This wild economy has set us up with an opportunity to smartly “time” both the real estate and stock markets—and grab ourselves a hefty 9.9% dividend along the way.

I’ll show you a ticker we can use to do it in a moment. But first, let’s talk about the stock/real estate “two step” I’m proposing—starting with the state of play in the housing market, which has changed a lot in the last few weeks.

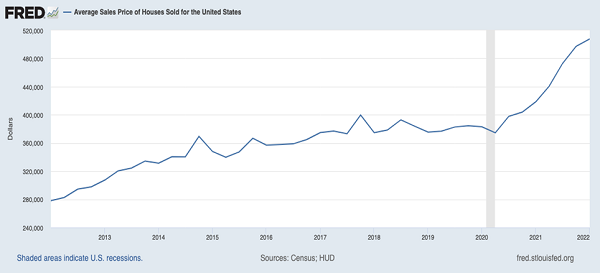

House Prices Look to Be Peaking

It comes as a surprise to no one that house prices are on a tear these days, hitting an average of $500,000, according to the latest numbers:

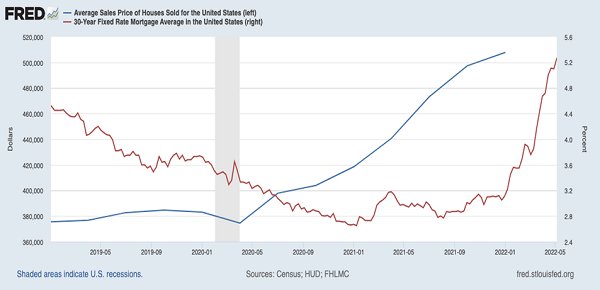

When most Americans buy their primary residence, they aren’t primarily focused on the sticker price; their monthly mortgage cost is what they’re really looking at. And when rates were low, their mortgages were low, thanks to cheap borrowing. Now, however, that’s history.

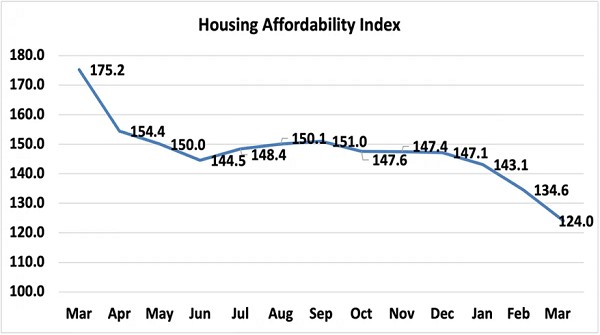

Source: National Association of Realtors

Source: National Association of Realtors

While the data above has lagged a bit (and with this particular index, the lower the number, the less affordable houses are), in March, the National Association of Realtors saw home prices reach their lowest affordability ever—and that was before the Fed’s latest rate hike.

Of course, as mortgage payments rise along with the Fed funds rate, housing will eat up more of Americans’ discretionary income. That, in turn, would weigh on consumer spending. This is one of the main concerns behind the latest stock-market drop.

But there are signs that the winds are starting to shift—and that’s where our opportunity comes in.

Stocks and Real Estate Are Trading Places

Of course, stocks aren’t going to fall forever, house prices can’t inflate forever, and the Fed won’t jack up interest rates up to obscene levels. Anyone warning you of any of these things is more interested in stoking fear than understanding market conditions.

Instead, we need to look for indications that the two trends—higher home prices and higher mortgage costs—are easing up. And there’s some good news there.

Almost the Beginning of the End

Home prices are still rising, but the rate of growth has begun to slow as of the start of 2022 versus 2021. That may be because supply is starting to finally go up.

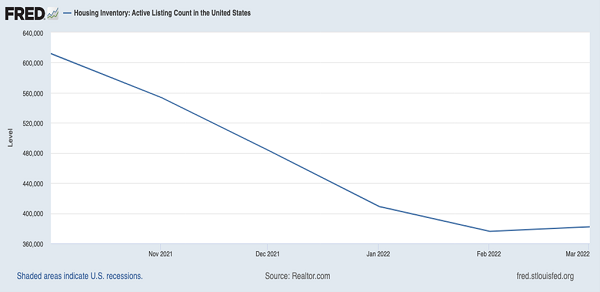

Housing Scarcity Abating

In February, the total number of active listings of houses for sale in the US reached its lowest point in history, just 376,018 (for reference, five years ago it was 1.5 million), but March saw a very slight uptick in inventory. If that continues, it could result in house prices stabilizing or going down, especially if demand for homes falls due to higher interest rates.

Quick Takeaway: Now Is the Time to Pivot From Real Estate to Stocks

The takeaway? Now is the time to sell any property you may be considering unloading before demand falls and supply starts to pick up in earnest. That’s particularly true if you’re one of the millions of Americans who owns more than one home.

Similarly, now is also the time to buy into those stocks that have been oversold in anticipation of weaker demand due to worries that higher housing costs will hit consumer spending.

That’s where a fund like the Royce Value Trust (RVT), a CEF holding a variety of companies with strong cash flows like KBR Inc (KBR), MKS Instruments (MKSI) and Cirrus Logic (CRUS) with a 5.6% discount to NAV that gets us its underlying stock portfolio at an even cheaper price while also getting us a 9.9% income stream thanks to RVT’s high yield.

Think about that for a moment—with a 9.9% yield, you’re recouping just shy of 10% of your original investment every year in dividends alone. Even if interest rates continue to rise, there’s almost no way Treasuries will pay much above 4.5% (the current Wall Street consensus of when the Fed will stop raising rates), let alone the near double digits many CEF dividends can pay out.

The bottom line? By slowly balancing a portfolio back into stocks and away from housing, you can play the overpriced real estate market and the underpriced stock market at the same time.

— Michael Foster

4 More “Bond Beater” CEFs Yielding 8.5% (With 20% Upside) [sponsor]

I’ve got 4 other CEFs that are a nice addition to RVT, with stout 8.5% dividends that are all paid monthly, to boot. And they’re trading at particularly bizarre discounts today, priming them for 20%+ price upside in the coming year. And thanks to their bargain valuations, they’re nicely positioned to hold their own if the market plunges from here.

In other words, these 4 funds are just what we income seekers crave these days: high-yielding monthly payers trading at deep discounts that give us pace of mind while we collect our payouts.

I’ve got the details waiting for you now: click here and I’ll tell you all about my CEF-investing strategy and show you how to get my 4 bargain-basement 8.5% yielding (and monthly paying!) CEF picks.

Source: Contrarian Outlook

Source: National Association of Realtors

Source: National Association of Realtors