If there were an exact science in determining fair value for every stock, it sure would make investing easier.

Unfortunately, the science is quite inexact. Even experts who have been assigning valuations for decades often disagree significantly about a given equity — and history proves many of them to have been “wrong.”

So what’s an investor to do?

Well, I look at a company’s current financial picture, and I also check out estimates of future earnings and other forward-looking data. I see what analysts have to say, even as I recognize that they face the same limitations the rest of us do.

All of the above illustrates why I favor the quality of a company even above valuation when deciding if I want to select it for the Income Builder Portfolio.

Case in point, my latest IBP pick: Union Pacific (UNP).

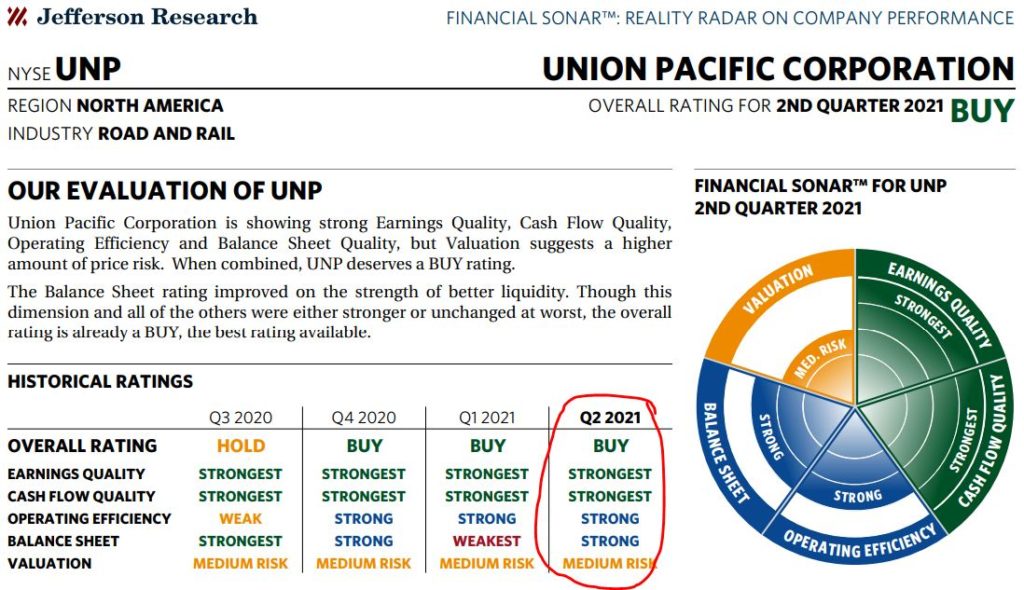

Here is the Jefferson Research “Financial Sonar” of the world’s largest railroad:

Jefferson Research, via fidelity.com

That’s one fundamentally sound company, with a great balance sheet, and with strong earnings and cash flow.

Union Pacific’s one “wart”? Depending upon what data one uses and how one analyzes it, the stock might be overvalued, hence Jefferson Research’s “medium risk” designation in that category.

As I’ll show in a minute, though, many analysts believe UNP is fairly valued or even undervalued. Regardless, I appreciate the quality of the business so much — as discussed in my previous article — that I wanted it in the Income Builder Portfolio.

And on Monday, Sept. 13, I executed a purchase order for $1,000 worth of UNP on behalf of this site’s co-founder (and IBP money-man) Greg Patrick.

Whole shares purchased via limit order; fractional share purchased via “Schwab Stock Slices”

