Just when it seemed the United States had become so divided that members of opposing political parties would rather stab themselves in their eyes with red-hot pokers than agree on anything ever again … the Senate passed a trillion-dollar infrastructure plan.

Nearly 40% of Republicans crossed the aisle, joining all 50 Democrats — an extremely rare, bipartisan show of support.

The bill is now in the House of Representatives, where in-fighting among Democrats threatens to delay or even derail it … although I believe the legislation eventually will pass because America so desperately needs to upgrade its roads, bridges, tunnels, waterways, broadband services, power grid, etc.; and because the plan would create hundreds of thousands of good-paying jobs.

With all that in mind, I gave myself a challenge as I prepared to make my next selection for our Income Builder Portfolio.

I told myself the choice should be:

- An “infrastructure play” — meaning a company that would benefit directly should the plan pass.

- A stock that isn’t so dependent on the infrastructure bill that it would suffer if the plan somehow ends up crashing and burning in the House.

- A high-quality, industry-leading business with a long track record of success.

- A company with a history of growing its dividend, and with a yield that is appreciably higher than that of the S&P 500 Index.

- A stock that is fairly valued (or at least not significantly overvalued).

Many candidates hit several of those notes but few nailed them all. I decided to go with one that did, a company that has been on my watch list for quite some time: truck-engine maker Cummins (CMI).

cummins.com

On Monday, Aug. 16, I will execute a purchase order on this site’s behalf for about $1,000 worth of CMI stock.

Cummins will become the IBP’s 44th holding — see the entire portfolio HERE — and sixth in the Industrial sector.

Why CMI?

As I research candidates for the IBP (as well as for my personal portfolio), I like to focus on each company’s business model.

How does it make money, and is it likely to be able to keep doing so for years (or, better yet, for decades)?

Here is what Morningstar Investment Research Center says about Cummins’ business model:

We think Cummins will continue to be a leading supplier of truck engines and components, despite increasing emissions regulation from government authorities. For over a century, the company has been the pre-eminent manufacturer of diesel engines, which has led to its place as one of the best heavy- and medium-duty engine brands. Cummins’ strong brand is underpinned by its high-performing and extremely durable engines. Customers also value Cummins’ ability to enhance the value of their trucks, leading to product differentiation.

The company’s strategy focuses on delivering a comprehensive solution for original equipment manufacturers (OEMs). We believe Cummins will continue to gain market share, as it captures a larger share of vehicle content. This is largely due to growing emissions regulation, which allows Cummins to sell more of its emissions solutions, namely its aftertreatment systems that convert pollutants into harmless emissions. Additionally, Cummins stands to benefit from the electrification of powertrains in the industry. The company has made progress in the school and transit bus markets. Long term, we expect the truck market to also increase electrification. The pressure to manufacture more environmentally friendly products is forcing truck OEMs to evaluate whether it’s economically viable to continue producing their own engines and components or to partner with a market leader like Cummins. We’ve seen this play out recently, through the increase in partnership announcements for medium-duty engines with truck OEMs. We think some OEMs will opt to shift investment away from engine and component development, leaving it to Cummins.

Cummins has exposure to end markets that have attractive tailwinds. In trucking, we think new truck orders will be strong in the near term, largely due to strong demand for consumer goods. In good times, truck operators replace aging trucks and opt to expand their fleet to meet strong demand. Longer term, we think Cummins will continue to invest in BEVs and fuel cells to power future truck models. We believe a zero-emission world is inevitable, but we believe Cummins can use returns from its diesel business to drive investments.

That all seems like a pretty solid basis for an investment, and that last paragraph really highlights the “infrastructure theme” I was looking for this time.

For example, Cummins:

- Supplies engines for Deere (DE) vehicles, which will be found at construction sites everywhere once infrastructure work begins.

- Has been working on hydrogen-based technologies for almost two decades, aligning it nicely with the Biden Administration’s emphasis on dealing with climate issues as part of infrastructure improvement.

- Is a major player in the drive to convert buses and other large vehicles to electric operation.

- Does significant business in China, which has been deeply into infrastructure building and improvement for many years.

Cummins has been around for more than 100 years, and its fingerprints are on just about every technology that has come to pass within its industry over the last century.

