There are plenty of people who might argue that our headline to this article should have read:

“We just paid too freakin’ much for more shares of Mastercard (MA) and Visa (V).”

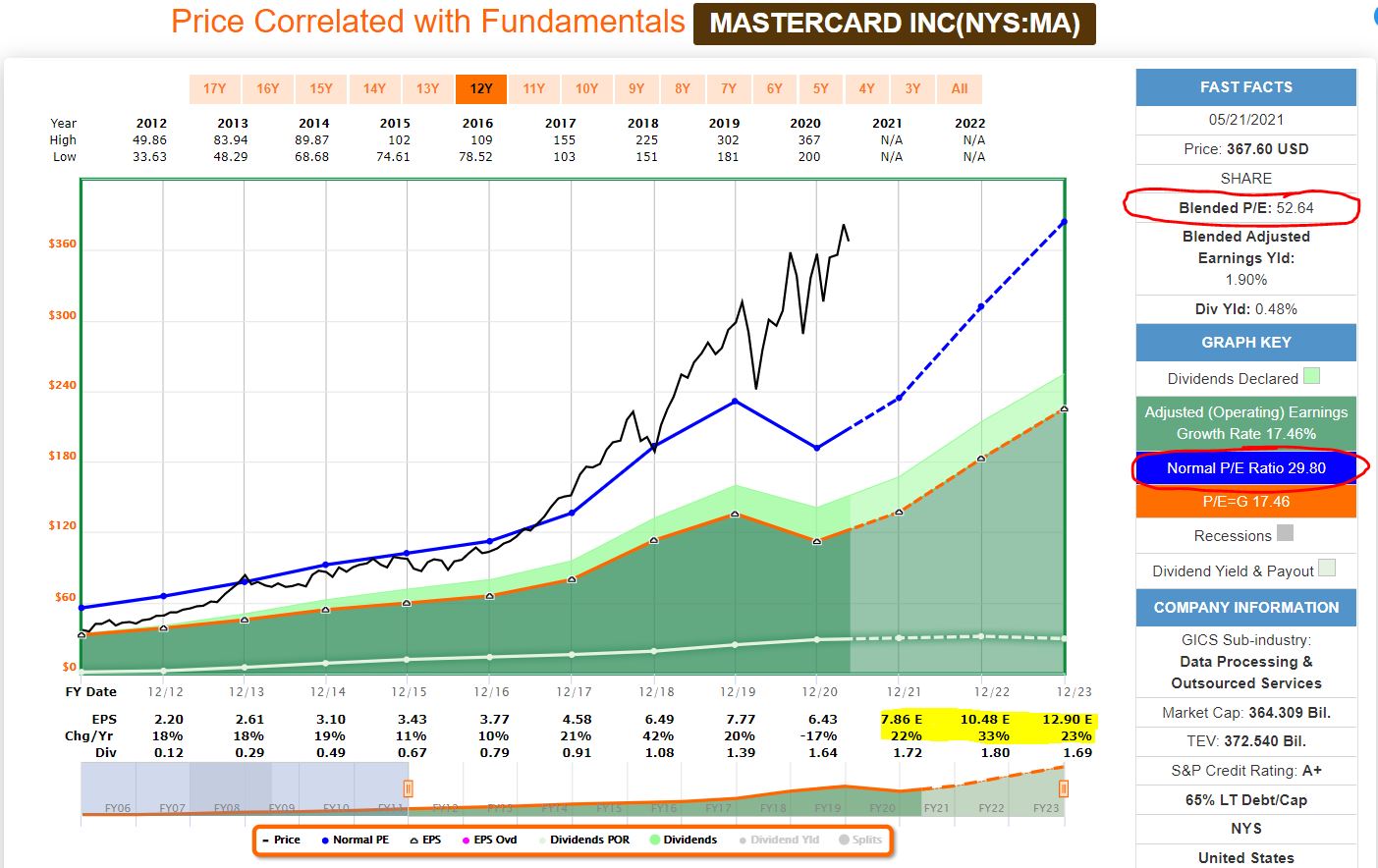

