This is the fourth article in my new series, High Quality Dividend Growth Stock of the Month. Stocks are selected based on their quality.

It also means that some stocks presented will be overvalued. That is often the case with high-quality companies. It can be hard to get them on sale.

That said, some investors, especially younger ones, may not care much about current valuations, because in 10-15 years, they won’t care what they paid for the best companies; they will just be glad that they own them.

If you want to go back and catch up with earlier articles in this series, click this page to access all of the articles. The stocks covered so far have been Apple (AAPL), Amgen (AMGN), and Bristol-Myers Squibb (BMY).

January 2021’s HQ Stock: Procter & Gamble (PG)

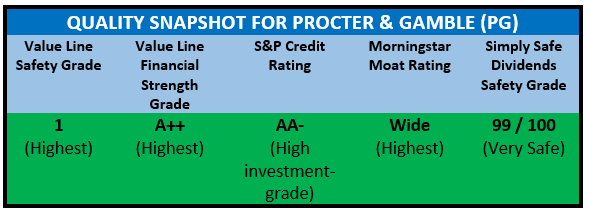

Procter & Gamble (PG) is one of the few companies that scores a perfect 25 out of 25 points on my Quality Snapshot.

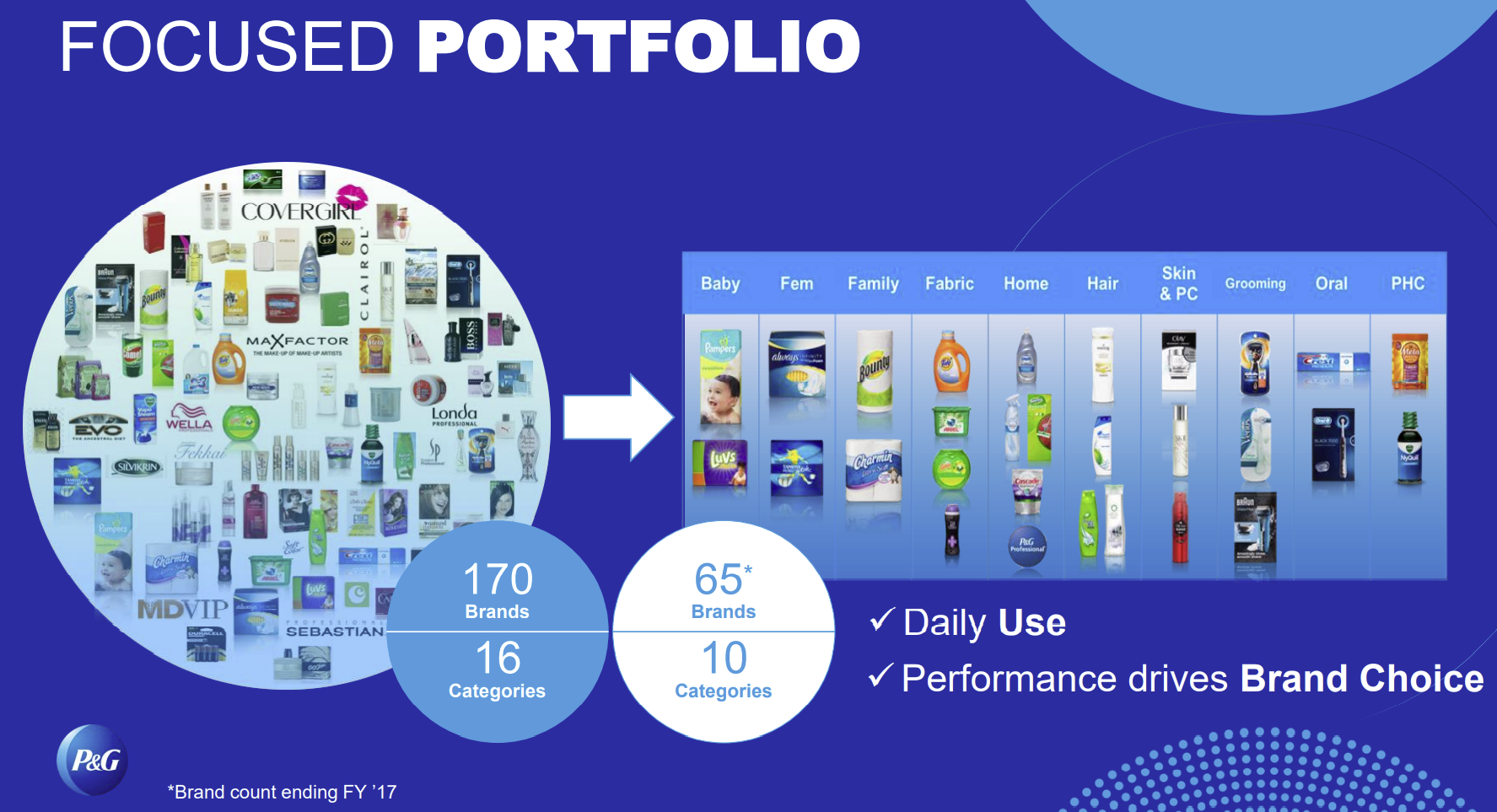

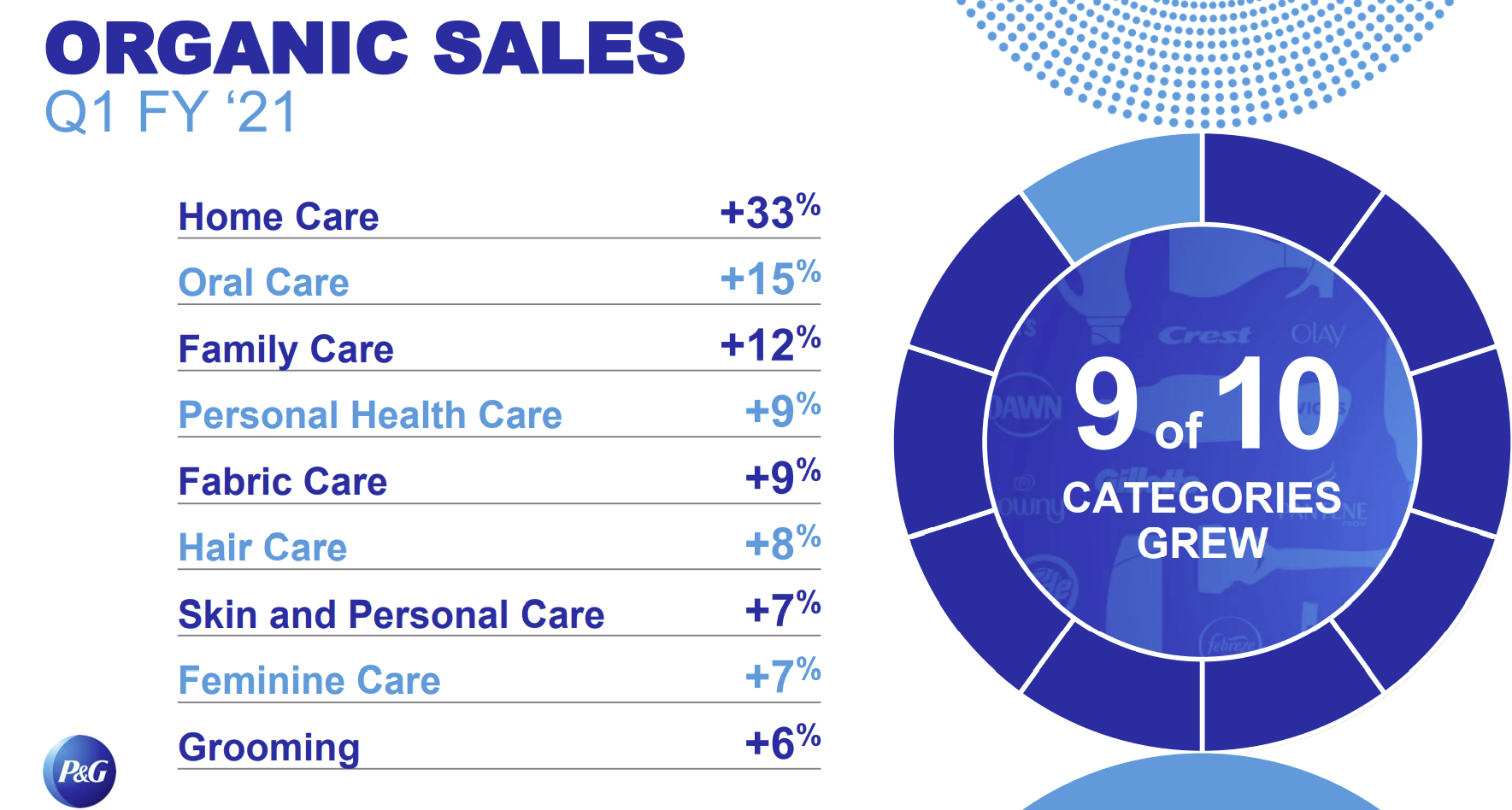

Your home is probably loaded with PG products. PG operates in 10 home and personal product areas, nine of which have been growing even during the pandemic:

(Source: Company presentation. PG’s fiscal 2021 started in July, 2020.)

(Source: Company presentation. PG’s fiscal 2021 started in July, 2020.)

PG is much more focused and “right sized” than it was a few years ago. From 2014 to 2017, PG devised and implemented a strategic reorganization that ended up removing over 100 brands from its portfolio of products.

The new, smaller PG has become a stock-market darling. During the downsizing, it was plagued by negative market sentiment, as investors had difficulty seeing PG’s shrinking revenue in a positive light.

Once the market figured out that PG’s downsizing was actually indicative of a stronger company, its price took off in mid-2018, and it hasn’t stopped except for a temporary speed-bump due to Covid-19 in early 2020.

In addition to its broad product scope, PG is geographically diverse. North America accounted for 45% of sales in fiscal 2019, followed by Europe (23%), and Asia Pacific (10%), with other regions accounting for the rest.