cummins.com

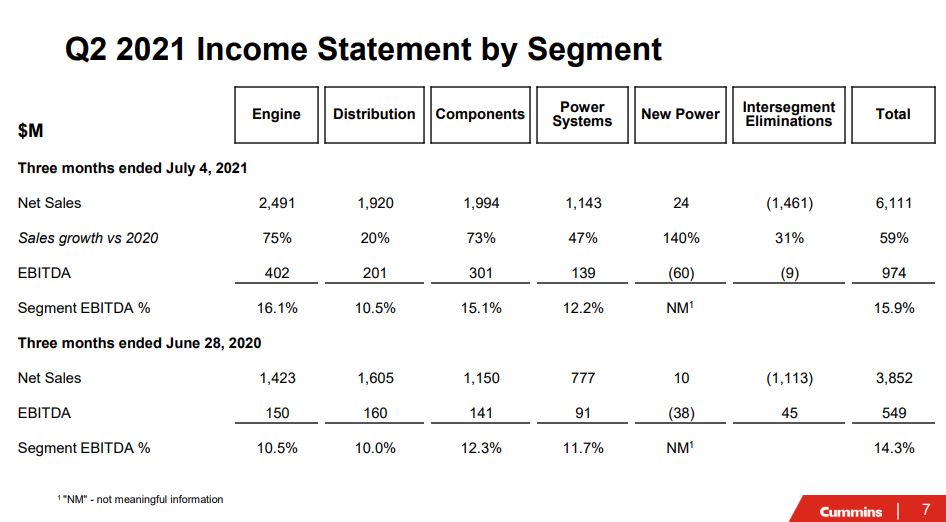

In its Q2 2021 earnings presentation on Aug. 3, Cummins announced huge year-over-year gains in earnings, sales and EBITDA, all easily beating analyst estimates.

Each of its divisions performed superbly, with considerable growth in the New Power, Engine and Components segments.

While a history of strong past performance is important, investing is always about the future.

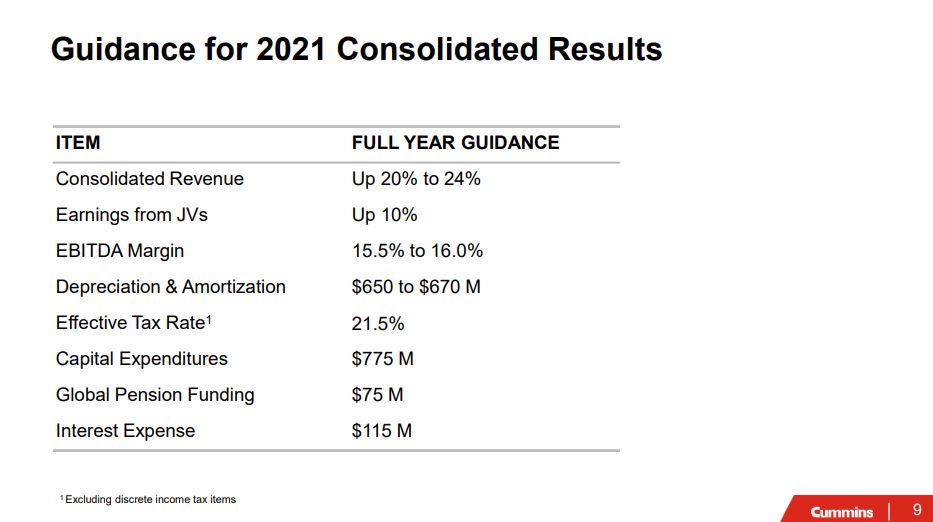

Cummins re-affirmed its previously stated robust guidance for the full year in most categories, while substantially increasing its outlook for earnings from joint ventures (JVs, in the following graphic).

And according to Yahoo Finance, Cummins’ earnings per share are expected to increase about 18% annually over the next 5 years — that’s some serious growth.

Quality Galore

Cummins certainly checks all the quality boxes, too.

Morningstar rates CMI’s moat as “narrow” — a designation that sounds mediocre but actually is Morningstar’s second-highest designation:

Cummins commands strong brand loyalty among customers, despite fierce competition in the industry. The company’s strong reputation is built on its demonstrated history of consistently providing customers with durable and fuel-efficient products. Cummins’ strong product performance empowers customers to lower the total cost of their operations. This dynamic allows the company to thrive in a highly competitive industry, which in most cases calls for Cummins to compete directly with its own customers, truck manufacturers.

Value Line gives CMI solid scores of A+ for Financial Strength and 2 for Safety due to “strength across various markets,” including North America, China and India.

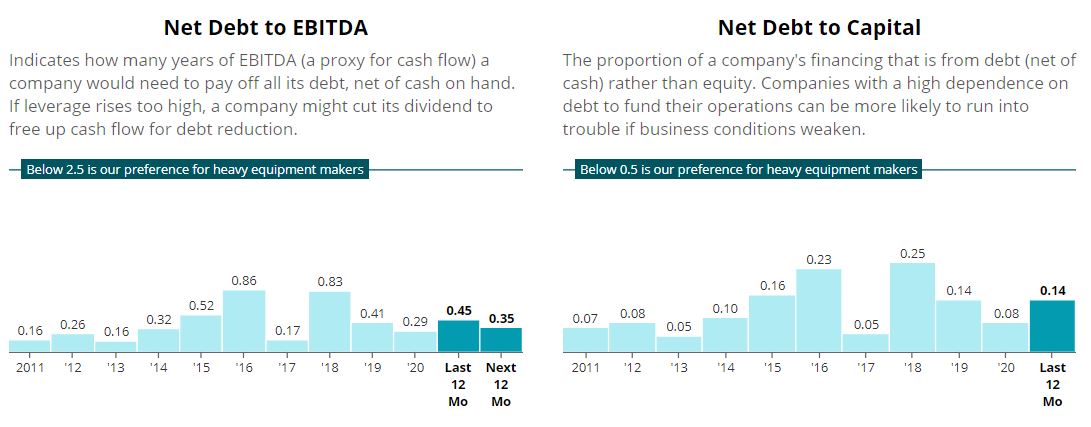

And thanks in great part to the company’s very low debt load, Standard & Poor’s assigns CMI an excellent A+ credit rating.

