For income investors, dividend strategies don’t come any easier than the “Dogs of the Dow.”

But does this simple technique still work?

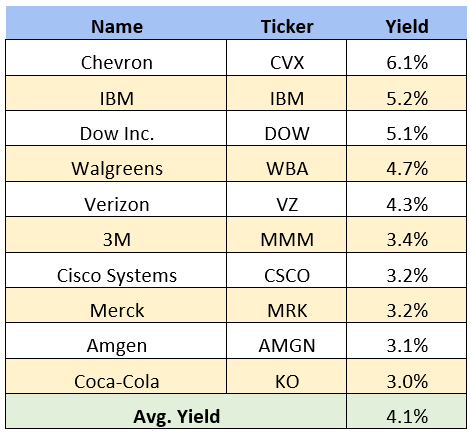

We’ll look at the 2021 Dogs, and their attached dividends (and prospects) in a moment. Their yields aren’t too shabby, averaging 4.1% in a 1% world! First, let’s review the mechanics of the popular contrarian strategy:

- Step 1: After the final trading day of the year, we identify the 10 highest-yielding stocks in the Dow.

- Step 2: We buy all 10 in equal amounts.

The Dow is considered to be a “who’s who” of blue chips—companies that in theory should withstand the test of time.

If we have the chance to buy them cheaply, the strategy says we should just hold our noses and buy, because chances are that market participants will once again bid these stocks back up over the coming year.

Rather than using P/E, P/S or P/B, the Dogs of the Dow strategy uses dividend yield to determine which components are most beaten down at the moment. It’s our kind of technique—based on cold, hard cash flow to investors.

Of course, a low stock price (and thus a high yield) doesn’t necessarily make a stock a good value. Stocks are often “cheap for a reason.” And despite several years of outperformance, the strategy started to show some cracks in 2019, and it really fell off the rails in 2020.

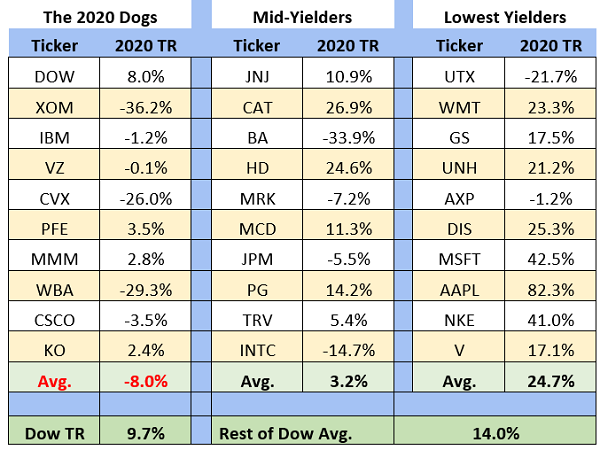

2020’s Dogs Underperformed By Nearly 18 Percentage Points

As shown above, the Dogs of the Dow strategy worked the opposite of how it should have in 2020. The Dogs produced a negative 8% total return across 2020, while the 10 next-best-yielding stocks produced a modest 3.2% return, and the 10 lowest yielders—in theory, the 10 most “overpriced” stocks—carried the Dow with nearly 25% returns.

To add insult to injury, two of last year’s dogs, Pfizer (PFE) and Exxon Mobil (XOM), were booted from the DJIA last year.

Was 2020 an anomaly? Or, has the economy shifted permanently so that the highest yielding Dow stocks are still “cheap for a reason?” Let’s consider this year’s Dog show lineup:

This is a nice yield, but let’s be honest, we ain’t retiring off a 4.1% yield. That’s just $41,000 on a million-dollar portfolio. My idea of a “perfect” portfolio yield is closer to 8%, or $80K on that million. So, we’re looking for a bit of upside price potential here.

Do we have it? Let’s take a quick peek behind the ears of each of these potential 2021 payout plays.

Coca-Cola (KO, 3.0%)

The Skinny: Drinking a couple more Cokes around the house while you were WFH (working from home) didn’t exactly move the needle for Coca-Cola in 2020. Restaurant volumes were crushed in the initial shutdowns and remain depressed. This “safety” play would’ve finished 2020 underwater if it weren’t for the dividend, which has grown for 58 consecutive years and counting.

