If you’re considering a cyclical stock for your portfolio, you probably should take one of two approaches:

- I’m going to actively trade this, trying to time buys when there are down cycles and sells when there are up cycles, or

- I’m going to try to buy this at fair value or better, with the plan to hold it long-term through many cycles.

As a Dividend Growth Investing practitioner who appreciates the strategy’s compounding effect over many years, I almost always travel the second road.

That’s also the way I manage the Income Builder Portfolio, the real-money project we launched at the start of 2018: I have made very few sells, and not a single one was an attempt to time a cycle.

So it should be no surprise that I’m planning something similar with the IBP’s latest addition: truck-engine maker Cummins (CMI).

On Monday, Aug. 16, I executed a purchase order for about $1,000 worth of CMI on behalf of this site’s co-founder (and IBP money-man), Greg Patrick.

Whole shares purchased via limit order; fractional share purchased via “Schwab Stock Slices”

Cummins becomes our 44th position — see them all, along with links to every IBP-related article I’ve written, HERE. It’s also our 6th Industrial holding.

Most companies in that sector are considered cyclical because their earnings usually rise, often significantly, when the overall economy and/or their given industries, are doing well; during rough patches, the opposite is true.

When customers such as construction equipment maker Deere (DE) and vehicle manufacturer Stellantis (STLA) are thriving, they buy engines, parts and technology from Cummins; when they are struggling, CMI’s earnings and revenues can be adversely affected.

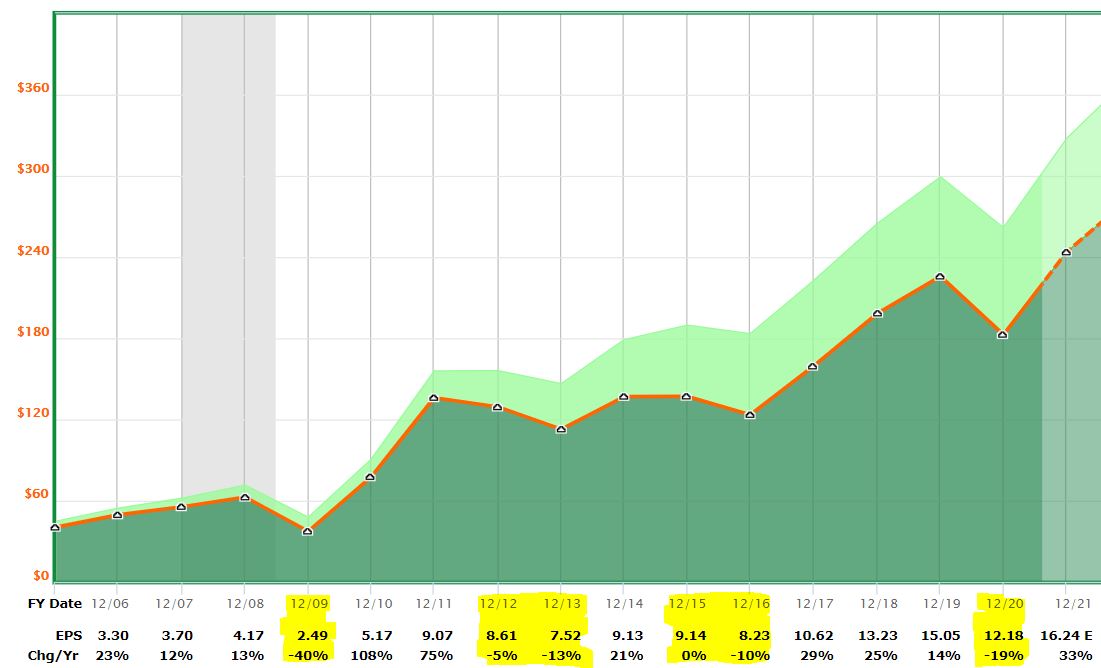

The following FAST Graphs image perfectly illustrates the economic cycles Cummins faced over the past 15 years, with the down cycles highlighted in yellow.

fastgraphs.com

Because stock prices generally follow earnings, cyclical Industrial stocks like Cummins often are more volatile than “defensive” stocks from the Consumer Staples, Health Care and Utilities sectors.

