The e-commerce space is booming and while Chewy (NYSE:CHWY) had been performing well, shares are under pressure now. On Sept. 2, Chewy stock hit a high of $74.84. Seven trading sessions later, on Sept. 14, and the stock was down 29.2% after closing at $53.

In my view, that dip represents a buying opportunity. The novel coronavirus is pushing sales toward online platforms, a shift that has benefited e-commerce, digital entertainment players, cybersecurity firms and cloud computing companies.

Obviously some of the growth will slow because we’ve witnessed such a fascinating pull-forward of various technologies.

But in many instances, we are not going back to the old ways.

In the case of e-commerce, Covid-19 is likely only cementing its place among retail. For Chewy, that’s great news. From CEO Sumit Singh in the recent earnings press release:

As e-commerce undergoes meaningful changes, multi-year growth curves have been compressed into timeframes measured in quarters, if not months. Over the past few years, we have invested in technology, new businesses, fulfillment capacity, and in building an extraordinary team. This has prepared us to quickly adapt to the acceleration of our own growth curve.

Earnings Were Good

Leading up to earnings on Sept. 10, shares of Chewy stock fell 20% from the recent high five days prior. For some long-term investors, perhaps that was enough of a correction to dip their toe in.

The headline results from the second quarter were solid, with Chewy beating on top- and bottom-line expectations.

A loss of 8 cents per share beat expectations by 8 cents, while revenue of $1.7 billion grew more than 47% year-over-year and topped estimates by $62 million. Adjusted EBITDA came in at $15.5 million. That’s up 153% year-over-year and well ahead of estimates looking for a loss of $16.1 million.

For the full year, management expects revenue of $6.775 billion to $6.825 billion. That’s up from its prior outlook of $6.55 billion to $6.65 billion and ahead of consensus estimates which were at the top of that range, at $6.65 billion.

Gross and net margins were up, active customers climbed to 16.6 million (up 38% year-over-year from 12 million), and net sales per active customer were up slightly when adjusting for an extra week in 2018.

The bottom line: I see a top and bottom line beat, solid customer retention, strong guidance and improving margins. The price action following earnings is just noise. We’re looking sustainable trends and it looks like we have one with Chewy.

Caught Between Two Secular Trends

Chewy stock is caught in between two major secular trends: E-commerce and pet spending.

