The “holy grail” of value investing is the only important “margin of safety.” A margin of safety is present if you invest in a common stock at a discount to its intrinsic value. This powerful concept simultaneously reduces risk while providing a greater potential for above-average return.

Risk is reduced because you are buying the company for less than it is worth or justified based on its earnings and cash flows. Consequently, if you hit a bear market, your undervalued stocks might fall along with the overvalued ones. However, history has shown that the undervalued stocks will typically recover fastest and typically exceed their previous values.

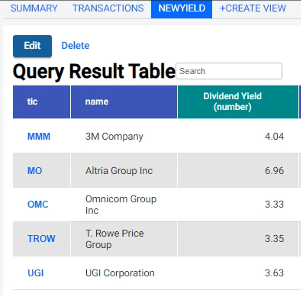

Overvalued stocks in contrast might never reach the high valuations they had achieved before the correction. With this video I feature 5 premier dividend growth stocks each offering a margin of safety and yields above 3%. Moreover, they all have a history of increasing their dividends at above-average rates over time as well. Therefore, they represent ideal research candidates for the dividend growth investor seeking safety, yield, and the potential for capital appreciation over time.

3M Company (MMM), Altria Group (MO), Omnicom Group (OMC), T. Rowe Price Group (TROW), UGI Corporation (UGI).

FAST Graphs Analyze Out Loud Video

— Chuck Carnevale

According to one of the world's top AI scientists, there's a major event coming as soon as three months from today that could cause expensive tech stocks like Microsoft, Google, and NVIDIA to double or triple in price in the months ahead... but whatever you do, don't go all in on big tech before you have all the details. Click here.

Source: FAST Graphs