There have been many stretches — including so far in 2021 — during which CMI has underperformed the overall market. Patience, however, has been rewarded quite handsomely.

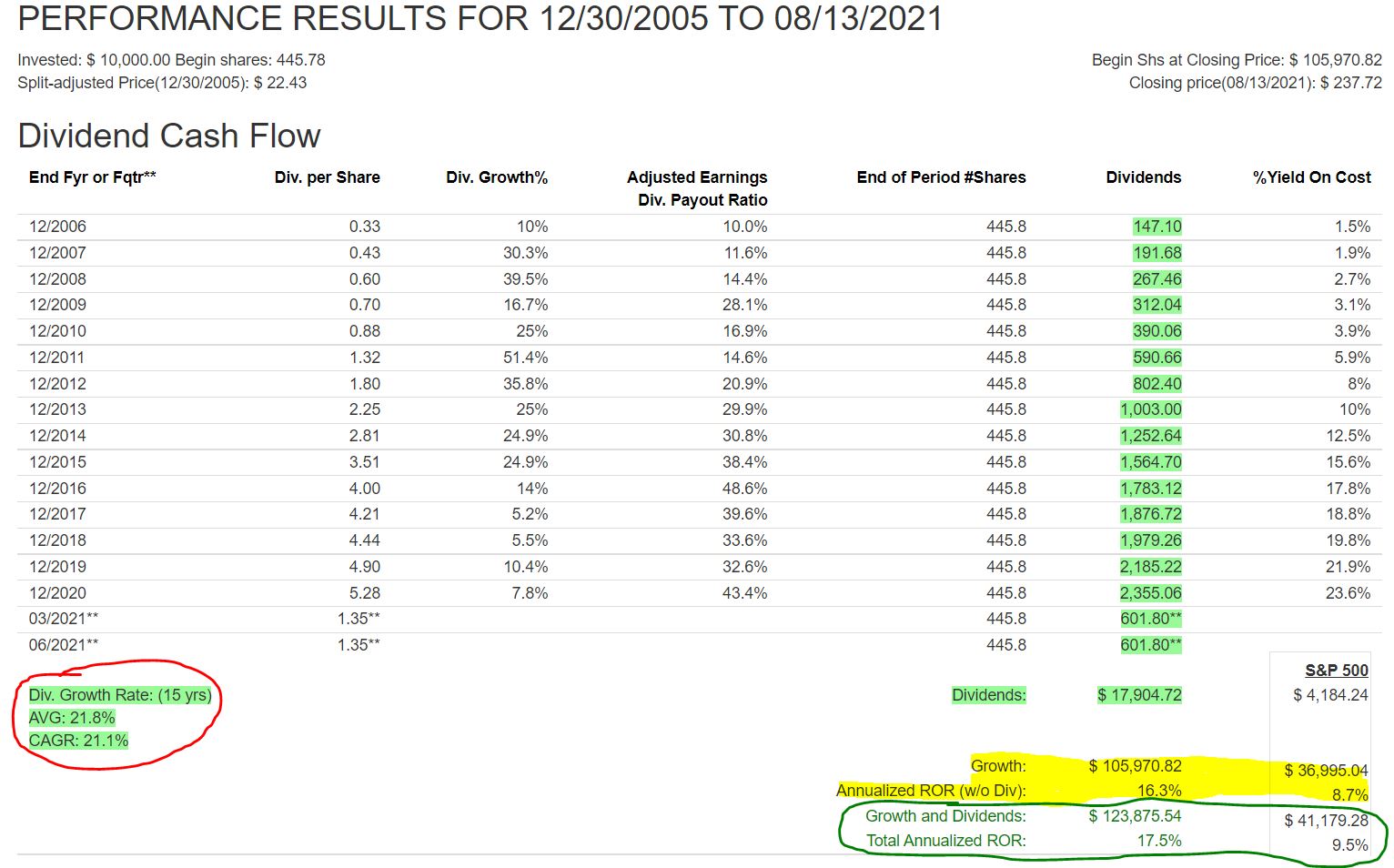

fastgraphs.com

As the above image shows, investors who bought CMI in 2006 and held it through both down and up cycles these last 15 years would have crushed the S&P 500 Index — and that’s true for both price appreciation (yellow highlight) and total return (green circle).