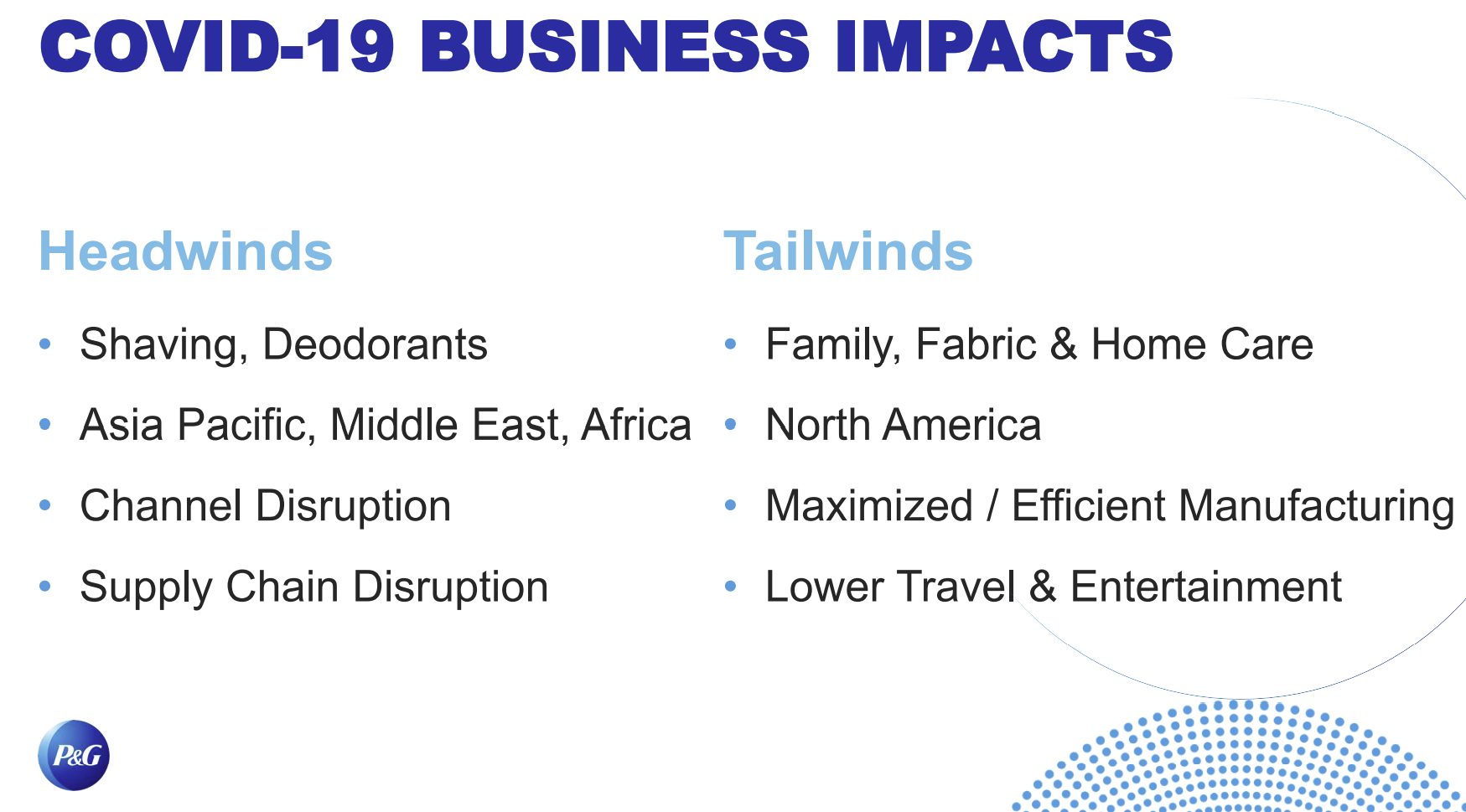

The pandemic has impacted PG’s product areas, geographic areas, and operations in different ways – helping some while weakening others.

Most analysts expect PG’s businesses to thrive as we emerge from the pandemic.

High Quality

As explained in Dividend Growth Investing Lesson 20: Quality Snapshots, I derive an overview of a company’s quality from the following sources, which I have come to trust and respect over the years:

- Safety and Financial Strength grades from Value Line

- S&P’s Credit rating

- Morningstar’s Moat rating

- Simply Safe Dividends’ Safety grade.

I grade these snapshots by awarding up to five points in each category. PG scores five points in every category for a total of 25, giving it the highest grade possible.

Morningstar awards PG a wide moat, meaning that it has durable competitive advantages. Their moat assessment is based on several factors, including PG’s brands, dominant market shares, ability to spend large on R&D and marketing, and cost advantages rooted in its huge scale.

Simply Safe Dividends reaffirmed PG’s “Very Safe” dividend safety score (99) in December, 2020, stating that –

This blue-chip dividend king should continue delivering safe income and steady payout growth in the years ahead, and in all economic environments.

