Up 250% so far this year, Square (NYSE:SQ) is finally rewarding patient and long-term investors. Looking back on the year, it’s absolutely stunning that Square stock sports a 52-week low of $32.33. In hindsight that was a huge gift for the bulls.

When the novel coronavirus came sweeping through the country, investors didn’t know what to make of it.

For Square specifically, investors who were thinking clearly were worried about the economic ramifications of Covid-19.

That was a logical takeaway. With lockdowns in effect all over the country, small- and medium-sized businesses were under significant pressure.

That’s where many Square point-of-sale (POS) systems are integrated, so losing these businesses was a pressure point. Or so it seemed. Square’s other business units stepped up big, while the economy bounced back much more quickly than expected. Part of that is due to sheer consumption power, the other part is due to the Federal Reserve’s stimulus power.

Either way, Square is not only surviving, but thriving amid the pandemic. Let’s dig deeper as this name churns near all-time highs.

Breaking Down Square Stock

Square didn’t crack under pressure in 2020, cementing its role in the commerce cycle. That may seem like a minor footnote, but it’s critical in the bull case. It also allows the stock to trade at a premium, in my humble opinion.

If Square’s business model didn’t fail in 2020 — a year mired in lockdowns and lower spending — what will take it down? It removes the worry that a recession or other economic downturn will render Square irrelevant.

Case in point, earnings are forecast to slip just 5% this year. Admittedly, that’s not blowout growth. But the fact that it’s not a catastrophic decline is rather bullish. In 2021, analysts expect earnings to grow almost 50% to $1.12 per share.

The revenue side is a bit trickier. Consensus expectations call for growth of more than 300% this year.

However, with Square classifying bitcoin transactions as revenue, that figure is inflated quite a bit vs. prior results. This has created some controversy with investors, as some consider bitcoin transactions as a pass-through action rather than a true sale. One could argue that only the profit — the portion Square takes from the transaction — should count as revenue.

We don’t work for Square’s CFO, though. So we simply observe the metrics the company gives us. I do not mention this so-called caveat as a dent to the bull case, but for transparency.

For next year, consensus estimates call for almost 40% revenue growth to $13.02 billion.

If 2021 gives us — the world — the type of economic rebound we are hoping for with vaccines in the mix and a return to normalcy, then SQ stock is going to be a major beneficiary.

Bottom Line on SQ Stock

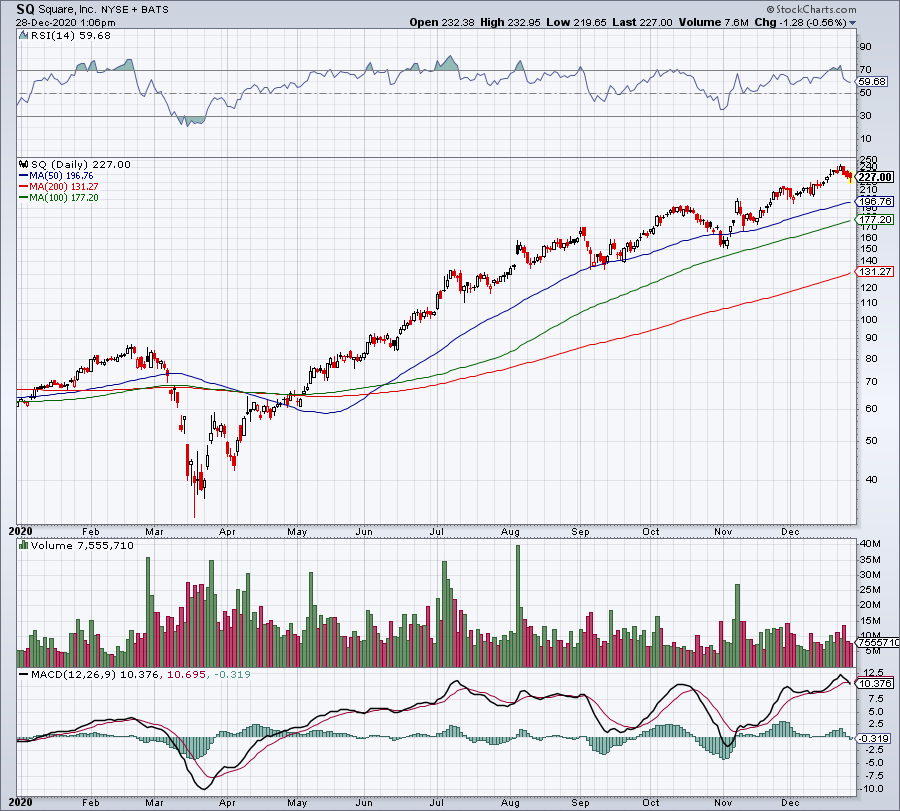

Source: Chart courtesy of StockCharts.com

Source: Chart courtesy of StockCharts.com

Some might still be a bit weary of Square’s method of revenue recording. In the public markets though, almost nothing gets by investors. That’s particularly true for a large company like Square.

While revenue is booming due to bitcoin transactions, gross margins are falling. Bitcoin revenue falls under the company’s Cash App segment, the latter of which generated revenue of $2.07 billion in the most recent quarter. It also generated $385 million in gross profit.

Of those figures, bitcoin generated revenue of $1.63 billion, or 78.7% of Cash App’s total revenue. However, bitcoin transactions generated gross profit of just $32 million, or less than 10% of Cash App’s total gross profit.

That’s why we are seeing overall gross margins dip, because bitcoin is driving a surge in the top line, but contributing very little to the bottom line.

So where’s the bull case in that? Engagement. From the most recent quarter:

As Cash App has expanded its ecosystem of products, we have provided more ways for customers to spend, send, store, and invest their money…Customers who adopted two or more products were highly engaged: during the third quarter, these customers had 3-4x more transactions and generated 3-4x more gross profit compared to customers who only used peer-to-peer payments.

Increased use of Cash App increases the platform’s other revenues, such as in the brokerage, subscription, business and peer-to-peer segments. Not every transaction is built around generating a profit, it’s built around increasing use and engagement.

The more times customers pull up their Cash App to generate a transaction, the more integrated it becomes in their lives and habits. That not only makes it a better business for Square, but it also increases the asset value of Cash App to shareholders.

Because of this value and Square’s focus on long-term growth, we are buyers on the dip.

— Matt McCall and the InvestorPlace Research Staff

Silicon Valley venture capitalist Luke Lango says this little-known Apple project could be 10X bigger than the iPhone, MacBook, and iPad COMBINED! Investing in Apple today would be a smart move... but he’s discovered a bigger opportunity lying under Wall Street’s radar -one that could give early investors a shot at 40X gains! Click here for more details.

Source: Investor Place

Source: Chart courtesy of StockCharts.com

Source: Chart courtesy of StockCharts.com