There’s a famous experiment called “the marshmallow test.” In it, scientists give little kids a marshmallow along with a choice: Eat the treat immediately, or wait 15 minutes to get a SECOND marshmallow to snack on.

The test has been repeated several times over the years, and the results are pretty simple: Kids who delay their gratification for bigger rewards are typically more successful and more well-adjusted in the long run.

And let’s face it, we all know kids who wouldn’t even listen to the instructions and simply stuff that marshmallow in their face as soon as the adult leaves the room. These aren’t exactly future world leaders in training.

The stock market is giving investors a similar test in 2022—but with much higher stakes. Can we delay our short-term desires to make a quick buck by bottom fishing? Will we sell everything, just to stop seeing red ink? Or will we keep our eyes on the long-term prize of a successful retirement?

Let me tell you about three different REITs that exemplify the options that are out there right now, and the kind of choices you should make if you want to get ahead.

These include my favorite REIT right now, which yields 6.2% and has actually seen its shares rise in an otherwise choppy market!

REIT #1 – Yield, but Crashing Prices

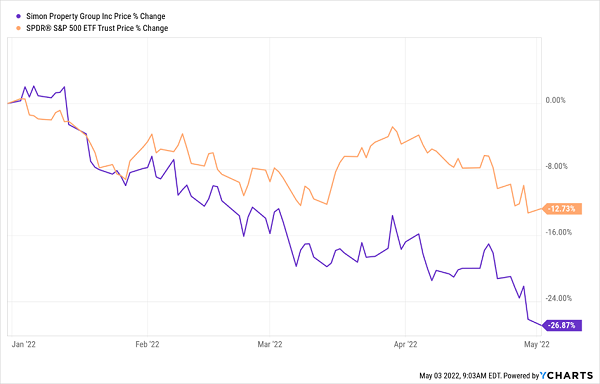

Whether you’re an income-oriented investor by nature or a new convert to the defensive nature of dividend stocks, one of the first metrics people tend to research is yield. And right now, there are a lot of stocks with juicy paydays—including big name mall operator Simon Property Group (SPG).

SPG has a lot to offer. It’s one of the largest Real Estate Investment Trust (REIT) investments out there, with a market capitalization north of $40 billion. It’s a component of the S&P 500 index. And as of this writing, it offers a generous dividend yield of 5.4%.

A pretty standard story, and the kind of REIT most investors go for… right?

Unfortunately, this stock is down an ugly 27% this year and momentum continues to look rather ugly. So much for Simon as a safe haven!

REIT #2 – Resilient Shares, but No Yield

OK, so what if we want an income investment that has been resilient amid the market volatility?

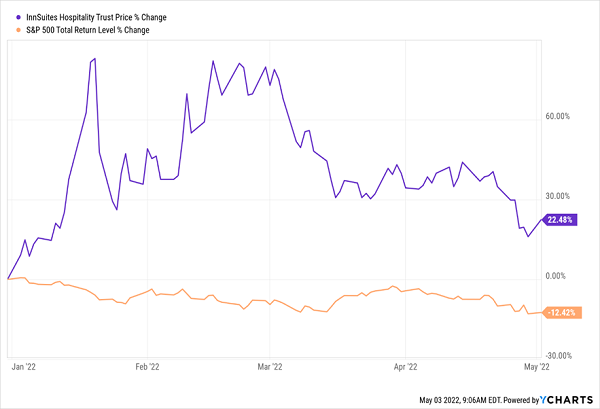

Well, one segment of the REIT marketplace that has done quite well lately are hotel and hospitality plays. As we continue to move past COVID-19 and many consumers are looking to act on long-delayed summer vacation plans, this family of stocks has been doing quite well.

In fact, one of the best performers out there is InnSuites Hospitality Trust (IHT) that has risen 22% so far since Jan. 1!

There’s a catch, however. The company pays just a penny per quarter in dividend, adding up to a yield of 0.8%. It’s barely profitable, and is fighting off delisting with a market cap of a mere $25 million or so.

An aggressive hotel REIT like this may be a decent swing trade. But if you’re after long-term income, you better keep looking.

REIT #3 – A Goldilocks Stock with Yield and Upside

These stocks clearly fall short. But the good news is there are a heck of a lot of REITs out there, and if you have the time to sift through the research and data… you can find some gems.

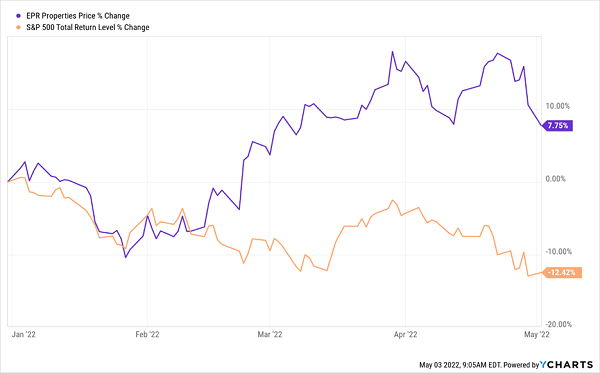

My favorite REIT right now is a “Goldilocks” stock that offers 5X the yield of the typical S&P 500 component, and has actually put up a decent gain in 2022 even as the rest of the market has gone haywire.

I’m talking about EPR Properties (EPR). This $4 billion company yields 6.2% at present and is comfortably profitable once more after some pandemic-era troubles. In fact, it’s so profitable that the REIT reinstated its monthly dividend in 2021 and then quickly increased it by 10% in March of 2022. And to top it off, that payout is just 75% of its estimated funds from operations for 2022 so it’s very sustainable at these generous levels.

All that means EPR checks out on the stability side of things.

Interestingly enough EPR, it is also a growth play based on the post-COVID travel boom. EPR specializes in “experiential” properties like theaters, resorts and stadiums that are bound to see a resurgence in the coming months. Its operations are nationwide, too, including waterparks in Oklahoma, amusement parks in upstate New York, ski slopes in Vermont, a museum in Tennessee and much more.

The strong outlook for travel has lifted the stock to nearly double-digit gains since Jan. 1 even as the rest of Wall Street has been in shambles. What’s more, a prediction of about 5% revenue expansion in fiscal 2023 shows that this is not just a rebound play and has continued upside ahead.

A high growth REIT that is not too risky, and not too skimpy on the yield… this is one Goldilocks play that is juuuuust right!

— Jeff Reeves

How to Find High-Yield Gems Paying 7.9% or More! [sponsor]

It’s easy to get caught up in the gloomy headlines and red numbers scrolling across ticker feeds right now. But if you want to be a successful investor, you have to stop and think rationally about your long-term retirement goals.

At Contrarian Outlook, we’re not just contrarian for the heck of it. What we advocate is a different way of looking at the world, which can offer outsized gains in non-traditional investments – and in rough markets like this one, keep you grounded and prevent you from making mistakes.

And more importantly, we aim to keep you making money – via reliable, generous, and consistent dividends that span any market.

If this is the kind of strategy you’re looking for, then you’ll want to check out our “7% Monthly Payer” portfolio. Details are waiting for you in our exclusive briefing HERE, including 3 “dividend superstars” that trade at attractive valuations and yield up to 8.1%!

Source: Contrarian Outlook