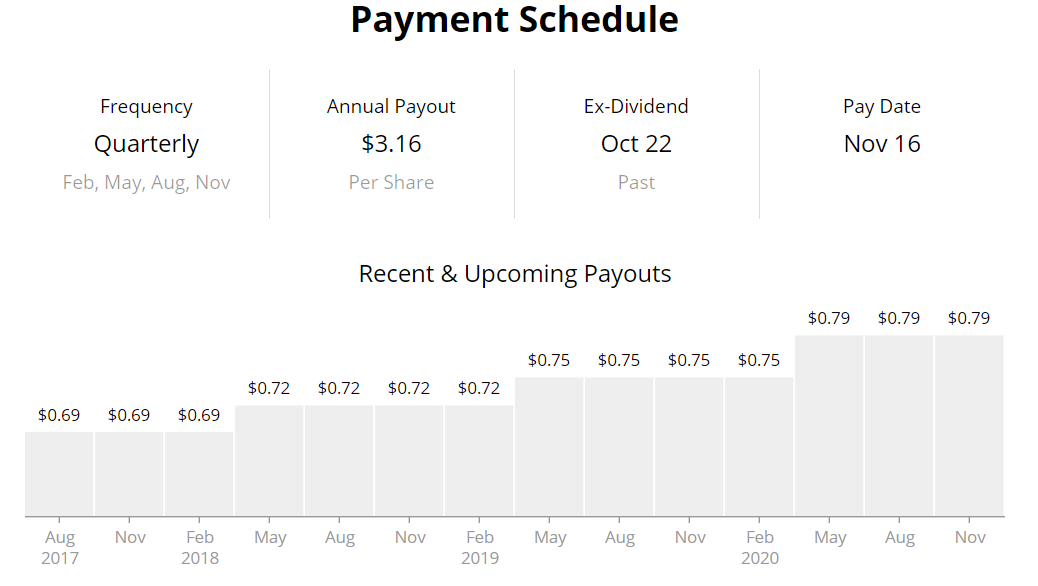

Dividend Record

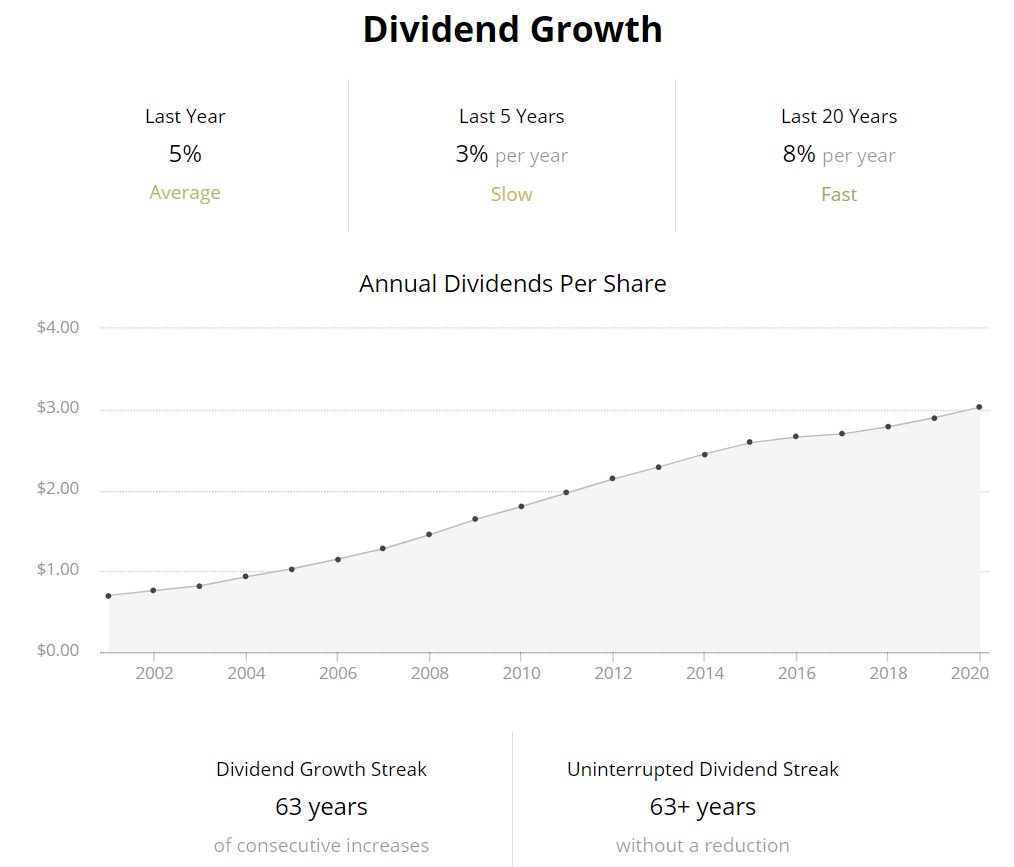

(Source: Simply Safe Dividends)

(Source: Simply Safe Dividends)

Procter & Gamble’s current yield is 2.3%, so I would classify it as a low-yield, mid-growth stock. Its yield, of course, has come down as its price has climbed up. PG’s 63-year streak of dividend increases makes it a Dividend King, a term of affection for companies that have raised their dividends for more than 50 years in a row. Dwight Eisenhower was president when PG’s streak began.

Valuation

To value a stock, I use four valuation models, then average them. For more details on my approach, see Dividend Growth Investing Lesson 11: Valuation.