Indeed, a CMI investor would have experienced total return almost exactly triple that of an index investor.

Dividend Dandy

And as the red-circled area in that graphic indicates, Cummins, regardless of the cycle, also increased its dividend aggressively over the last 15 years. That’s an impressive annual growth rate of more than 21%.

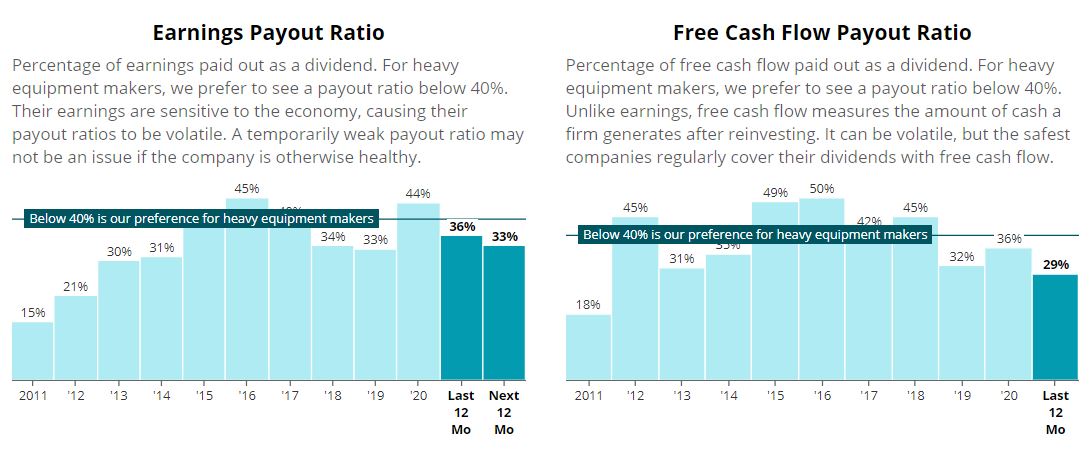

Cummins’ free cash flow easily covers its dividend. The company also has low payout ratios, suggesting there is plenty of room for future dividend increases.

SimplySafeDividends.com

No wonder Simply Safe Dividends gives Cummins an almost perfect “safety” score of 98, a sign that SSD’s researchers believe there is virtually no chance CMI will cut its dividend.

Because we initiated our Cummins position before the ex-dividend date (Thursday, Aug. 19), we will receive the $1.45 quarterly payout on Sept. 2 for each of our 4.1882 shares — a total of $6.07.

That will be reinvested right back into CMI, as mandated by the IBP Business Plan, to buy an additional fraction of a share. It won’t seem like much at the time, but over the years that compounding process will create considerable extra income from CMI and our other 43 positions.

Valuation Station

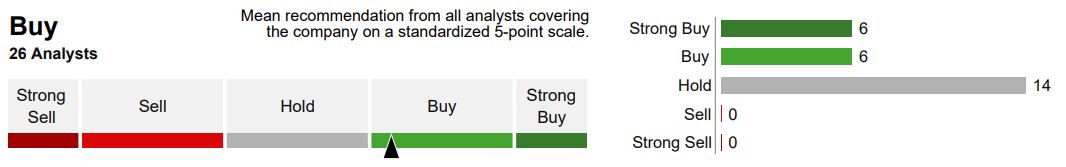

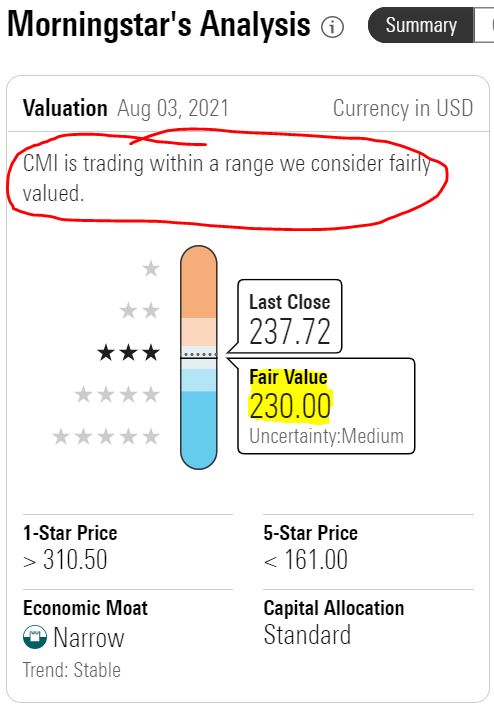

General market sentiment seems to indicate that CMI is neither significantly overvalued nor undervalued now.

