Claims that we’re 100% heading into a recession (because the never-wrong inverted yield curve says so) are fake news. This time the recession indicator is wrong.

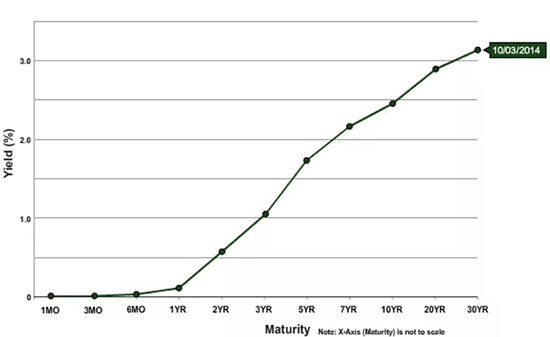

The yield curve is a simple concept. It shows graphically what different maturity bonds pay investors in terms of the yield (or interest rate) they pay.

Super short maturity instruments, like the fed funds rate (the interest rate banks charge each other when they lend money), yield very little because the loan is only overnight. The risk of default in a day is infinitesimally small. The yield on a 6-month T-Bill would be higher due to investors lending money to the government for 6-months also wanting more interest. The yield on a 2-year Treasury note would be higher because of the longer maturity of the loan. The 10-year yield would be higher still. And so on, out to 30-year bonds.

When graphed, these yields typically slope upwards like the Treasury yield curve shown below.

The yield curve is said to be inverted any time the yield on a shorter-dated maturity is higher than a longer-dated maturity instrument – in other words, a reversal of the chart above. What everyone’s panicking about was an inversion of the U.S. Treasury 2-year note and U.S Treasury 10-year bond (referred to as the 2s and 10s in Wall Street Parlance).

Over the past 30-days, the yield curve (as measured by 2s and 10s) has inverted a couple of times. At some points, this inversion was only by a few points or a few tenths of a percent, but an inversion nonetheless.

And this is concerning to some because, historically, whenever the curve inverts (even by a tiny amount), a recession follows. That’s what’s making headlines now.

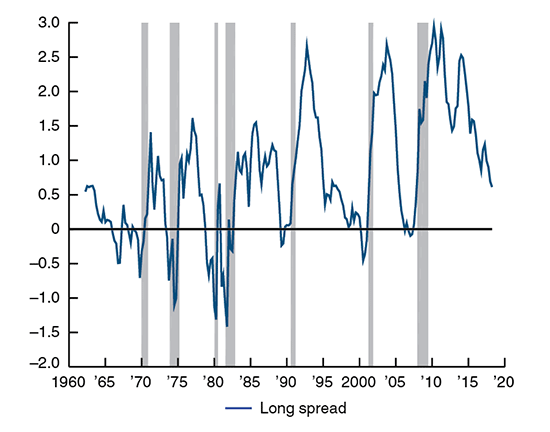

The graph below shows the spread between 2s and 10s in the blue line. Whenever the spread goes negative, a recession (the gray longitudinal bars) occurs. So, it’s been a pretty good indicator so far.

But dare I say, “this time is different.”

Yields don’t move on their own. Traders and investors are buying and selling bills, notes, and bonds all the time. Their buying knocks yields down because, in the fixed income world, yield has a negative correlation to price. When prices go up, yields go down. When traders are selling, yields go up.

Yield curve inversions don’t happen because of a recession; they happen before a recession. That means traders and investors are placing bets on rates based on what they see in the economy, or in capital markets, or what the Fed’s doing.

Typically, past inversions have happened because expectations are for lower rates ahead, maybe because traders see the economy weakening and interest rates falling if demand for money slows. They’ll typically buy longer-dated maturity bonds (like 10-year Treasuries) to lock in a better yield than they would get if interest rates decline. If that happens, the yield on newer bonds would be less. Their buying of 10s increases their price and lowers their yield. If the yield drops enough, it might fall below the yield on 2s.

Of course, traders sometimes sell 2s, increasing their yield to get slightly above 10s to raise money to buy 10s. Sometimes traders sell 2s as a hedge, and sometimes they sell them as part of a yield curve spread trade.

The point is this: most yield curve inversions that preceded a recession were the product of buying 10s and selling 2s.

This time is different because everyone knows the Fed’s going to raise the fed funds rate. The faster they raise it, the steeper the selloff in short-term maturity bills and notes will be. That’s because as rates rise, prices of existing bills notes and bonds fall. As traders anticipate higher rates they’ve been selling longer-dated bonds, including 10s and replacing them with shorter dated bonds and bills so they won’t get hit as hard if prices continue to drop and interest rates continue to rise.

The thing is, traders thought interest-rate hikes would be more measured than they what everyone has come to fear, which is the Fed might raise rates a lot higher, a lot sooner. That change in thinking drove traders to sell the 2s they’d been buying and start shorting them, raising the yield til it got to and above the yield on 10s.

That’s how this inversion happened.

It didn’t happen because traders and investors see the economy slowing so much we’re about to go into a recession. The inversion happened because the Fed’s raising rates to dampen inflation. The economy’s still growing robustly and the Fed raising rates isn’t going to all of a sudden stop economic growth.

If the Fed “overshoots” and raises rates too much too quickly, they could push the economy into a recession.

I’m betting that’s not going to happen and that this inversion heralding a recession is fake news.

What’s real, however, is inflation.

Since the Fed’s hopefully not stupid enough to plunge the economy into another Great Recession, they’ll raise rates measuredly and inflation will remain persistent.

Until next time,

— Shah

Experts are predicting that in as little as three months, AI as we know it could be totally blown away. And that means as early as October 8, ChatGPT could be replaced by a new AI that's thousands of times more powerful... something that could cause expensive tech stocks like Microsoft, Google, and NVIDIA to double - maybe even triple - in price in the months ahead. Click here for all the details.

Source: Total Wealth