We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Cepton, Inc. (NASDAQ: CPTN)

Today’s penny stock pick is the lidar-based solutions provider, Cepton, Inc. (NASDAQ: CPTN).

Cepton, Inc. provides lidar-based solutions for automotive, smart cities, smart spaces, and smart industrial applications in the United States, Japan, and internationally.

The company offers auto grade lidar sensors, including Vista-X, a compact lidar solution with a range of up to 200m for long-range applications in ADAS L2+/L3, AV L4/L5, and suitable for smart infrastructure applications; Vista-T, a lidar solution with a range of up to 300m for ultra-long-range applications in ADAS L2+/L3 and AV L4/L5; and Nova, an ultra-small form factor lidar solution with a range of up to 30m for near-range applications in ADAS L2+/L3, AV L4/L5, and suitable for smart infrastructure applications.

It also provides industrial grade lidar sensors, such as Vista-P, a compact lidar solution with a range of up to 200m for long-range applications in ADAS L2+/L3, AV L4/L5, and smart infrastructure applications; and Sora-P, an ultra-high scan rate, compact, and quasi line-scanning lidar solution that delivers high-fidelity profiling of objects moving at high speeds for free flow tolling and other industrial applications.

Website: https://www.cepton.com

Latest 10-k report: https://sec.report/Document/0001104659-21-149315 (amended), https://sec.report/Document/0001104659-21-093197/ (original)

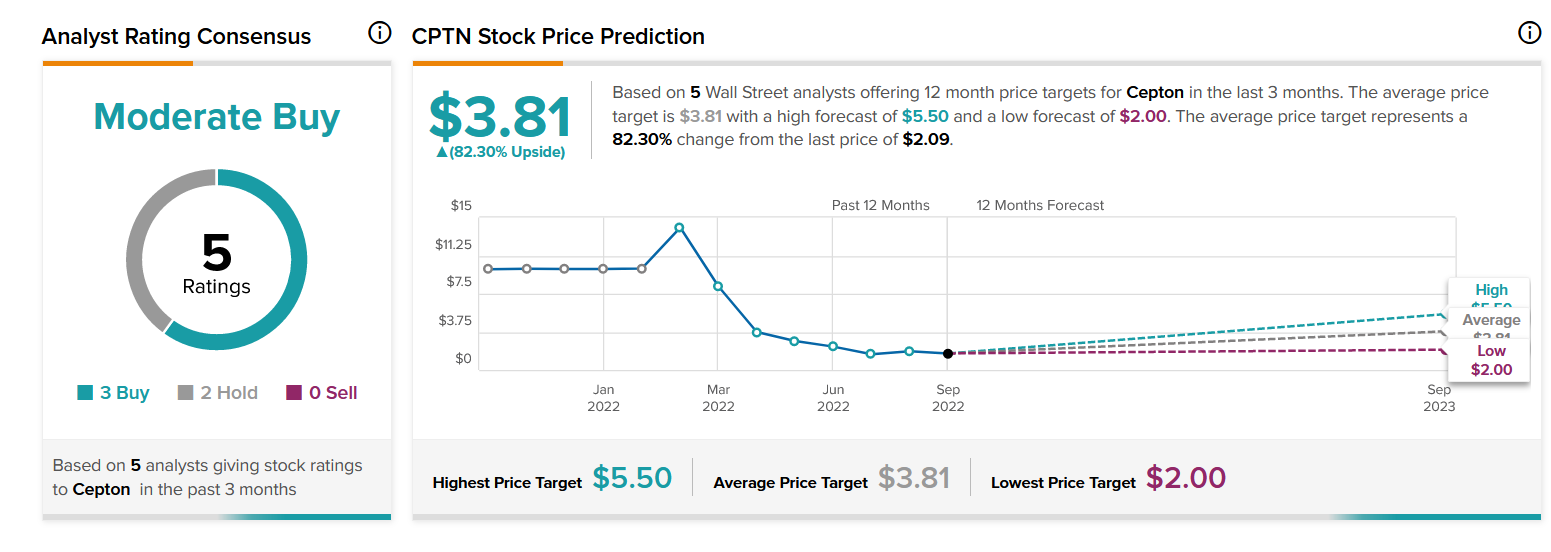

Analyst Consensus: As per TipRanks Analytics, based on 5 Wall Street analysts offering 12-month price targets for CPTN in the last 3 months, the stock has an average price target of $3.81, which is nearly 82% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The company announced that it is collaborating with NVIDIA to add Cepton lidar models into NVIDIA DRIVE Sim.

