Electric vehicle (EV) stocks could be some of the biggest winners of 2022, and three of the top EV stocks investors may want to consider for next year are Tesla (TSLA), Nio Inc. (NIO), and Li Auto (LI). When it comes to EV investment opportunities, Tesla is, of course, one of the top stocks. Tesla is getting set to open its Berlin Gigafactory plant to supply European demand for the vehicles, reports Investor’s Business Daily. While Tesla stock has more than doubled to $1,134, it could race to even higher highs as the electric vehicle story accelerates.

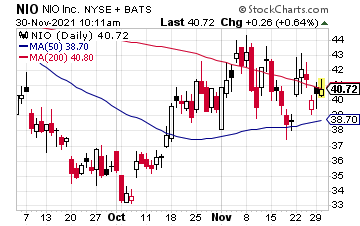

Or, look at Nio Inc.—which was just upgraded to a buy rating—with a $56 price target over at Goldman Sachs. At the moment, Nio trades at $40, and could push higher, as we near “Nio Day” in mid-December, as well as the company’s November 2021 delivery report.

Even better, Nio continues to produce solid numbers.

Even better, Nio continues to produce solid numbers.

Most recently, a company spokesperson said of the business: “With the concerted efforts of Nio teams and supply chain partners, Nio delivered 10,628 vehicles globally in September 2021, an all-time high monthly record representing a robust growth of 125.7% year-over-year.

Nio delivered 24,439 vehicles in the third quarter of 2021, representing an increase of 100.2% year-over-year and exceeding the higher end of the Company’s quarterly guidance.”

Finally, take a look at Li Auto, which just crushed earnings estimates.

In fact, Li Auto posted adjusted EPS of $0.03 per share on $1.21 billion in sales. Meanwhile, analysts were looking for a loss of $0.03 on $1.13 billion in sales.

“In light of our strong order intake and users’ rising acceptance of smart electric vehicles, we remain as enthusiastic as ever about our growth prospects,” said CEO Xiang Li, as quoted by Barron’s. “We will further increase our production capacity through the addition of the Beijing manufacturing base, and consistently expand our sales and servicing network to prepare our business growth.”

Even better, the company expects to deliver 30,000 to 32,000 vehicles in the fourth quarter, and to see total revenues of between $1.37 billion and $1.46 billion—above estimates for $1.35 billion.

With a good deal of consumer demand, and global governments clamoring for millions of EVs over the next decade, Tesla, Nio, and Li Auto could be some of the biggest winners of 2022.

— Ian Cooper

This stock checks all the boxes. Pays a high dividend (8%), has a record of increasing that yield (an average of 37.5% throughout company history), and is set up perfectly to profit from continued Fed rate hikes. Click here for the name and ticker of the most perfect dividend stock on the market right now.

Source: Investors Alley