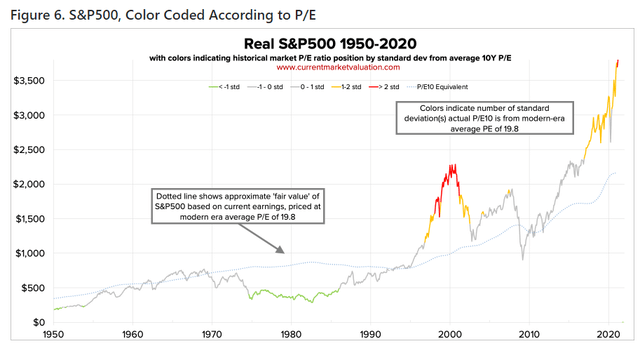

The stock market as measured by the S&P 500 is at an all-time high. However, that is not what concerns me. What I am worried about is the extremely high relative valuation of the market. To be clear, the market can be trading at an all-time high and still be attractively valued. Moreover, the long-term direction of the stock market has been up. On the other hand, that ascension is interrupted from time to time due to overvaluation eventually instigating the inevitable reversion to the mean valuation.

The following graphic courtesy of Current Market Valuation is an awesome job of illustrating and validating the above paragraph. On the graph you can see the long-term steady increase in the market as described. However, what I really like about the following graph is how they color-coded valuation. When the price line is gray valuation is reasonable, when the price line is green it connotes periods of undervaluation, yellow denotes overvaluation and red reveals extreme or what I call dangerous overvaluation. The reader should note that the S&P 500 has currently entered that dangerous territory.

(Graph courtesy of Current Market Valuation)

(Graph courtesy of Current Market Valuation)

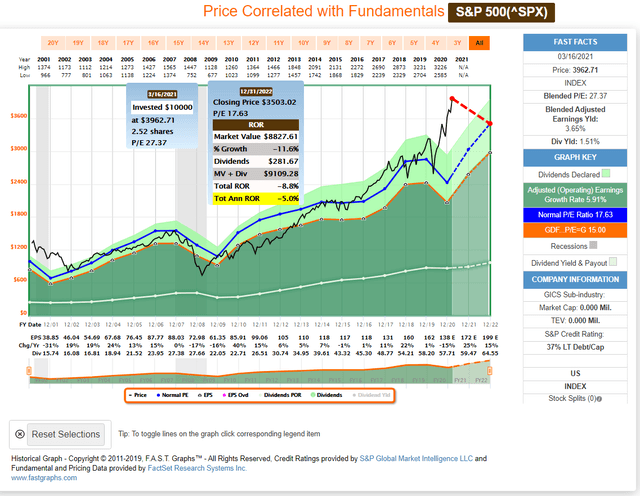

S&P 500 Price Correlated With Fundamentals Since 2001

With the following graphic I will utilize the calculator functionality of FAST Graphs to provide a perspective of the S&P 500’s overvaluation based on a conservative calculation of the index reverting to the normal (mean) valuation since calendar year 2001. The moral of this story is that current valuation would suggest that this would be a very poor time to be investing in a S&P 500 index fund. The major issue here is not necessarily the potential loss of capital. Rather, the real issue is the loss of time.

Today’s current valuation suggests that investors purchasing the index today could suffer through negative returns for the next 2 to 3 years or longer. In the long run, which I am suggesting would be a decade or more, they might do okay based on the market’s historical ascension. However, I have found few investors willing to wait patiently for 2 years or more before they start seeing positive momentum.

(Source: FAST Graphs)

(Source: FAST Graphs)

It is a Market of Stocks

With the above said I am on record many times of pointing out that it is a market of stocks not a stock market. In summary, this simply means that in every market – whether it be a bull market or a bear market – there will always be value to be found. Obviously, you can find more value in a bear market than you can in a bull market. Nevertheless, there are a lot of individual stocks that can be found at attractive valuations even in today’s expensive stock market.

Low Interest Rates Have Generated Strong Demand For Dividend Growth Stocks

Today’s low interest rates have stimulated demand for high quality dividend growth stocks. Investors seeking income have turned to dividend paying stocks offering more yield than they can get on fixed income today. However, the downside to that – in addition to more risk – is that this abnormal demand is driving the yields down on the best-of-breed dividend growth stocks.

For example, as Mr. Valuation I have only found a dozen out of more than 60 S&P Dividend Aristocrats that I consider attractively valued. In the much larger Dividend Champions list curated by Justin Law, I only found 28 dividend growth stocks out of more than 140 that I consider at or below fair value. And even if I’m willing to move further down the quality food chain into the Dividend Contenders list of more than 300 dividend growth stocks that have increased their dividends from 10 to 25 years, I only found 80 with earnings yields high enough to be considered at value.

