When I first selected Automatic Data Processing (ADP) for our Income Builder Portfolio back in August 2020, the global COVID-19 pandemic was wreaking havoc on the economy.

ADP management was concerned about “pressures” on the company, and the forecast was for earnings to suffer a year-over-year decline for the first time in more than a decade.

I picked ADP anyway because of its exceptional history as a global provider of human capital management and business outsourcing services, and because I was confident it would weather the pandemic better than most.

And as a Dividend Growth Investing proponent, I appreciated ADP’s decades-long streak of consecutive annual dividend increases.

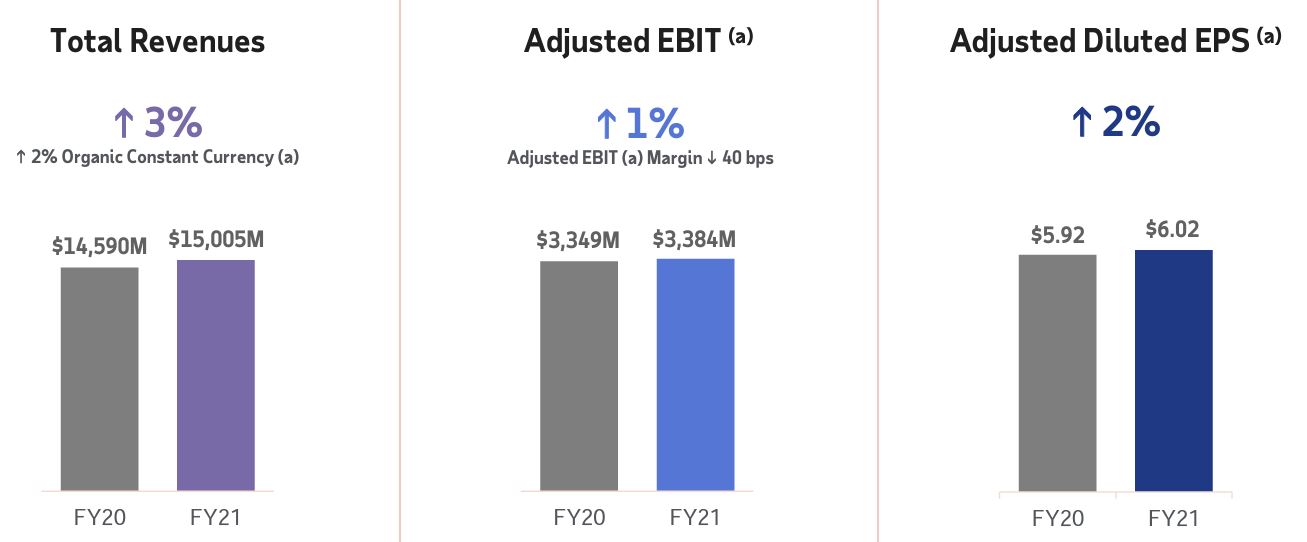

As it turns out, Automatic Data has navigated the unique challenges presented by the pandemic even better than its own management team expected. Revenues, earnings before interest and taxes (EBIT), and earnings per share (EPS) actually increased from 2020 to 2021.

adp.com

Taking note of those metrics and other strong fundamentals, investors drove up the price.

As a result, our ADP position has been one of the Income Builder Portfolio’s top performers. With a 49% total return since we bought it on Aug. 4, 2020, it has handily beaten the S&P 500 Index.

