When the market goes into the dumpster like it has in the last few months, one group of folks have an advantage: those who hold high-yield closed-end funds (CEFs).

If you haven’t already, now is a great time to join this group, thanks to the selloff. I’ll name an oversold bond fund that’s a great pick to start your CEF portfolio—or add to your current one—in a moment. It throws off a stable 7.5% payout that rolls your way monthly.

A 7.5%-Yielding “Dividend Lifeline”

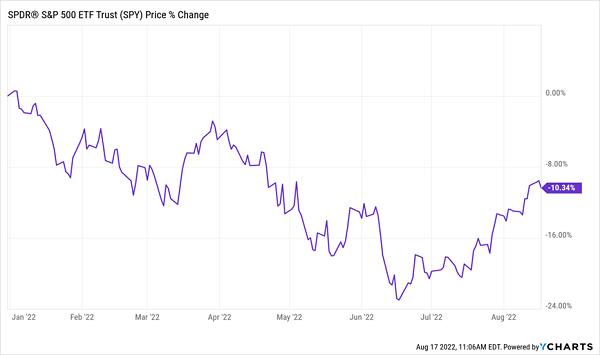

Investors in “regular” stocks only wish they could get a payout like that. Unfortunately, the measly dividend on the typical S&P 500 stock (around 1.5%) means those who stick to the household names are reliant on price gains alone, so they’re forced to deal with sickening drops like the 2022 mess:

“Regular” Stock Investors Are Forced to Rely on This

To be sure, CEFs, like regular stocks, have fallen in the last few months, too. But instead of low (or no) dividends, our CEF holders collected a big income stream, which reduced their need to sell units of their funds at bargain prices to pay their bills.

To be sure, CEFs, like regular stocks, have fallen in the last few months, too. But instead of low (or no) dividends, our CEF holders collected a big income stream, which reduced their need to sell units of their funds at bargain prices to pay their bills.

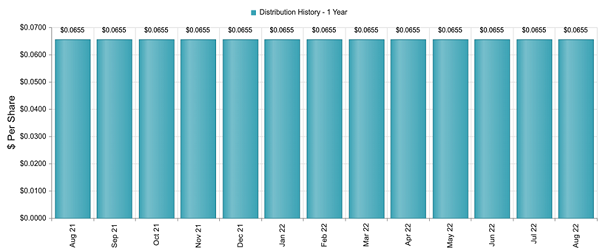

Holders of the CEF we’ll zero in on today—the AllianceBernstein Global High Income Fund (AWF)—collected just such an income stream. Despite the market carnage, AWF’s payout, which yields 7.5% today, was as steady as they come.

AWF’s Monthly Payout Rolls Right Through the Crisis

Source: CEFConnect

Source: CEFConnect

With a payout that size, you can invest $100K in AWF today and get $7,500 in annual dividend income. And the fund’s well-built portfolio and savvy management team are good reasons to consider doing just that.

A Dividend Built on a Strong Foundation

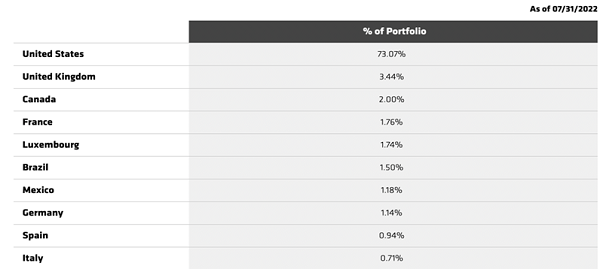

AWF generates its strong cash flow from a diversified portfolio of bonds from countries around the world, with about 70% based in America. The rest of the portfolio is filled out with assets from the United Kingdom, Brazil, Germany, Sweden and Australia.

AWF’s Diversified Portfolio: Our “Dividend Backstop”

Source: AllianceBernstein

Source: AllianceBernstein

The Rationale on Rates

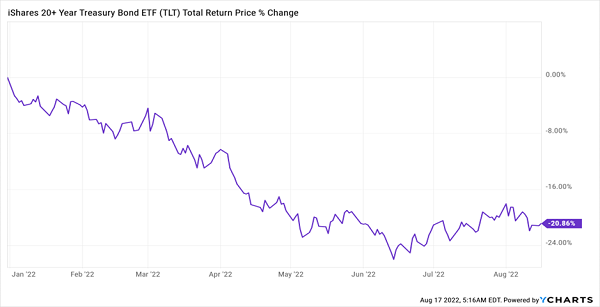

I know what you’re likely thinking: “But wait, do I really want to hold bonds like these with rates rising, given that bonds tend to move inversely to rates?”

It’s a good question. The truth is, rising rates have already been priced into bonds, which is why long-term US Treasuries, in particular, have fallen sharply this year.

