Statistician and trader Nassim Nicholas Taleb published his book “The Black Swan: The Impact of the Highly Improbable” in 2007 – just months before the global financial crisis and Great Recession hit full swing. In this, and in other writings, he explores the importance of preparing for the unexpected.

After a brutal year or so on Wall Street, I recently went back to Taleb’s works. They offer some very important lessons on resilience and risk, and I highly recommend them.

But since most people prefer simple, real-world examples to a homework assignment, let me give you the Reader’s Digest version – using tobacco giant Altria Group Inc. (MO) as my case study.

Altria is perhaps the best example of an “antifragile” stock on Wall Street, to borrow from another one of Taleb’s titles. This nearly $80 billion company has faced major disruptions to the global financial system as well as existential threats within its specific business area, but has managed to thrive over the decades despite everything it has faced.

Here’s why it’s a buy right now and how it provides a great measuring stick for a stock that can hang tough in any environment.

“Antifragile” Altria is as solid as they come

For those who don’t know, Altria is the domestic operations spun out of international tobacco giant Philip Morris (PM) in 2008. It depends on sales from iconic brands including Marlboro cigarettes, Black & Mild pipe and cigar products, and smokeless tobacco such as Copenhagen and Skoal.

These products aren’t particularly good for you. But research about the health risks of tobacco has been out there for decades, so it’s not like consumers are uninformed. And perhaps more importantly, it’s not like Altria hasn’t learned several hard lessons about proper marketing for these products over the decades.

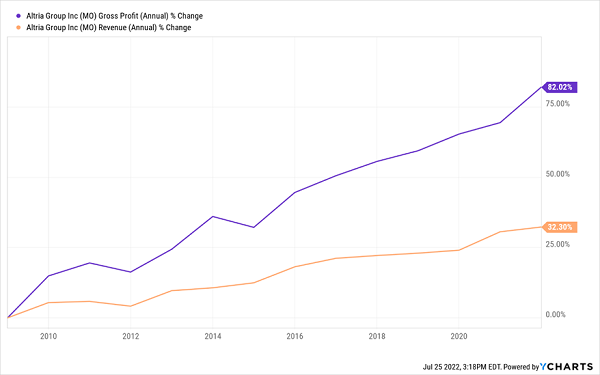

In fact, the stability of Altria is surprising to many investors. The company has $4.5 billion in cash sitting on its books to protect against any uncertainty. And despite admittedly flat revenue over the past few years, it continues to squeeze higher and higher earnings out of operations. For instance, gross income has risen steadily in each of the past five years, from $12 billion in 2007 to about $14 billion presently. Just look at this chart and you’ll see at a glance how much faster profits are growing over sales.

From an income perspective, there’s even more to like. MO has continued to deliver reliable low-risk returns for many years – including an enviable history of more than 50 dividend increases over the last 50 years. And that’s not a token dividend, either, but a generous 90-cent per quarter payday that equals an impressive 8.4% annually… but is still just 70% of projected earnings, and ripe for more increases down the road!

You don’t have to smoke cigarettes to know a well-managed income investment when you see one.

The icing on the cake is that cigarettes are an incredibly stable consumer staple item. “Sin stocks” like cigarette companies along with junk food brands and alcohol producers sometimes even see an uptick in sales during tough economic times, as shoppers look to destress with simple pleasures as they tighten their belts and pass over major discretionary items.

If you’re uncertain about the state of the stock market, then this is an “antifragile” stock that can certainly provide peace of mind.

The contrarian outlook on Altria

I’ve written before about my MVP strategy here on Contrarian Outlook, which involves selecting stocks that have strong management, valuation and payouts. If you’re unfamiliar with this approach and want to learn more, you can read more about that philosophy in these three other recommendations:

- Pharmaceutical giant AbbVie (ABBV) – a dividend darling that soaring in a down year.