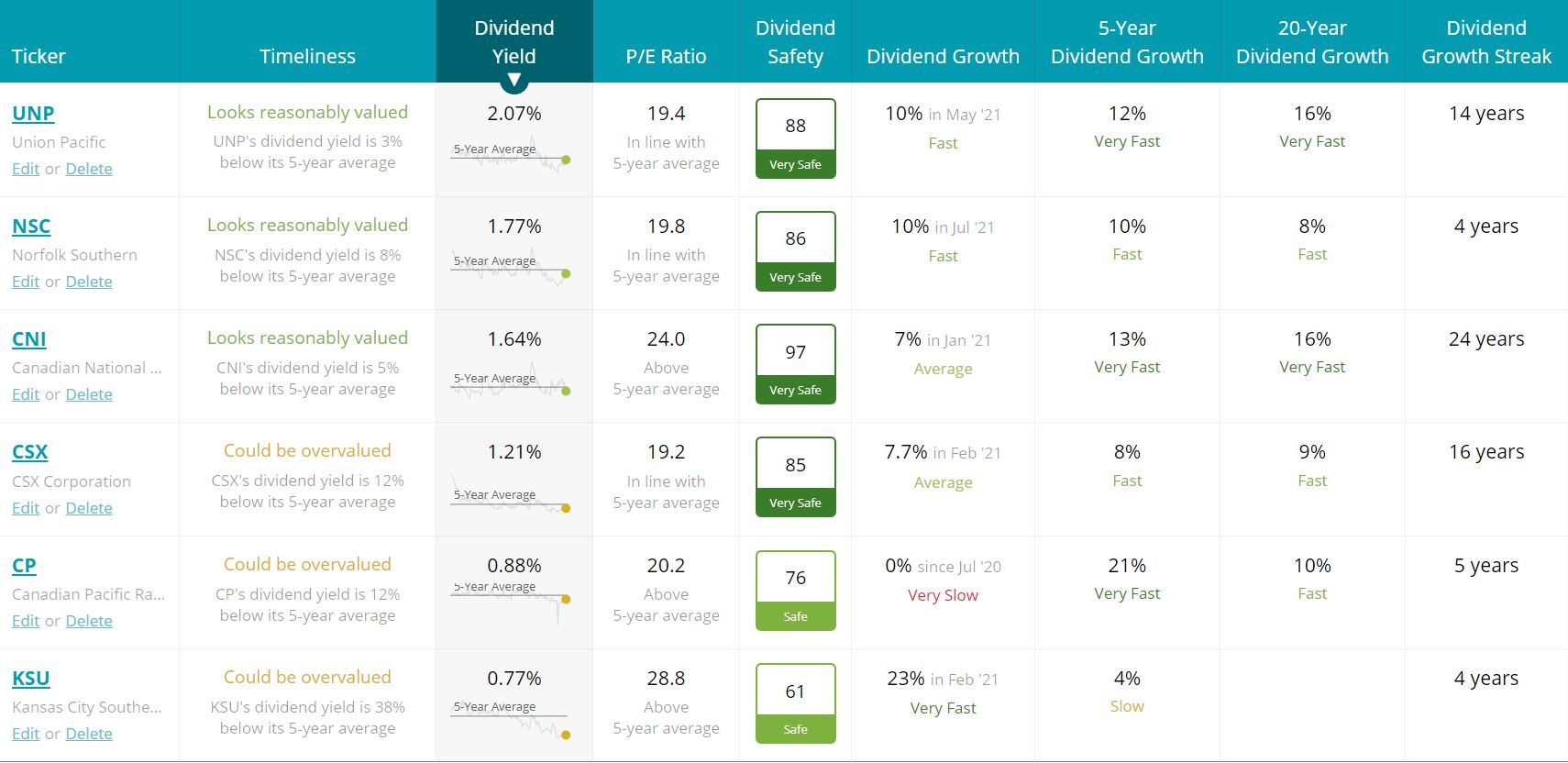

I also considered a few other railroads: CSX Corporation (CSX), Norfolk Southern (NSC), Canadian National (CNI), Canadian Pacific (CP) and Kansas City Southern (KSU).

But I felt Union Pacific offered the best combination of proven quality, future prospects and dividend yield/safety/growth.

SimplySafeDividends.com

Union Pacific becomes the IBP’s 45th position. (See the entire portfolio — as well as links to every article I’ve written — HERE.)

It’s also the 7th company we own in the Industrial sector, which makes up about 12% of the portfolio. Only Information Technology (21%), Health Care (15%) and Consumer Staples (14%) are more heavily weighted within the IBP.

Valuation Station

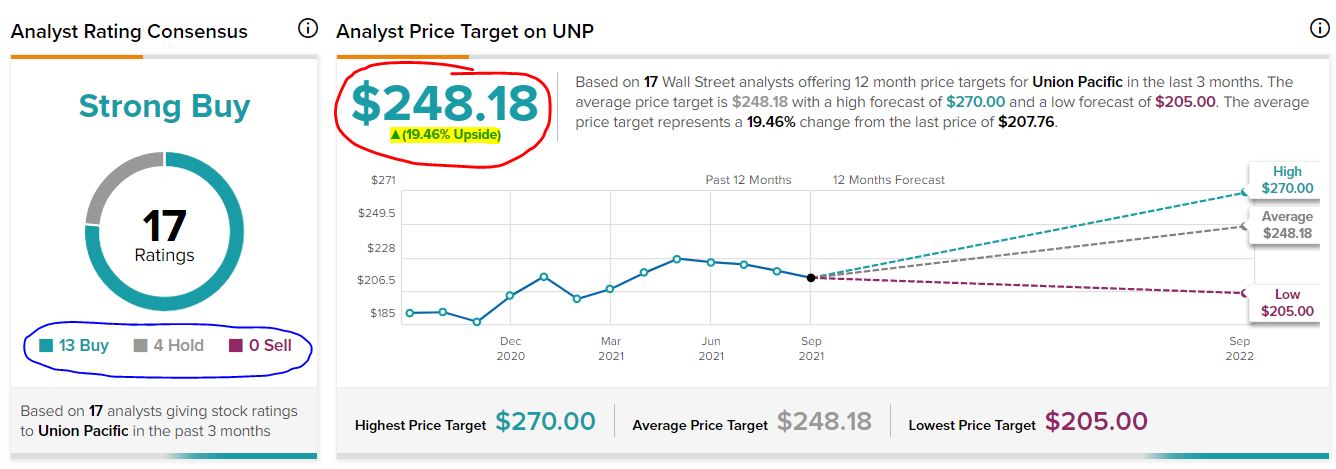

Is UNP overvalued, undervalued or fairly valued? First, let’s take a look at a couple of consensus views of analysts.

