I hate to see so many folks buying into the hype and snapping up popular ETFs like the Vanguard S&P 500 ETF (VOO).

Not only are they denying themselves a proper dividend (with VOO, you’d need a $3-million nest egg to generate a liveable $40,000 income stream!), they’re missing out on gains, too.

That’s because this is no longer a market you can simply ride with a passive index fund. We’re now entering a new investment world that requires two things:

- Active management (because the pandemic has sharply split this market into winners and losers) and …

- More income. With the volatility we’ve lived through, I think you’ll agree that a high cash stream, like, say, the 7%+ dividends you get from actively managed closed-end funds (CEFs) provides a lot more safety than here-today, gone-tomorrow paper gains. A diversified mix of CEFs will hand you yields of 7.5% or more, which would let you retire with that $40K income stream on just over $530,000.

Truth is, we’ve seen many CEFs beat S&P 500 index funds in 2020, as volatility rocks just about everything we know about the markets. I expect that trend to continue as the events of this turbulent year continue to split the market into clear winners and losers—something ETFs’ inflexible algorithms simply can’t cope with.

Today I want to go over this development in a little more detail, showing you why now is the time to “swap out” your index funds for high-yielding CEFs.

Something incredible happened in July: US retail spending rose to pre-pandemic levels.

That means there’s just as much money flowing through the economy as if social distancing and shutdowns weren’t impairing consumption.

How is this possible? It’s simply a story of people shifting spending on one thing to another when conditions change.

For instance, when pork falls in price, people will begin eating more pork chops, or McDonald’s (MCD) will release the McRib.

Prices aren’t the only thing that can change consumer behavior. A pandemic, and the limitations it imposes, can do the same thing.

Travel, Luxury Fall Off a Cliff

Source: Refinitiv

Source: Refinitiv

Unsurprisingly, the biggest drop in earnings in the second quarter of 2020 was in the travel sector, where massive losses and bankruptcies are just getting started. We’ve also seen this trend in fashion, which also makes sense. In a world of quarantines and lockdowns, filling your closet with high-quality clothing isn’t top of mind.

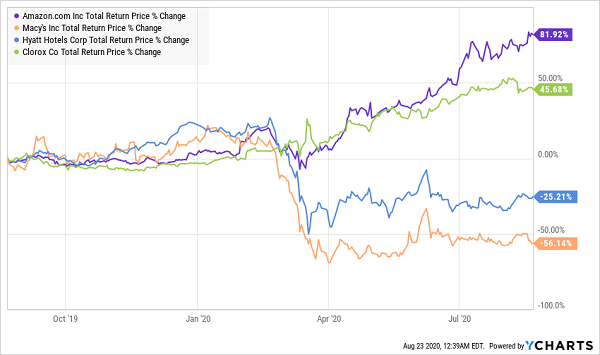

The market is reflecting that reality. Macy’s (M) and Hyatt Hotels (H) are far from recovering, while household-products manufacturer Clorox (CLX) and e-commerce giant Amazon.com (AMZN) are soaring.

Big Winners and Losers in This Market

This chart is exactly why we’re in a stock-picker’s market today: investors who shied away from the clear losers in a pandemic world have been crushing those who simply own an index fund; they’re stuck with duds like Hyatt and Macy’s because the index funds hold them, too.

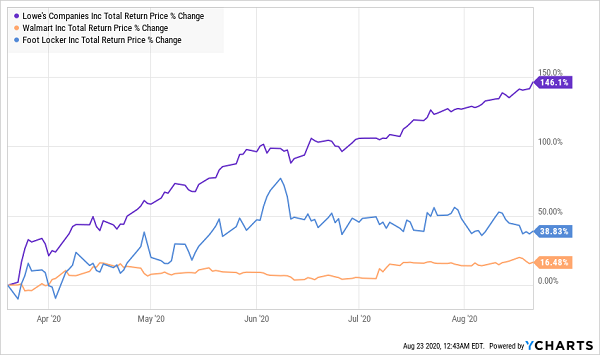

Passive investors were also unable to pivot when it became clear that discretionary items, like athletic wear from companies like Foot Locker (FL) and home-improvement products from Lowe’s (LOW) would suddenly be in high demand, something no one considered in March.

