With so much free time, many retirees spend more money after they’ve stopped working than they did while they were employed … so they need income to support their wants and needs.

Many near-retirees also seek to build a reliable, growing income stream as they try to prepare for the imminent absence of paychecks.

Beyond those folks who have an obvious interest in income-centric investing, there are younger people — many considerably younger — who simply believe Dividend Growth Investing is a valid strategy that, over decades, has competed quite favorably with most others.

DGI is the main method I have used in putting together DTA’s Income Builder Portfolio, and the results of this project through Year 3 have been very satisfying.

In Part 1 of my annual review, I showed how the IBP’s total return has just about matched that of the S&P 500 Index — even though the market has been on a tear for years, and really went bonkers the last several months of 2020.

Here in Part 2, I will look at the sensational — bordering on absurd — income growth that this portfolio achieved during the past 12 months.

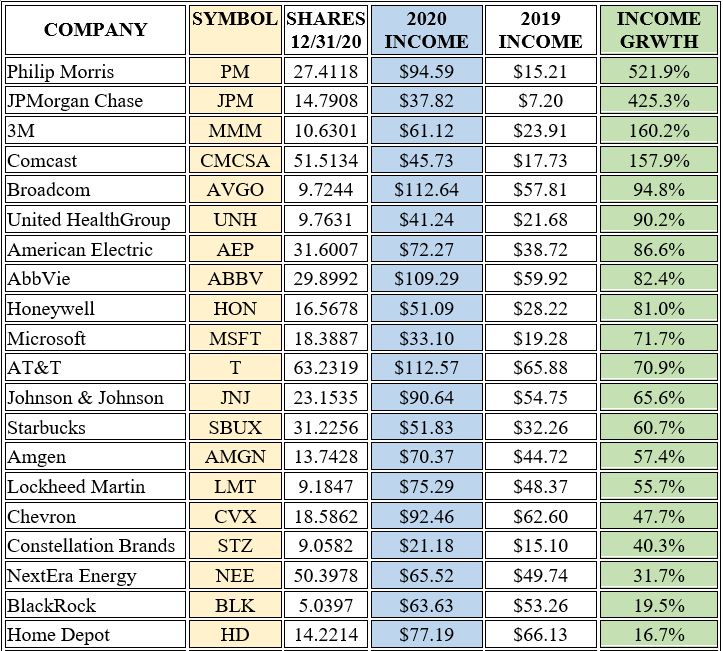

Let’s get right to it. The following table shows how much income each IBP component produced in 2020 compared to 2019.

That’s right … the IBP produced 74% more income in 2020 than it did the previous year.

Four of our positions generated increases of at least 100%, and one — tobacco giant Philip Morris (PM) — had a cartoonish increase in excess of 500%.

Those are not typos, and what seems impossible is explained quite simply:

The IBP is a living, active, real-money endeavor in which new cash is constantly coming in and being invested.

Money Flows In, Income Pours Out

Unlike my colleague Dave Van Knapp’s fabulous Dividend Growth Portfolio, in which there have been no new contributions since its inception in 2008, the IBP gets a big-time boost from Daily Trade Alert — which allocates $2,000/month for me to invest on its behalf.

Twelve companies that weren’t in the portfolio in 2019 were there by the end of ’20, and a 13th — Cisco Systems (CSCO) — was bought too late in 2019 to receive dividends until 2020. So all the dividends they brought in last year showed as an increase in the overall income stream.

Of the 37 companies in the IBP (see the home page HERE), most have been selected for investment on multiple occasions. Fourteen have been bought three times, and two companies — biopharm giants AbbVie (ABBV) and Amgen (AMGN) — have been purchased four times apiece.

Each AMGN buy is marked with a blue X; each dividend reinvestment is market with a purple X

Amgen was my very first pick for the IBP back in January 2018, and it also was our most recent buy on Dec. 22, 2020. In between, there were two other executed purchase orders, a dozen dividend reinvestments, and a pair of 10% dividend hikes.

No wonder AMGN’s income production grew some 57% within the IBP last year.

The IBP has more holdings now than it did a year ago. There are more shares (in many cases, significantly more shares) of each holding that already had been in the portfolio in 2019. And nearly every IBP company increased its dividend.

Given all of that, it would have been surprising only if income production hadn’t zoomed.

The 522% income growth in our Philip Morris position obviously wasn’t due to a 522% dividend raise. What happened was this:

In 2019, the portfolio received only one dividend payment based on a 13-share position; in 2020, the IBP got four distributions based on a 27-share position. PM also raised its dividend about 3%.