Of the 17 used by TipRanks, 13 consider Union Pacific to be a “buy,” and their average 12-month target price represents a nearly 20% upside.

TipRanks.com

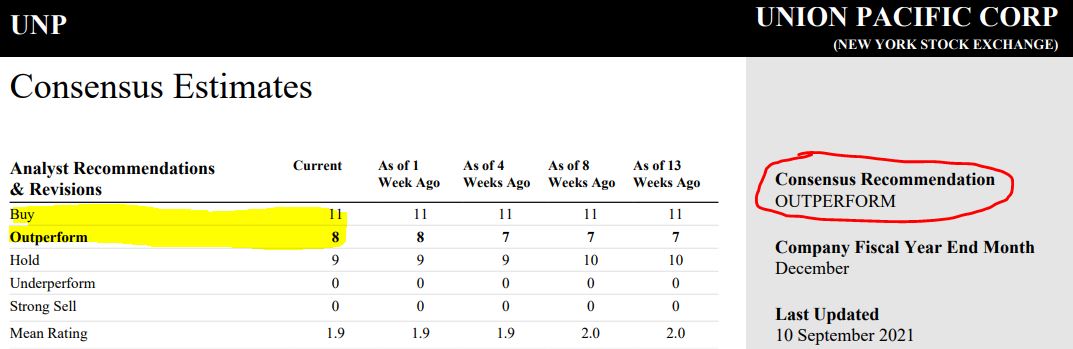

The story is fairly similar among the 28 analysts in the Reuters survey, with 19 giving either a “buy” or “overweight” call.

Reuters, via schwab.com

Value Line has Union Pacific in two of its model portfolios: “Stocks with Above-Average Year-Ahead Price Appreciation” and “Stocks for Income and Potential Price Appreciation.”

Interestingly, VL says the first portfolio is for more conservative investors while the second is for more aggressive investors. I guess the folks there believe UNP is for everybody!

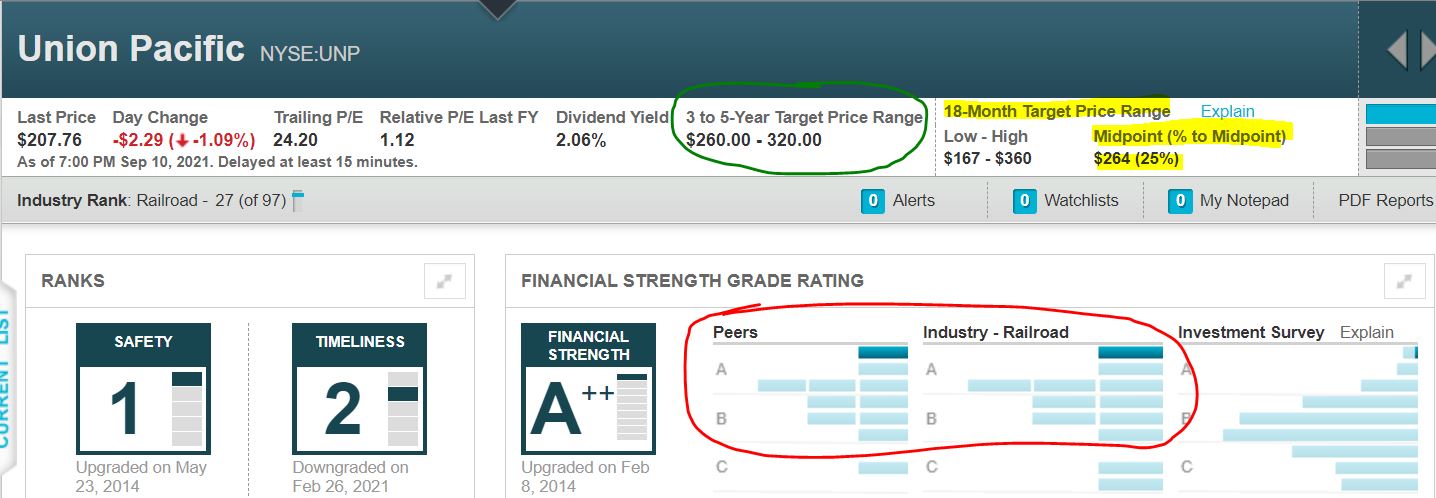

Value Line’s analysts believe the stock could appreciate more than 50% over the next 3-5 years (green-circled area) and about 25% over the next 18 months (yellow highlight). VL’s relative safety and financial strength ratings reflect the company’s quality, as do UNP’s rankings compared to its peers (red circle).