The result is that even though the “pickens” are currently slim, there are enough attractively valued dividend growth stocks available to build a dividend growth stock portfolio today. Therefore, I created an attractively valued dividend growth stock buy list that I can use to build a portfolio according to my needs. For me personally, I prefer a more concentrated portfolio over one that is more diversified. The idea is straightforward. I want enough stocks in the portfolio to protect me from the catastrophic loss. Recent studies have suggested that once you get past 16 stocks you have utilized most if not all the benefit that diversification provides. Consequently, I like portfolios comprised of 15 to 20 stocks.

On the other hand, I have served clients that prefer 30 or more. They just feel more comfortable spreading their eggs over more baskets. Nevertheless, another reason I prefer concentration is because it simplifies my research and due diligence process. The more stocks I am required to monitor, the more difficult it is and the more time it takes to do the job correctly. So my personal preference is concentrate your eggs into only a few baskets (15 to 20) and then watch those baskets very carefully. I do not think there is a right or wrong answer. I believe the right answer is the one that suits you best.

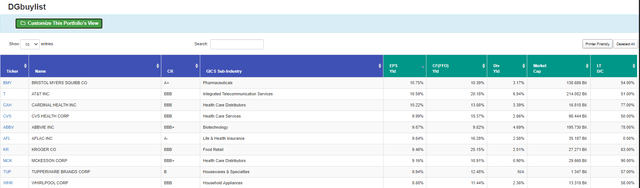

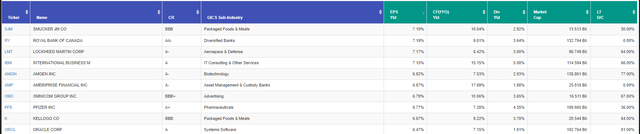

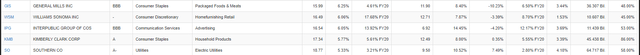

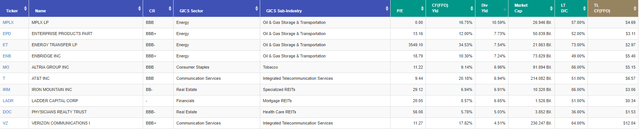

Dividend Growth Stock Attractively Valued Buy List

My current dividend growth stock buy list is comprised of 55 stocks in total. However, there are only 40 that I believe are currently truly at value. The remainder are close; therefore, I include them on the list so that I can monitor more closely. Most importantly, these lists comprise my options, not my actual decisions. In other words, I will pick and choose among this list to narrow it down to the 15 or 20 that meet my specific yield objective.

The dividend yields on this list range from around 1% current yield to as high as 7%. However, it is not my only consideration. I am also concerned about things such as quality, growth, and potential dividend growth. In other words, I am trying to build a portfolio that meets a specific yield requirement for example 3% current yield, but also has the option to increase the dividend each year as well as provide some capital appreciation.

The point I am trying to convey is that I can utilize the large list to configure different dividend growth portfolios that provide different objectives and potential. In one case it might be more yield, and another might require a lower yield but more growth – and just about everything in between. The key is that I make my decisions to design a portfolio that can perform in a precise and specific way. I am not always trying to make as much money as I can. Sometimes, I might be looking for safety over growth, vice versa, and once again -everything in between.

Click each image to open in a larger window. (Source: FAST Graphs)

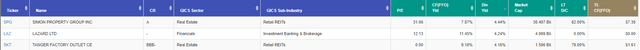

Dividend Growth Stocks Honorable Mentions

This following list of 5 stocks represent examples of companies that I believe are very close to my strict valuation criteria but not quite there yet. Therefore, these are stocks I call honorable mentions that I would be motivated to utilize if I could get slightly better valuations.

Click the image to open in a larger window. (Source: FAST Graphs)

Dividend Growth Stock Yield Accelerators

Additionally, I also keep a list of dividend paying stocks that I call yield accelerators. These are simply alternative choices that provide high yields but may not provide the safety or growth I would prefer. Nevertheless, these are also candidates I can utilize to increase the overall yield of the portfolio if it was necessary. In other words, I would average these names in with others so that I could tweak more income out of the portfolio if needed.

Click each image to open in a larger window. (Source: FAST Graphs)

Click each image to open in a larger window. (Source: FAST Graphs)