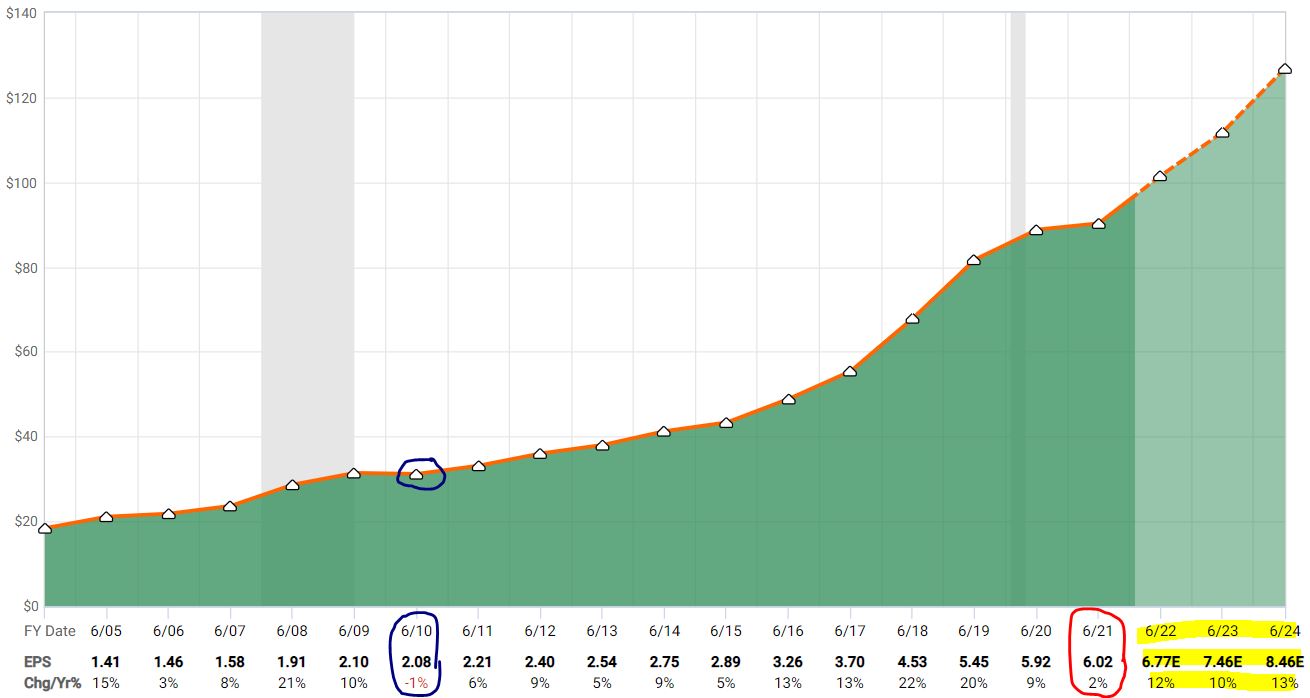

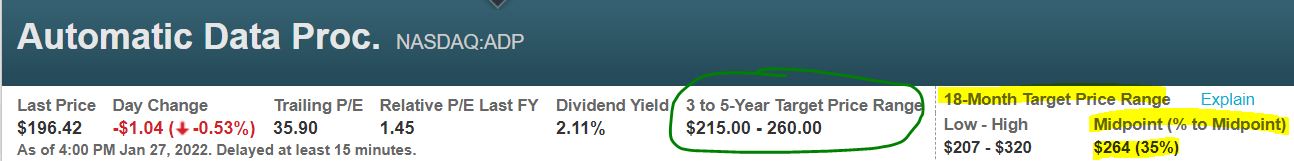

I guess that should have been expected. The following FAST Graphs illustration of ADP’s earnings over the years offers a treasure trove of information about the company’s consistent excellence.

fastgraphs.com

- The orange line represents earnings; note the steady climb with no deep troughs.

- The blue-circled area shows the company’s lone EPS decline over the last 15+ years, a mere 1% reduction in 2010 in the aftermath of the Great Recession.

- The red-circled area indicates the 2% earnings growth in the most recent fiscal year, which ended on June 30, 2021.

- And the yellow-highlighted area shows how earnings are expected to increase at a double-digit-percentage pace for the foreseeable future.

The stock’s outperformance wasn’t exactly shocking, either, as ADP has beaten the overall market over the past 5, 10 and 20 years.

Perhaps the most surprising thing for me: Despite ADP’s outstanding showing, I somehow avoided selecting the stock again for the IBP.

Automatic Data Processing’s price ran up so fast it felt like it got away from me a little, and I was busy choosing other great companies. (See our entire 46-stock portfolio, along with links to every IBP-related article I’ve written, HERE.)

Well, thanks to the negative sentiment that has knocked down the market so far in 2022, especially when it comes to “growthier” tech companies, ADP’s price has become more attractive again.

