I get a lot of readers asking me when this market will bottom. We don’t know for sure, of course, because market bottoms are only visible in hindsight. But I would say that now is a good time to buy dividend-paying stocks—especially if you use dollar cost averaging (DCA), which you probably used to build your portfolio.

DCA (or buying a fixed amount on a fixed date throughout the year, say) is particularly effective for high-yield CEFs, which are, of course, our beat at my CEF Insider service.

That’s because of these funds’ above-average dividends and deep discounts to net asset value (NAV, or the value of the stocks in their portfolios). CEF investors who DCA into CEFs can slowly build their income stream over time, reduce their volatility and naturally grab big dividends and discounts, too.

To see what I mean, consider a CEF like the BlackRock Innovation & Growth Trust (BIGZ), a contrarian’s choice if there ever was one. Buying this fund through DCA starting now gets your first buy in the door at a 10.2% yield and a 17.3% discount to NAV.

That might be a good strategy if you’re hesitant to go all in on BIGZ, which I can understand, given that it holds small-cap tech stocks like Bill.com Holdings (BILL), which makes back-end software for small to medium-sized businesses; Five9 (FIVN), which supplies customer-service software; and Axon Enterprise (AXON), a maker of software for the police and the military.

Diversification, DCA Cover CEF Investors Either Way

No matter if you buy all at once or average in, I continue to believe now is a good time to purchase equity-focused CEFs. And while I see BIGZ as a good choice for a speculative play on an economic rebound, you should always hold a collection of CEFs with a diversified range of assets, such as blue-chip stocks, corporate bonds and real estate investment trusts (REITs). You’ll find those among the buy-rated CEFs I recommend in CEF Insider.

That way, you’ll be exposed to today’s healthy (and it is healthy!) economy in a number of ways. And if the market does take a tumble, you’ll be well diversified and able to continue collecting your high CEF dividends in peace.

But I do see good signs for the economy and our CEFs, even though things are likely to move in a two-steps-forward, one-step-back manner—highlighting the importance of high dividends (which allow us to get through pullbacks without having to sell) and a DCA approach, which lets us naturally buy more of our CEFs when their prices are low and less when they’re high.

Here are two reasons why I’m optimistic:

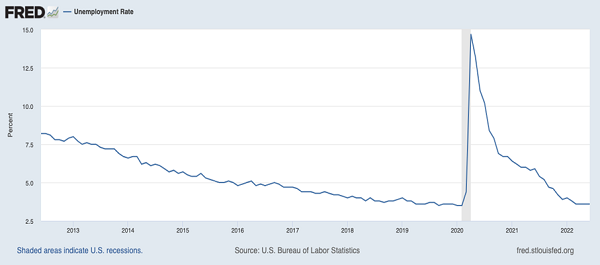

Employment Remains Strong

Despite the constant stream of bad news coming from the media, we can take solace in the fact that jobs remain plentiful in America:

Unemployment Sinks to Historic Lows

Americans are working more than ever, with a 3.6% unemployment rate that is the lowest since 1969. Employees have so much power in today’s work marketplace—something they haven’t felt for generations—that it’s causing a rush of spending across the board.

Data from Mastercard makes it clear that we aren’t just seeing higher spending because of elevated inflation. After all, if consumers were scared that rampant inflation will make life unaffordable, they wouldn’t boost their spending on, say, jewelry by nearly 90% since before the pandemic. Yet that’s exactly what we’re seeing.

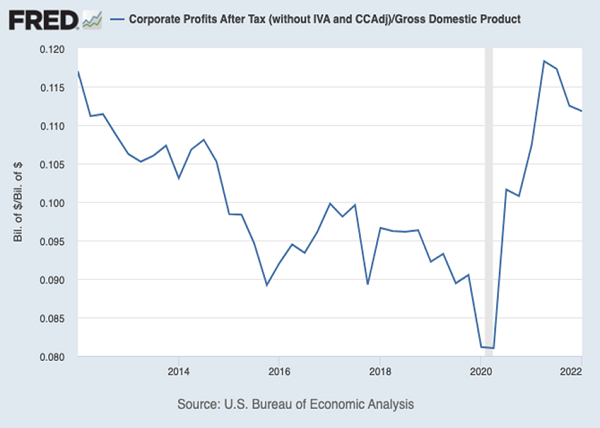

Corporate Profits Are Surging Despite Rising Costs

Does this higher demand translate into higher corporate profits? You could argue that, maybe, it doesn’t, as companies pay more for workers and raw materials. However, those costs are being more than offset by higher sales, driving profits to 10-year highs:

The left side of that chart—the last profit peak in 2012—is important because it marked the start of a bull market after the Great Recession.

That’s a good sign, because investors who bought then—a time that looks a lot like the period we’re living through now—would’ve pulled in a 14% annualized return in the decade since. Despite the Federal Reserve’s interest-rate announcement [Wednesday], I have a feeling that a decade from now, those who buy today will be able to say something similar.

— Michael Foster

Urgent: Buy This “Instant” 5-CEF Portfolio (Yielding 8.6%) Now [sponsor]

As I said above, any investment in tech stocks should be part of a balanced CEF portfolio—and that’s exactly what you get with the 5 CEFs I’ll tell you about right here.

These 5 unheralded funds come from across the economy, giving you exposure to healthcare stocks, household-name US blue chips, corporate bonds, real estate investment trusts and, yes, tech stocks (techs that profit from surging interest in artificial intelligence, to be specific).

These 5 CEFs yield 8.6% today and trade at deep discounts, too—so deep that I expect them to bounce a fast 20% once the market rebound fully kicks in, and hold up well if we see another leg down. Either way, you’ll collect your reliable 8.6% dividend the whole time.

Click here and I’ll reveal my full CEF investing strategy and give you the opportunity to download an exclusive Investor Report detailing these 5 discounted CEFs. You’ll get their names, tickers, current yields and more, so you can start collecting their 8.6% dividends today.

Source: Contrarian Outlook