Specific Examples Based On Characteristics

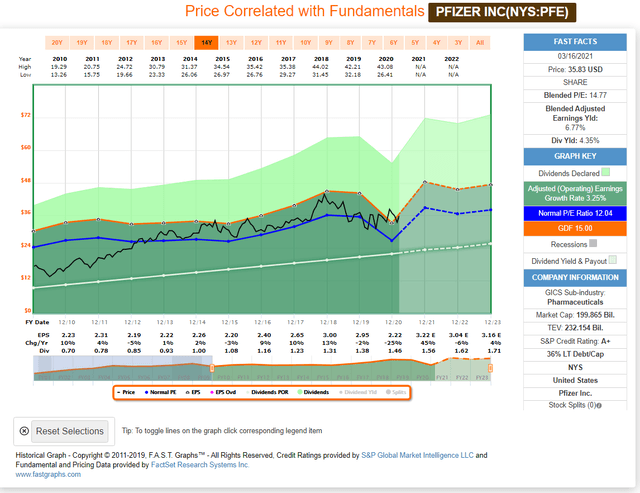

Pfizer Inc.: High Quality, Above Average Yield, Sound Valuation

Pfizer (PFE) would be an excellent choice for quality, yield, and attractive valuation with short to intermediate term above-average capital appreciation. However, other choices in the same category could include AbbVie, Bristol-Myers Squibb and/or Sanofi. Rather than provide specific recommendations, my objective is to share my thought process and point out that there are choices and options.

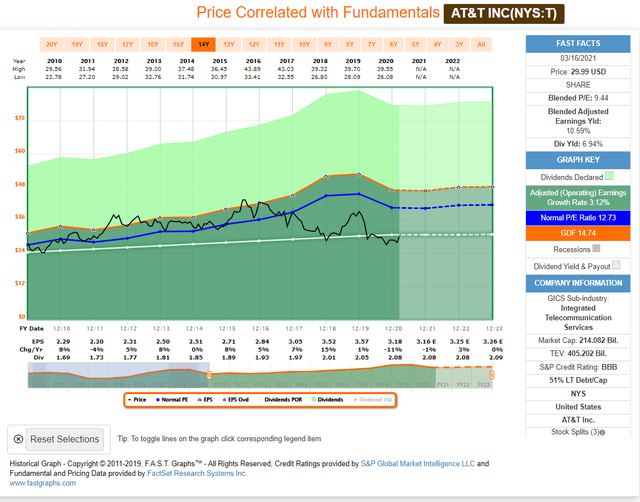

AT&T: High Yield, Extremely Low Valuation, Growth Through P/E Ratio Expansion

For a dividend growth portfolio, my attraction to AT&T (T) is its very low valuation and high yield. In this case, I would be willing to forgo dividend growth for high current yield. However, I do believe this company is in transition and could provide significant short to intermediate term capital appreciation via P/E ratio expansion. The point is that I would be choosing the stock with my eyes wide open and for its specific ability to meet a yield requirement.

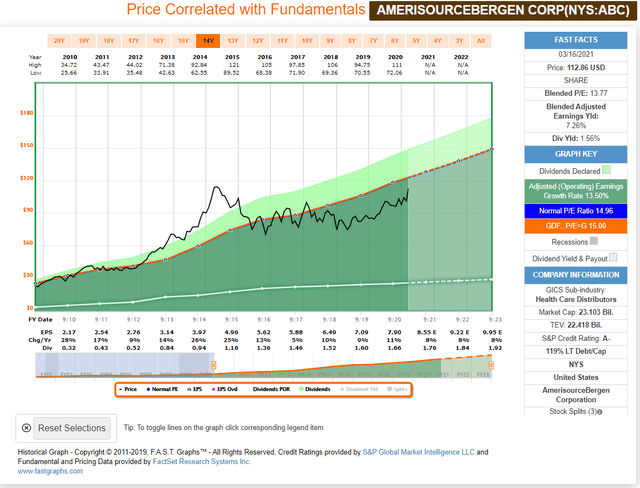

AmerisourceBergen Corp.: Above Average Growth, Attractive Valuation, High Dividend Growth

AmerisourceBergen (ABC) would represent an option where capital appreciation and above-average dividend growth potential was more important than current yield. With this specific selection I put a premium on its consistent historical growth record of both earnings and dividends.

FAST Graphs Analyze Out Loud Utilizing AmerisourceBergen (ABC), Omega Healthcare (OHI), Enterprise Products (EPD), CVS Health (CVS), Oracle (ORCL), McKesson (MCK), Abbvie (ABBV), Kimberly Clark (KMB), Bristol Myers Squibb (BMY), Omnicom Group (OMC):

Summary and Conclusions

With this article I am simply introducing the process that I personally go through to construct a dividend growth stock portfolio in today’s overheated market. My main message is that as investors – regardless of general market conditions – we have numerous and various options that can be implemented and chosen. The key is to make those choices based on specific goals, objectives, and risk tolerances with a focus on including stocks that can meet those goals.

Although a well-designed portfolio is the sum of its parts, every part does not need to be the same. Savvy investors can mix-and-match stocks with different characteristics that position their portfolio to meet their specific goals and objectives. In short, have a plan and then follow that plan religiously.

— Chuck Carnevale

Experts are predicting that in as little as three months, AI as we know it could be totally blown away. And that means as early as October 8, ChatGPT could be replaced by a new AI that's thousands of times more powerful... something that could cause expensive tech stocks like Microsoft, Google, and NVIDIA to double - maybe even triple - in price in the months ahead. Click here for all the details.

Source: FAST Graphs