So the PM position’s income production soared from $15.21 to $94.59. BOOM!

Apples To Apples

In an active portfolio, with an additional $2,000 invested every month, it obviously is impossible to make a true year-over-year income comparison.

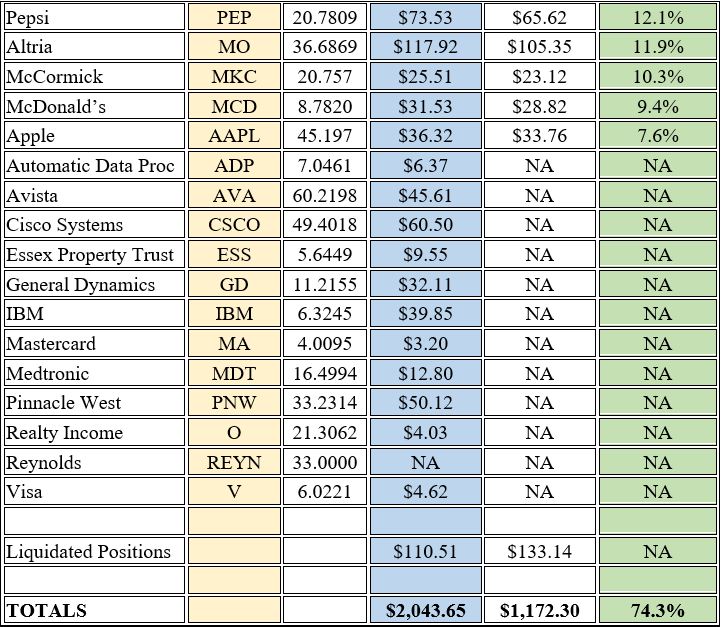

There were seven IBP positions that existed at the end of 2019 in which there were no income-generating investments during 2020, so we can legitimately compare those.

The COMP DIVS column reflects the number of comparable dividend payments each year for each company.

For example, our last Starbucks buy was Nov. 1, 2019, and we received a $12.49 dividend four weeks later, as shown in the 2019 INCOME column. For an accurate year-over-year comparison, the 2020 INCOME column includes the income produced by SBUX only in the fourth quarter of 2020, reflecting 12% YOY growth.

Led by Chevron (CVX), which somewhat surprisingly came through with an 8.4% dividend raise in 2020, the seven positions in the above table produced 11.1% more income for the IBP last year than they did in 2019.

Looking Ahead

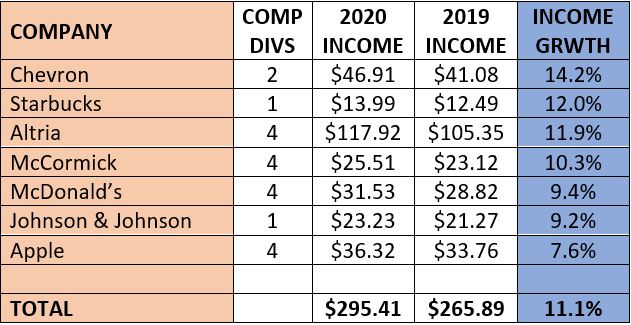

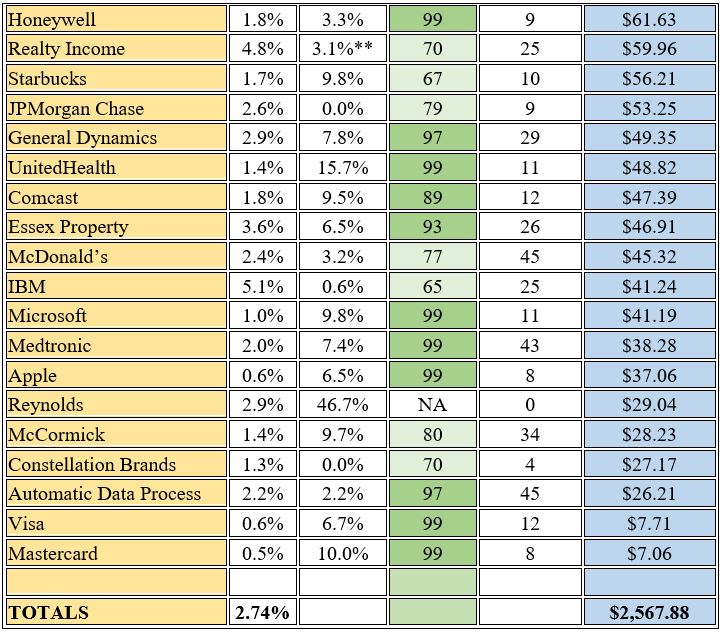

Here is some more income-related information about each of the portfolio’s holdings, presented in order of projected income for the year ahead:

