This year has been incredibly volatile for stocks. Thanks to runaway inflation, rate hikes, soaring yields and COVID lockdowns, we’ve definitely seen our fair share of down days. But now the stock market is ready to shake out of its slump and stage a massive breakout. And growth stocks will lead the way.

Yesterday, stocks soared, continuing what has been an excellent month for the market. Over the past 30 days, the Dow Jones and S&P 500 are both up about 7%. The Nasdaq is up 8%. And growth stocks have led this rally, outperforming the rest of the market!

Now, everyone’s got the same question on their minds. Are we at the beginning of a major market reversal, or is this just another unsustainable bear market rally?

We think it’s the former — for a lot of reasons. The Fed is finally committed to fighting inflation. That same inflation is consequently peaking. Commodity prices are crashing, and so are Treasury yields. Valuations have reset to historically discounted levels. Insiders are buying the way they only do at market bottoms.

There are lots of bullish signals flashing right now.

And yesterday, the two biggest “Strong Buy” signals flashed for the first time since the market hit its COVID-19 lows — and before that, the bottom of the stock market crash in 2008/09.

And they have us pretty convinced. This market reversal is most likely the real deal. If it is, we have the best group of stocks to buy right now.

They’re stocks that, amid the recent upturn in equities, are already outperforming the market by 3X in just a month!

Let’s take a deeper look.

Risk Sentiments Have Crashed to “Max Pain” Levels

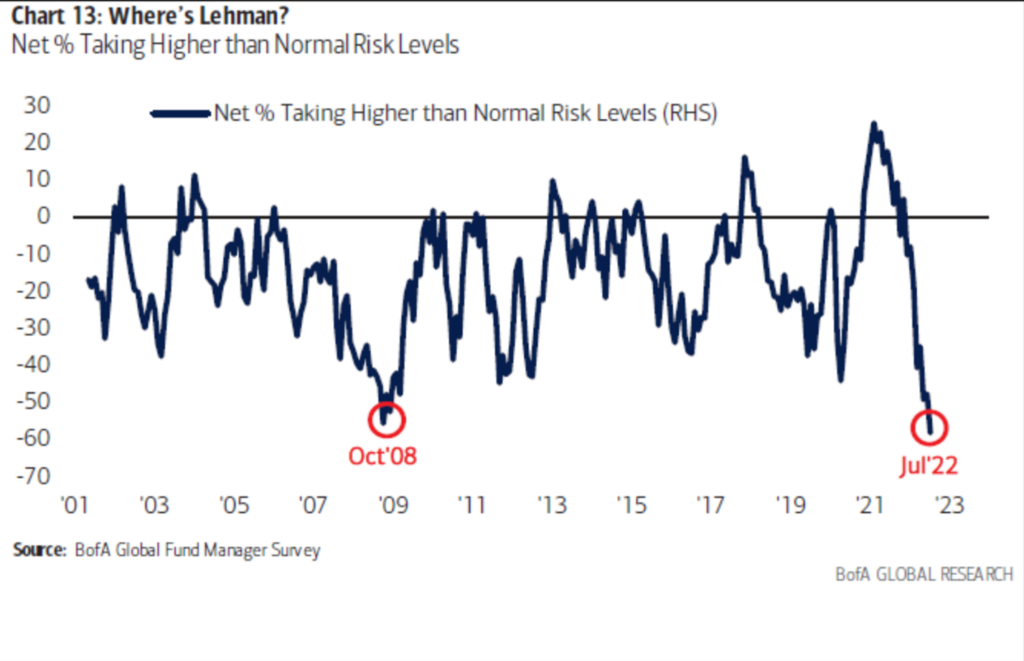

Both of our two buy signals come from Bank of America’s (BAC) July 2022 fund manager’s survey. In it, BofA asked a group of fund managers how much risk they’re taking in the markets these days. And it also asked if a recession’s likely over the next few months.

