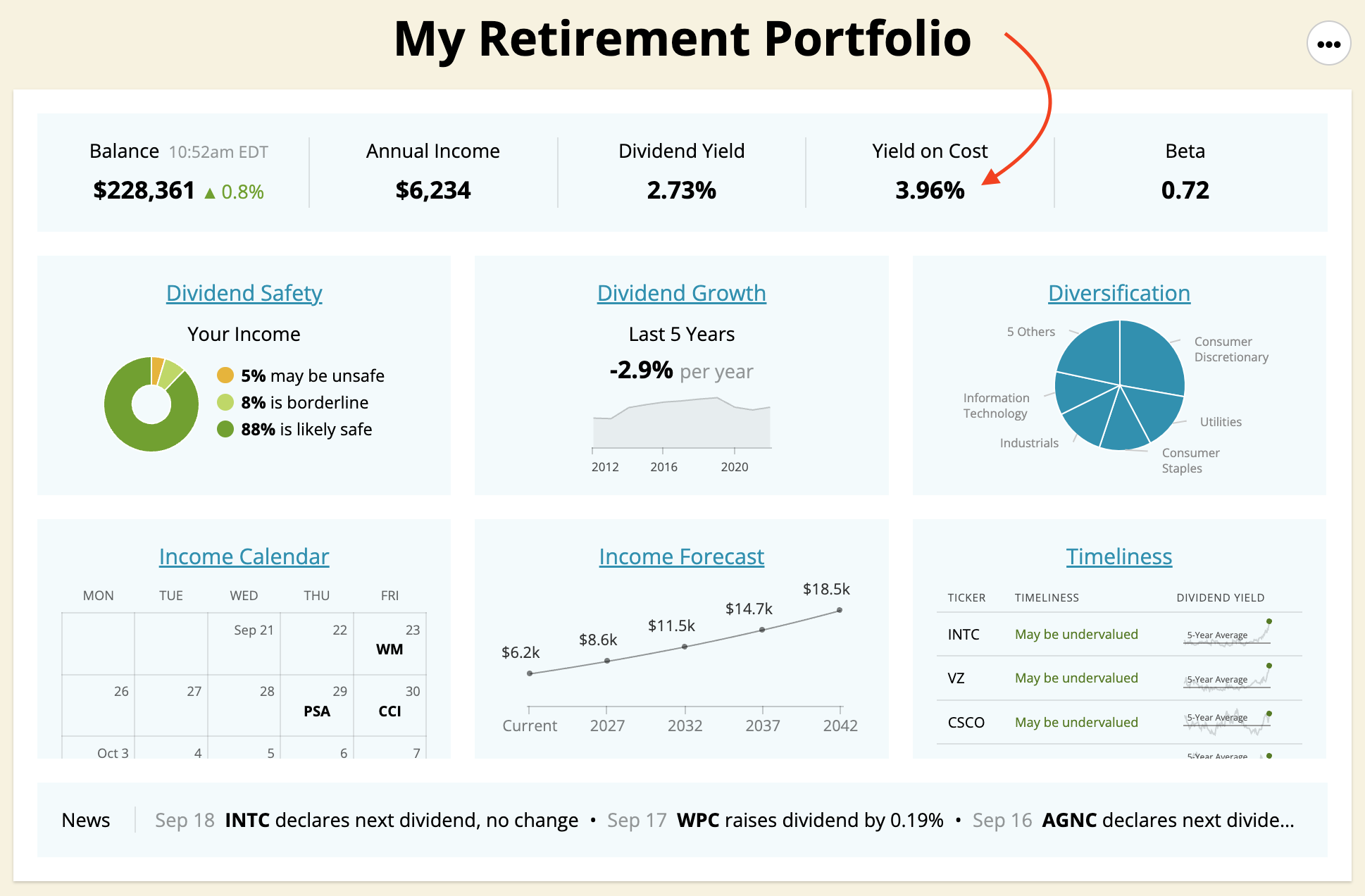

We created a dividend portfolio tracker that takes care of the heavy lifting required to calculate a portfolio’s yield on cost, in addition to other helpful metrics such as dividend safety.