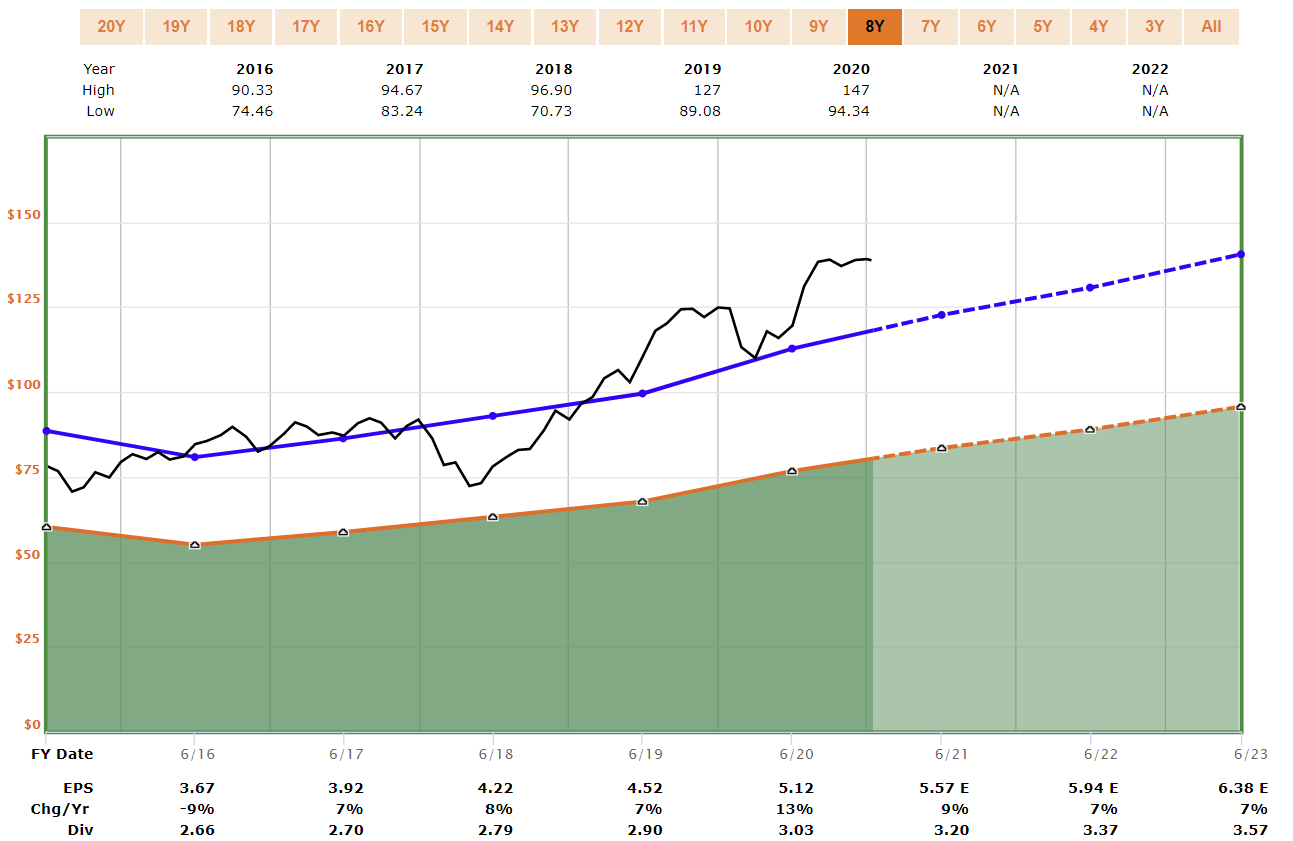

Models 1 and 2: FASTGraphs P/E Benchmarks

FASTGraphs present a stock’s price on the same chart as valuation reference lines for easy comparison. I use two that are built into the system:

- An orange line based on widely-used formulas regarding the historical performance of the stock market and the company’s own earnings growth rate. The orange line usually is drawn using a P/E ratio of 15 for mid-growth stocks.

- A blue line based on the stock’s own P/E ratio for any time-period you choose. I select a 5-year backwards look. That requires an 8-year display of the chart, because of the future years displayed.

Here is the FASTGraph for PG, using the 8-year display period. You can see the blue and orange reference lines. The black line is PG’s actual market price.

You can tell visually that PG is over-priced based on the elevation of its price line compared to the two reference lines.

The company’s current P/E ratio is 25.9. I create a valuation ratio for each model.

Valuation Ratio = Actual P/E divided by Reference P/E

Valuation ratio #1 (orange line) = 25.9 / 15 = 1.73

Valuation ratio #2 (blue line) = 25.9 / 22.0 = 1.18

Both models suggest overvaluation.