SimplySafeDividends.com

CMI = Creating More Income

Cummins has been paying dividends for decades, and the firm has a stated goal of returning 75% of its operating cash flow to investors through dividends and stock buybacks.

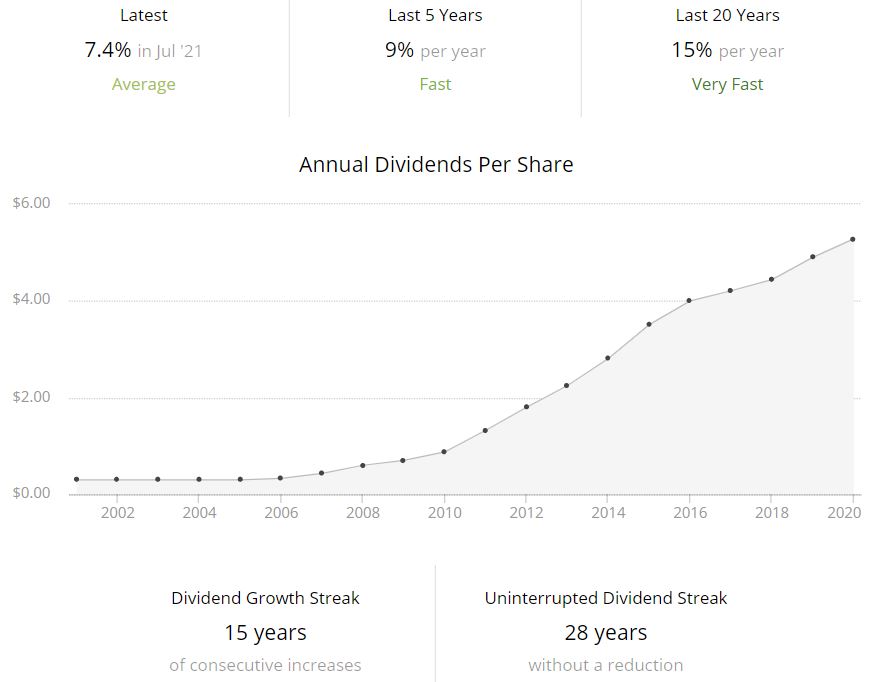

It has grown its dividend for 15 straight years. CMI didn’t reduce its payout during the Great Recession, but its growth has slowed some in recent years after increasing by about 500% from 2010-16.

Owing to the company’s low debt and impressive free cash flow, Simply Safe Dividends gives Cummins a near-perfect “dividend safety” score of 98.

CMI has a yield of just under 2.5% — more than a full percent greater than that of the SPDR S&P 500 Trust ETF (SPY).

Cummins’ goes ex-dividend on Thursday, Aug. 19, so those who want to receive the next quarterly payment need to invest by Aug. 18.

Wrapping Things Up

Generally, politicians love infrastructure policy because it’s relatively easy to sell their constituents on better roads, safer bridges and the jobs such projects create.

Despite that fact — and despite presidents Trump, Obama and their predecessors prioritizing such policies during their terms — it’s been years since a president actually has been able to shepherd an infrastructure initiative through Congress. So if this becomes law, it will be a major victory for Joe Biden.

As an investor, however, I like to focus not on the politics but on how policy can affect my income stream and total return.

Cummins should profit nicely from infrastructure legislation, yes. But it’s also an outstanding business regardless of which way political winds might be blowing from one minute to the next, making CMI a fine long-term addition to the Income Builder Portfolio.

I will discuss Cummins’ valuation thoroughly in my post-buy article, which is scheduled for publication on Tuesday, Aug. 17.

As always, investors are strongly encouraged to conduct their own due diligence before buying any stock.

Note: The July update for my “growth and income” Grand-Twins College Fund was published recently. For a link to that and other GTCF articles, and to see the entire portfolio, check out the GTCF home page HERE.

— Mike Nadel

Motley Fool Stock Advisor's average stock pick is up over 350%*, beating the market by an incredible 4-1 margin. Here’s what you get if you join up with us today: Two new stock recommendations each month. A short list of Best Buys Now. Stocks we feel present the most timely buying opportunity, so you know what to focus on today. There's so much more, including a membership-fee-back guarantee. New members can join today for only $99/year.

Source: Dividends and Income