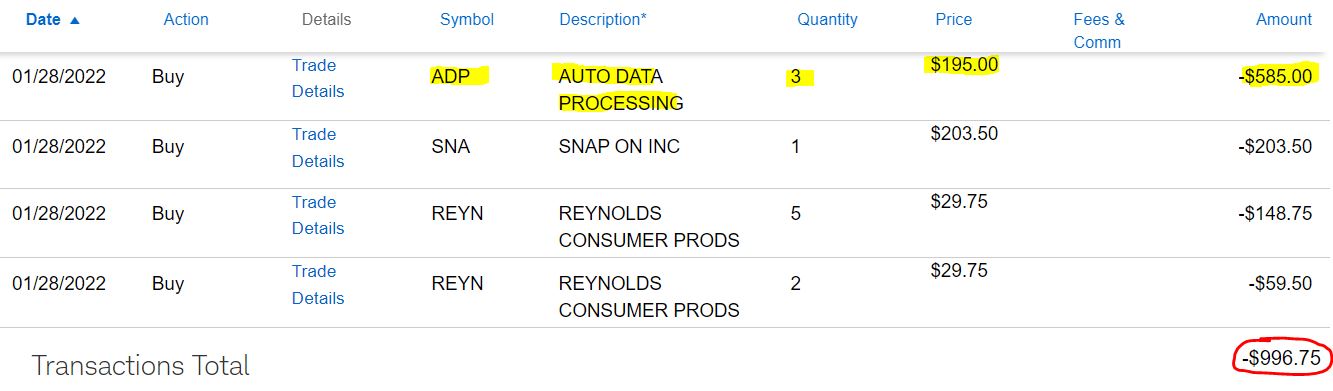

So on Friday, Jan. 28, I executed a purchase order for 3 shares of the stock at $195 apiece on behalf of this site’s co-founder (and IBP money man), Greg Patrick.

Limit orders were used to buy all 3 stocks; with REYN, the order filled in two separate transactions a moment apart.

As you can see by the above image, I used the rest of Greg’s $1,000 semimonthly allocation to add a little to the IBP’s positions in Snap-on (SNA) and Reynolds Consumer Products (REYN).

Snap-on, the commercial toolmaker, was one of our most recent additions to the portfolio. Reynolds, which markets iconic household products such as Reynolds Wrap and Hefty trash bags, is one of our smaller holdings; it became part of the IBP in November 2020 and was last bought about a year ago.

The main focus here, however, is on Automatic Data Processing, a Fortune 500 technology giant.

What’s New With ADP?

First, here’s a quick recap from Morningstar about what the world’s leading provider of cloud-based human capital management (HCM) solutions does:

ADP operates two segments: Employer Services (ES) and the Professional Employer Organization (PEO). The Employer Services segment offers payroll, HCM solutions, HR outsourcing, insurance, and retirement services. The smaller but faster-growing PEO segment provides HR outsourcing solutions to small and midsize businesses through a co-employment model. PEO clients’ employees, referred to as worksite employees, are co-employed by ADP but in practice work for the client. The arrangement allows clients to benefit from ADP’s scale to secure competitively priced benefits for their employees.

Large clients include Hyatt, Bristol-Myers Squibb, Party City and Camping World. Meanwhile, some of ADP’s smaller clients have hundreds, or even only dozens, of employees.

adp.com

ADP also “partners” with hundreds of individual franchisees of larger corporations, such as Gold’s Gym and Dairy Queen.

adp.com

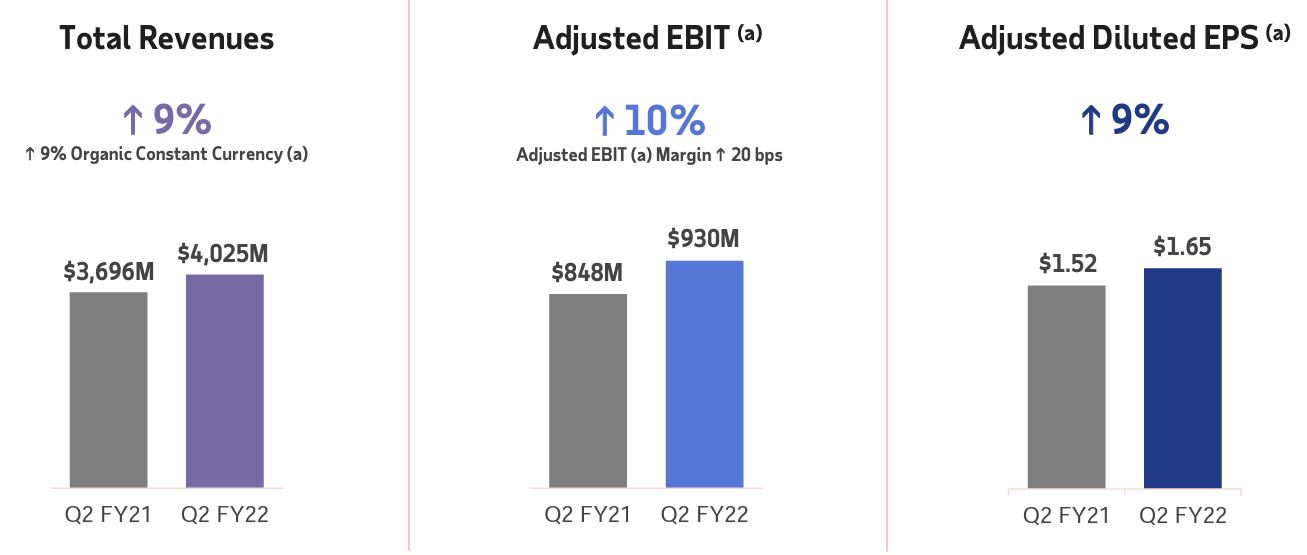

On Jan. 26, ADP reported second-quarter financial information. The company had another in a long line of stellar showings, with revenue and earnings each up 9% year-over-year, and EBIT 10% higher.