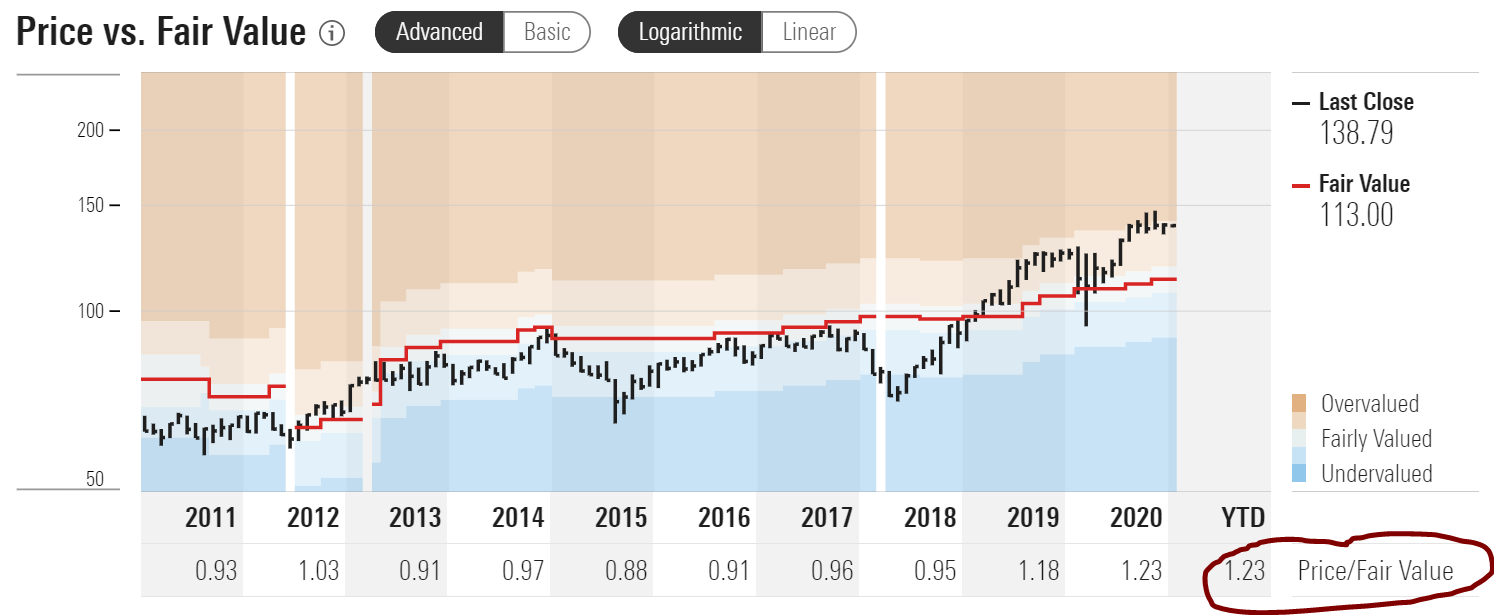

Model 3: Morningstar’s Discounted Cash Flow

Morningstar takes a different approach. They ignore P/E and other valuation ratios.

Instead, they construct a discounted cash flow (DCF) model. Using conservative projections, they discount all of the stock’s estimated future cash flows back to the present to arrive at a fair value estimate. The idea is that a stock’s fair price is equal to the net present value of all of the company’s future cash flows.

Here is Morningstar’s valuation history on PG. The red line on the graph is Morningstar’s fair-value calculation over the past 10 years, and the black bars represent PG’s price. You can see how PG’s price took off in early 2018 compared to its fair-value line.

Morningstar’s present valuation ratio (circled) is 1.23. As with the first two models, that suggests overvaluation.

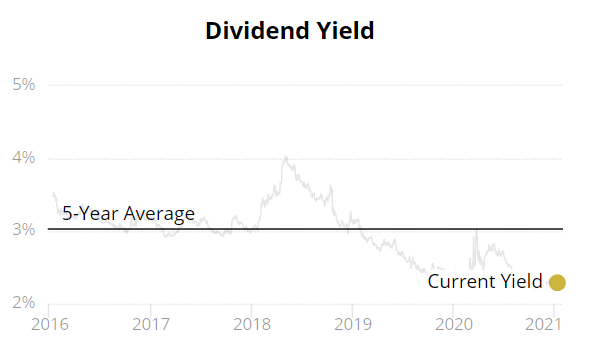

Model 4: Current Yield vs. Historical Yield

The final model compares the stock’s current yield to its historical yield.