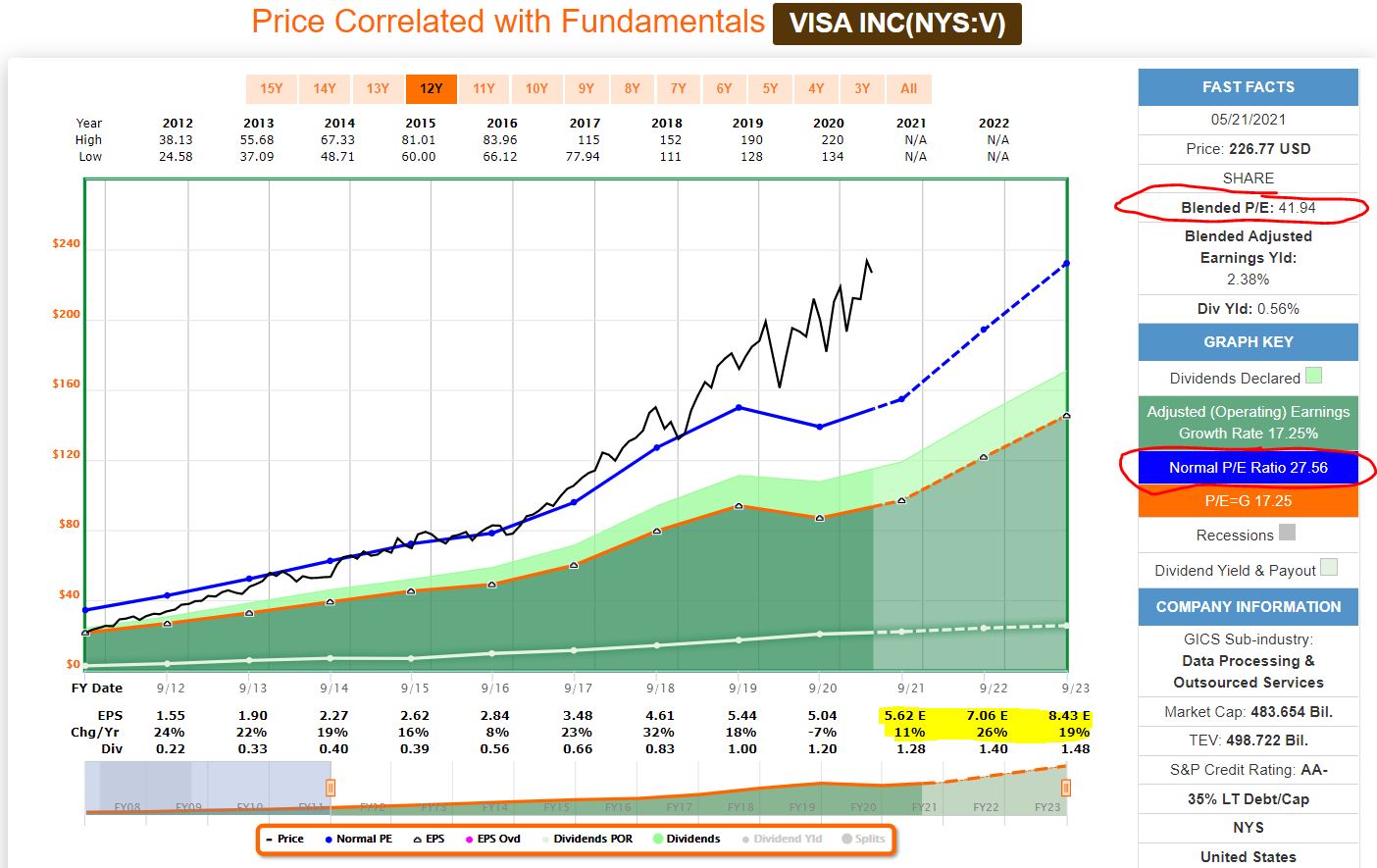

After all, Mastercard is trading at almost 50 times this year’s expected earnings, and Visa’s forward P/E ratio is well over 40. Both are approaching historic highs.