- Automaker Stellantis (STLA) – a rock-bottom valuation plus a yield that’s 5X its peers.

- Megabank JPMorgan Chase (JPM) – a megabuy after its bounce from recent lows

Altria is another MVP stock that I think is worth a look right now. Its management is shrewd at delivering long-term profitability and its payout is among the top five in the entire S&P 500 index.

The only thing we haven’t talked about yet is valuation. So let’s round things out:

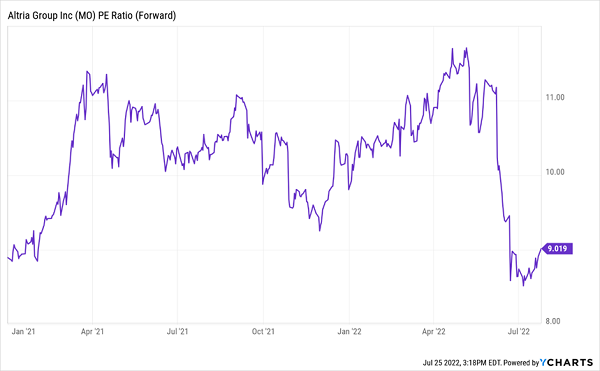

Thanks to the recent hit this stock took in June after setbacks to e-cigarette producer Juul, MO is trading at a forward price-to-earnings ratio of less than 9. That’s down significantly from its normal range of around 11 and its lowest reading for that important valuation metric since its early days after the spin-off of 2008.

Yes, Altria invested a whopping $12.8 billion in Juul a few years ago. But just this last May, before the FDA ordered Juul to pull its products from the market, the company was valued at more than $103 billion in total – and after its recent declines, is now valued at around $80 billion. Even if some naysayers on Wall Street claim the entirety of that $12.8 billion was a waste with not a penny of ROI, why in the world would the stock be punished by a decline that is nearly twice that amount? Or put another way, do investors really think $1 out of every $5 in Altria’s market value was tied to Juul and Juul alone?

You would have to presume that Altria is a cash-poor, mismanaged mess that has been seeing the world through rose colored classes for years to justify a flop like that. But as we just went over, that’s decidedly not Altria.

Which means Wall Street is wrong – and those of us who think like a contrarian have an opportunity to cash in.

— Jeff Reeves

Build a complete lineup of winners for the long haul [sponsor]

Altria is near the top of my buy list right now. The long-term management is strong and the dividend payouts are generous, but that’s pretty well known on Wall Street. What makes it a screaming buy this summer, however, is the rock-bottom valuation that makes it a complete MVP.

It’s funny… not a week goes by without an old colleague or family friend remarking to me how crazy I am for owning individual stocks and not just pledging blind allegiance to the Industrial Index Fund Complex.

But they don’t see what I see. They aren’t willing to look under the surface, to think like a contrarian and stick with stocks that deliver significant outperformance to those who buy at the right time and then hang on for the long haul.

That’s what this is about for me and all of us here at Contrarian Outlook. We’re out to build low-risk, diversified portfolios that deliver for many years to come.

This isn’t about aggressively trading our way to short-lived gains that get eaten up by fees and taxes. This is about a “permanent portfolio” that will let you live on dividends alone—generating a comfortable living for you and your family, without requiring you to sell a single stock. Ever!

That’s one more reason Altria is such a great play. You need a baseline of 7%+ annual income to live the retirement you deserve, and generate $70,000 annually on a $1 million portfolio. Not only does a generous stock like MO offer stability in a tough market like 2022, it also delivers for many years to come thanks to consistent dividend growth and sustainable payouts.

Right now, our Contrarian Income Report portfolio yields an average 7.6% across a baker’s dozen of stocks – all of them as good or better than Altria. And the kicker is that many of these stocks pay on a monthly basis to help you manage your cash flow, too!

Click here and check out our favorite 7%+ monthly payers—risk free for a limited time!

Source: Contrarian Outlook