valueline.com

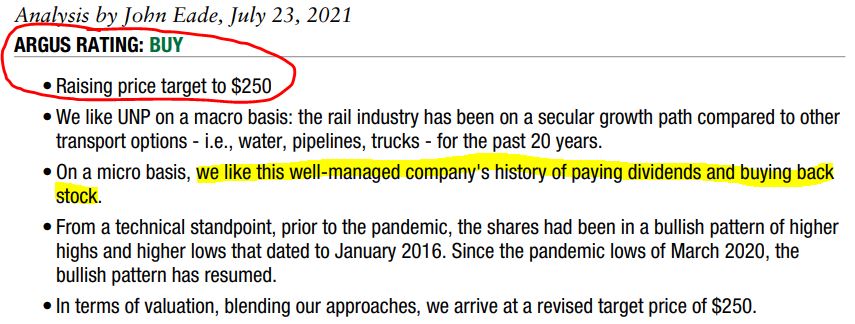

Argus analyst John Eade recently raised his 12-month price target to $250, and he took special note of the company’s dividend policy.

Argus, via schwab.com

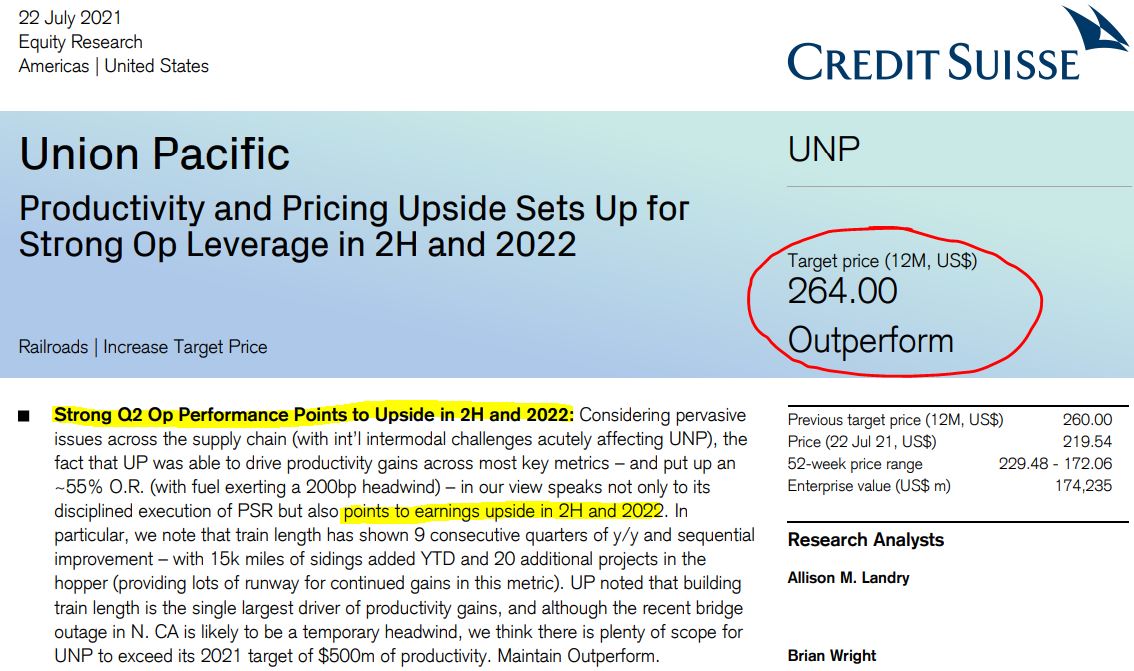

Credit Suisse’s analytical team is bullish on Union Pacific, pointing to expected future earnings growth in assessing a $264 target price.