For example, while a dozen analysts surveyed by Thomson Reuters think CMI is either a strong buy or buy (and no one is saying to sell the stock), 14 are calling it a hold.

Thomson Reuters, via fidelity.com

Morningstar Investment Research Center says the stock is priced right, trading just a bit higher than its fair value estimate of $230.

morningstar.com

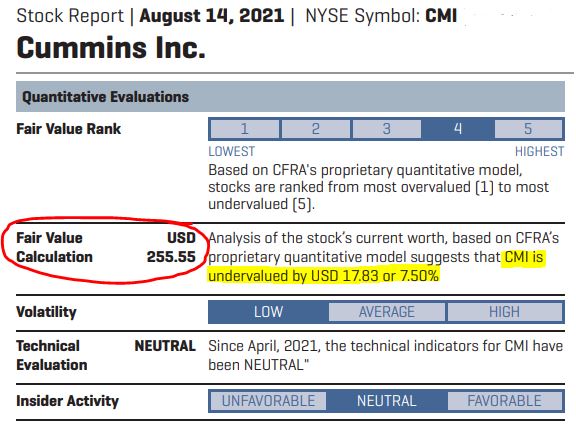

CFRA has come up with a $256 fair value, indicating the company is slightly undervalued.

CFRA, via schwab.com

CFRA also has assigned Cummins a 12-month target price of $270, with analyst Elizabeth Vermillion explaining:

Our Buy opinion on the shares reflects our outlook for improved truck sales and accelerating benefits from increased investment in electrification. We see this investment supported by President Biden’s campaign platform goals to reduce emissions and accelerate the shift to electric vehicles and electrified machinery. CMI benefits from leading-edge technology in truck engines and fuel cell development, aiding market share. CMI is testing hydrogen-fueled internal combustion engines for use in heavy-duty trucking applications. We expect CMI to continue growing market share, especially in N. America. …

Our $270 12-month target values the shares at 14.7x our 2022 EPS estimate, below CMI’s five-year average of 17.3x and in line with peers’ forward average of 14.4x, due to our outlook for growth catalysts from increased investments in electrification and green technology.

Some of that sounds similar to the investment thesis I laid out in my previous article, in which I said Cummins could benefit nicely from the trillion-dollar infrastructure package that is working its way through Congress.

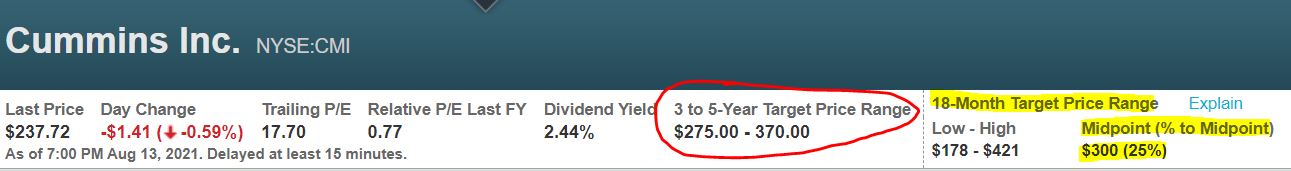

Value Line projects possible share-price appreciation of 25% in the mid-term (yellow highlight below) and as much as 55% in the next 3-5 years.

