For our next Income Builder Portfolio buy, I thought about selecting a health care stock that we didn’t already own … but then I took a good look at those we do own, and I asked myself, “Why?”

I continued the interrogation: “The IBP components from that sector are extremely high quality and are performing well, so why not just add to those stakes?”

As much as I enjoy arguing with myself, I had to admit I was right.

So after the market opens today, I will execute purchase orders to divide Daily Trade Alert’s $1,000 semimonthly allocation between Johnson & Johnson (JNJ), AbbVie (ABBV) and Medtronic (MDT).

It’s hard to go wrong with these companies, as their “quality metrics” indicate:

AbbVie was spun off from Abbott Labs (ABT) in 2013, so it has some catching up to do. Nevertheless, its fundamentals have improved dramatically over the past few years, and I feel good about its place in the IBP.

Let’s take a look at the recent goings-on with these pharmaceutical and/or medical-device giants …

JNJ Shows The Way

April was a big month for the world’s largest health-care conglomerate.

- During its Q1 2021 earnings call on April 20, Johnson & Johnson announced that earnings per share grew 7% year-over-year and revenue rose 8%. Both easily beat estimates.

- Guidance for the full fiscal year was raised, with diluted adjusted EPS expected to be in the $9.42 to $9.57 range and adjusted operational sales set to grow 9% over 2020.

- The company announced it was raising its dividend 5% — which will make it the 59th consecutive year JNJ has increased its annual payout.

- JNJ has recorded more than $100 million in COVID-19 vaccine sales in the United States. After being paused for a couple of weeks after a tiny percentage of recipients suffered fatal blood clots, the shots are being delivered again.

Reuters photo

As usual, there’s a lot to like and very little to dislike about Johnson & Johnson. We haven’t bought any shares for the IBP since October 2019, so we’re long overdue.

ABBVery Good Results

On April 30, drugmaker AbbVie also had an outstanding Q1 earnings report — with an astounding 51% year-over-year increase in revenue, a solid beat in profits, and a raise in full-year EPS guidance to the $12.37 to $12.57 range.

Leading the way was ABBV’s aesthetics division — which is a fancy name for products that help people feel better about the way they look.

And pacing that department was Botox, which produced global net revenues of $477 million — an increase of 45%.

AP photo

Obviously, AbbVie already is seeing huge benefits from its major acquisition of Botox-maker Allergan, a deal that was finalized almost exactly a year ago.

There has been much handwringing about the imminent patent expiration of Humira.

Indeed, the company said during its earnings presentation that while U.S. revenues from its blockbuster drug increased 7%, international sales fell about 8% “due to biosimilar competition.”

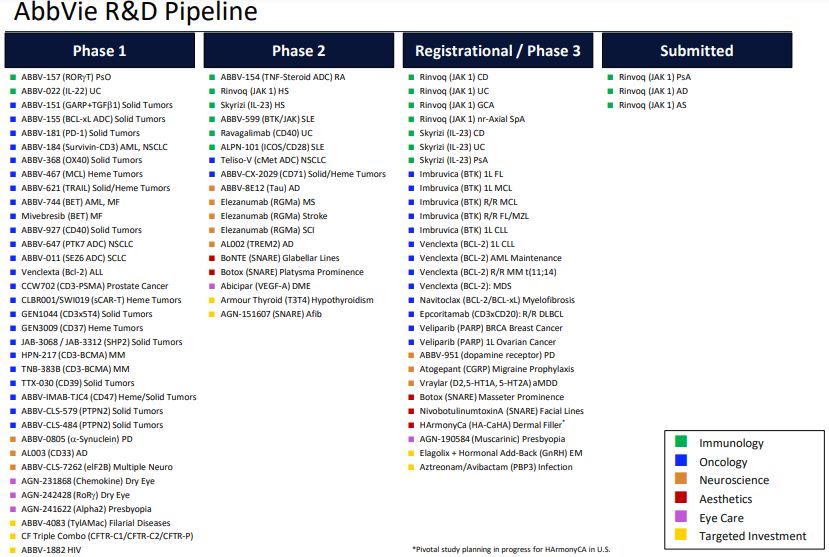

Biosimilars will continue to eat into ABBV’s profits from Humira, but the company has a deep portfolio of effective drugs, and dozens more in the pipeline.

abbvie.com

MDT Could Go On A Spree

Medtronic’s next earnings call is only three weeks away, and I normally like to hold off until after a company reports.

But I feel confident that the world’s largest pure-play medical-device producer will show that it is continuing to recover well from the pandemic-related slowdown.

Despite the fact that delays in non-emergency procedures hurt Medtronic’s bottom line, investors remained bullish.

