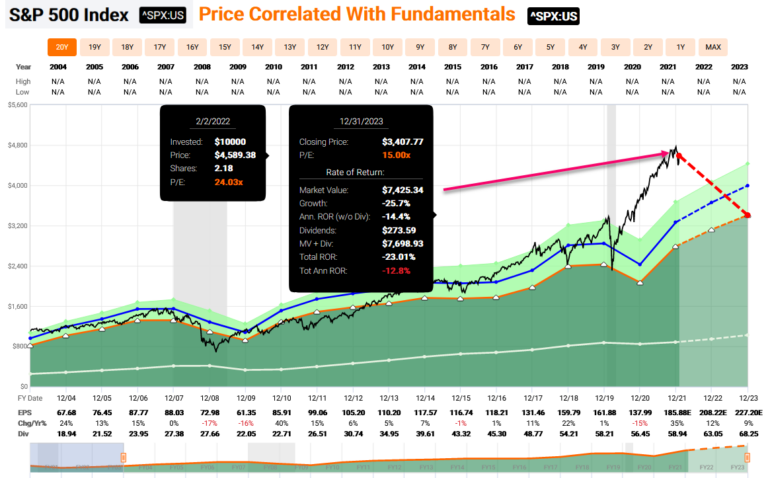

The stock market as measured by the S&P 500 has been correcting since the start of the new year. However, as I always contend, it is a market of stocks and not a stock market.

True that statement is the reality that most of the damage has come from the significantly overvalued constituents. The fairly valued or undervalued S&P 500 stocks are actually performing pretty well.

This is something that makes logical sense because some of the valuations on these overvalued stocks have been beyond excessive. In this video I am going to take a high level look at 20% of the S&P 500 constituents representing the majority of the overvalued companies and showing how excessive valuation is beginning to take its toll. My goal is to give you a perspective that you might not have had before watching this video.

FAST Graphs Analyze Out Loud Video

— Chuck Carnevale

Experts are predicting that in as little as three months, AI as we know it could be totally blown away. And that means as early as October 8, ChatGPT could be replaced by a new AI that's thousands of times more powerful... something that could cause expensive tech stocks like Microsoft, Google, and NVIDIA to double - maybe even triple - in price in the months ahead. Click here for all the details.

Source: FAST Graphs