valueline.com

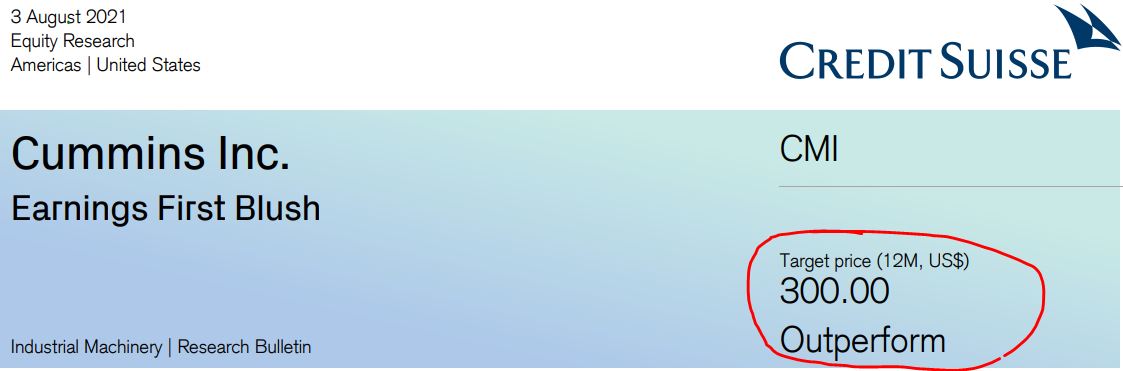

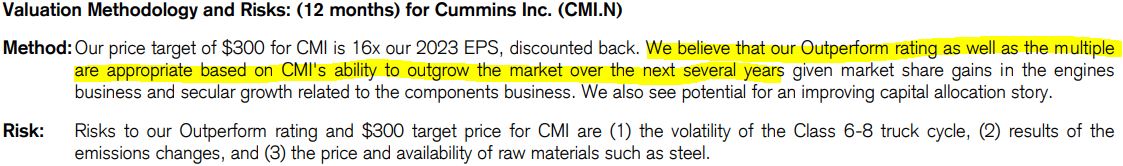

Credit Suisse analysts are high on Cummins, giving a 12-month target price of $300.

Credit Suisse, via schwab.com

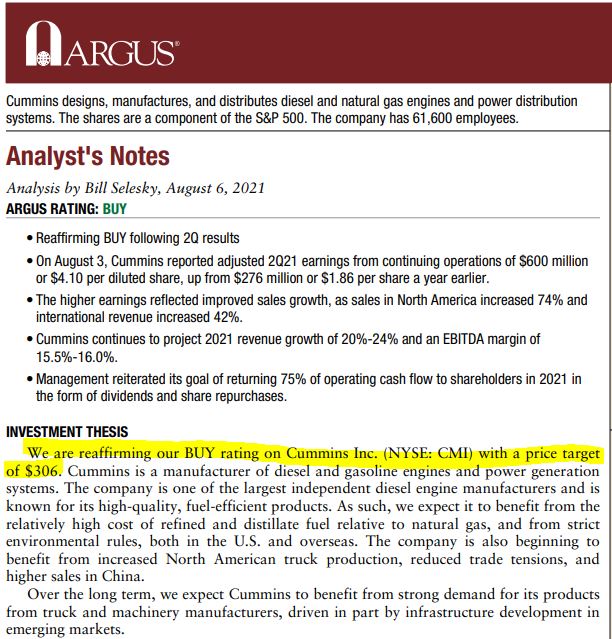

Argus analyst Bill Selesky thinks similarly, with a $306 target price, citing potential infrastructure projects not only in the United States but also in emerging markets.