What Needs to Go Right in 2021: Like many stocks, Coca-Cola needs the world to return to normal. Restaurant reopenings will be big for the drinks purveyor (here, and worldwide). One particular focus is in the UK, where KO recently bought coffee-shop chain Costa Coffee.

Amgen (AMGN, 3.1%)

The Skinny: Amgen shares consolidated in 2020, as Mr. and Ms. Market fretted about lower prescribing volumes for its drugs. Competition for its legacy Neulasta pulled on revenues, too.

But long-term, the “OG” of biotechs is a winner. Investors have already been treated to yet another 10% dividend hike from Amgen, which will start with its March payout.

What Needs to Go Right in 2021: Continued gains from Amgen’s more recently approved products, such as Repatha and Otezla, as well as progress from its deep pipeline could serve as catalysts for the share price. This includes KRAS G12C inhibitor Sotorasib—Amgen gained a Breakthrough Therapy Designation for the treatment in early December and filed for FDA approval a little more than a week later.

Merck (MRK, 3.2%)

The Skinny: “Vaccine” will get an excited response in some investor circles, but not from Merck shareholders. COVID-19 put the brakes on a lot of other common vaccinations, including the company’s HPV vaccine, Gardasil. Like Amgen and other pharma outfits without a first-tier coronavirus product, MRK shares delivered a 7% loss including dividends.

What Needs to Go Right in 2021: Merck isn’t as bad off as 2020’s declines would suggest. Third-quarter sales barely budged higher but adjusted profits jumped 15%, and the company raised its full-year 2020 outlook. Cancer drug Keytruda is a blockbuster—in the third quarter alone, Keytruda did $3.7 billion in sales, up 21% YoY—and most analysts expect the drug to overtake Humira as the world’s best-selling drug well before its patent expiration in 2026. Merck keeps spending to find new treatments, like its $2.75 billion deal for VelosBio, to provide additional growth. Slightly underpriced shares and a decent yield could help MRK shares along.

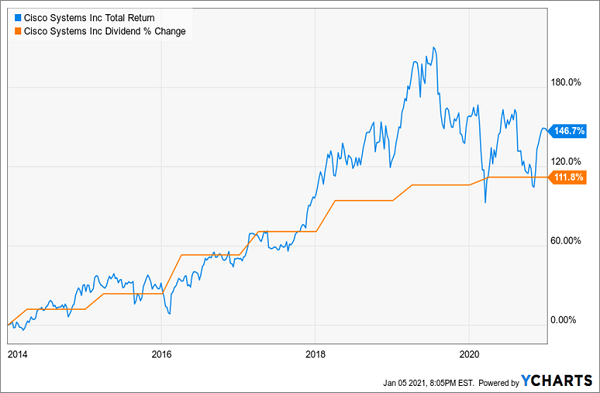

Cisco Systems (CSCO, 3.2%)

The Skinny: Cisco might be transitioning to the cloud and voyaging into security, but hardware sales to datacenters remain its bread ‘n’ butter. Thus, it was not a beneficiary of work-from-home trends like so many other stocks were, and the company finished 2020 with four consecutive quarters of year-over-year revenue declines.

What Needs to Go Right in 2021: This is one tech firm that will be much better off when Americans are allowed to return to the office. But Cisco brings back memories Iron Mountain (IRM), which knew well enough to pivot but didn’t do so fast enough. Cisco isn’t leading, it’s playing catch-up, and that’s a tougher game in technology. Its slowing dividend increases won’t win much loyalty, either. CSCO delivered a mere 3% uptick in 2020, following a modest 6% raise in 2019.

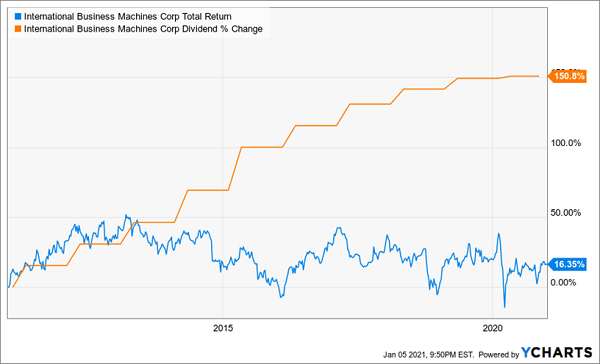

Cisco’s Dividend Growth Flatlines. Is the Stock Following Suit?

