If you are into Dividend Growth Investing, your portfolio almost certainly includes several companies from the consumer staples sector.

Personally, staples make up about 22% of my stock holdings, the largest percentage of any sector in my portfolio.

Why do I like this group? The following Investopedia definition might help explain:

The consumer staples sector is comprised of companies that produce and sell items considered essential for everyday use. Consumer staples products include household goods, food, beverages, hygiene products, and other items that individuals are either unwilling or unable to eliminate from their budgets even in times of financial trouble. As a result, these companies are viewed as non-cyclical and able to maintain stable growth regardless of the state of the economy.

I own plenty of technology, industrial and other cyclical stocks, so it’s nice to have a significant investment in more defensive companies that can continue to grow (even if relatively slowly) whether times are good or bad.

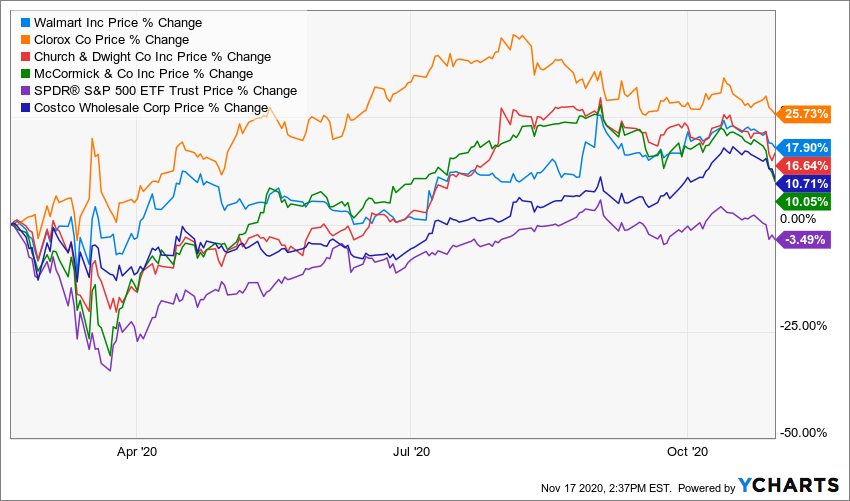

During the global COVID-19 pandemic, this point has been driven home all the more, as top staples significantly outperformed the overall market in the eight months after the late-February “coronavirus crash.”

While putting together the Income Builder Portfolio for Daily Trade Alert these last three years, I haven’t forced myself to buy companies just because they are in a certain sector.

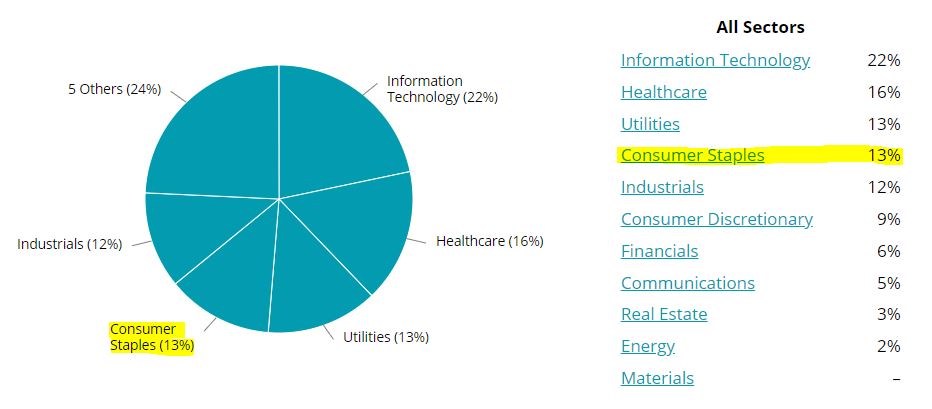

Nevertheless, I did think we had gotten a little light on consumer staples after having invested very little in that group during 2020.

So, all else being equal, I decided it wouldn’t be a bad idea to choose one this time — and I did: Reynolds Consumer Products (REYN). (Read more about my selection HERE.)