Those managers’ responses strongly indicate we’ve hit a bottom in the stock market and that a big breakout is imminent.

To the first question, about 80% of fund managers say they’re taking less risk than normal in the current market. Going back to 2000, that’s an all-time-high reading for the survey. Even during the 2008 financial crisis, the percent taking less risk than normal peaked below 80% in October 2008.

Now… guess what happened in October 2008?

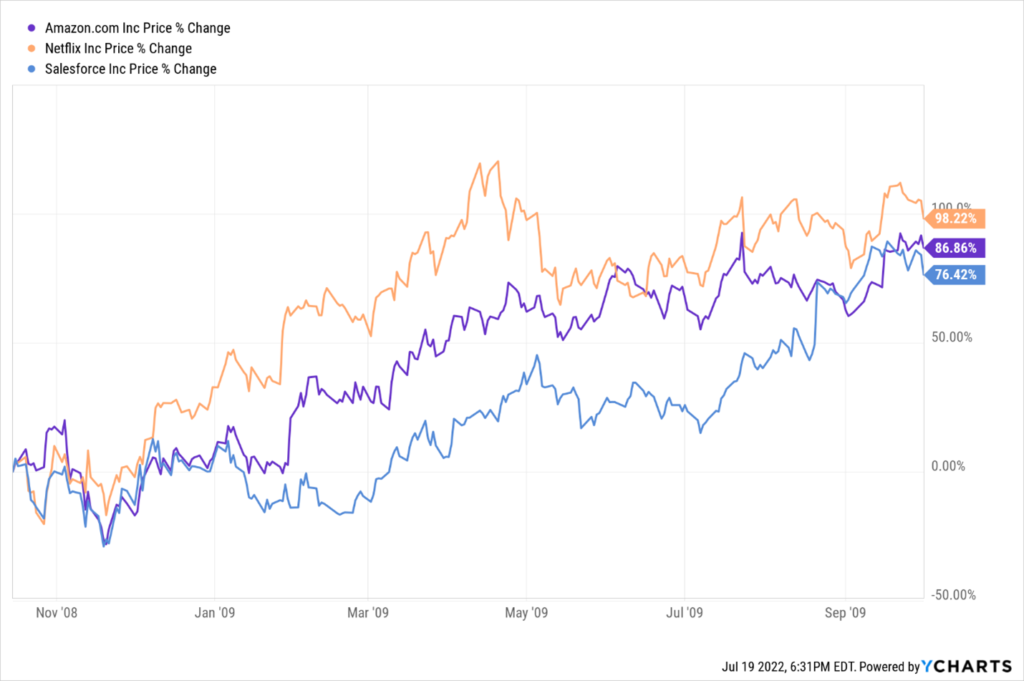

Growth stocks bottomed after an abysmal year-to-date performance. Stocks like Amazon (AMZN), Netflix (NFLX), and Salesforce (CRM), which had been crushed to that point, proceeded to double from mid-October 2008 to mid-October 2009.

In other words, the last time fund managers were nearly this “risk-off” when growth stocks bottomed during the financial crisis. Back then, many proceeded to double over the next 12 months.

Will history repeat?

We think so. And that’s why we’re backing up the truck on growth stocks right now.