3M (MMM, 3.4%)

The Skinny: All things considered, 2020 wasn’t that bad for 3M. The stock eked out a small but positive total return, and it turned around a nasty trend that saw the company lose more than half its value between January 2018 and March 2020. Industrials felt the pinch last year, but 3M’s diversification shielded it somewhat. Full-year 2020 revenues should finish down only fractionally, and profits should decline by a modest 6%.

What Needs to Go Right in 2021: 3M will watch its N-95 mask sales dry up, but it should make it up across its tens of thousands of other products. 3M is globally diversified, which should help it reap the rewards of a global recovery while limiting the effects of any regional pockets of weakness. Profits and revenues should rebound by high single digits to low double digits if all goes to plan. It’s a safe play in that a slower-than-expected economic recovery won’t cripple it, but it would limit its already modest upside potential.

Verizon (VZ, 4.3%)

The Skinny: Verizon slipped a bit in 2020, but the sizable yield helped shares roughly break even. Like many companies, 2020 was supposed to be so much better for VZ, which was rolling out the 5G technology it has poured its capital into. But COVID put many of its plans on hold. On the upside, people weren’t exactly rushing to cancel their wireless plans in the middle of a pandemic that kept them homebound, though many cut back where they could.

What Needs to Go Right in 2021: You don’t just get 5G when you get a 5G phone—you need to pay up for it, and that’s how Verizon plans on growing its profits even if it can’t meaningfully grow its subscriber base. It’s also building out a completely new revenue stream, 5G Home, which currently is available in a handful of cities. It’s foolish to ever expect big price gains from Verizon, which is a perpetual dog because of its high dividend yield. But its next couple of years at least have the potential to be better than average.

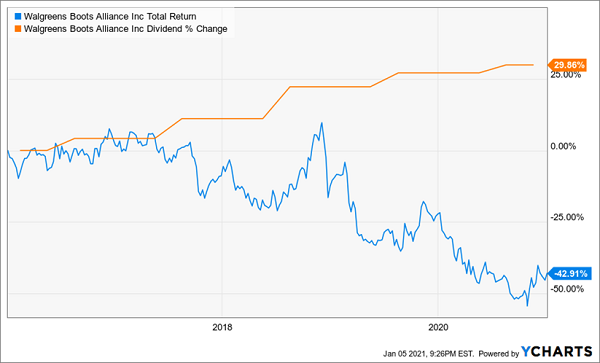

Walgreens (WBA, 4.7%)

The Skinny: Amazon.com (AMZN) opened a full online pharmacy late last year. In most years, that would’ve been the biggest weight on Walgreens shares, but not in 2020. The company started wetting the bed in early January with an earnings dud, and it was mostly downhill from there. COVID, which many thought would bolster Walgreen’s fortunes, just spanked it even more. While it was an “essential retailer” allowed to remain open when other retailers couldn’t, Walgreens had to spend big to keep its stores safe, and when people spent, they weren’t buying the higher-margin products they typically did. Its UK arm struggled, too. All told, WBA shareholders were out about 30% in 2020.

What Needs to Go Right in 2021: The best things to like about WBA are its simple fundamental metrics: a nearly 5% yield on a stock that’s trading at just 8 times forward earnings. But it’s cheap for a reason. Even after a miserable 2020, the Street’s expecting just 8% profit growth and a 3% sales bump in 2021. Yuck. The spirit of the “Dogs” is Walgreens’ best hope—that a simple reversion to the mean is in order after such a miserable year.

Walgreens’ Problems Predated COVID

Dow (DOW, 5.1%)

The Skinny: Dow—the chemical firm, not the index—is a pretty simple story. Most any of its businesses that had to do with typical industrial or durable-goods applications were hammered. A few businesses, such as packaging for consumer staples, did well. But 2020 was a bad year, period. Sales will end up about 13% lower, profits will be hacked away by 60% or so. The stock returned a total of 8%, and that almost felt like an accomplishment.

What Needs to Go Right in 2021: “The recovery is more likely than not to be gradual and more likely than not to be uneven.” That’s what CFO Howard Ungerleider had to say about things all the way back in June. But lowered expectations could be a boon for Dow, which should pick up steam whenever the economy does. And Dow is expected to snap back pretty solidly; profits should roughly double from depressed levels on sales up by high single digits. The 5% yield is compelling, too.

