Introduction S&P 500 Blue Chips

The S&P 500 is a popular proxy to represent the state of the stock market. Since stock prices of the S&P 500 bottomed out in the spring of 2009, the index produced above-average performance approaching 15% per annum.

However, simultaneous with this great performance came high valuations significantly above historical norms. To make matters worse, it appears that the US economy is headed into what could be a serious recession while simultaneously the market was overvalued.

In general terms, this is a recipe for disaster. On the other hand, since it is a market of stocks and not a stock market, there are pockets within the S&P 500 where valuation, quality, and even strong dividend growth is available.

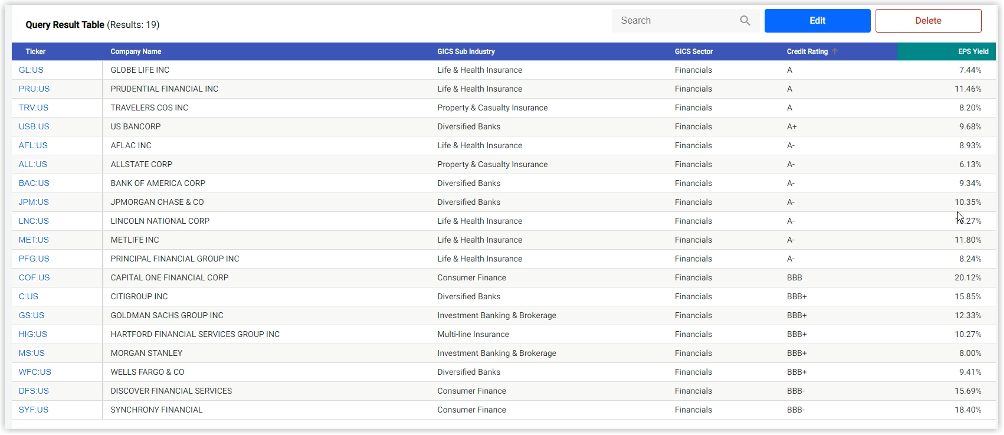

Aflac $AFL, Allstate Corp $ALL, Bank of America Corp $BAC, Citigroup $C, Capital One Financial $COF, Discover Financial Services $DFS, Globe Life $GL, Goldman Sachs Group $GS, Hartford Financial Services Group $HIG, JP Morgan Chase $JPM, Lincoln National Corp $LNC, MetLife Inc $MET, Morgan Stanley $MS, Principal Financial Group $PFG, Prudential Financial Group $PRU, Synchrony Financial $SYF, Travelers $TRV, US Bancorp $USB, Wells Fargo $WFC

In this video, I identified and review 19 S&P 500 blue-chip, investment grade, dividend growth stocks in the S&P 500 that offer a margin of safety. Given the potential ramifications of overall weakness in the economy and the market, these companies may offer conservative investors an opportunity to invest for safety, income, and even high long-term returns.

In this video, I identified and review 19 S&P 500 blue-chip, investment grade, dividend growth stocks in the S&P 500 that offer a margin of safety. Given the potential ramifications of overall weakness in the economy and the market, these companies may offer conservative investors an opportunity to invest for safety, income, and even high long-term returns.

After researching income stocks for over 30 years, I've come up with a one of a kind dividend portfolio. With the right 20-30 stocks, you can collect a dividend check every single day the market is open. That's over 260 dividend checks per year. Click here for the names of these 20+ stocks.

Source: FAST Graphs