But stock pickers who keyed into that shift brought in strong gains by adding stocks like Foot Locker and Lowe’s, while holding obvious pandemic beneficiaries like Wal-Mart.

The Right Strategy for a Pandemic World

Again, this is something your typical passive investor had no chance to exploit.

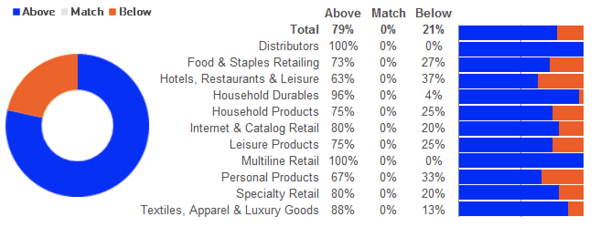

So where does that leave us today? Well, market expectations have largely priced in the lockdown portion of the pandemic, which is why earnings results have beaten expectations even in the worst affected sectors. In fact, travel has had 63% of companies beat expectations, not far behind other sectors.

Expectations Brought to Reality

Source: Refinitiv

For the next few months, to really win in a post-lockdown global economy, you can’t just buy the index funds anymore. The days of easy passive investing are over. Now is the time to be tactical—and doing so through a high-yield CEF is your best option.

— Michael Foster

Yours NOW: 5 Smartly Run CEFs Yielding 8%—With 800%+ Upside [sponsor]

My 5 top CEFs pay you an incredible 8% dividend, on average, and they’re all crushing their benchmarks, too, thanks to their savvy management teams.

In fact, my top pick among this quintet perfectly illustrates the value of professional management. It’s a 9.1% payer run by some of the smartest minds in the pharmaceutical business.

This ignored fund holds drug stocks you know well, like Gilead Sciences, which recently hit a home run by getting its remdesivir treatment approved for COVID-19.

Gilead isn’t the only familiar name you’ll find here—this fund holds many big-cap stocks you’d find in any ETF. But instead of an algorithm, a battle-hardened team of researchers and financial pros from UCLA, MIT and Harvard take personal control of this fund.

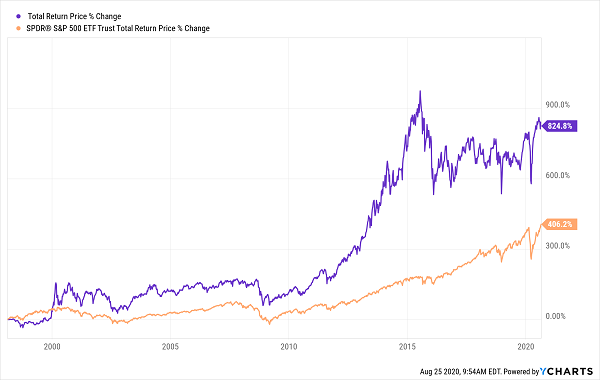

The results show up in its market-obliterating performance since inception:

Active Management: 1; Algorithm: 0

If you’d invested $50,000 in our “hidden” fund 20 years ago, you’d be sitting on a tidy $462,400 in gains and dividends today, compared to just $253,100 with the popular SPDR S&P 500 ETF (SPY).

So you’d have an extra $209,300 sitting in your account right now!

And before you ask, no, this fund is not tapped out. It trades at a totally unusual 12% discount to the value of the stocks in its portfolio, so we’ve still got LOTS of upside ahead. And while we wait for those gains to kick in, we’ll be collecting its outsized 9.2% dividend!

All the profitable details on this fund and the 4 other high-yielding CEFs in this 5-fund “instant portfolio” are waiting for you now. Click here to get everything you need to know: names, tickers, complete dividend histories, my full analysis of each fund’s management and much more.

Source: Contrarian Outlook