The two buys we made last year for the IBP — on June 23 and Oct. 6 — have resulted in 33% total return; that beats the 31% return we would have experienced had we bought the S&P 500 Index instead.

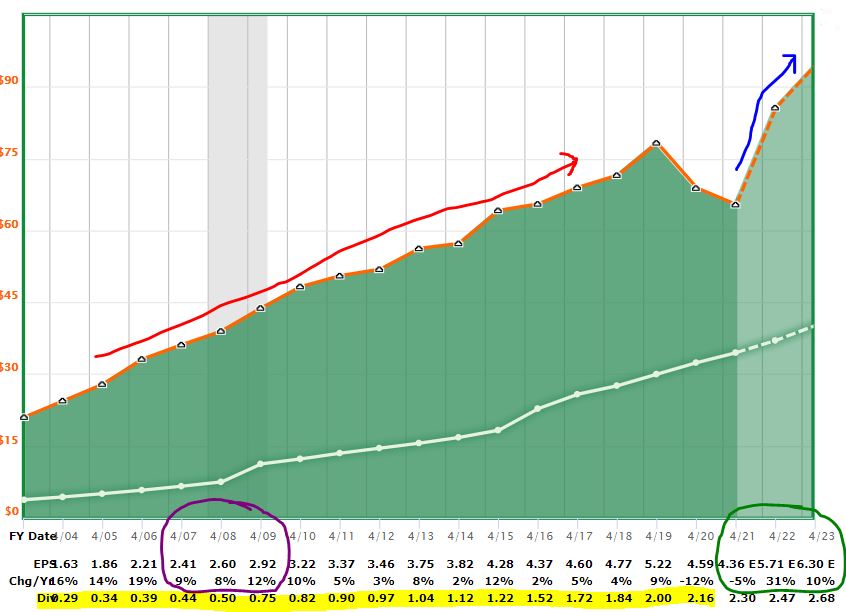

The following FAST Graphs image illustrates how consistently well MDT’s operations have done over the years; it also points toward a bright future:

Earnings ascended year after year (red arrow), and not even the Great Recession could stop them (purple circle). The pandemic has been rough, but earnings are expected to take a dramatic turn for the better the next few years (blue arrow and green circle).

And of course, the dividend has continued to rise (white line in graph and yellow-highlighted numbers beneath it), as MDT is a Dividend Aristocrat, with 42 straight years of increases.

Dividends Aplenty

JNJ, MDT and ABBV are the kinds of companies Dividend Growth Investing proponents know they can count on, as this image from Simply Safe Dividends shows:

AbbVie has by far the shortest record of dividend growth, but that’s misleading due to the recency of its spin-off from Abbott Labs.

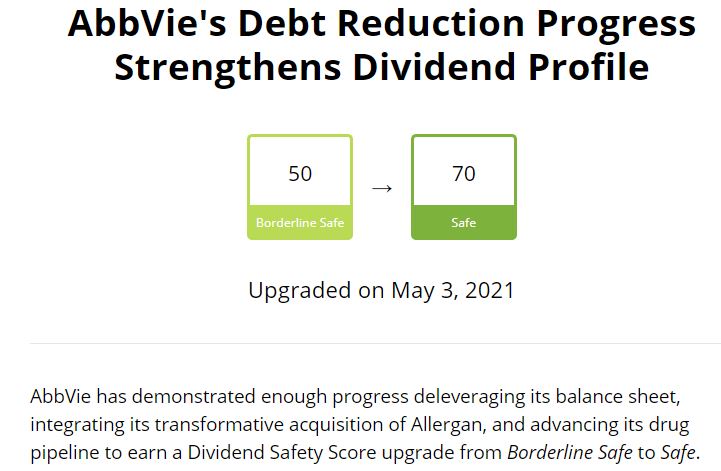

ABBV has been raising its dividend aggressively, and it recently had its safety score upgraded by Simply Safe Dividends:

Wrapping Things Up

I am always open to adding new companies to the Income Builder Portfolio, and we will continue doing just that many, many times over the years to come.

Still, it is comforting to know that those we already own are so fundamentally sound that adding to them is almost always a good idea. (See the entire 41-stock portfolio on the IBP Home Page — HERE.)

In my next article, to be published Monday, May 10, I will provide details of the buys, and I also will examine each company’s valuation.

As always, investors are strongly urged to conduct their own thorough due diligence before buying any stocks.

— Mike Nadel

This article first appeared on Dividends & Income

The goal? To build a reliable, growing income stream by making regular investments in high-quality dividend-paying companies. Click here to access our Income Builder Portfolio and see what we’re buying this month.