Argus, via schwab.com

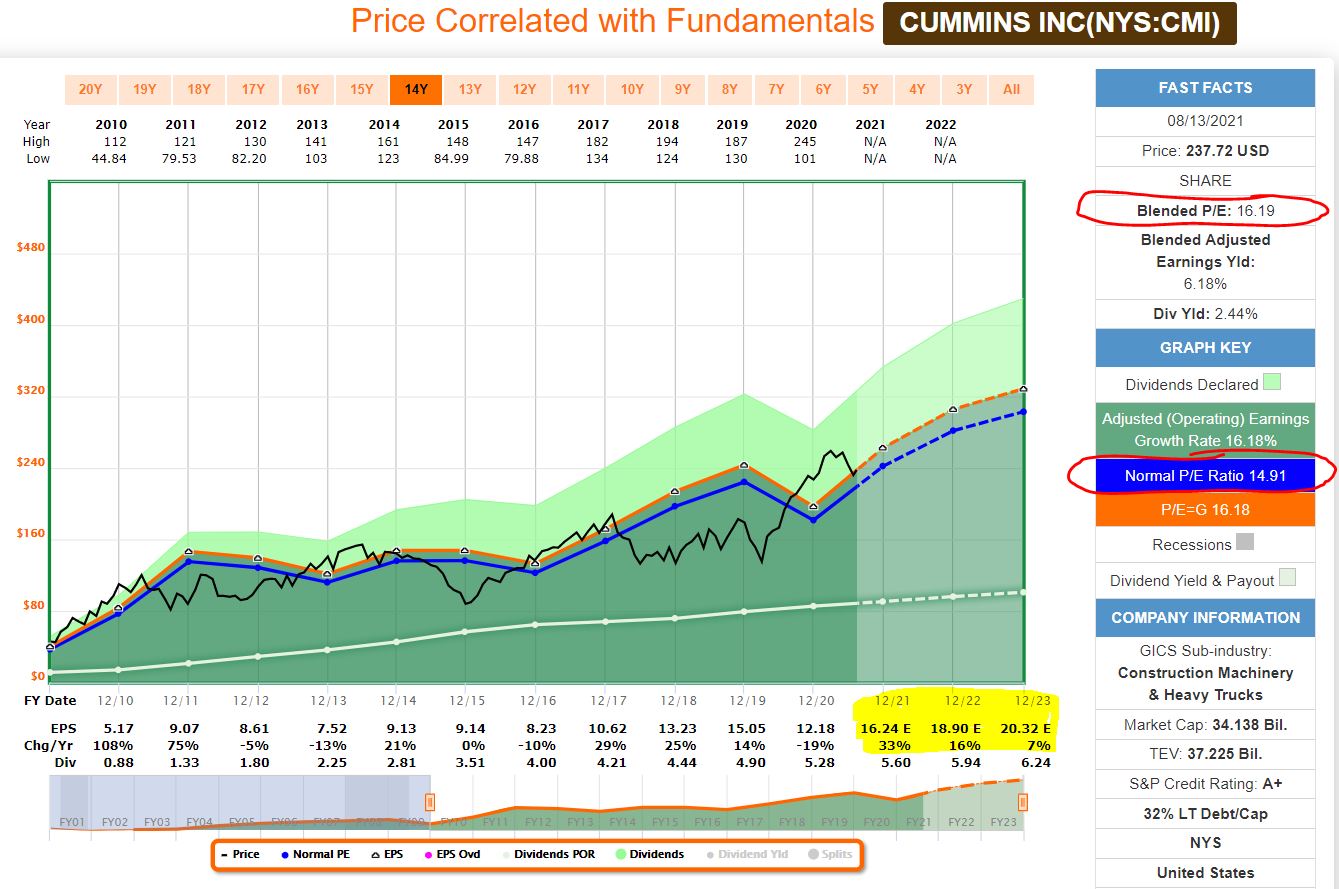

FAST Graphs shows that CMI’s current “blended P/E ratio” of 16.2 is a bit higher than its post-recession norm of 14.9 (red-circled areas) — but not so much higher that it suggests true overvaluation.

fastgraphs.com

That lines up well with the general consensus as I see it: CMI is currently priced in a fairly valued range.

Wrapping Things Up

With this selection of Cummins for the Income Builder Portfolio, I’m reasonably confident that there is plenty of life remaining in its industry’s current up cycle.

Admittedly, though, we sometimes don’t know a cycle has flipped until the change is already well underway.

That’s why I’m almost always thinking about choosing high-quality businesses and holding them long-term. To that extent, CMI is a fitting addition to this portfolio.

Note: For more about the IBP, please check out my YouTube videos on our Dividends And Income Channel. The most recent, detailing our previous purchase, can be seen HERE.

— Mike Nadel

Marc Lichtenfeld - Author of the best-selling book Get Rich With Dividends – is giving away his Ultimate Dividend Package... Free of charge! Click Here to Get His #1 Dividend Stock... The Safest 8% Dividend in the World... Top Three "Extreme Dividend" Stocks, And Much, Much More.

Source: Dividends and Income