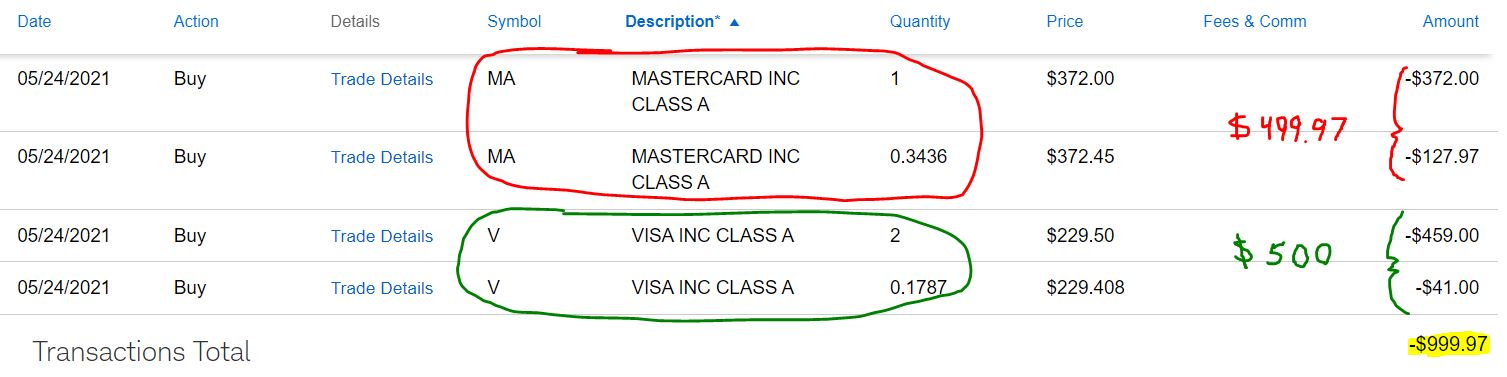

Despite that fact, I executed purchase orders for about $500 worth of each on behalf of Daily Trade Alert for our Income Builder Portfolio.

Purchases of whole shares were done via limit orders. Partial shares were bought using Schwab Stock Slices.

It was the third time the IBP has added shares of the credit-card industry’s two dominant players, with the previous transactions coming on April 21, 2020, and May 21, 2020.

On each of those occasions, Visa and Mastercard were considered extremely overvalued. Indeed, every single time I have clicked on the buy button for V and MA — whether for myself or for one of the real-money, public portfolios I manage such as the IBP or the Dividend Growth 50 — it appeared at the time that the prices were astronomical bordering on insane.

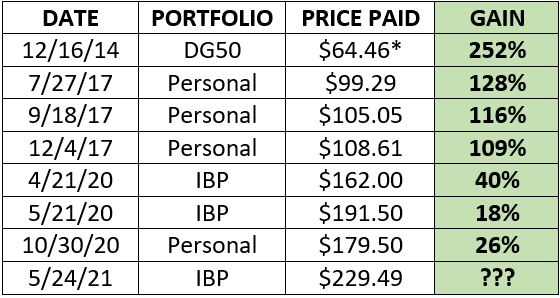

Nevertheless, the following rundown of my history with Visa suggests that the only mistake I made was not buying even more V each time.

*Visa had a 4-for-1 split in March 2015, so this reflects the split-adjusted price.

And, as I showed in my previous article, Mastercard has performed even better than Visa in recent years.

Morningstar Investment Research Center says both are pricey, assigning fair values of $320 to MA and $194 to V.

In addition to putting Mastercard and Visa in its “Hare Portfolio,” however, the analytical service has Visa is its “Tortoise Portfolio” — which, Morningstar says, “seeks long-term capital appreciation by investing in select common stocks of undervalued companies with durable competitive advantages and strong balance sheets.”

So which is it? Undervalued or overvalued?

FAST Graphs certainly places both companies in the overvalued category when comparing current “blended P/E ratios” with their historic norms (red-circled areas), although both also have nice growth projections that some would say helps justify their price premiums (yellow highlights).

Analyze This!

Given all that, it’s notable that the vast majority of analysts are saying: “Full speed ahead!”