IBM (IBM, 5.2%)

The Skinny: At least IBM had something else but itself to blame for its continued inability to grow the business. I won’t dawdle here. COVID-19 cramped big-ticket technology purchases, and that hurt massive IT providers such as IBM.

What Needs to Go Right in 2021: Sometime before the end of 2021, IBM will have split into two companies—it’s spinning off its low-growth infrastructure services business (currently dubbed “NewCo.”) and retaining its newer cloud and AI businesses under the old IBM moniker. That likely means the heft of IBM’s big yield will be sent packing with NewCo. This ultimately could be a good thing for what remains in the new IBM, but there’s a lot of uncertainty between here and there.

Something Had to Change!

Chevron (CVX, 6.1%)

The Skinny: You know the score. Oil prices were thrashed last year, going low, lower, even negative before finally starting to rebound. Chevron, a massive integrated oil major, had more financial means than most but still had to make a number of cost-cutting moves. Even then, it returned -26% after dividends. Still, that was a lot better than many smaller oil firms that went belly-up.

What Needs to Go Right in 2021: In general, a recovery in oil and gas demand is going to make life a whole lot easier on Chevron. Chevron’s numerous operations, which include a large refining arm, mean that it doesn’t benefit as perfectly from higher prices as, say, a pure-play oil exploration company. If you factor in an eye-popping yield (for a blue chip), though, CVX should recover enough to make it a respectable total-return winner in 2021.

— Brett Owens

How to Double the Dividends From These Dogs (and Your Principal, Too!) [sponsor]

But that’s the problem with the Dogs, isn’t it?

Do you really want to fill your portfolio with a bunch of OK to somewhat high yielders each New Year’s, just to turn around and do it all over again, year after year?

But what’s the alternative with these stocks? Sure, Chevron’s 6% yield is juicy for a company of that size, but do you really want to gamble your retirement on something as cyclical as oil?

I know I don’t. I know you don’t want to, either.

And thanks to my “Perfect Income” portfolio, you don’t have to.

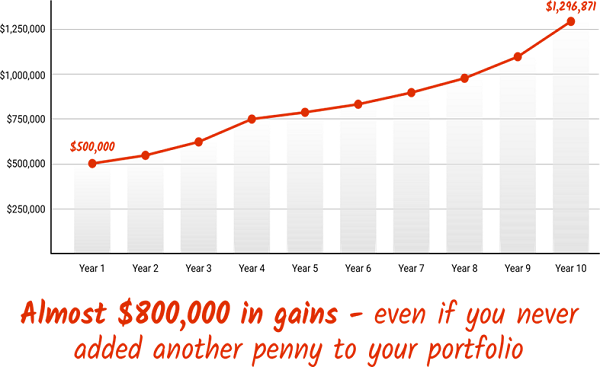

Current and soon-to-be retirees have been sent into a panic looking for replacement income investments after 2020 saw dozens of so-called “safe” blue chips abandoned their dividends. But even if you had a million dollars in cash to plunk down right now, the S&P 500 would earn you just $17,000 a year! And a traditional 60/40 portfolio is even worse, at just $13,000 annually!

You can’t retire happily on that. You can’t even survive on that.

Thankfully, the dividend-rich stocks in my “Perfect Income Portfolio” can deliver so much more.

I frequently talk to my readers, who tell me that these stocks have managed to double, triple and sometimes even triple the dividends they were earning from their old income portfolios. And it does so while also …

- Paying those dividends consistently, predictably and reliably.

- Surviving, even thriving, in market crashes.

- Delivering double-digit returns across several safe investments.

- Gambling your hard-earned nest egg on flimsy day-trading strategies, options contracts or penny stocks.

That sounds pretty perfect to me. But you tell me what you think:

Stop obsessively staring at your 401(k) or IRA while it yo-yos up and down. You don’t need to pray to the Federal Reserve to keep your retirement hopes alive.

Instead, just let me show you the stocks and funds you need to stabilize your retirement … and even teach you more about this incredible strategy itself, so you better understand exactly what you’re investing in.

Heck, I’ll even let other investors tell you about the wealth they’ve built using my research service.

Take control of your financial legacy today. Let me show you how to get 2x to 4x your current income with this simple, straightforward system.

Click here to get a FREE copy of my Perfect Income Portfolio report, including tickers, buy-in prices, detailed analyses of each pick … and a few other bonuses!

Source: Contrarian Outlook