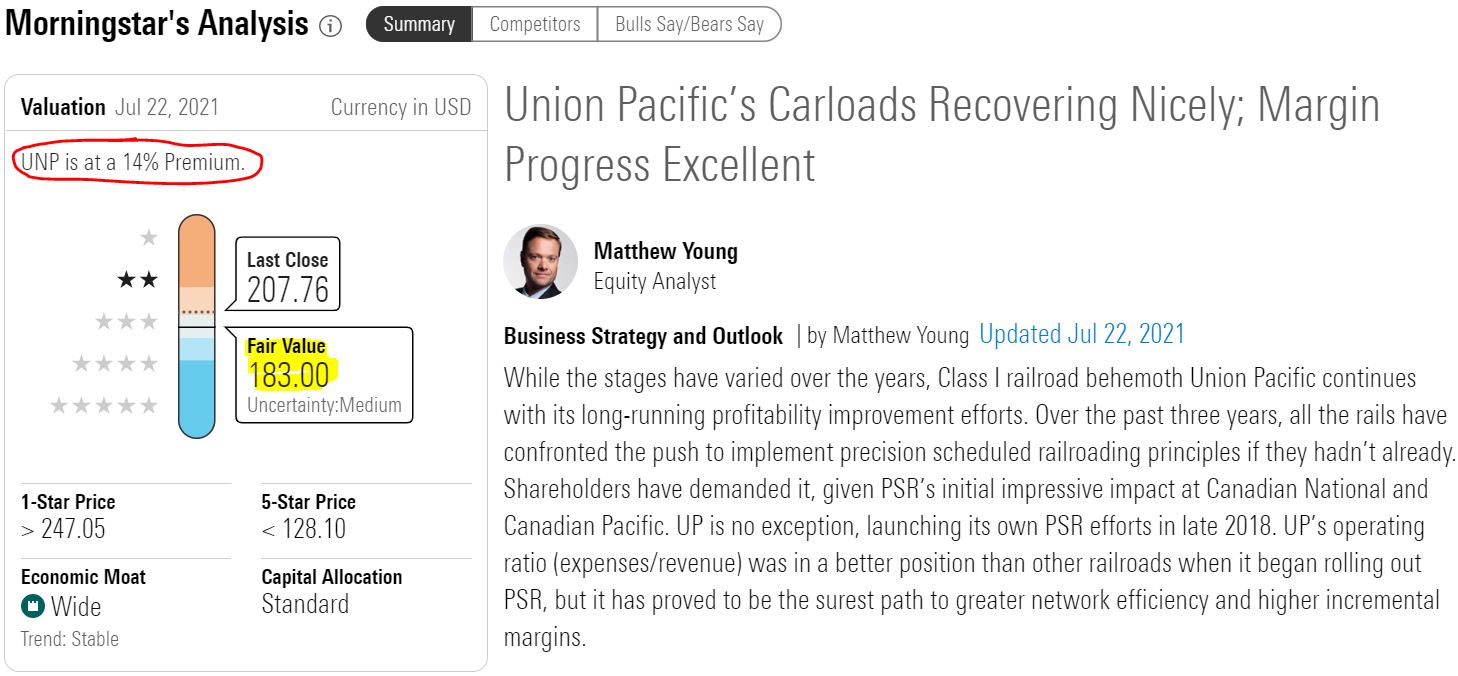

Morningstar, on the other hand, believes Union Pacific is already trading at a premium — even though analyst Matthew Young generally sings the company’s praises.

Now let’s take a look at a few FAST Graphs images.

