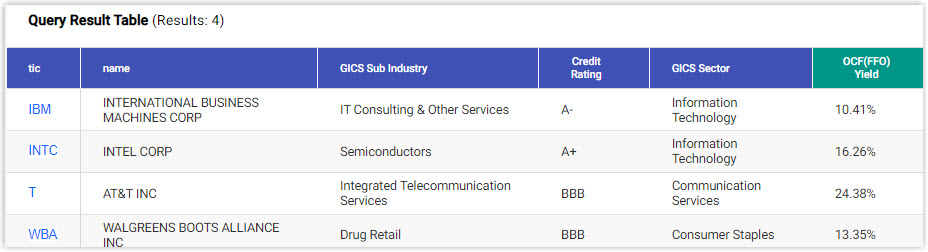

In this video I will cover 4 dividend growth stocks: Walgreens Boots Alliance (WBA), Intel Corp (INTC), International Business Machines (IBM) and AT&T Inc (T).

I believe one of the most important considerations when selecting stocks to add to your portfolio is honestly answering this question: What am I investing for? However, the correct answer to this question will vary from individual investor to another. For example, one investor may be entering retirement and only have enough capital to fund their retirement if they can earn 3% income from their investments. In contrast, another investor could have many years to go before they retire and therefore most interested in accumulating capital to fund their retirement.

Clearly, individual situations can vary to an almost infinite degree. Every investor is different and has different needs. Furthermore, there is also the issue of risk tolerance. Some investors are simply not psychologically suited to deal with risk. In contrast, some investors are fully capable of assessing risk and therefore dealing with it. Consequently, when considering individual stocks to add to their portfolio, quality characteristics may be important to one investor, whereas growth characteristics may be more important to another. And just like the need for income, the situations can vary, again, to an almost infinite degree.

What this boils down to is that one stock that may be attractive to one individual, may be completely inappropriate for the other. Therefore, the key is to build your portfolios with common stocks that possess the characteristics that the investor needs, and therefore, are capable of getting the job done that investor needs to. Although I used a couple of specific examples here, it is important to repeat that the situations and variables can differ greatly between one investor and the other. In simple terms, a stock that does not pay a dividend might not be very useful for the investor who desperately needs current income.

For these reasons and more, I refrain from recommending direct investment into individual stocks. Instead, I prefer to offer potential research candidates to those investors that may find stocks I am reviewing of interest or value. The primary point is that unless I know the specific goals, objectives, and risk tolerances of the individual, I do not feel comfortable making specific recommendations. On the other hand, I am not unwilling to offer stocks that certain individuals may find worthy of conducting further research and due diligence on.

In closing, there are additional considerations that need to be mentioned. People need to decide whether they are speculators or investors. Speculators tend to be short-term oriented whereas investors are more prone to invest for the long-term. Although there is no specific definition for long-term versus short-term, I would posit that when investing in common stocks long-term suggests at least a business cycle. Typically, that runs 3 to 5 years, but preferably much longer. In this video I will cover these principles and others with the hopes of bringing clarity to the minds of people needing to invest their money in common stocks.

FAST Graphs Analyze Out Loud Video

— Chuck Carnevale

Experts are predicting that in as little as three months, AI as we know it could be totally blown away. And that means as early as October 8, ChatGPT could be replaced by a new AI that's thousands of times more powerful... something that could cause expensive tech stocks like Microsoft, Google, and NVIDIA to double - maybe even triple - in price in the months ahead. Click here for all the details.

Source: FAST Graphs