MOST RECENT RAISE is each company’s most recent announced dividend increase; ** Realty Income had several small raises over the last year, totaling 3.1%. … SSD SAFETY SCORE is provided by Simply Safe Dividends; 81-100 is “Very Safe,” 61-80 is “Safe,” 41-60 is “Borderline Safe.” … DIV GROWTH STREAK is consecutive years each company has raised its dividend. … PROJECTED ANNUAL INCOME is income each position is expected to produce over the next 12 months. … All information is as of Dec. 31, 2020.

In general, recent dividend raises were not as robust as in previous years, a situation mostly attributable to the global coronavirus pandemic.

COVID-19 adversely affected corporate earnings and free cash flow for many companies, which in turn affected dividend raises.

JPMorgan Chase (JPM) and Constellation Brands (STZ) have at least temporarily frozen dividends — they’re still paying them, just not growing them — and several companies that had aggressively raised divvies announced much smaller hikes in 2020.

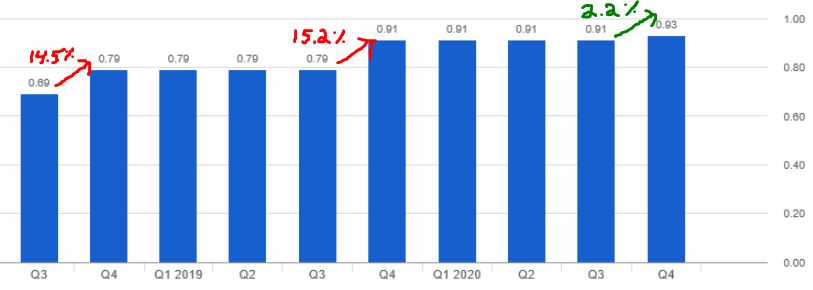

Automatic Data Processing (ADP), for example, went from double-digit increases to only a little over 2%.

ADP Dividend Growth; image from Fidelity.com

Even AT&T (T), which has been growing its dividend for 36 years but is facing some financial pressure now, passed on its customary penny-per-quarter increase for 2021.

The nearly 47% raise for Reynolds (REYN) is misleading because the company only went public last year. Its first dividend was .15/share in April, and then it went up to .22 for August. We’ll get a better picture of how REYN will approach the dividend later this year.

The YIELD column shows the dividend yield for each company, as well as for the Income Builder Portfolio as a whole, through market close Dec. 31, 2020.

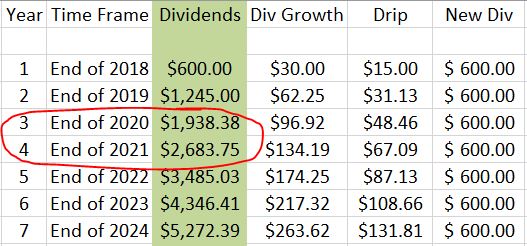

The 2.74% overall figure is above the rate of inflation, higher than the yield of most index funds, and greater than the yield I was counting on when determining the IBP’s Income Target as stated in our Business Plan:

Build a portfolio that will produce at least $5,000 in annual dividends within 7 years of the IBP’s inception.

Using the assumptions of a 2.5% yield and 5% annual dividend growth, I expected the projected annual income after 3 years to be $1,938. Instead, it’s at $2,568 — which puts it only about $116 shy of my expectations through FOUR years.

Wrapping Things Up

Yes, having invested in dozens of high-quality companies, our dividend stream is growing exponentially. And total return has been nothing to sneeze at, either.

Three years in, I’m delighted with how the Income Builder Portfolio is performing, and I’m looking forward to the years to come.

Remember: We are not recommending that investors replicate the IBP. This project is all about discussing the process of DGI, passing along some portfolio management techniques, and presenting interesting companies for further research.

My first stock selection of 2021 will be detailed in my next article, scheduled to be published Tuesday, Jan. 12.

In the meantime, be sure to check out my other real-money portfolio, the “growth-and-income” Grand-Twins College Fund — HERE.

— Mike Nadel

This article first appeared on Dividends & Income

The goal? To build a reliable, growing income stream by making regular investments in high-quality dividend-paying companies. Click here to access our Income Builder Portfolio and see what we’re buying this month.