If a stock is yielding more than its historical average, that suggests that it is a better value than usual, because you are paying less for the stock’s dividends. And vice-versa.

We can see the comparison visually with this graph from Simply Safe Dividends:

Just as with the earlier models, we make a valuation ratio. PG’s current yield is 2.3% and its 5-year historical average is 3.0%.

Valuation ratio = 3.0% / 2.3% = 1.30

I cap this valuation ratio at 1.20, because I think it is the least-direct way of assessing valuation.

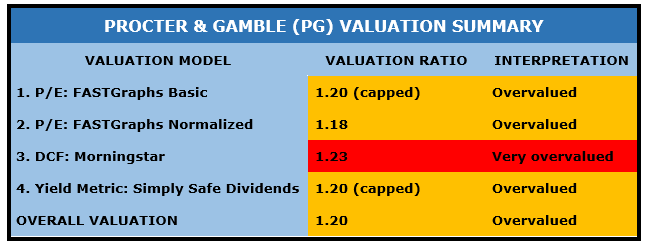

PG’s Valuation Summary

The models are unanimous in estimating that PG is overvalued.

That said, Model #1 is well out of line with the others in its magnitude. Therefore, I am also going to cap it at 1.20.

In the aggregate, the assessment is that PG is overvalued, with a valuation rato of 1.20. Using that ratio, it is easy to calculate a fair price:

Fair price = Current price / Valuation ratio

PG’s recent price was about $139. Using the formula above, we get $139 / 1.20 = $116 as PG’s fair price.

Because valuation is an assessment, not a physical measurement, all valuations are estimates. Therefore, it is logical to think in ranges rather than exact values. I usually regard any price within +/- 10% of my calculated fair price to be “fair.”

If I apply that 10% range to PG, that would put the top of its fair-price range at $127.

With PG currently around $139, it is clear that now is not the time to buy PG shares. Despite its very high quality, PG’s stock is overpriced.

Given its high quality, I would be willing to pay up to the top of its fair-value range, or $127. If you have PG on a watch list, that would require an 8% price drop from current levels.

It is noteworthy that if the stock were selling for $127, its yield would be 2.5%. If the price fell all the way to the calculated fair-value price of $116, PG’s yield would be 2.8%. Both of those yields would be more attractive than the current yield of 2.3%.

One further note: On January 20, PG will present its Q2 2021 earnings report. Those earnings could change PG’s valuation estimates, and they could also trigger some price volatility that could bring PG down to a better entry price.

Closing Thoughts

Procter & Gamble is selling at too high a price (and too low a yield) to buy at the moment. It is a very high-quality company with a bulletproof dividend, but I would wait for a better entry price.

For further reading about PG, see these articles:

This Dividend Stock Is Poised for Consistent Returns in 2021 (Louis Navellier, October 2020)

7 Hot Stocks to Buy with Mega-Cap Status (Louis Navellier, November 2020)

Disclosure: I own shares of PG.

This is not a recommendation to buy, sell, hold, trim, or add to PG. As always, perform your own due diligence. Check the company’s complete dividend record, business model, financial situation, and prospects for the future. Also consider your tolerance for risk and how well the company fits (or does not fit) your long-term investing goals.

Download the Best Dividend-Growth Book Directly to Your Computer or Tablet

Top 30 Dividend Growth Stocks for 2021: A Sensible Guide to Dividend Growth Investing is the premier guide to DG investing.

Top 30 Dividend Growth Stocks for 2021: A Sensible Guide to Dividend Growth Investing is the premier guide to DG investing.

One customer has said:

I downloaded your eBook last night. I was blown away by how much thought and care you put into this. People are going to love it! The first half of the book contains so much timeless wisdom and information on the strategy. You have a real gift for explaining complex topics in terms that anyone can understand.

Please click here to learn more about it.

— Dave Van Knapp

This article first appeared on Dividends & Income

The goal? To build a reliable, growing income stream by making regular investments in high-quality dividend-paying companies. Click here to access our Income Builder Portfolio and see what we’re buying this month.