For this Subscriber Request, I was asked to provide examples of dividend growth stocks that were getting cheaper because of the current market drops. Consequently, I thought it would be interesting and informative to survey the Standard & Poor’s Dividend Aristocrats.

These are the crème de la crème of dividend growth stocks. To make this prestigious list, the company had to increase their dividend for 25 consecutive years or greater. However, given today’s low interest rate environment, investors have driven the prices of these bluest of blue-chip Dividend Aristocrats to what I call nosebleed levels.

Due to the recent state of the economy, runaway inflation, war, and a Federal Reserve committed to increasing interest rates, stocks have been falling in 2022 after rising for several years in a row. In this video I take a high level look at how far this correction has gone, how far it has the go and to what extent these blue-chip Dividend Aristocrats have participated.

My goal is to provide you an intelligent perspective of what this bear market has really meant. Perhaps shockingly, I still believe we have a ways to go. Nevertheless, things are better from a valuation perspective than they have been in recent history. Perhaps it is time to start paying attention and preparing for the time when these premier dividend growth stocks can be safely purchased.

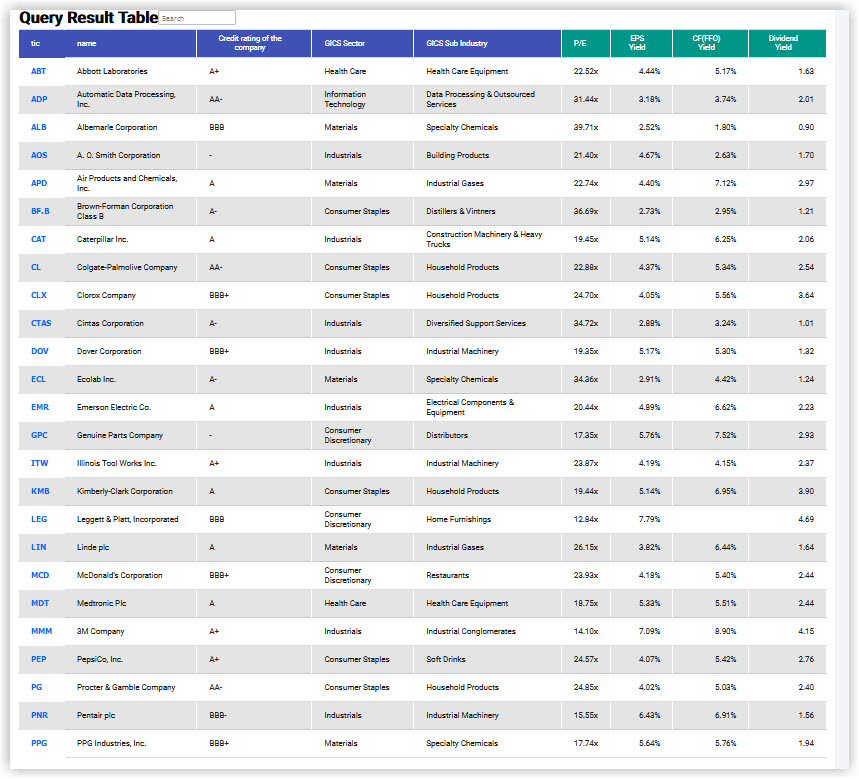

Abbott Labs (ABT), Automatic Data Processing (ADP), Albemarle Corp (ALB), AO Smith Corp (AOS), Air Products & Chemicals (APD), Brown Forman (BF.B), Caterpillar (CAT), Colgate Palmolive (CL), Clorox (CLX), Cintas Corp (CTAS), Dover Corp (DOV), Ecolab (ECL), Emerson Electric (EMR), Genuine Parts (GPC), Illinois Tool Works (ITW), Kimberly Clark (KMB), Leggett & Platt (LEG), Linde Plc (LIN), McDonalds (MCD), Medtronic 3M (MMM), PepsiCo (PEP), Procter & Gamble (PG), Pentair (PNR), PPG Industries (PPG), Roper Technologies (ROP), Sherwin Williams (SHW), S&P Global (SPGI), Stanley Black & Decker (SWK), Target (TGT), T Rowe Price (TROW), VF Corp (VF), West Pharmaceutical (WST).

FAST Graphs Analyze Out Loud Video

— Chuck Carnevale

According to one of the world's top AI scientists, there's a major event coming as soon as three months from today that could cause expensive tech stocks like Microsoft, Google, and NVIDIA to double or triple in price in the months ahead... but whatever you do, don't go all in on big tech before you have all the details. Click here.

Source: FAST Graphs