Shares of Beyond Meat (BYND) tested a 52-week low north of $35 in mid-March, but the stock has rebounded along with the overall market in recent weeks as it tries to recover a key level of resistance. However, the stock still has large short bets placed against it by hedge funds.

Roughly 40% of BYND’s available shares are sold short; it is one of the top U.S. companies in terms of size of short bets initiated by hedge funds.

Aside from the tremendous short interest and volatility, the company continues to lose money and it remains a risky investment. In late February, Beyond Meat reported a loss of $1.27 per share on revenue of $100.7 million. Expectations were for a loss of $0.71 per share on revenue just above $101 million.

The wider-than-expected earnings miss comes as the company started it sees slowing growth after sales turned slightly negative compared to the previous year. One of the biggest reasons was the slump in grocery retail sales, which fell 8% year-over-year.

For the current quarter, analysts expect BYND to post another loss of $0.97 cents per share on sales of $112 million. Additionally, for 2022, losses could reach $2.84 per share, with 2023 losses pegged at an average of $1.92 a share.

Despite some of the deals the company has with some of the nation’s largest restaurant chains, this is a disturbing trend. Earlier this year, its highly anticipated plant-based chicken nuggets made their debut on KFC’s menu following a multiyear partnership with Yum Brands’ (YUM).

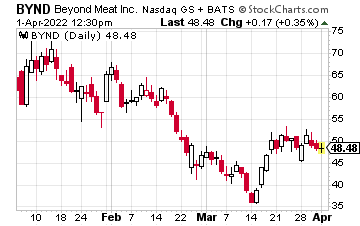

The company also has partnerships with McDonald’s (MCD) and PepsiCo (PEP) to produce healthy, protein-based products. However, the demand for these products hasn’t lived up to expectations after failing to generate sustained traction. The chart below shows resistance at $52.50-$53 and the 50-day moving average. Continued closes above $55 would be a more bullish development with additional upside towards the $60-$65 area. Key support is at $45, with a close below this level likely signaling additional selling pressure.

Shares still seem expensive at current levels—dispute the free-fall from a 52-week peak of $160—as quarterly losses will continue into the foreseeable future.

Shares still seem expensive at current levels—dispute the free-fall from a 52-week peak of $160—as quarterly losses will continue into the foreseeable future.

However, stocks with high short interest are often very volatile and can make explosive upside moves despite lousy fundamentals.

This type of action is known as a short squeeze as traders with open short positions rush to cover. This is the one caveat to keep in mind when shorting Beyond Meat as shares remain overvalued in my opinion.

— Rick Rouse

This stock checks all the boxes. Pays a high dividend (8%), has a record of increasing that yield (an average of 37.5% throughout company history), and is set up perfectly to profit from continued Fed rate hikes. Click here for the name and ticker of the most perfect dividend stock on the market right now.

Source: Investors Alley