Last week, I shared with you one of my top picks right now in pharmaceutical giant AbbVie (ABBV). The stock has tripled its dividend in about 10 years and is one of the rare investments that’s actually up in an admittedly rocky 2022.

And the week before that, I detailed another “MVP” stock in Stellantis (STLA). This automaker is plotting big cost-savings after a recent merger, currently delivering more than 5X the yield of the typical stock in the S&P 500.

This time around I want to share with you another recommendation, megabank JPMorgan Chase (JPM). This financial stock also exhibits the three must-have factors I look for – strong management, attractive value and generous payouts – but has recently been making headlines after earnings that make this trade a bit time-sensitive.

We’ll get to those long-term factors in a moment. But first, here’s the latest news on JPM and what it means.

JPMorgan Chase Looks Strong After Earnings

As usual, JPM started the earnings parade for the financial sector. That’s fitting, as it’s the largest bank in the U.S. by assets and the largest traditional bank by market cap in the U.S.

Unfortunately, the stock stumbled out of the gate. After earnings on July 14, the stock slumped on a very small earnings miss and news it would suspend stock buybacks in order to sock away cash as part of higher regulatory capital requirements through 2024.

This certainly wasn’t the end of the world – particularly since regulatory capital requirements were well telegraphed to investors, and are in fact a sector-wide concern and not thanks to any shenanigans on behalf of JPM. But since the stock is seen as a bellwether, Wall Street sold off all banks in a knee-jerk reaction late last week.

As the dust settled and investors got deeper into the details, however, shares not just stabilized but started to move higher. After all, who is surprised by the fact its investment-banking activity is down sharply from mid-2021 considering as events like initial public offerings (IPOs) have all but dried up in the “risk off” environment of 2022?

Secondly, banks across the board have rallied this week after the Federal Reserve signaled it is poised for yet another 0.75-point interest rate increase. Higher rates are good for financials because it raises their margins on most interest-bearing products and allows better low-risk returns on cash reserves.

The result is JPM briefly setting a 52-week low, but snapping back quickly including a 4% up day on last Friday. It’s now back around $115 a share, where it has traded consistently since early June. That proves there is cash on the “sidelines” just waiting for the right moment to dive into high quality stocks like JPMorgan Chase on a pullback like the one we saw last week.

Historically, that’s a great sign of a stock with firm support underneath shares – and potential to move higher.

JPM is an MVP

Let me be clear: I am not an aggressive trader by nature, and would never advocate trying to jump in and out of a stock after just a few sessions.

However, just because I’m a long-term investor doesn’t mean I ignore short-term trends. This balance of long-term potential and real-time analysis is what it takes in a challenging market like this one to get ahead.

So let’s get beyond the here and now and think about what a long-term investment – years, not months – might look like in JPM.

I’ve talked before about my MVP philosophy, with a focus on Management, Valuation and Payouts. Here’s how the stock stacks up on these key factors…

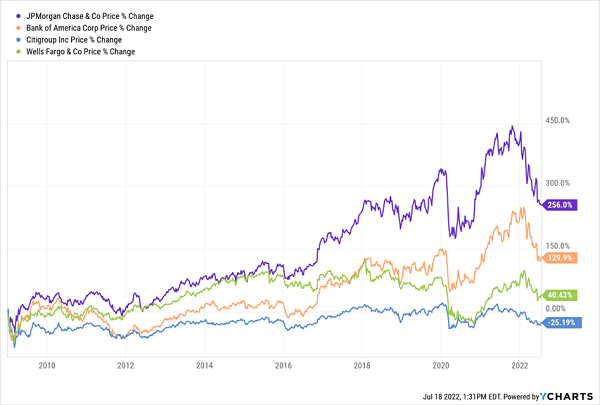

First, let’s look at management. The strategic dominance of JPMorgan Chase is well established, with roots of the company dating back to 1799. It’s not resting on its laurels, either; during the financial crisis, CEO Jaime Dimon made his reputation as the shrewdest banker on Wall Street as the company weathered the storm better than its peers and made massively profitable acquisitions of the troubled Bear Stearns and Washington Mutual at fire sale prices. This shored up JPM’s long-term dominance – and as a result, when you look at long-term performance of peers like Bank of America (BAC), Wells Fargo (WFC) and Citigroup (C), there simply is no contest.