Source: Simply Safe Dividends

Source: Simply Safe Dividends

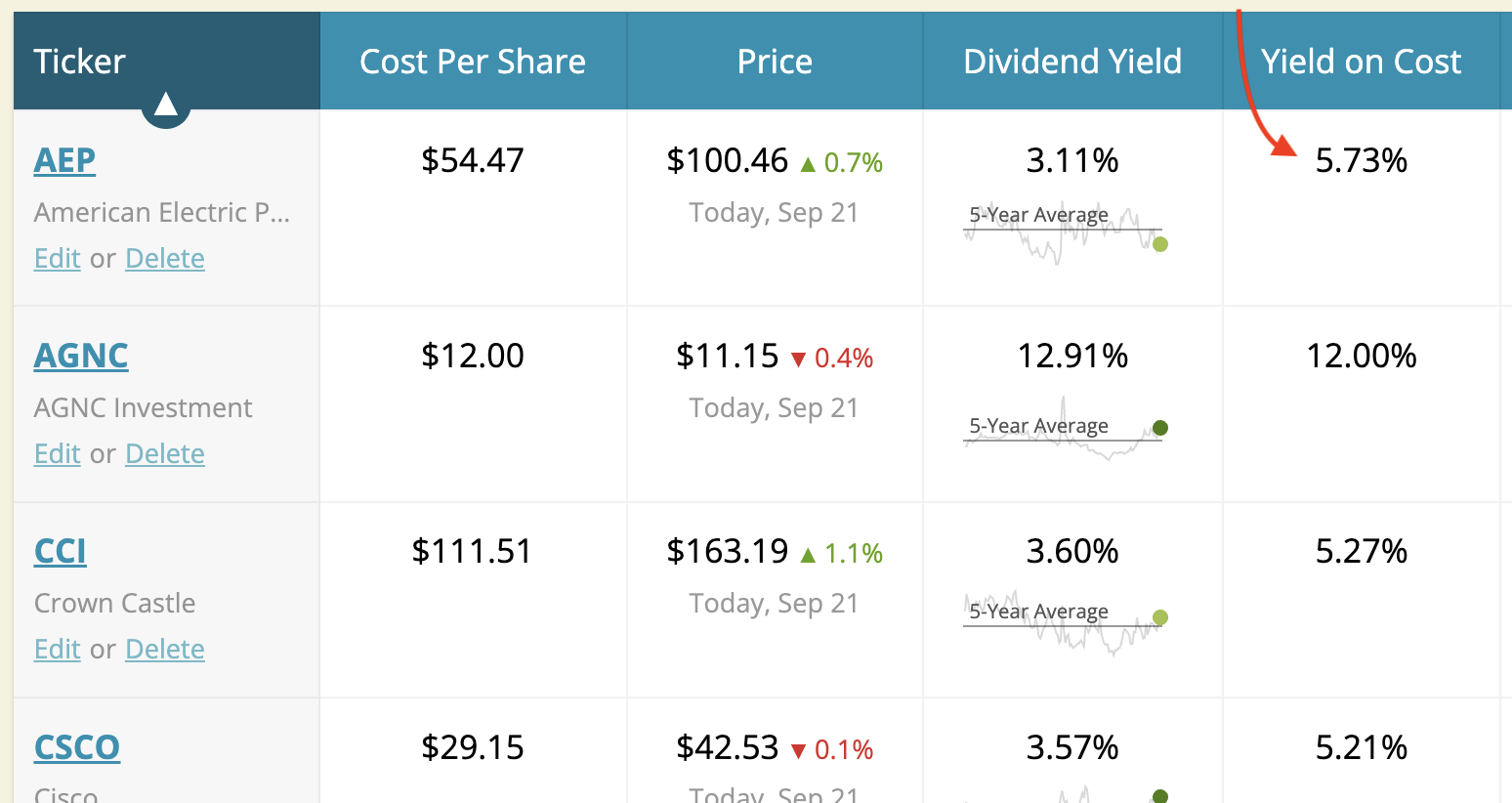

Investors can view yield on cost information for any individual holding, with dozens of other column options also available.