adp.com

Here’s what Morningstar analyst Emma Williams had to say about the quarter:

In our view, the firm remains well placed to benefit from near-term industry tailwinds, including tight labor markets, dispersed workforces, and increasing regulatory complexity driving demand for solutions to attract, manage and retain employees, and outsource HR functions. ADP reported record client-satisfaction scores over the quarter and robust revenue retention, which we believe reflects the attractive value proposition of its product offering and the inherent switching costs underpinning our wide moat rating.

Recovering labor markets drove higher payrolls per client in the Employer Services segment and an uplift in worksite employees in the PEO segment. Group revenue increased 9% year on year, with a standout 15% revenue growth in PEO. This was driven by improved client retention and new bookings growth, a rebound in the number of worksite employees per client to pre-pandemic levels, and revenue growth tied to wage inflation.

It was the 18th consecutive quarter in which Automatic Data Processing beat analysts’ earnings estimates, and I like that kind of consistent outperformance.

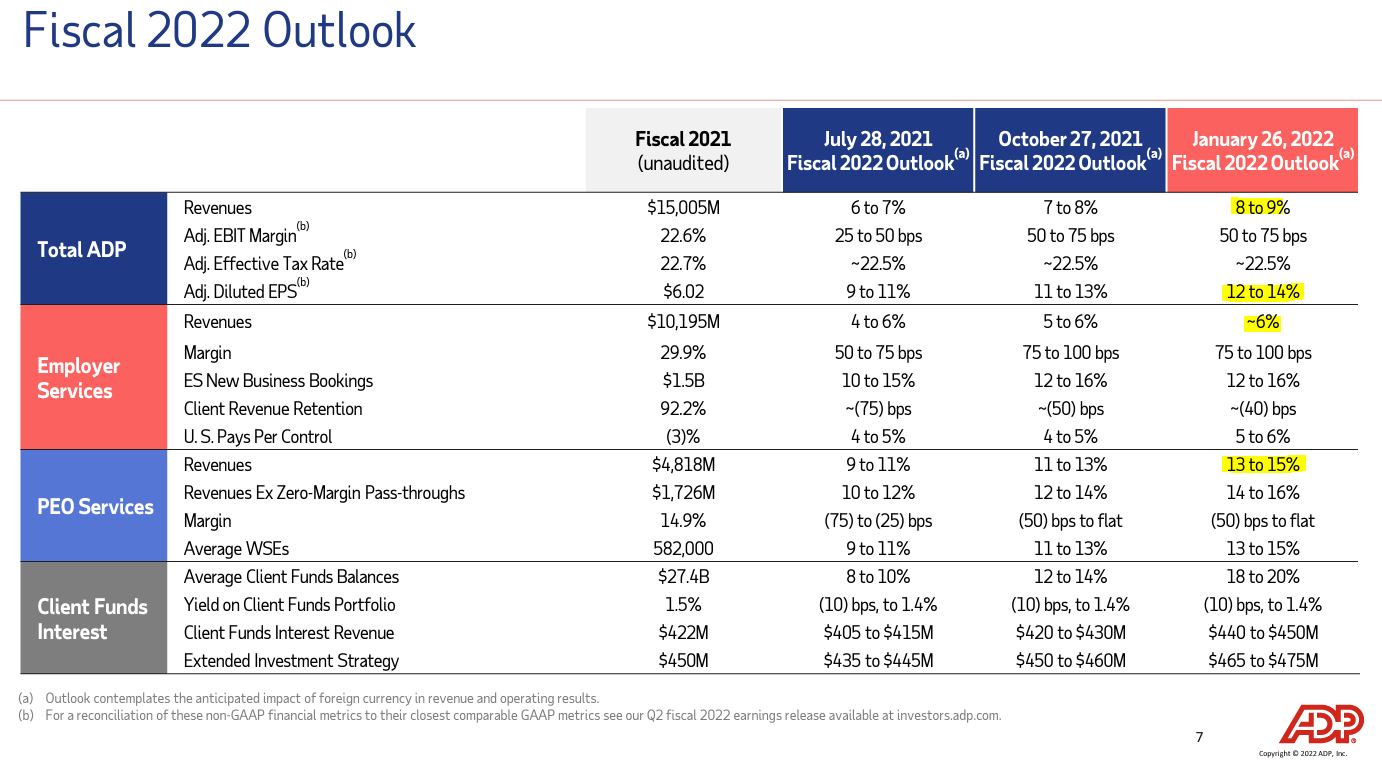

Because investing is ultimately a forward-looking endeavor, what I liked even more from the earnings report was the company’s own outlook for the full 2022 fiscal year. ADP is now forecasting 8-9% revenue growth and 12-14% EPS growth, and it also has upped its guidance for each segment.

adp.com

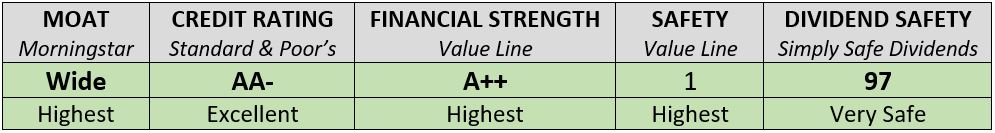

There aren’t many higher-quality companies out there than ADP, which receives top-level grades from rating agencies and analytical services.

ADP = Ample Dividends Paid

Investors always want to see growth, and that goes for dividends, too. ADP never fails to deliver in that department, having raised its payout to shareholders for 47 consecutive years.

That ADP’s most recent raise — 11.8%, as announced on Nov. 10 — was roughly the same percentage as the 5-year and 20-year averages speaks to the reliability of the dividend and the financial strength of the business.