Treasuries Hit Oversold Levels

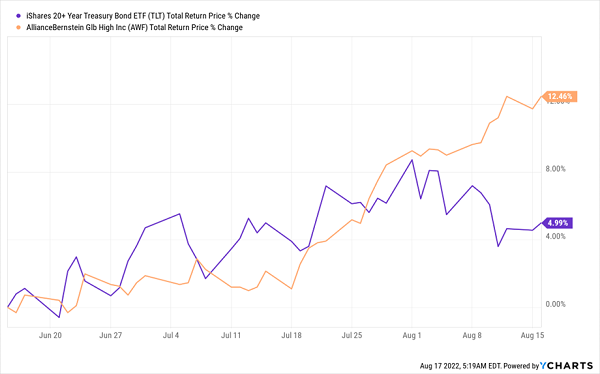

One thing to note here is that we’re well off the bottom of mid-June, and there’s a simple reason for that: the fear of rising rates has already been priced into bonds. With expectations for rate hikes hitting their highest levels in mid-June, the market priced bonds at their lowest point then—and AWF has jumped about 12.5% from then to now.

One thing to note here is that we’re well off the bottom of mid-June, and there’s a simple reason for that: the fear of rising rates has already been priced into bonds. With expectations for rate hikes hitting their highest levels in mid-June, the market priced bonds at their lowest point then—and AWF has jumped about 12.5% from then to now.

AWF’s Recovery Begins

The reason for this is simple: AWF has a collection of bonds of a variety of durations with a variety of exposures to US interest rates, thanks to management’s more active approach to markets. Thanks to that active approach, AWF (in orange below) has run circles around the benchmark ETF for US Treasuries (in purple) since AWF’s inception.

The reason for this is simple: AWF has a collection of bonds of a variety of durations with a variety of exposures to US interest rates, thanks to management’s more active approach to markets. Thanks to that active approach, AWF (in orange below) has run circles around the benchmark ETF for US Treasuries (in purple) since AWF’s inception.

Active Management Pays Off for AWF

And right now, AWF is beginning a recovery from a short-term selloff, just as it did in 2009, 2016, 2018 and 2020, as you can see in the chart above. This is also causing its discount to net asset value (NAV, or the value of the bonds in its portfolio), which was recently over 10%, to shrink (it’s now at 4.6%). I expect that discount to shrink further as more investors realize that short-term fears over the economy have already been priced in.

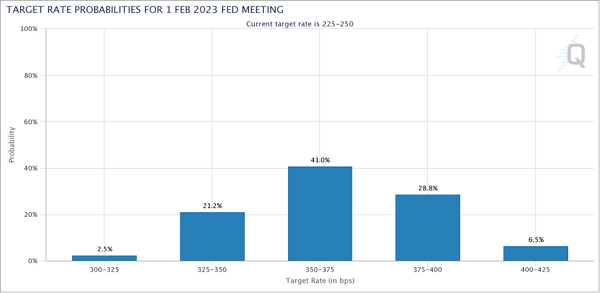

Rate-Hike Cycle Could Be in Late Innings

Remember, too, that both stocks and bonds are forward looking, so they don’t price in yesterday’s fears of higher rates, but tomorrow’s interest-rate outlook instead. That may sound a bit confusing, but this chart should make things clear.

The End of the Rate Hike Road?

Source: FedWatch.com

Source: FedWatch.com

According to the Fed futures markets, rates will rise in September, November and December, with a forecast pause after that, with possible rate cuts later next year.

Bond traders are looking to get ahead of this shift and buy before the average investor, which is why bonds have been soaring since June. And until there is economic data to combat that view, bonds are likely to keep soaring, setting up AWF for substantial gains on top of its 7.5% income stream.

— Michael Foster

These 5 Monthly Dividend CEFs (Yielding 7.9%) Are a Perfect Fit With AWF [sponsor]

As I mentioned, AWF is a good “cornerstone” bond fund for an income portfolio. Its price momentum, discount and high, steady dividend are all things we search for when we buy CEFs. The fact that it pays monthly makes it even more attractive.

I’ve got 5 other CEFs that match up perfectly with AWF, because they give us the same four strengths: high dividends (these 5 funds yield 7.9%, on average); big discounts (I’m calling for 20% price gains from these 5 CEFs); price momentum—and even monthly payouts.

These 5 funds also come from across the market, holding global stocks, blue chip stocks, international stocks, bonds and more, so you’ll be well diversified.

I’m ready to share all of my research on these 5 income (and growth) plays now. Click here and I’ll give you their names, tickers and all the other “must-have” details in an exclusive Special Report.

Source: Contrarian Outlook