As 2022 begins we find the stock market as measured by the S&P 500 extremely overvalued and vulnerable to rising interest rates. Historically, rising interest rates are bad for stocks generally.

Currently, inflation is running rampant and at all-time highs. The general antidote to fight inflation is to increase interest rates. The Federal Reserve has indicated that interest rates could be risen 3 times or more in 2022. This makes the market trading at nosebleed valuations vulnerable. However, there are sectors and industries that are not trading at extreme levels.

As I have often stated, it is a market of stocks not a stock market. With this video I will look at 9 dividend growth stocks that are high-quality, high yield, and available at unjustifiably low valuations. Furthermore, the stocks in this subsector are interest-rate sensitive. As interest rates rise, historical analysis has shown that the P/E ratios of companies in this industry rise in direct proportion to the increases.

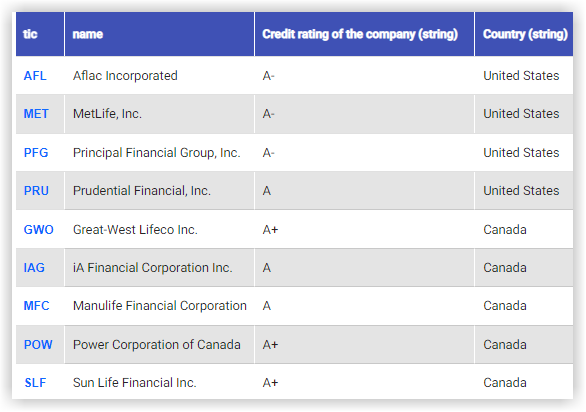

In this video I will review: Aflac (AFL), MetLife (MET), Principal Financial Group (PFG), Prudential Financial (PRU), Great-West Life (GWO) iA Financial (IAG), ManuLife Financial (MFC), Power Corporation of Canada (POW), Sun Life Financial (SLF).

FAST Graphs Analyze Out Loud Video

— Chuck Carnevale

Experts are predicting that in as little as three months, AI as we know it could be totally blown away. And that means as early as October 8, ChatGPT could be replaced by a new AI that's thousands of times more powerful... something that could cause expensive tech stocks like Microsoft, Google, and NVIDIA to double - maybe even triple - in price in the months ahead. Click here for all the details.

Source: FAST Graphs