SimplySafeDividends.com

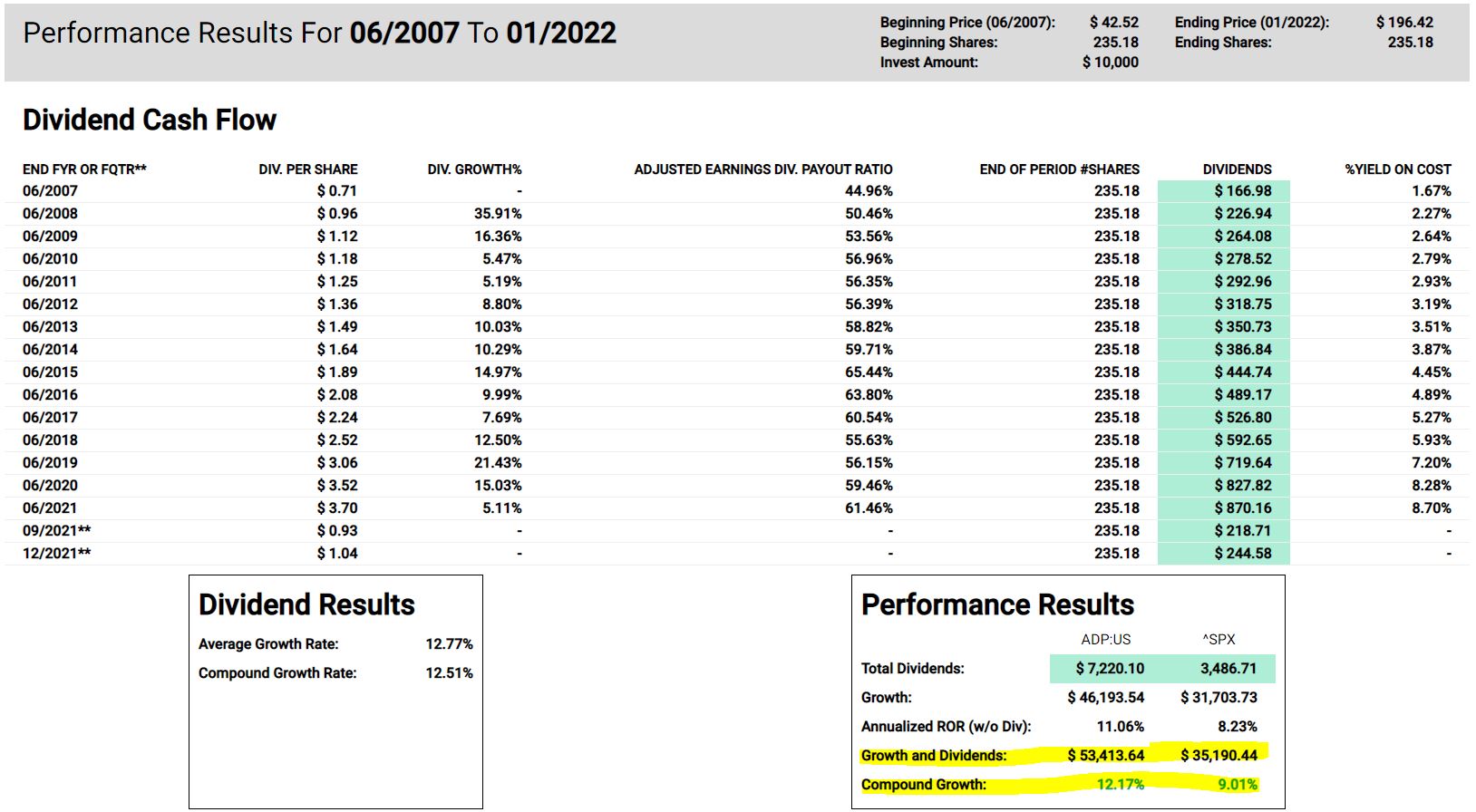

The dividend has played a major role in Automatic Data Processing outperforming the S&P 500 Index over the years.

In the following FAST Graphs image, note that while ADP outgrew the index even without dividends as part of the calculation, the margin was even larger once dividends are figured in: $10,000 turned into $53,413 in 15 years for a 12.2% compound growth rate, compared to $35,190 and 9% for the index.

fastgraphs.com

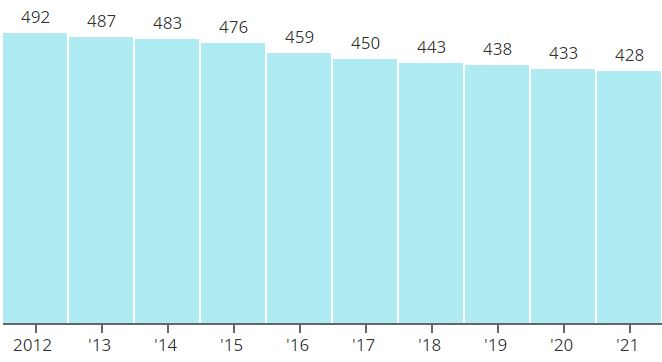