Source: Simply Safe Dividends

Source: Simply Safe Dividends

If you want to review the dividend yield on cost of your portfolio, you might be interested in taking a free trial of our dividend portfolio tracker.

While tracking yield on cost data is straightforward, let’s take a closer look at how dividend investors should apply the metric.

What Is Yield on Cost Used For?

Yield on cost highlights the power of a dividend growth strategy. A “good” dividend yield on cost is one that rises over time.

Suppose in 2022 we invested $100,000 in Union Pacific (UNP) at $210 per share. The company paid annual dividends of $5.20 per share, resulting in an initial yield on cost of 2.48% and annual dividend income of approximately $2,476.

If UNP grew its dividend by 8% per year from 2022 through 2030, the yield on cost of our investment would nearly double from 2.48% to 4.58%.

Instead of generating $2,476 of dividend income per year, our original investment of $100,000 would now be throwing off about $4,583 of annual dividend income, or even more if dividends were reinvested over this period.

This is a key advantage that dividend growth investing has over purchasing securities such as bonds that have fixed interest rates.

While stocks are much more volatile investments, a bond paying 2% today will still be paying 2% in the future – regardless of inflation.

Quality dividend stocks provide an opportunity to earn higher income on our original investment over time, reflected by a rising yield on cost.

And a portfolio that sees its yield on cost rise is likely appreciating in value because rising dividends are often the sign of a healthy, growing business.

Using the UNP example above, if the company’s dividend rose from $5.20 per share in 2022 to $9.62 in 2030, its stock price would almost certainly have appreciated.

If UNP continued to yield about 2.5% in 2030, just like it did when our shares were bought in 2022, UNP’s share price would be about $388, up over 80% since our initial purchase.

Seeing yield on cost rise over time can help investors stay the course and remember the long-term compounding benefits of a dividend growth strategy, especially in retirement.

Don’t Focus Too Much on Yield on Cost

Despite the excitement created by a rising yield on cost, investors must remain aware that yield on cost is mostly a backwards-looking measure.

Some investors argue yield on cost is irrelevant because it tells us little about a company’s future growth potential and business fundamentals.

Instead, yield on cost simply informs an investor whether a stock’s dividend has increased or fallen since the investment was purchased, and we shouldn’t always extrapolate past results.

We need to especially guard ourselves from falling in love with a holding simply because it has a high yield on cost.

Investors should resist the temptation to hold a stock with a high yield on cost if the investment is no longer attractive.

There is always an opportunity cost to consider from holding a stock, and it’s important to remember that dividend income is only part of the total return equation.

Yield on cost does not play a role in our investment decisions or process to manage a dividend portfolio.

Instead, we focus on metrics that provide clues about a company’s future, with a goal to own businesses that steadily grow their earnings over the long term to fuel sustainable dividend growth and a more valuable portfolio.

This involves studying how an industry works, reviewing a company’s track record, analyzing financial metrics, and other research techniques.

Yield on cost doesn’t help with this analysis process, but it should rise over time for high-quality dividend portfolios.

In other words, yield on cost should be viewed as an output of your investment process – not an input.

Closing Thoughts on Yield on Cost

Yield on cost is one of the most popular metrics used by dividend investors.

While a rising yield on cost can signal a winning dividend growth strategy, the measure itself is not all that useful when it comes to making incremental investment decisions.

Instead, we need to evaluate the fundamentals of a business and make sure the investment aligns with our long-term objectives and tolerance for risk.

As the great hockey legend Wayne Gretzky once said, “I skate to where the puck is going to be, not where it has been.”

— Simply Safe Dividends

This article was originally published by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. Try their service FREE for 14 days.

Source: SimplySafeDividends.com