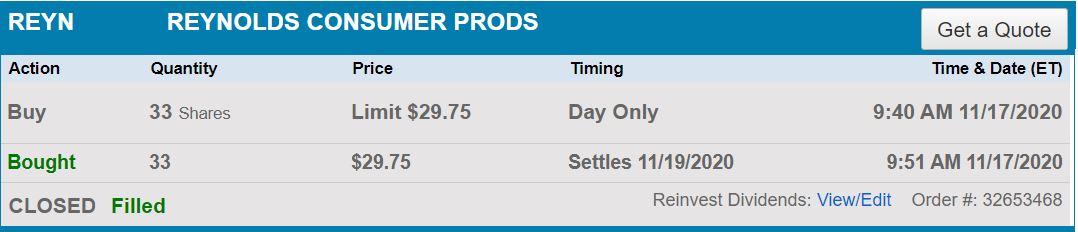

On Tuesday, Nov. 17, I executed a purchase order on DTA’s behalf for about $1,000 worth of the maker of Reynolds Wrap and Hefty trash bags, getting 33 shares at $29.75 apiece.

Reynolds becomes the IBP’s 37th position (see the entire portfolio HERE) and sixth consumer staples component.

At 13%, consumer staples has moved into a tie with utilities for the portfolio’s third-largest sector representation.

SimplySafeDividends.com

While many (perhaps most) DGI practitioners buy consumer staples for slow-but-steady growth of earnings, revenues and dividends, some of the IBP stocks from that sector have performed quite well in total return, too.

Our McCormick (MKC) position has an 82% total return since we bought it all the way back in May 2018; Apple (AAPL) is the only IBP component that has outperformed the world’s leading spice-maker.

I have wanted to buy more MKC for the longest time, and actually considered it for the IBP this time. As outstanding a company as McCormick is, however, I didn’t want to ask DTA to pay 32 times forward earnings for a business that is expected to grow profit by only 1% next year.

Going forward, it will be interesting to see how the seemingly much better-valued Reynolds does in relation to MKC.

Dividend Doings

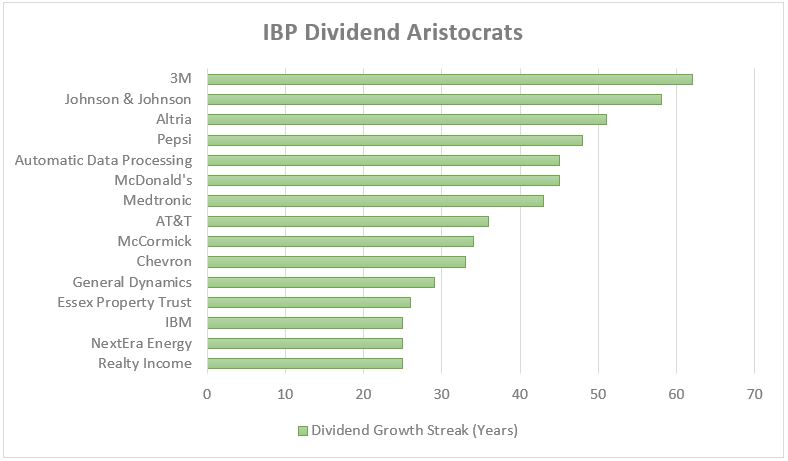

The vast majority of Income Builder Portfolio companies have been growing their dividends for 10 or more consecutive years, and 15 IBP holdings are Dividend Aristocrats with streaks at least a quarter-century long.

REYN, which was spun off of a private company in January, has been paying a dividend only since April, so we’re trusting management when they say they are committed to growing the dividend over time.

The company’s current quarterly payout is 22 cents/share.

Because we bought our position just after the ex-dividend date, the IBP isn’t expected to receive a dividend from Reynolds until February.

At that time, the portfolio will get $7.26. In accordance with IBP rules, that dividend will be reinvested right back into REYN stock, buying about a quarter-share.

Then, three months later, the slightly larger position will generate a little more income, which will purchase another fraction of a share.

That’s the way things roll around here, not just with REYN but with all of our positions, and it’s why we gave this project the name we did.

Analyze This!

In most of my IBP post-buy articles, I use one section to discuss what analysts think about the company we just purchased and another to examine current valuation.

Given that Reynolds has been publicly traded for such a brief period of time, though, I couldn’t find any reliable valuation estimates.