- Equities research analysts at JPMorgan Chase & Co. initiated coverage on shares of Cepton. The brokerage set a “neutral” rating on the stock.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Consolidation Area: The daily chart shows that the stock has been trading within a consolidation area for the past several months. This is marked as a pink color rectangle. The stock currently looks poised for a breakout from this consolidation area. This is a possible bullish indication.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently starting to move higher from below the +DI and -DI lines.

#3 Price above MA: The stock is currently above its 50-day SMA, indicating that the bulls have currently gained control.

#4 Bullish Stoch: The %K line of the stochastic is above the %D line, and has also moved higher from oversold levels, indicating possible bullishness.

#5 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#6 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a purple color dotted line. This is a possible bullish indication.

#7 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart as well, indicating possible bullishness.

#8 MACD above Signal Line: In the weekly chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for CPTN is above the price of $2.15.

Target Prices: Our first target is $3.50. If it closes above that level, the second target price is $4.00.

Stop Loss: To limit risk, place a stop loss at $1.50. Note that the stop loss is on a closing basis.

Our target potential upside is 63% to 86%.

For a risk of $0.65, our first target reward is $1.35, and the second target reward is $1.85. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

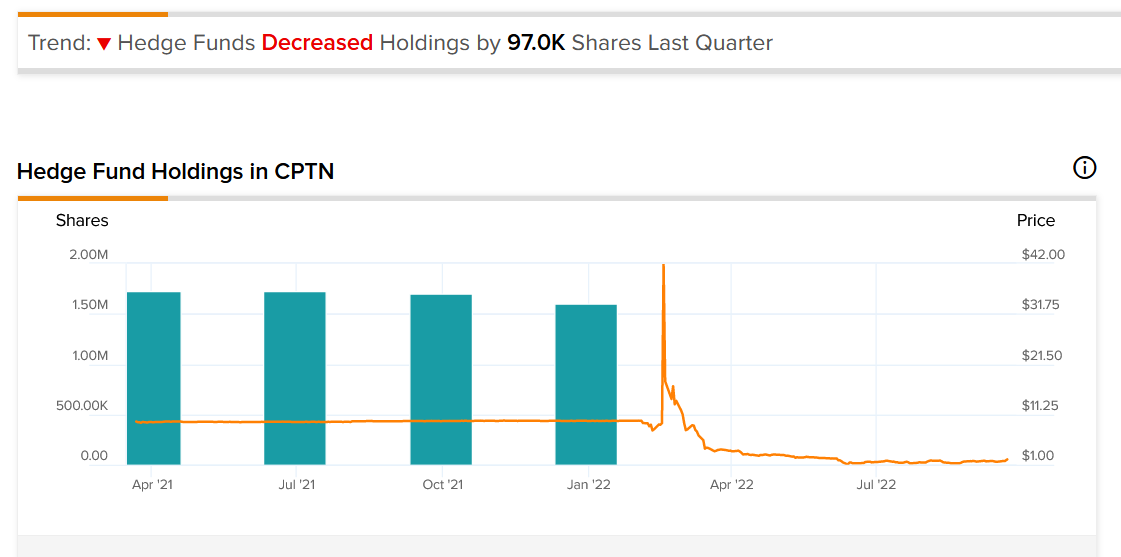

- Hedge Funds Decreased Holdings by 97.0K Shares Last Quarter.

- The company’s shareholders have been substantially diluted in the past year, with total shares outstanding growing by 621.7%.

- CPTN has a high level of non-cash earnings.

- The company has a history of net losses according to the latest quarterly report.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

I have been working very hard to introduce you to the greatest trading book ever written. At my trading firm, the very first thing that any new trader had to do was read this book. They wouldn't be allowed in my office if this book was not read. Now, I've taken this book and built an entire trading system around it. For anyone that has any interest in trading, this is a must read. It's about success, failure and then success again. This book is being offered today, Get Your Copy Now.

Source: Trades of the Day