This “stocks-up, yields-down” market is clobbering income investors. With stock prices floating higher, yields are crumbling to dust: with the 1.3% payout on the typical S&P 500 stock—a 20-year low—you’d need to invest $2.2 million to get just $2,500 a month in dividends!

(And let’s not forget that the typical S&P 500 stock pays dividends quarterly, not monthly, so your lame income stream would also be pretty lumpy!)

The 10-year Treasury note—long an income go-to—isn’t much better. With a 1.6% yield, you’d still need $1.8 mil to get that same $2,500 a month.

An Oasis in the (Dividend) Desert

Of course, none of this is a surprise to anyone who’s been investing for income over the last decade or so—it’s a slightly worse version of the same old story. But salvation is available if you go just one step beyond the mainstream stocks and funds everyone invests in.

One corner of the market where high yields run like water is closed-end funds (CEFs). They’re a unique type of fund most folks (wrongly) think are too complicated. But nothing could be further from the truth. Fact is, CEFs hold many of the same stocks you probably own now. The twist is that, instead of 1.3% yields, CEFs pay a hefty 7%, on average.

And you can find many CEFs that pay a lot more, like the three we’ll look at now.

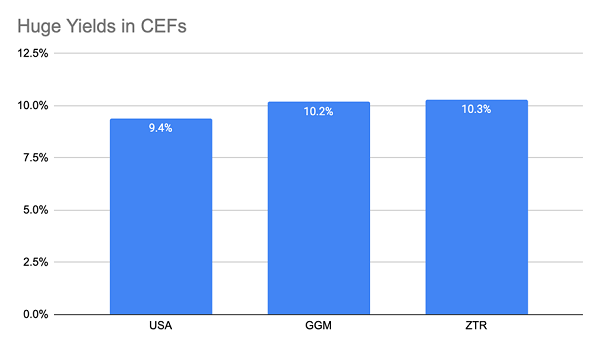

A 3-CEF “Mini-Portfolio” Yielding 10% Today

The three funds we’ll examine below—the Liberty All-Star Equity Fund (USA), Guggenheim Credit Allocation Fund (GGM) and the Virtus Total Return Fund (ZTR)—yield an incredible 10%, on average, between them—enough to give you that $2,500 monthly payout with just $300,000 saved.

That’s a mere 13% of what you’d need to retire with a portfolio of S&P 500 names! These funds also boast good track records and diversification for additional safety.

High-Yield CEF No. 1: Liberty All-Star Equity Fund (USA)

Let’s start with USA, a 9.3%-yielding CEF that invests in growth and value stocks with reliable cash flow from a variety of sectors. Its portfolio includes some of the strongest companies in America, including top performers during the pandemic, like Amazon.com (AMZN), Visa (V) and Microsoft (MSFT).

It’s also got some nice representation in the financial space, its second-biggest sector, including top-10 holding JPMorgan Chase & Co. (JPM). Finance stocks are well positioned for gains as the yield on the 10-year Treasury gains, pushing up loan income.

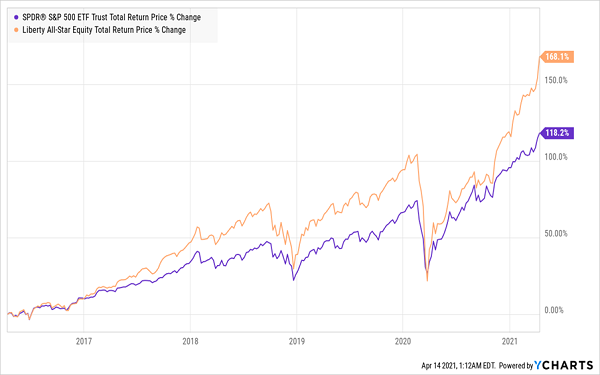

USA’s well-crafted portfolio of growth and value companies has delivered a market-beating performance:

USA Soars Past SPY

Now let’s move on to …

Now let’s move on to …

High-Yield CEF No. 2: Guggenheim Credit Allocation Fund (GGM)

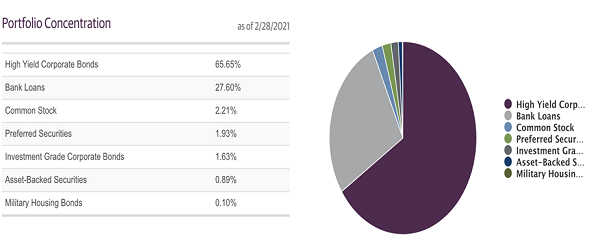

With GGM, we get a dividend that yields 10.2%, in addition to broad diversification, thanks to its portfolio of corporate bonds, bank loans, and stocks.

Source: Guggenheim

Source: Guggenheim

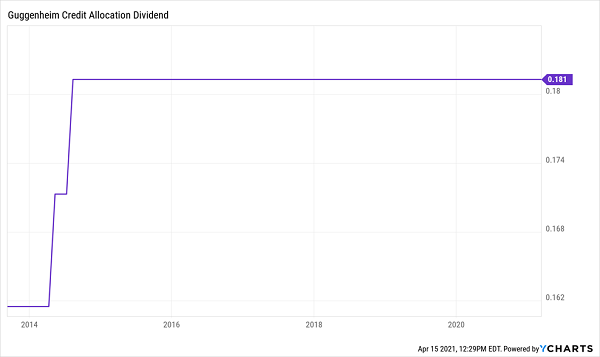

By adding this fund to our 3-CEF “mini-portfolio,” we are protecting ourselves from being too concentrated in one asset class. We’re also getting a dividend that comes your way monthly, and has held steady (and even grown) since the fund’s inception less than a decade ago:

GGM’s Dividend Is the Picture of Stability

High-Yield CEF No. 3: Virtus Total Return Fund (ZTR)

High-Yield CEF No. 3: Virtus Total Return Fund (ZTR)

Finally, with ZTR, payer of a 10.3% dividend that also comes your way monthly, we’re getting a mix of stocks and corporate bonds from infrastructure and energy companies at a time when these sectors are seeing the strongest cash flow in the last five years.

Its top holdings include top renewable-energy producer NextEra Energy (NEE), as well as railroad operator Union Pacific (UNP)—another clear beneficiary of the economic reopening—and pipeline operator Enbridge (ENB), which will also benefit from rising oil and gas demand.

The Final Word: It’s Easy to Pull in Big, Safe Dividends in CEFs

Put together, these funds are getting you an incredibly diversified portfolio to help protect you from a decline in one sector, since you’re holding many different sectors (and asset classes).

Source: CEF Insider

Source: CEF Insider

These three CEFs get you the 10% dividend yield you need to get $2,500 per month with just $300,000 invested.

— Michael Foster

4 MORE CEFs to Buy for Fast 27%+ Gains [sponsor]

The only snag with these funds is that they’re not trading at discounts to NAV (net asset value, or what they’re portfolios are worth). That doesn’t mean they’re not worthy of your attention; you just might want to put them on your watch list to pick up on the next dip, especially if you’re not leaning on your portfolio for income now.

But don’t worry! I’m not going to leave you hanging here, because I’ve got 4 other CEFs that are terrific buys today. They yield a rock-steady 7.4%, on average, and they’re incredible bargains —so much so that I’m calling for 20%+ price gains in the next 12 months.

Your forecast total return: 27% by this time next year!

All the details on these 4 bargain-priced 7.4%-payers is waiting for you now. Every detail you need—from names and tickers to dividend histories and best-buy prices—is waiting for you right here.

Source: Contrarian Outlook