ADP also adds investor value with share buybacks; over the last decade, the company has reduced its share count by 13%.

ADP shares outstanding (in millions), from SimplySafeDividends.com

ADP’s dividend yield is 2.1%.

Valuation Station

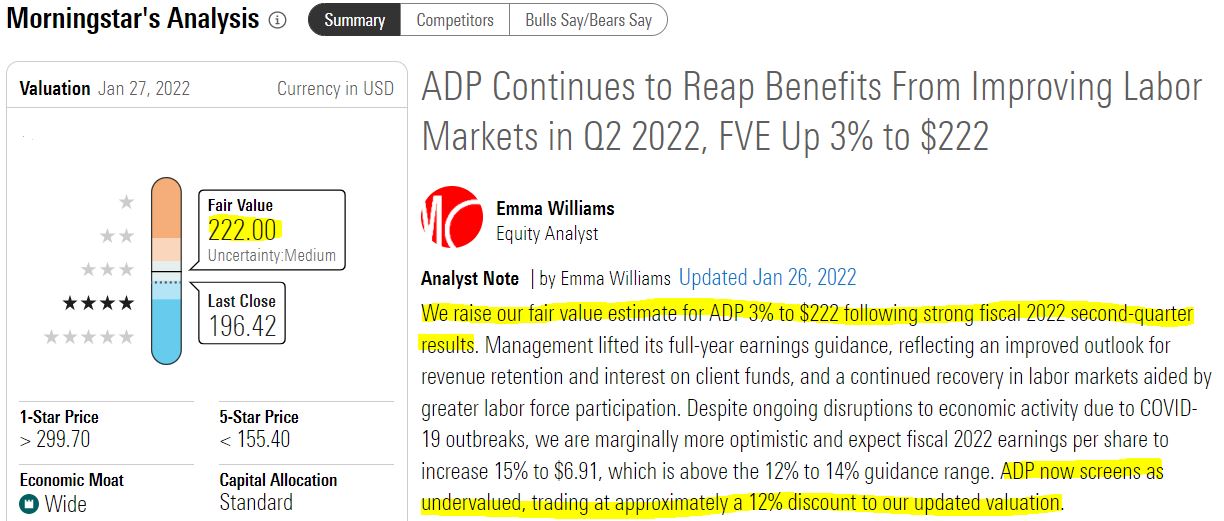

Morningstar is bullish on Automatic Data Processing, raising its fair value estimate on the stock to $222 after digesting the earnings report. That’s about 12% higher than the $195 we just paid to increase the size of the IBP’s position.