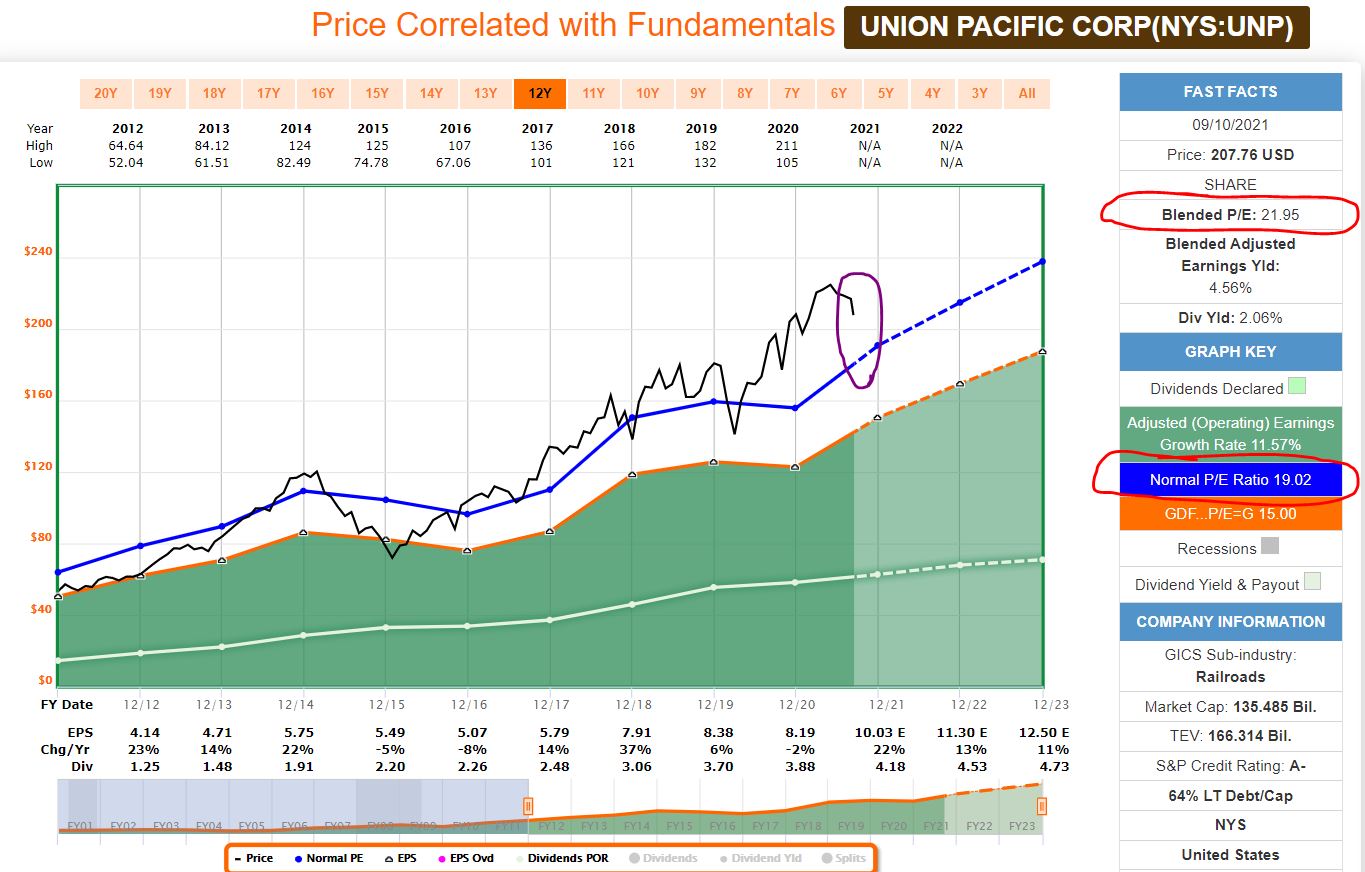

On the first, the current “blended P/E ratio” of about 22 is quite a bit higher than the 10-year norm of 19 (red-circled areas), and the end of the black price line sits quite a bit higher than the blue normal valuation line (purple circle). This seems to indicate at least moderate overvaluation.

