Crypto is a mess, and many (former) crypto fans are finally realizing that shares of companies that make goods and services people actually want—and pay dividends—are the place to be.

Of course, that’s no secret to those of us who know about closed-end funds (CEFs), many of which hold these companies and pay us rich dividends, often yielding north of 7%. To us, crypto is just the latest “investment” that held out the promise of building wealth faster than “boring” stocks ever could—and failed to deliver.

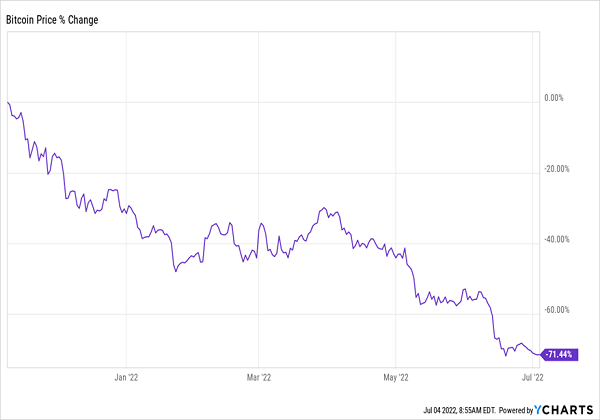

You might have even heard that crypto is a great inflation hedge. Anyone who bought Bitcoin based on that idea is now struggling with 71%+ inflation as their money literally disappears before their eyes!

Bitcoin Fails (Miserably) to Live Up to the Hype

I guess Bitcoin holders can take some (cold) comfort in the fact that they didn’t go big on the thousands of cryptocurrencies that have gone to zero, like Terra, eBit, San Coin, Lucifer Coin, Meta Legends, RhbCoin or OneCoin.

If anything, it seems pretty clear that betting on crypto was just that—betting. Over half of Bitcoin investors have lost money, according to one study, while another puts that figure closer to two-thirds.

Those losses aren’t likely to reverse soon, either. Too many potential buyers are turned off as they see more evidence of market manipulation, a rising number of lawsuits against crypto-peddlers and more crypto exchanges shutting down (Crypto.com, Cryptopia, Coinnest), losing clients’ money (Binance, Africrypt, Mt. Gox) or refusing to let clients withdraw their cash (Binance, Celsius).

While some cryptocurrencies may recover in the future, right now, it seems that the promises of Web 3.0 are empty, and investors who want to have money for themselves and their future need to look elsewhere.

Why Stocks—and 7%+ Yielding CEFs—Always Win Over Speculations Like Crypto

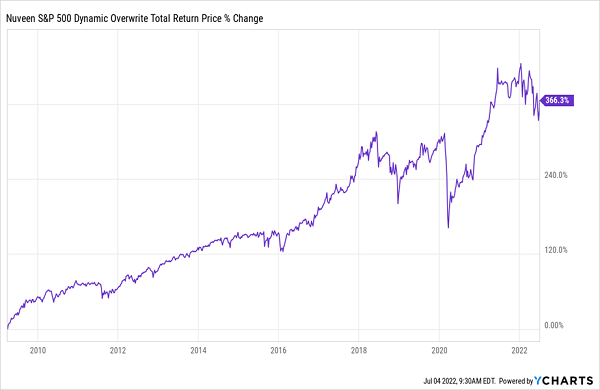

The crypto massacre stands in sharp contrast to the stock market, which, over the last 33 years, has given investors an impressive 9.7% annualized return, on average, even after the recent downturn.

That’s because stocks are an investment in companies that produce and sell actual goods and services that are in demand, including, somewhat ironically, the high-powered computer chips that cryptocurrency miners needed to keep the crypto infrastructure running.

And if you buy now, you’re buying at a time when stocks are oversold due to the market’s panic over rising rates. And buying in a downturn has traditionally amplified long-term returns: buying at the bottom of the 2009 market plunge, for example, would have boosted an investor’s returns from the historical average of 9.7% to 12.6%.

Even if you don’t time the drop precisely (because let’s be honest, no one can do that consistently), you’ll still increase your long-term return just by purchasing during a pullback.

Dip Buyers Amplify Their Gains in the Long Run

Now, here’s the cherry on top: we can buy the Nuveen S&P 500 Dynamic Overwrite Fund (SPXX) and get S&P 500 exposure, plus a 7.3% dividend yield, thanks in part to the fund’s selling of call options (a kind of insurance on stocks, which SPXX sells in exchange for straight cash).

Because it holds all the stocks in the main index, you’re getting the most important companies in America, including Microsoft (MSFT), Amazon.com (AMZN), Goldman Sachs (GS), Bank of America (BAC), Visa (V) and Alphabet (GOOGL)—the companies crypto has failed to replace. These are firms whose cash flow and profitability have been rising, even during the recent market meltdown.

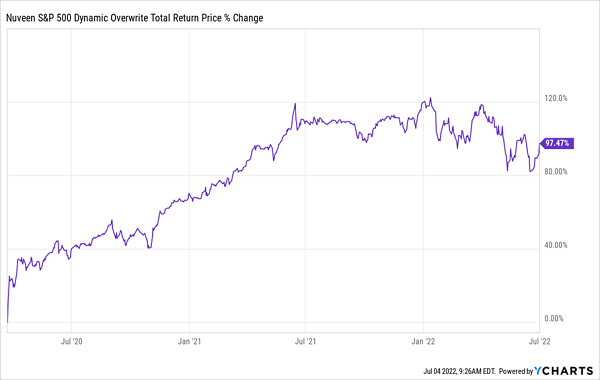

Buying SPXX during a downturn is smart: those who did during the COVID-19 selloff have nearly doubled their money in a bit over two years, all while collecting that nice 7.3% income stream.

Buying SPXX in the Last Crash Paid Off Handsomely

You don’t need crypto, or the risks, scams and losses associated with it, to achieve true financial independence. All you need is a long-term plan and strong, high-yielding funds like SPXX.

— Michael Foster

5 More CEFs to “Recession-Proof” Your Dividend Stream [sponsor]

SPXX is a great fund, but I consider it a “starter CEF”: great for new CEF investors because it basically mimics an ETF, except for its savvy option strategy.

When you get into “next level” CEFs, you get even more, like higher dividends, deeper discounts and savvy managers to help steer us through crashing markets like this one.

The 5 CEFs I’ve selected as some of my top buys for 2022 are the perfect examples. They yield a sky-high 8.6% on average, come from across the economy (with bonds, blue-chip stocks, healthcare plays and cash-generating real estate investment trusts all represented) and trade at deep discounts that set them up for serious gains when the market dust settles (as it inevitably will).

In the meantime, we’ll pocket their rich 8.6% average dividend!

I’ve put these funds’ names, tickers, dividend yields, discounts and my analysis of each of their portfolios in a new Special Report I want to make available to you now. Click here and I’ll show you how to get instant access—and start profiting from these 5 funds’ stout dividends right away.

Source: Contrarian Outlook