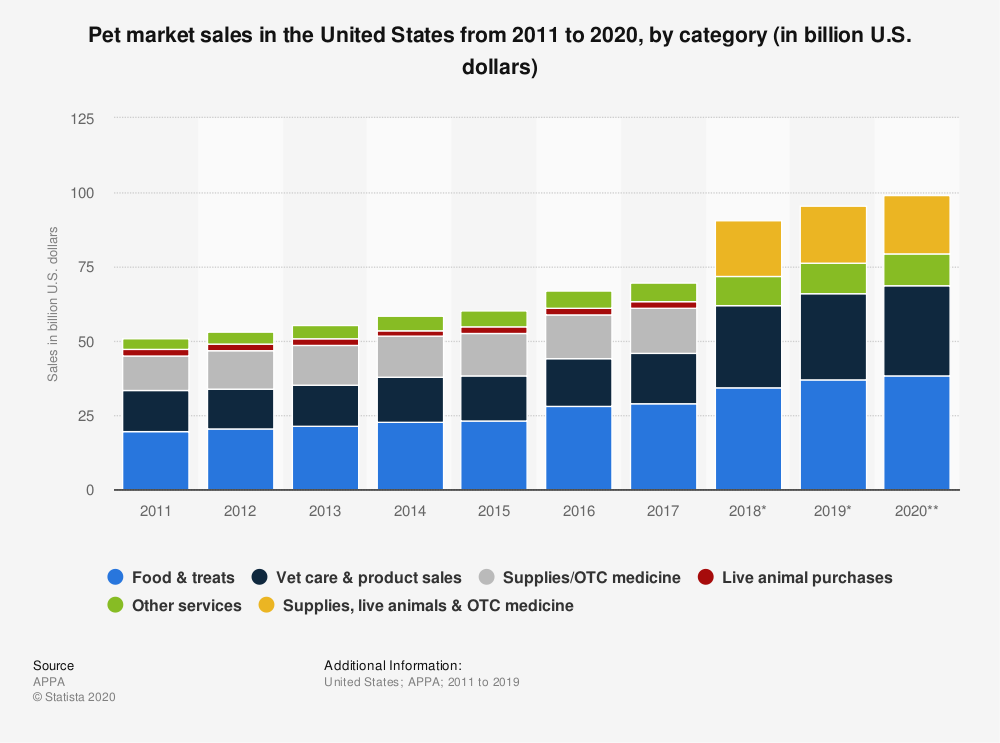

The graph above highlights one of those trends, as pet spending has grown steadily over the years. As our animals become more closely referred to as “family” rather than just pets, spending is bound to go up.

Combine the situation with Covid-19 and perhaps even more Americans are feeling the itch to get a new furry family member. Of course, the coronavirus has been an accelerant on the other trend, which is e-commerce.

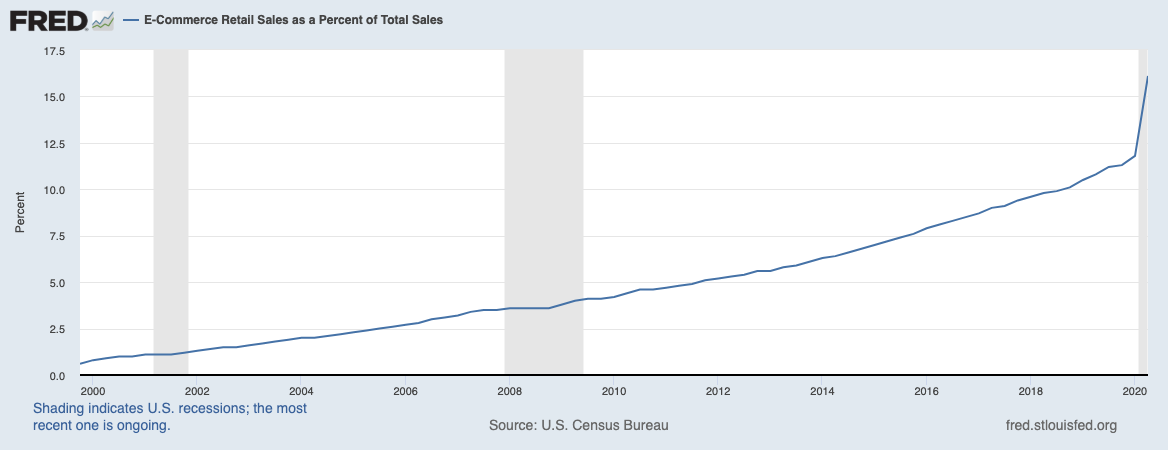

With more people working from home and less people going to the store, this has accelerated the already-strong trend of online shopping. Just check out the graphic below, which highlights just how steady e-commerce sales as a percentage of retail sales has grown.

Only in this case, notice the recessions that are highlighted in gray. E-commerce stalled but didn’t crater. In the 2020 recession, e-commerce sales ballooned.

The Bottom Line

While there will be bumps along the way — as there always is in the stock market — it’s hard to fight a secular trend. That’s particularly true when there are two secular trends in play at once.

This, combined with the most recent quarterly update from management, is why Chewy stock is one to buy the dip. It helps that there have been rumors about a potential strategic partnership, but really, it doesn’t matter. That would be a positive, but not necessary for success.

As of now, consensus expectations call for 40% growth in revenue this year and almost 23% growth in fiscal 2022 (next year). To be honest, I wouldn’t be surprised if this is too conservative. On the earnings front, estimates call for 30% growth this year and an acceleration to 60% growth next year.

It’s just too hard to bet against the long-term trends with this one.

— Matt McCall

Silicon Valley venture capitalist Luke Lango says this little-known Apple project could be 10X bigger than the iPhone, MacBook, and iPad COMBINED! Investing in Apple today would be a smart move... but he’s discovered a bigger opportunity lying under Wall Street’s radar -one that could give early investors a shot at 40X gains! Click here for more details.

Source: Investor Place