As we prepare to say farewell (or, good riddance!) to 2020, let’s beat the investing herd and figure out how we can really rake in some cash in 2021. And, in doing so, put this dumpster fire of a year behind us in spectacular fashion.

Why are we having this conversation now? Well, Mr. and Ms. Market love looking ahead. Plus, the “seasonally strong” months for the stock market tend to happen between November 1 and May 1.

Fortunately, thanks to two stock market pullbacks in 2020, equity prices are likely still “catching up” with their pre-2020 trajectories.

Big tech is frothy but many lesser known dividend growers are still cheap.

And that’s music to my ears, because the surest, safest way for us to double our money in the stock market is to buy the payouts that are growing the fastest.

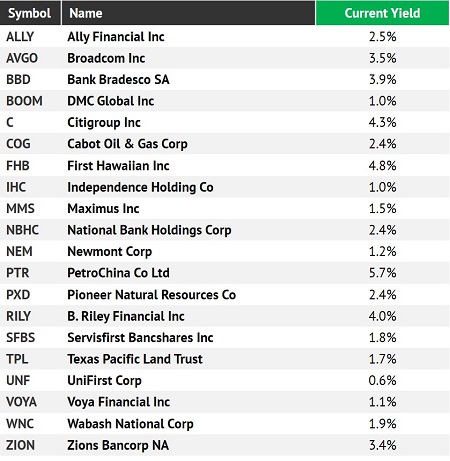

Specifically, I’ve got my eye on dividend growers—20 of them—that have the potential to boost their dividends by 21% or more next year. Here are the criteria:

- At least 20% dividend growth in 2020 versus 2019,

- Three-year total dividend growth of at least 50% (to prove that 2020 wasn’t a one-hit wonder), and

- A market cap of $500 million or more (for liquidity).

Before I reveal the list, some caveats. First, past dividend growth does not guarantee future payout hikes. This is where we must look past the spreadsheet and use our brains to think about each business model and make sure that it properly projects dividend growth into the future. We are looking for continued success in 2021 and beyond.

Second, the price that we pay matters. Ideally, we want a stock price that is lagging its payout. This means the stock is cheap with respect to its dividend, and we have potential upside when the stock price races to catch up with its payout.

Third, I would like to reiterate that these dividend growth numbers are real, and they are indeed spectacular. If you spend your life looking only at the 6%, 7% and 8%+ yields that we discuss in our Contrarian Income Report, you’ll miss out on dividend growth stories like these.

These current yields are modest by CIR standards, but don’t be fooled. It’s the trajectory of these dividend curves that has our attention.

20 Recent Dividend Raises of 21% or More

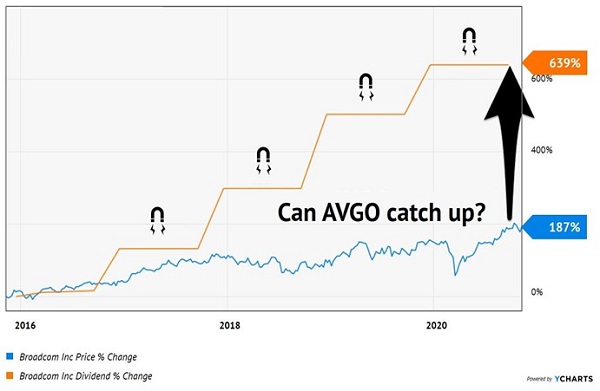

Broadcom (AVGO) is the rare tech company that always seems to pop up when we talk payouts. The telecom semiconductor specialist is shaping up to be a major player in the rollout of 5G technology.

Over the past five years, Broadcom has boosted its dividend by an other-worldly 639%! Its stock price, which has returned 187%, lags the dividend growth rate and is exactly what we look for:

Broadcom’s “Dividend Magnet” Sure is Due

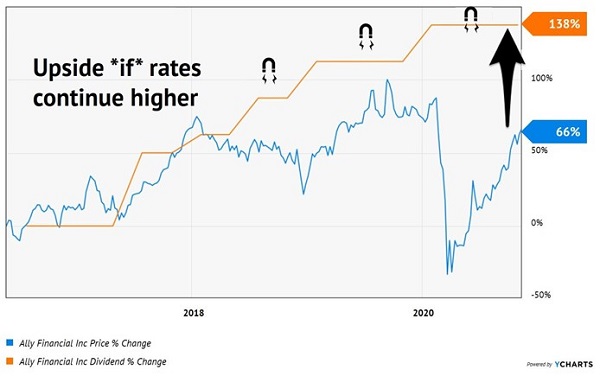

Ally Financial (ALLY), meanwhile, is an online-only bank that regularly boasts the highest savings account rates anywhere. (As I write, they’re boasting a 0.60% rate with no monthly fees or minimum balance requirements. Pretty good by 2020’s “zero point nothing” standards.)

The company actually grew up as the financing arm of General Motors (GM), known most recently as GMAC. In 2010, GMAC rebranded as Ally and in 2014, the firm went public on its own.

Thus far, Ally shareholders have done OK since the company initiated its dividend, but its 66% stock price gain lags Ally’s 138% payout growth:

Low Rates Weigh on Ally

When Mr. and Ms. Market eye financial firms for investment, they look for higher interest rates as a catalyst. They know that it is challenging for many banks, who “borrow short and lend long,” to make money when the entire rate curve is as flat as a pancake. But, if and when we do see rates actually “break out” to the upside, this stock will be on our Hidden Yields shortlist. (It doesn’t yield enough today for CIR, but its potential to double in price qualifies it for HY.)

Moving up to the big banks, Citigroup (C) boasts big dividend growth in recent years. Of course, that doesn’t mean much by itself.

“The dividend’s as safe as the next board meeting,” they told themselves as the yield on their shares climbed well above 10%. On a trailing basis, that is. Next board meeting, the bigwigs chopped Citigroup’s payout, and shares dropped by more than 90%. The prior “rich” dividend turned into a Goodwill donation!

Now, I don’t believe that Citigroup’s dividend is in trouble this time around, at least yet. The firm’s reported payout ratio is a nosebleed 209% of net income, but it’s a manageable 48% with respect to cash flow, and companies pay dividend out of cash, not accounting profits calculated for taxes

Shares trade for just 56% of book value, which is “fire sale cheap.” It means, in theory, Citigroup could be liquidated, sold off for its individual parts (assets), and pay investors nearly double what it trades for today.

In reality, this bank (like many big banks) is a glorified financial utility in need of a profit catalyst. I’ve got Citi in the cheap “cigar butt” pile until we identify that booster.

— Brett Owens

Sponsored Link: Instead of waiting around for an interest rate catalyst that may or may not appear, I’ll have a timelier dividend play with 100%+ upside potential in your new Hidden Yields, which I’m wrapping up as we speak. Please keep an eye out for it.

Unfortunately, if you’re reading this, it’s probably because you’re not yet a subscriber to HY!

If fast 100%+ gains are not a problem for you—ha!—then I invite you to take my dividend growth-focused service for a spin. It’s a double to triple-digit return machine: we recently banked profits of 157.1% in just 2 years, 65.3% in 15 months and 68.8% in less than 3 years! Please take Hidden Yields for a risk-free test drive today so that I can send you my best idea this Friday along with seven more dividend payers primed to return a fast 40% to 50% in 2021.

Source: Contrarian Outlook