Still, several analysts have started following the stock, so let’s see what they have to say.

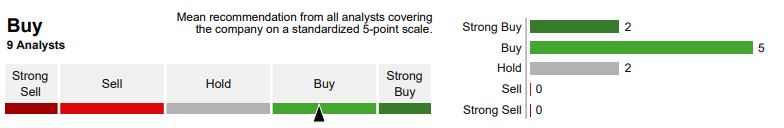

Thomson Reuters surveyed 9 analysts, with 7 calling REYN either a Buy or Strong Buy.

Thomson Reuters (via Fidelity.com)

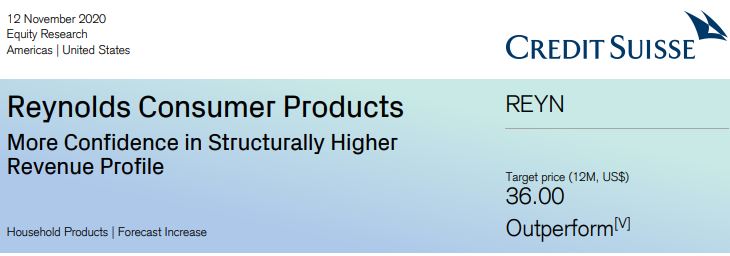

Credit Suisse has a $36 target price for REYN, based on 20 times the analyst’s expectations of a 2023 EPS of $2.24 (discounted at 8%).

Value Line projects long-term price appreciation of 17% to 67% (yellow highlight in the following graphic), but its analyst said: “Growth will likely be slow here. Overall, we think that interested long-term accounts should wait for a price dip.” (It should be noted that VL has not updated its analysis to include Reynolds’ just-completed third quarter.)

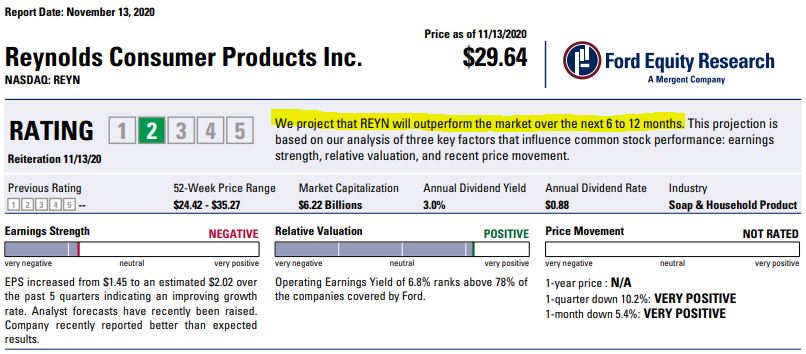

Although Ford Equity Research did not give a price target, its analyst is expecting REYN to outperform the market in the months ahead.

Morningstar Investment Research Center provides fair values for hundreds upon hundreds of companies but has not initiated coverage on Reynolds yet.

Morningstar does show “consensus forward P/E ratio” for REYN to be 14.99. Many market observers consider 15 times earnings to be an attractive valuation point for consumer staples companies.

Wrapping Things Up

Even though I have sealed leftovers in Reynolds Wrap and Hefty slider bags for years, I didn’t think much about the company as an investment when it went public in January.

But a few months ago, after noticing that REYN had a 3% dividend yield and that it seemed reasonably valued, I began to research it as a potential addition to the Income Builder Portfolio.

Yes, it takes a leap of faith to select a stock that has not been on the market very long — not to mention one that lacks a multi-year history of dividend growth.

Part of the IBP’s mission, however, is to introduce interesting names to investors. And considering that I was looking for a reasonably valued, dividend-paying consumer staples company that sells well-known products, I decided it was worth giving Reynolds a whirl.

Note to Readers: The IBP is one of the two real-money portfolios I write about for this site. The other is my growth-and-income Grand-Twins College Fund. Check out its home page HERE, and look for my next update in early December.

— Mike Nadel

This article first appeared on Dividends & Income

The goal? To build a reliable, growing income stream by making regular investments in high-quality dividend-paying companies. Click here to access our Income Builder Portfolio and see what we’re buying this month.