morningstar.com

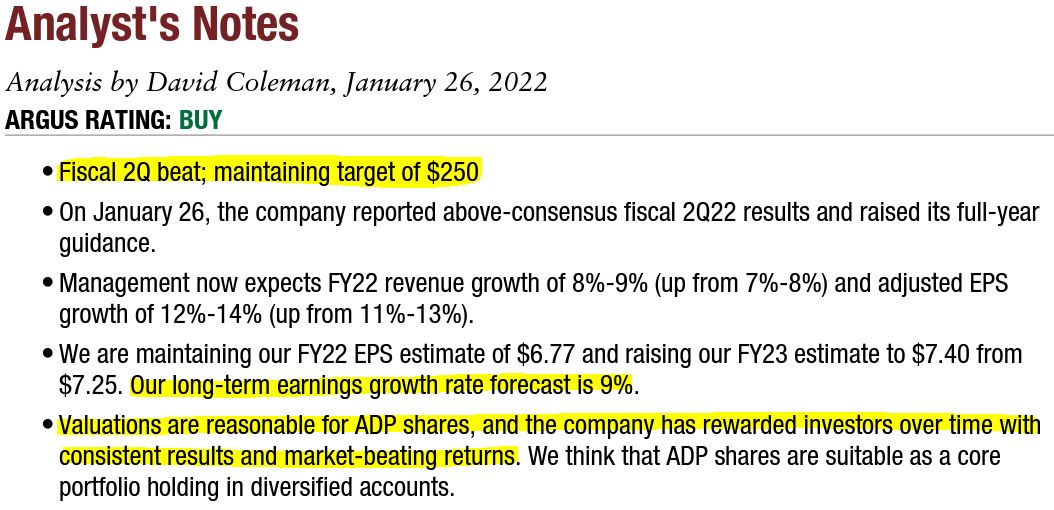

Argus also is high on ADP, with a 12-month target price of $250 and a projected long-term earnings growth rate of 9%. I agree with analyst David Coleman’s thesis that valuations are reasonable and that the company has rewarded investors over time with consistent results and market-beating returns.

schwab.com

Other analyst 12-month target prices include $241 by Zacks, $228 by JPMorgan, $226 by CFRA, $225 by Jefferies, $215 by Credit Suisse, $213 by Cowen, $212 by Citigroup, and $203 by Deutsche Bank.

Value Line believes ADP’s stock price can appreciate about 35% over the next 18 months — which is actually higher than projected gains for the next 3-5 years.

valueline.com

Value Line analyst Adam Rosner said: “ADP is in excellent financial shape. At the end of fiscal 2021, the company had cash of over $2.5 billion, which leaves it well positioned to fund expansion initiatives.”