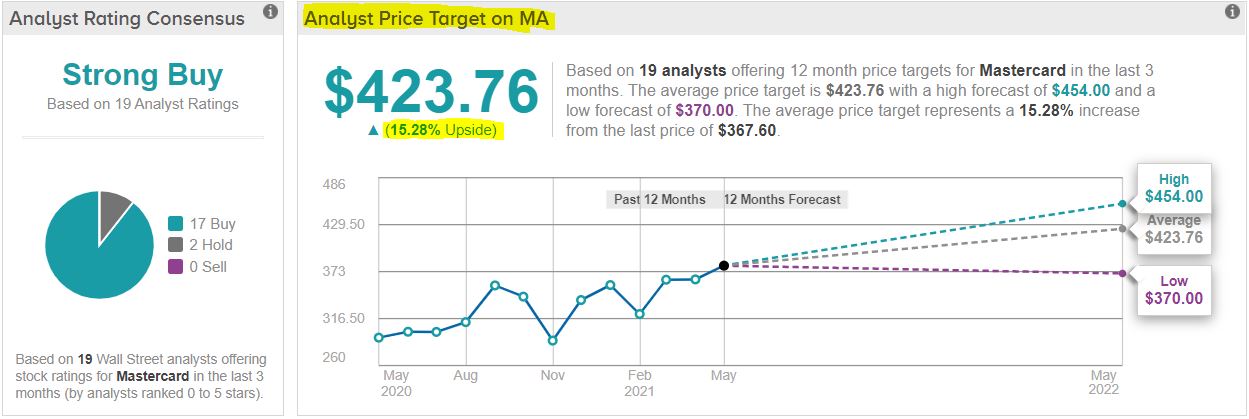

For example, of the 19 Mastercard analysts surveyed by TipRanks, 17 are calling MA a buy — with an average 12-month target price that offers a 15% upside, and the very lowest projection being about what the stock is priced now.

Meanwhile, 19 of 22 analysts in the TipRanks surveys say Visa is a buy — again suggesting that those who invest today will be quite pleased a year from now.

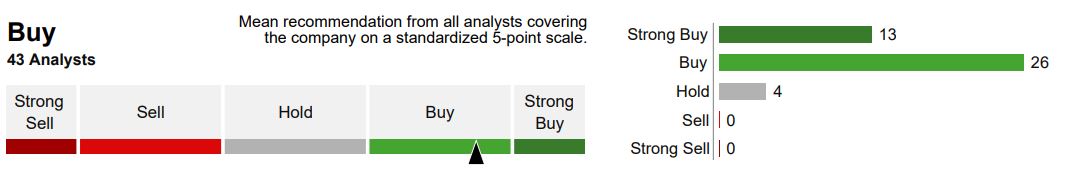

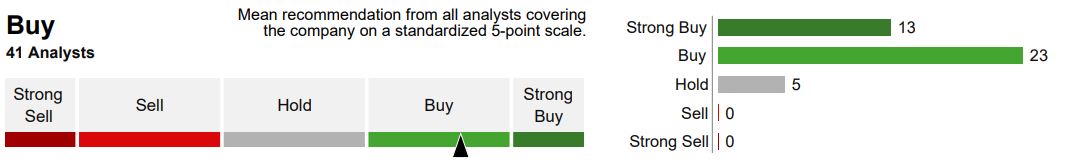

We see the same trend in Thomson Reuters’ polls of analysts.

Mastercard Analyst View by Thomson Reuters (via Fidelity)

Visa Analyst View by Thomson Reuters (via Fidelity)

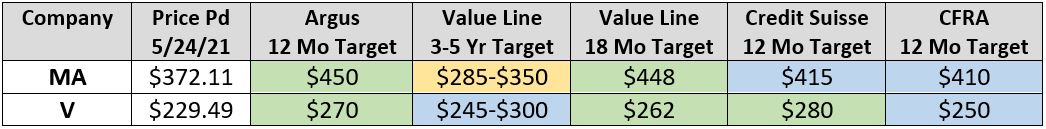

Those are some seriously strong convictions … and here are more, with a look at some price targets by specific analysts:

Both Visa and Mastercard get Value Line’s top score (1) for Timeliness, a “buy” signal that VL describes as its “measure of the expected relative price performance of a stock over the coming 6-to-12 months.”

