With stocks crowding all-time highs, we need to follow our contrarian instincts now more than ever.

That, of course, means going where everyone else isn’t.

And the best contrarian investment I can think of right now is municipal bonds, or bonds issued by state and local governments to pay for vital infrastructure.

Better still, “munis” boast the highest stability on the market, so we’ll be “backstopped” by rock-steady prices while we collect our outsized dividends.

Let’s be honest, that kind of outperformance-with-stability is what we all want. And if we can get the bulk of our returns in safe-and-sound dividend cash, instead of relying solely on volatile stock prices, why wouldn’t we take that deal?

How We’ll Coax an 8.3% Payout From a 2% “Headline” Yield

First up, you might be wondering how we’ll get that 8.3% yield when the benchmark municipal bond ETF, the iShares National Muni Bond ETF (MUB), yields just 2% today.

Here’s how we’ll do it, in two simple steps:

- Skip the ETF option: When it comes to municipal bonds, you can more than double the ETF’s yield by going with a closed-end fund (CEF). As we’ll see in a minute, you can get more upside, too, as most CEFs outperform MUB. Best of all, many muni-bond CEFs are trading for less than they’re actually worth.

- Take advantage of muni-bonds’ “stealth” yields: Whether you buy your munis direct or through an ETF or CEF, the dividends aren’t taxed by the federal government or most states for most US taxpayers. This means if you’re in the top tax bracket, a 5% muni-bond yield equals 8.3% from stocks or corporate bonds.

How Muni-Bond CEFs Pay Us Big, Tax-Free Dividends (With Price Upside)

CEFs are similar to ETFs in that they pool together investments. CEFs, however, limit the number of shares of the fund that they issue (hence they’re “closed” rather than “open,” as ETFs and mutual funds are). This sometimes means the CEF trades for less than the value of its holdings, which is called a discount to net asset value, or NAV. There are many muni-bond CEFs with big discounts now.

Before we get into exact tickers, let’s take a quick look at why it makes even more sense to buy muni-bond CEFs today.

As Michael Cohick, product manager at fund-management firm VanEck recently described it, there’s a low supply of municipal bonds; more confidence that munis are in a better financial position than expected (as the Federal Reserve has said it will support the muni-bond market through the current crisis); and munis’ yields are very attractive in light of roughly 1% yields on 10-year Treasuries.

There’s also the issue of President Biden’s tax plan, which, as I discussed a couple weeks ago, will raise taxes on higher earners. The changes are modest, but they’ll likely be enough to encourage some investors to buy munis to shield at least some of their income.

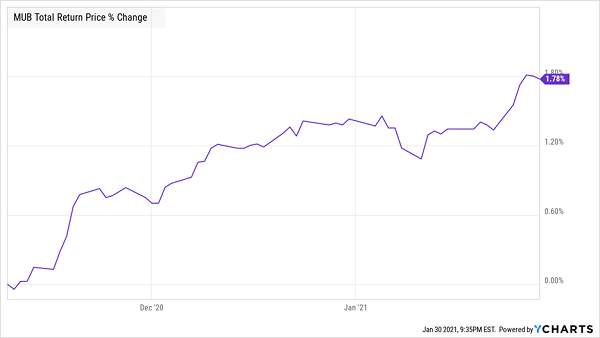

The result of all these factors has been a significant rise in the benchmark muni-bond ETF since the election, as you can see below. (I know a 1.8% gain doesn’t seem like much in three months, but it is for a low-volatility asset class like this.)

A Big (for Munis) Jump

2 “Stealth” High-Yield Muni CEFs to Target

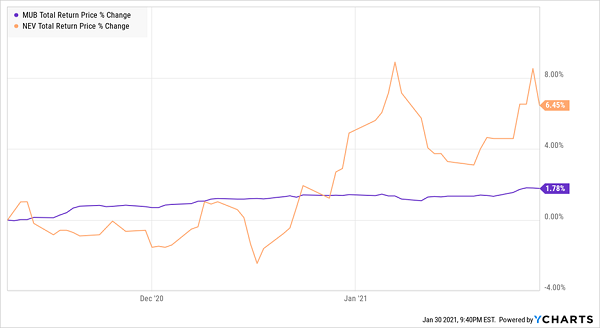

The muni-bond CEFs we’re going to talk about now have outrun MUB in the short and long run. The 4.5%-yielding Nuveen Enhanced Municipal Value Fund (NEV) is up a nice 6.5% since Biden’s win, and it still trades at a 3% discount to NAV, indicating more upside ahead. (And remember that its 4.5% yield will be worth more to you, depending on your tax bracket.)

NEV Takes Off Post-Election …

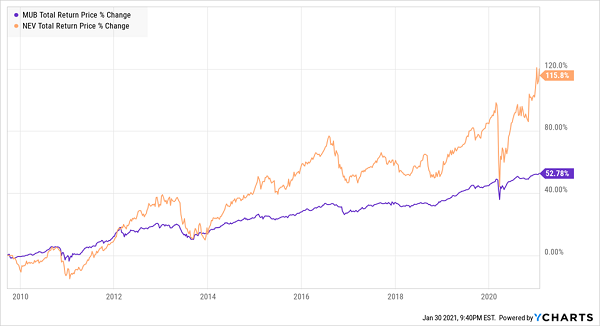

This is par for the course; NEV has beaten MUB by a big margin since its inception.

… and Outruns the Benchmark Over Its Lifetime, Too

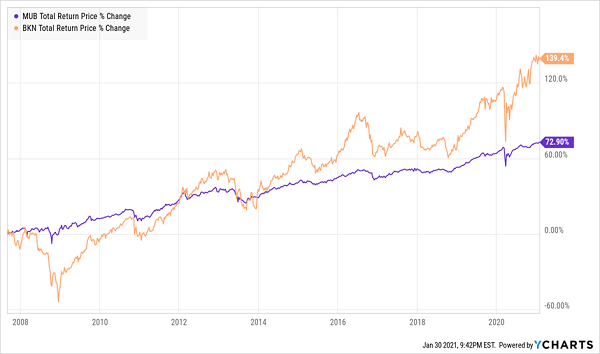

Then there’s the BlackRock Investment Quality Municipal Trust Fund (BKN), which sports a headline yield of 4.8% and has a 2.7% discount to NAV. BKN has also been beating MUB by a big margin since its inception, and it’s up nearly 10% since Biden’s win.

BKN Beats the Index, Too

These funds get top-bracket taxpayers an 8% taxable-equivalent yield and low volatility while beating the muni-bond index. And they’re just two of dozens of such high-quality funds in the CEF universe.

— Michael Foster

My 5 Best Picks for 2021 Yield 8% (and They’re Primed to Soar) [sponsor]

We’re not stopping here, because we can add some very nice price upside (I’m talking 20%+ price gains in the next 12 months) when we add the 5 other CEFs I want to show you now.

These 5 funds go beautifully with the 2 muni-bond CEFs I just showed you because they trade at even more unusual discounts, which is where that 20%+ price upside comes from. AND while these 5 funds’ dividends are taxable, you’re still getting an 8% average yield here, so you’re not missing out on anything!

I’m recommending that paying members of my CEF Insider service buy all 5 of these funds with both hands now that 2021 has kicked off. And I strongly urge you to move into them, too.

I’ve named all 5 in an exclusive Special Report I’m making available to the public, and I want to make sure you get your hands on it. Go right here and I’ll give you a copy, which will reveal all the critical data on these 5 income plays: names, tickers, best-buy prices, complete dividend histories—the works.

Source: Contrarian Outlook