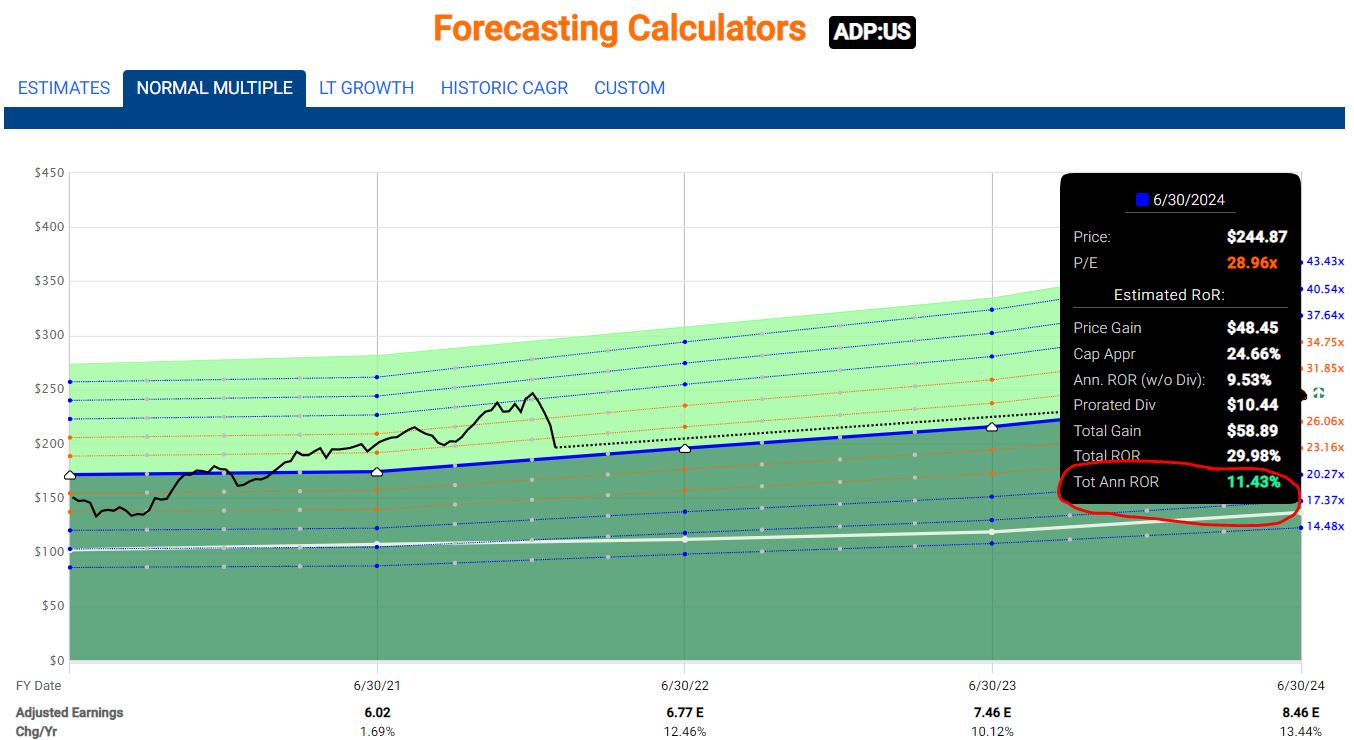

Looking at FAST Graphs, ADP appears to be pretty fairly valued, with a 30-ish blended P/E ratio compared to a 5-year norm of 29. The end of the black price line almost touches the blue normal valuation line, also signifying fair value.

fastgraphs.com

Using the FAST Graphs forecasting calculator … if ADP continues to trade at its average 5-year P/E ratio, the stock would have an annual rate of return of about 11.4% through the end of the company’s 2024 fiscal year.

fastgraphs.com

All in all, despite its 30 P/E ratio, I’d call ADP “fairly valued.” Given that it often trades at a hefty premium, the stock could appeal to some investors here. Others might consider it still too expensive.

Wrapping Things Up

The Income Builder Portfolio now has a 10.216-share position of Automatic Data Processing, which is projected to generate $42.50 in annual income.

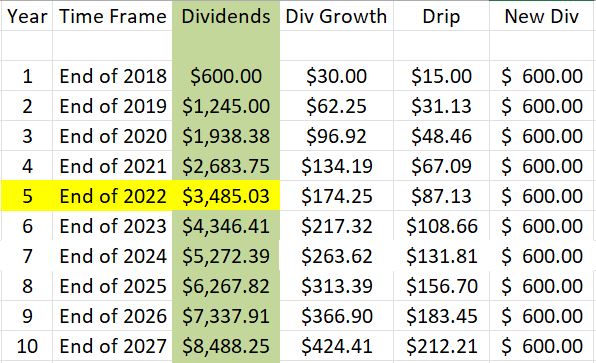

Add in the income produced by the now-larger Snap-on and Reynolds positions — as well as January dividend raises for IBP holdings BlackRock (BLK), Alliant Energy (LNT), Chevron (CVX) and Comcast (CMCSA) — and the portfolio’s projected annual income stream has surpassed the $3,500 mark.

As outlined in the Business Plan, the IBP’s “Income Target” is $5,000 in annual dividends within 7 years of the portfolio’s inception. Using the assumptions of a 2.5% yield and 5% annual dividend growth, the projected income stream after 5 years was $3,485. But now, only one month into Year 5, we’ve already surpassed that number.

I like celebrating milestones, so I’ll give that a big “WOO HOO!” and look for even bigger things ahead for the IBP.

As always, investors are strongly urged to conduct their own due diligence before buying any stocks.

NOTE: I also manage another real-money project for this site, the Growth & Income Portfolio. It includes “growthier” names such as Alphabet (GOOGL) and Apple (AAPL), along with Dividend Aristocrats like Johnson & Johnson (JNJ) and McDonald’s (MCD). Check it out HERE. Additionally, I do videos for our Dividends And Income Channel on YouTube; my latest, which talks about “The Safest 7% Yield in the World,” can be seen HERE.

— Mike Nadel

The goal? To build a reliable, growing income stream by making regular investments in high-quality dividend-paying companies. Click here to access our Income Builder Portfolio and see what we’re buying this month.

Source: DividendsAndIncome.com