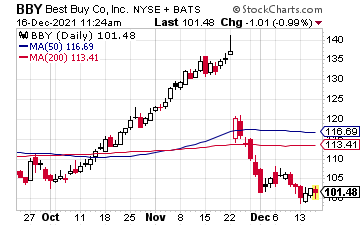

Best Buy (BBY) shares have been clobbered, all thanks to disappointing gross margins in the company’s latest earnings report.

However, after dropping from $140 to about $102.50, the pullback has become overkill. At current prices, not only has the BBY stock found strong support dating back to early 2021, but it’s also become aggressively oversold on RSI, MACD, and Williams’ %R.

In fact, if you pull up a two-year chart of BBY, you can see that whenever RSI, MACD, and Williams’ %R have become this oversold, the stock bounced back shortly after. It happened in March 2021, December 2020, and in February 2020. Right now, if oversold shares of BBY can hold support, it could potentially refill its bearish gap around $140 in the near-term.

Aside from disappointing gross margins, Best Buy’s latest earnings report wasn’t bad at all.

Aside from disappointing gross margins, Best Buy’s latest earnings report wasn’t bad at all.

Enterprise comparable sales jumped 37.2%, and GAAP diluted EPS was up 280% to $2.34, as non-GAAP diluted EPS jumped 233% to $2.23.

Future growth may be even more impressive, with Best Buy CFO Matt Bilunas stating in the company’s latest earnings release: “The year has clearly started out much stronger than we originally expected. The sales momentum is continuing into Q2 and we are raising our annual comparable sales growth outlook. As we think about the back half of this year, we expect shopping behavior will evolve as customers are able to spend more time on activities like eating out, traveling and other events.”

Helping, Chairman J. Patrick Doyle just bought 20,000 shares of BBY for $2.1 million at an average price of $104.47.

While BBY may be one of the most hated stocks on the market, it’s also become one of the most oversold, with insiders betting the bottom may be in.

— Ian Cooper

This stock checks all the boxes. Pays a high dividend (8%), has a record of increasing that yield (an average of 37.5% throughout company history), and is set up perfectly to profit from continued Fed rate hikes. Click here for the name and ticker of the most perfect dividend stock on the market right now.

Source: Investors Alley