Recession Odds Have Soared to Levels Consistent with Market Bottoms

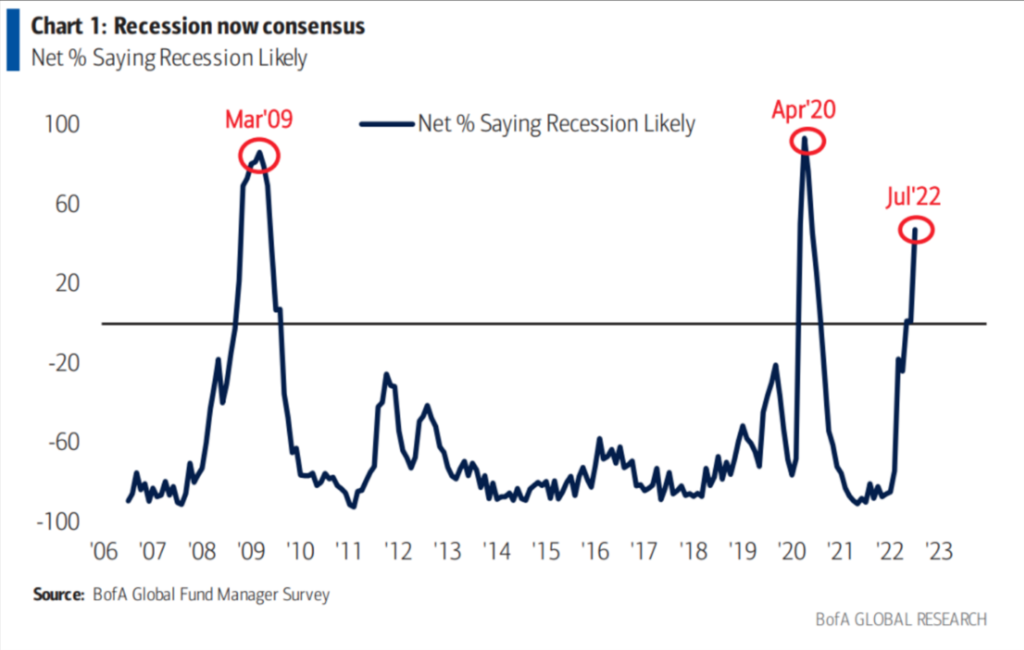

The second big question in BofA’s survey — whether fund managers think a recession is likely.

In that July 2022 survey, the percentage of fund managers who believe a recession is likely soared to over 50%. Indeed, most now believe a recession is likely.

That’s rare territory. We’ve breached that 50% mark only twice before: early 2020 and early 2009. Both periods coincided with stock market bottoms.

Specifically, the stock market bottomed during the 2008 Financial Crisis in March 2009. That was the same month that the percentage of fund managers who believed a recession was likely peaked. Over the next 12 months, the S&P 500 rose a jaw-dropping 70%.

In April 2020, this metric again peaked near 100%. That coincided with the bottom of the COVID-19 market selloff. Again, over the next 12 months, the S&P 500 surged more than 60% higher.

In other words, history says the stock market is due for a 60%-plus melt-up over the next 12 months.

To be sure, history isn’t always right. But on this point, we think it is. And that means stocks are ready to soar over the next year.

The Final Word on Growth Stocks

The stock market is nothing more than a collection of buyers and sellers. So, the very definition of a stock market peak is when there are many buyers and very few sellers. Similarly, the very definition of a stock market bottom is when there are many sellers and very few buyers.

Most investors don’t truly understand that concept. Yet, it’s the most important concept in financial markets. Tops happen when everyone is bullish. Bottoms happen when everyone is bearish.

That’s what the two charts above illustrate.

The market tends to top out when all the fund managers are super bullish and taking lots of risks – late 2006, early 2018, and late 2021.

By the same token, when the market tends to bottom, all the fund managers are super bearish and taking very little risk, while saying a recession is likely – early 2009, late 2018, and early 2020.

In other words, forget the crowd. Want to make big money? Play the contrarian. Bet against the consensus.

Today, the consensus is very bearish. Yet, growth stocks have been soaring, with many up about 20% over the past month!

We think the rally is set to continue. A major market reversal has likely arrived. Playing the contrarian today could pay off handsomely over the next 12 months.

— Luke Lango

Silicon Valley venture capitalist Luke Lango says this little-known Apple project could be 10X bigger than the iPhone, MacBook, and iPad COMBINED! Investing in Apple today would be a smart move... but he’s discovered a bigger opportunity lying under Wall Street’s radar -one that could give early investors a shot at 40X gains! Click here for more details.

Source: Investor Place