fastgraphs.com

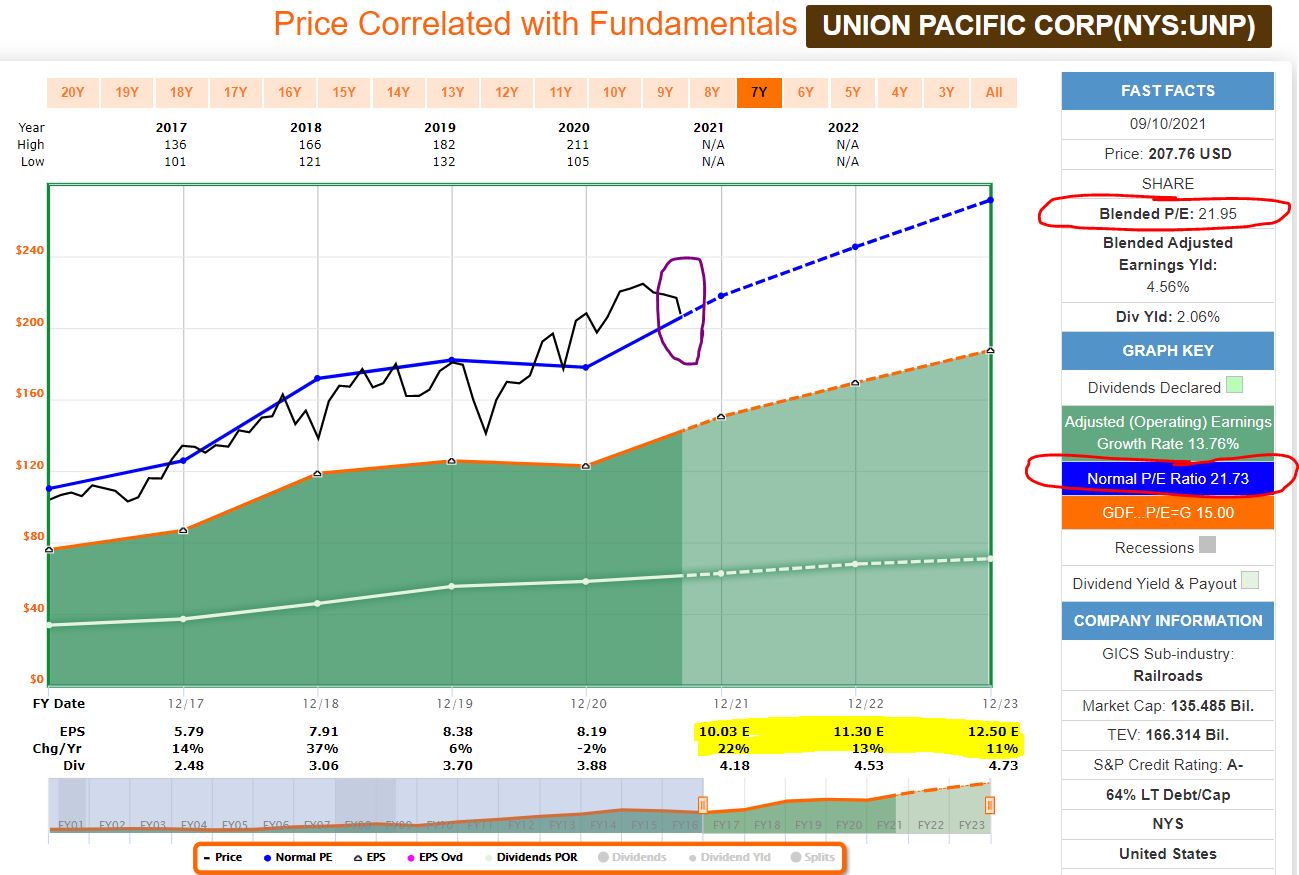

But a look at the 5-year picture shows that UNP’s current valuation is almost exactly in line with its recent history, suggesting that the stock is fairly valued. I also used yellow to highlight the fact that earnings are expected to grow nicely over the next few years.

fastgraphs.com

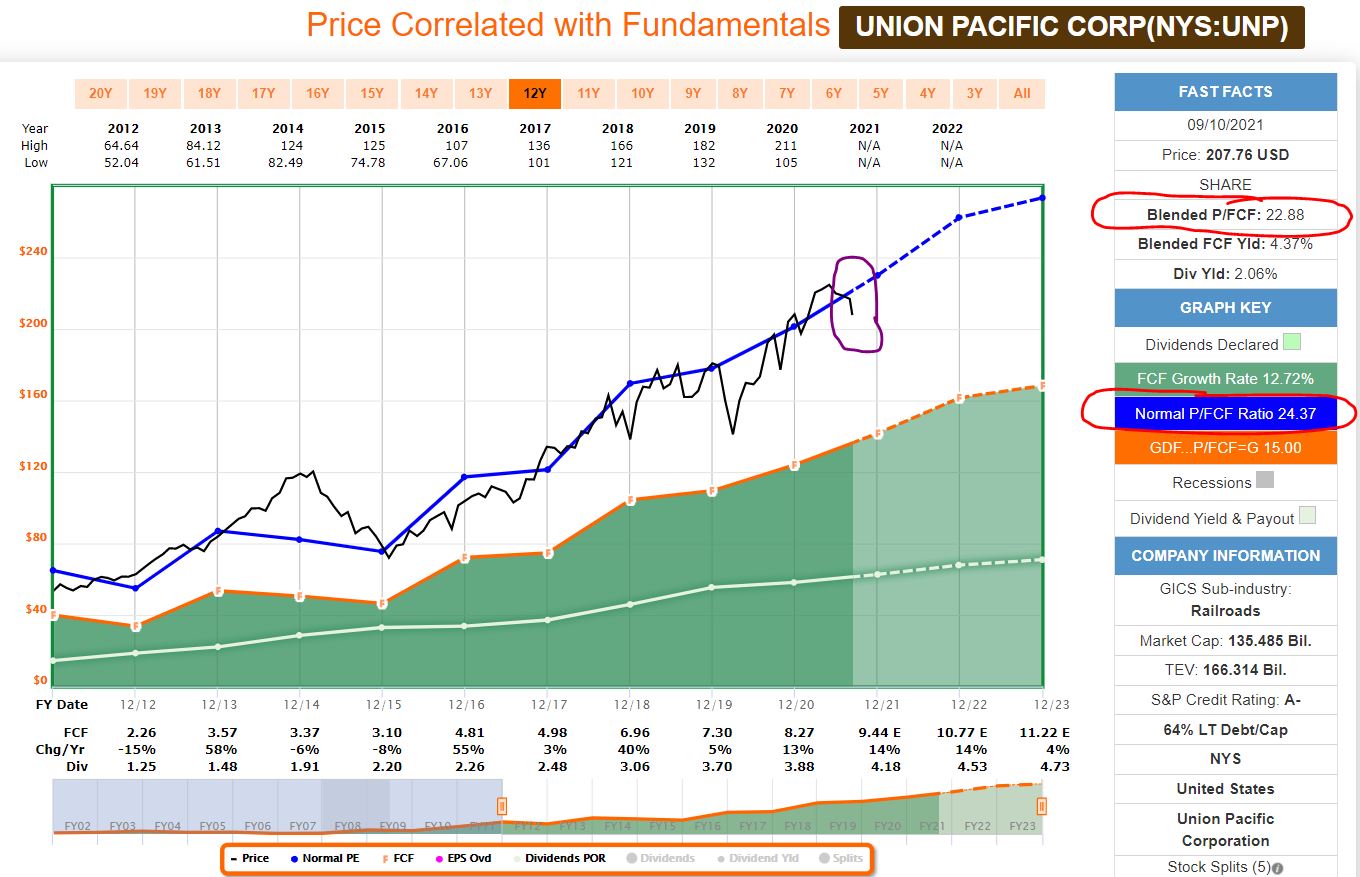

Finally, the following FAST Graphs illustration deals with free cash flow … and by that metric, Union Pacific appears to be a little undervalued.

fastgraphs.com

One other thing in that graphic caught my eye: The orange FCF line sits well above the white dividends line, showing how Union Pacific’s free cash flow easily has covered the dividend over the years.

