I am going to cover 10 stocks today. As an old saying states that statistics do not lie, but statisticians are darn liars. In simple terms, this implies that examining data without the proper perspective can be very dangerous – especially for investors.

For example, valuation is not simply about low P/E ratios, high dividend yields, or other mere statistical references. Instead, valuation and future growth are literally joined at the hip. To be clear, you can have low multiples, high dividend yields, but if your fundamentals are deteriorating, what appears low can be quite high.

In this week’s subscriber request video, I provide examples of how growth impacts valuation on these stocks. To summarize, it is not enough to just know what the numbers are, you must correlate those numbers to both historical and future operating results. Remember, there is no substitute for comprehensive research and due diligence.

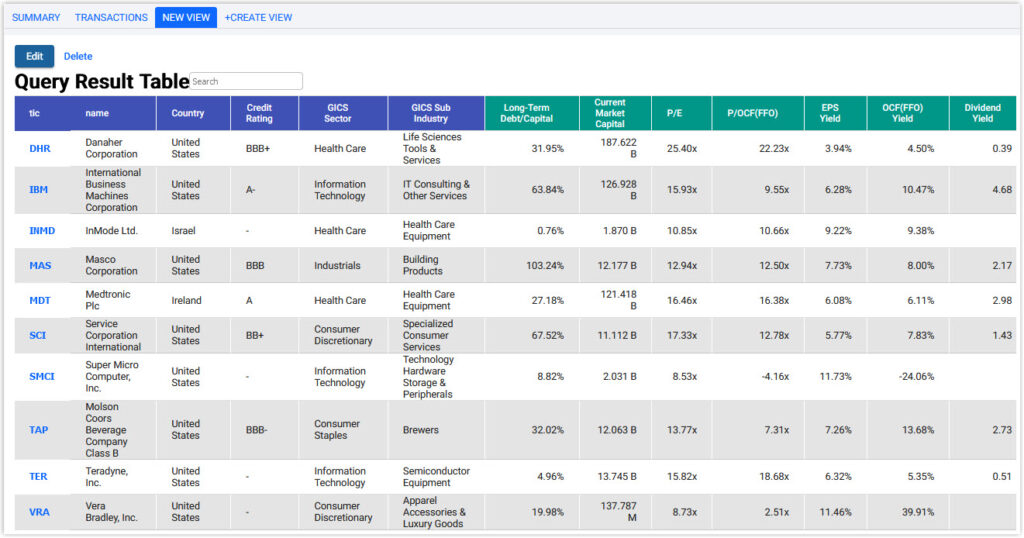

The stocks I will go over in this video are: International Business Machines (IBM), Danaher Corp (DHR), Inmode Ltd (INMD), Masco Corp (MAS), Medtronic (MDT), Service Corp International (SCI), Super Micro Computer (SMCI), Molson Coors Beverage (TAP), Teradyne Inc (TER), Vera Bradley (VRA).

FAST Graphs Analyze Out Loud Video

— Chuck Carnevale

According to one of the world's top AI scientists, there's a major event coming as soon as three months from today that could cause expensive tech stocks like Microsoft, Google, and NVIDIA to double or triple in price in the months ahead... but whatever you do, don't go all in on big tech before you have all the details. Click here.

Source: FAST Graphs