Now let’s look at valuation.

JPMorgan trades for less than 10 times future earnings, well below the reading of just over 16 that is the current forward price-to-earnings ratio for the average S&P 500 component. It trades for a slight premium above its “book” value at a multiple of around 1.3, but consider smaller regional bank PNC Financial Services Group, Inc. (PNC) trades at that same level – while others such as U.S. Bancorp (USB) trade at an even bigger premium.

And in case you’re wondering, it’s not the only megabank trading for a premium. Bank of America isn’t quite that high, but still has a price-to-book ratio of about 1.1 as investors are placing a premium on the expected success of this sector under higher interest rates.

In a nutshell, JPM is fairly valued when you consider its peers and new investors will likely not be overpaying for shares. Now let’s finish things up with the income outlook.

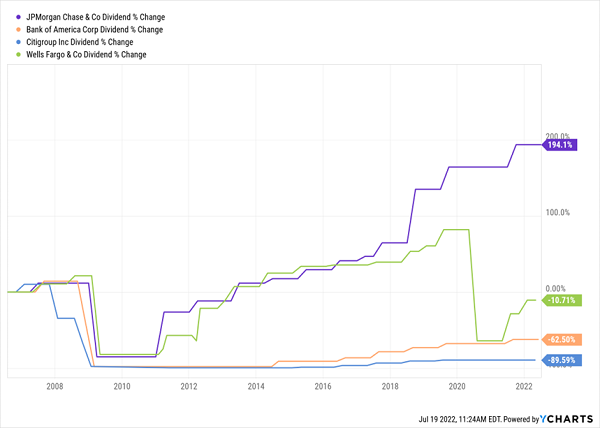

While lesser peers BofA and Citi were gutted by the financial crisis, JPM not only held tough but was among the first major financial organizations to return to pre-crisis dividend levels. Consider that in 2008 it was paying $1.52 annually and by the end of 2014 it had paid $1.56 per share; by contrast, Bank of America and Citigroup are both paying less than a third of their peak dividends per share.

What’s more, the headline yield of JPM is even better than BofA with a 3.5% dividend right now – and with payouts roughly a third of projected earnings, you can depend on that moving higher in the future, too.

— Jeff Reeves

Add More MVPs to Your Lineup [sponsor]

These three factors – management, valuation and payouts — are key to a successful long-term return and reliable retirement income.

And when you marry that strategy with deep analysis based on current market trends, it’s possible to unlock significant and reliable outperformance.

The challenge for many investors, of course, is sifting through heaps of market information to identify the best opportunities.

But thankfully, here at Contrarian Outlook we have a host of resources to help you in your investing journey!

We’re passionate about the markets here. And we’re equally passionate about making sure investing is something that everyone can do safely and profitably. That’s why you’ll find our investing strategies written out in plain English — offered up at no risk to readers like you, to show you we’re not just playing around.

Our goal is a serious one: to help you build a low-risk, diversified portfolio that will let you live on dividends alone—without selling a single stock to generate extra cash.

JPM is a great stock, but in all honesty it’s only a small part of the puzzle. Our recommendation is a baseline of 7% annual income — which would generate $70,000 annually on a $1 million portfolio. Not only does a generous payday like that provide a hedge in a tough market, it also ensures you can retire in style without worrying about bleeding your portfolio dry just to pay the bills.

Right now, the baker’s dozen in our Contrarian Income Report portfolio yield an average 7.6%. Best of all, many of these stocks pay on a monthly basis to help you manage your cash flow.

Click here and check out our favorite 7%+ monthly payers—risk free for a limited time!

Source: Contrarian Outlook