Which lets us segue into the next section …

A Reliable, Growing Dividend

Within its second-quarter earnings presentation, UNP stated it would have a “Dividend Target Payout of about 45% of Earnings.”

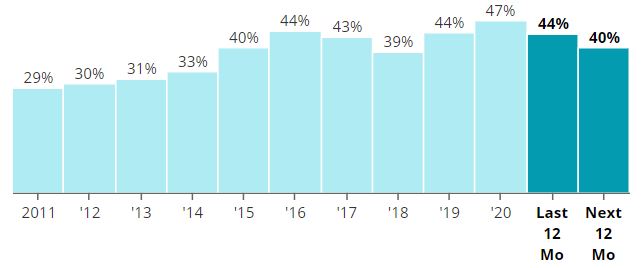

That’s a reasonable and healthy target when it comes to keeping a strong balance sheet, and it falls in line with where Union Pacific’s payout ratio has been in recent years.

SimplySafeDividends.com

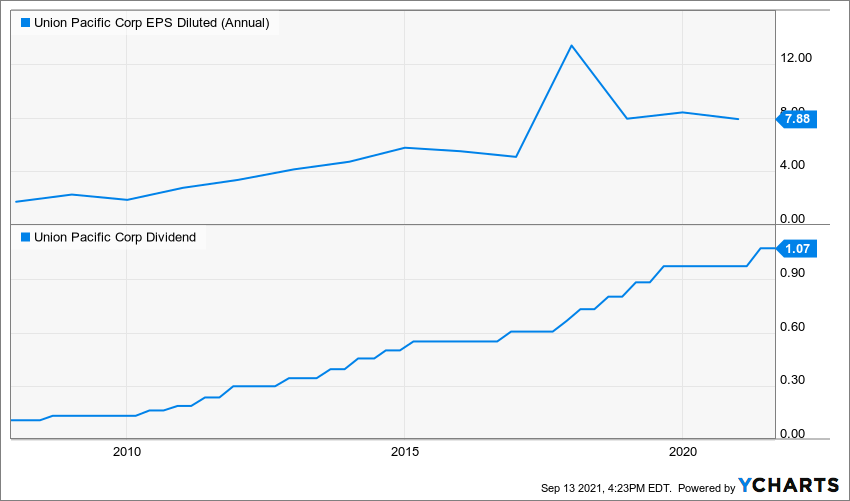

After raising its dividend by 10.3% earlier this year, UNP will have paid a $4.18/share dividend in 2021 on projected earnings per share of $10.03 — about 42%.

For 2022, EPS is expected to be $11.30, which means the dividend could grow by 22% to $5.08 and still fall within the 45% target.

Earnings, of course, are not guaranteed to meet projections … but it’s nonetheless comforting to know that even in down years for earnings, UNP has increased its dividend.

With Union Pacific’s quarterly dividend at $1.07/share, the IBP’s 4.7892-share position will generate $5.12 in income come December.

That will get reinvested automatically to buy another fraction of a share of UNP stock, per portfolio rules. The same thing will happen three months later, and then three months after that, and so on and so on.

We do the same with all 45 positions in the portfolio. That’s how an income stream gets built, and it’s why we named this project what we did.

Wrapping Things Up

Not long after I executed the order to buy UNP for the IBP, the stock price started heading lower. It almost hit $205 before closing Monday at $206.75 — down about a half-percent for the day.

One possible reason for the quick price drop: The U.S. Environmental Protection Agency is asking Union Pacific for answers regarding a hazardous waste site the railroad is supposed to be cleaning up. (Read about it HERE.)

Then again, maybe it had little to do with that. Three other railroads also saw their stock prices fall Monday, two by higher percentages than UNP’s drop.

I am NOT saying the hazardous-waste issue isn’t important, because it is. From an investing standpoint, however, it feels like “noise” — an external situation that temporarily makes a company’s stock price fall or rise.

Despite the news (or the “noise”), I’m glad to have added a proven, high-quality, dividend-growing company to the Income Builder Portfolio.

— Mike Nadel

The goal? To build a reliable, growing income stream by making regular investments in high-quality dividend-paying companies. Click here to access our Income Builder Portfolio and see what we’re buying this month.

Source: DividendsAndIncome.com