Value Line goes on to say:

You will often find stocks that seem very promising based on the Timeliness Rank, but show little appreciation 3-to-5 years out. … Timeliness Rank is a forecast for the next 6-to-12 months only, while the 3-to-5 year projected gain is obviously a much longer time period. When there is such a discrepancy, you will have to consider whether a shorter-term or longer-term appreciation fits better with your personal investment strategy and goals.

I consider that to be wise advice … although, so far during their time as publicly traded companies, MA and V have done pretty darn well in just about any time period.

Diminutive Dividends

Those looking to generate significant income from every position in their portfolios will need to look elsewhere.

Although both MA and V have increased their dividends smartly since they began paying them, these have been the IBP’s two lowest-yielding, smallest-income-producing positions … and that won’t change just because we have added to them.

The following dividend snapshot shows the fast growth but low yield, as well as the tiny amount of annual income each position is expected to produce.

Due to the economic effect of the COVID-19 pandemic, dividend growth slowed for these companies. The most recent increases — 10% for MA and 6.7% for V — were well below the 20% (and higher) raises they often had dished out.

This most recent buy added only about $5 to the Income Builder Portfolio’s projected annual income, bringing it to $2,878.

Not surprisingly, I look at the dividends generated by MA and V as a bonus and not the reason to own the stocks. I have selected them for the IBP to improve the portfolio’s quality level and, hopefully, its long-term total return.

While retirees who live on their dividends might disagree — as might Dividend Growth Investing practitioners who have strict yield requirements — I happen to think that even income-centric portfolios have room for these kinds of proven, wide-moat companies. (See all 41 IBP positions HERE.)

Wrapping Things Up

It is up to each investor to decide if Mastercard and Visa are too rich for their blood right now.

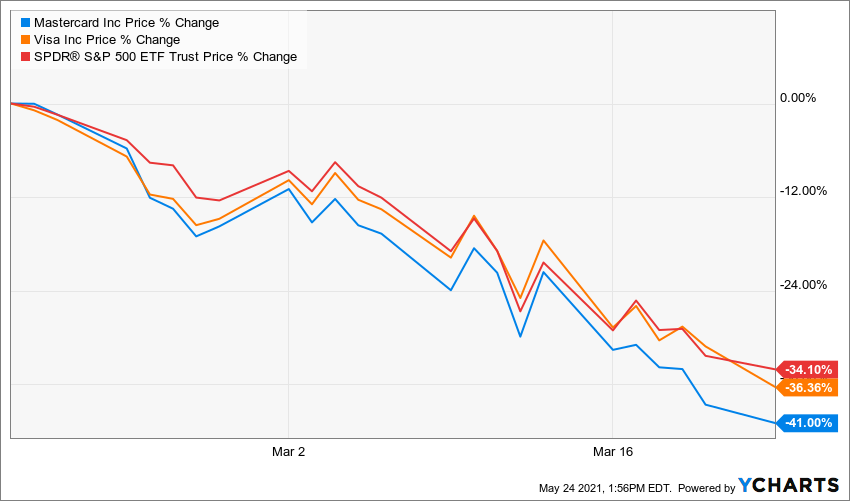

These technology leaders have had stretches with price declines — including pretty severe pullbacks during last year’s “coronavirus crash.”

Although I own both of these companies in my personal portfolio, and I am very comfortable making relatively small purchases of MA and V for the IBP regardless of valuation, I mostly am presenting them as interesting candidates for further research. I am not making specific buy recommendations.

After all, every investor has his or her own ideas about “timeliness” and suitability for a portfolio.

Note: Mastercard also is part of the other public, real-money project I manage for this site, the Grand-Twins College Fund. Check out that entire market-beating, “growth and income” portfolio HERE, and watch my video on YouTube’s Dividends and Income Channel HERE. My next GTCF article is expected to be published on June 2.

— Mike Nadel

Source: DividendsAndIncome.com

The goal? To build a reliable, growing income stream by making regular investments in high-quality dividend-paying companies. Click here to access our Income Builder Portfolio and see what we’re buying this month.