Last week, I accomplished something that had been on my “to do” list for no less than three months.

I figured out how to log into my 401(K)!

Well, I’m not embarrassed, just glad that my long personal investing nightmare is over.

What is it about 401(K) access? It’s a circus when we try to log into my wife’s retirement plan, too. (Any task that starts with “logging into her company’s VPN” is off to a rough start.)

Most people I know don’t even bother checking these accounts. Which is probably good (and perhaps a big unintentional benefit of this user unfriendliness!) It is tough to beat the “set it and forget it” rhythm of regular retirement contributions, where dollar cost averaging works in our favor.

That’s what I’ve done with my own 401(K) since we launched the program on April 6, 2016. Others at my firm, unfortunately, were too scared to invest in stocks after the violent selloff in early ’16, so they stuck their allocations in cash—and, sadly, never reinvested!

The dividend growth fund I have plowed 100% of my allocations into, Vanguard Dividend Growth (VDIGX), has meanwhile delivered total returns of 66% since 2016. That’s quite a bit ahead of the near-zero my cash-focused colleagues have generated.

Now I did underperform the S&P 500 in the VDIGX, so my choice was not perfect. But I’m using this real-life example to illustrate two key points.

First, when in doubt, invest in equities, not cash. The stock market goes up two-thirds of the time. If it’s a roll of the dice, it is weighted in our favor. Plus, the dealer (the Federal Reserve) really wants us to win, so much so that “the house” is currently buying corporate bonds and ETFs and may soon buy stocks!

My second point is that most mutual funds are flawed. VDIGX is a well-run fund and so popular that it closes itself to new money from time to time. But you and I can do better, simply by cherry picking the current holdings of VDIGX.

Heck, we can even buy the stocks on the fund’s watch list and beat manager Donald Gilbride to the punch!

I agree with Don on his top holding, UnitedHealth (UNH). The company just delivered a generous 16% dividend hike in June, but its stock hasn’t moved much. When a payout pops yet its price stalls, it’s often a reliable signal that the stock is a buy.

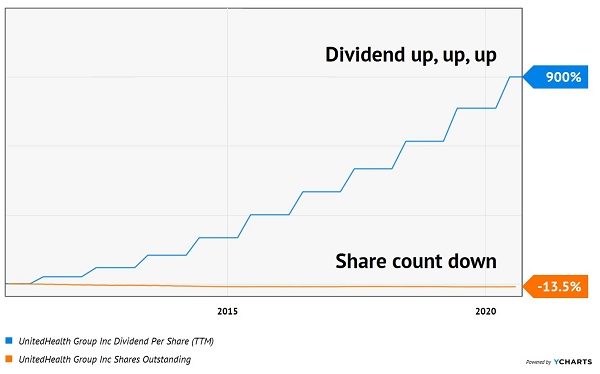

Now, UnitedHealth is rarely “cheap” by traditional measures. Yet it regularly makes long-term investors money, thanks to its ever-rising dividend and shrinking share count:

UNH’s Dividend Moonshot

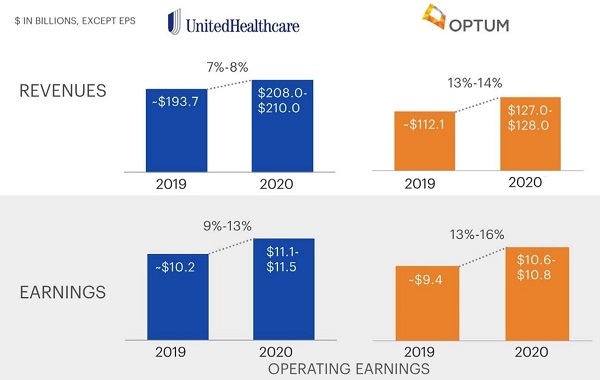

Of course, perennial dividend growth isn’t simply due to good fortune. In 2011, UnitedHealth had the foresight to start its own technology driven “Optum” unit. Optum provides pharmacy benefits, runs clinics and supplies data analytics and other cutting-edge tech to streamline healthcare.

The Optum business is booming. It now accounts for nearly half of UnitedHealth’s overall profits!

With Optum growing faster than the firm’s legacy business, this is a sweet inflection point to step in as a buyer. Good job, Don.

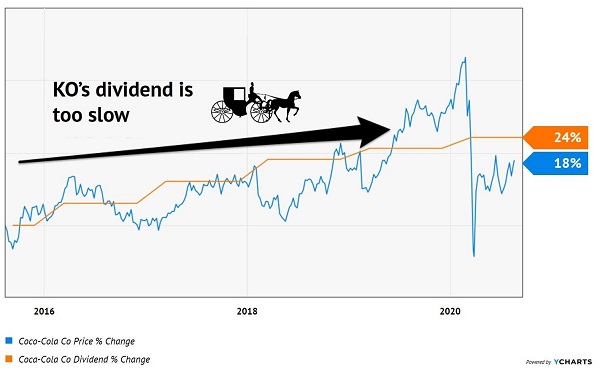

But, my man, you are killing me with holding number four! Coca Cola (KO) is no longer the growth blue-chip that Warren Buffett made his money on back in the day.

Its dividend is rock solid but that’s part of the problem—it also rolls slowly like a rock. Coke’s payout has increased by just 24% over the last five years, which is simply not enough to make shareholders any money.

Remember, over the long haul, stock prices move with their payouts. They are attracted to them like “magnets.” Check out the orange line below, which represents Coke’s dividend moving like molasses uphill. It is the “anchor” for which the blue line (Coke’s stock price) will swing above and below, but always come back to:

Coke’s (Slow Moving) Dividend Magnet

I suppose we can give Don credit for at least owning KO when its blue line (price) is below its dividend. Earlier this year, the stock had really overshot its payout, a sign shares were due for a pullback (which is exactly what happened.)

Since late 2019, I’ve told anyone who would listen or read that Coke was overpriced. Don, if you owned it then, I don’t want to know about it! (Remember, I couldn’t log in to check my statement.)

So, what’s next for me? I am looking into a rollover IRA, which would give me more control over the capital. But who cares about me! Let’s talk about someone more interesting: you.

If you have some money you are looking to put to work today, then you can do better than my 401(K). It’s a simple two-step formula:

- Target the dividends that are growing the fastest (more like UNH than KO), and

- Buy them when their stock prices lag their payouts.

It’s really the easiest way to make money in the stock market. Just find a dividend growing by double-digits, buy it at a discount, and you have a formula for safe 10% to 15% returns per year or better.

— Brett Owens

Sponsored Link: But there is one more thing! This being 2020 and all, we are slipping into a recession that has already put 2008 to shame and may eventually challenge the Great Depression itself. Which brings me to step three:

Make sure the dividends identified in steps one and two above are recession-proof.

UnitedHealth certainly qualifies. It is a battleship, the largest health insurance carrier in the US.

A “cell phone tower” landlord would also qualify. After all, no recession is going to take everyone’s precious phones away from them! My favorite cell traffic landlord is structured as a REIT (real estate investment trust), which means it pays a fat and growing dividend on this megatrend.

Plus, the firm’s economics scale beautifully once the towers are built. The landlord is able to support an additional tenant simply by bolting additional equipment to an already-built tower. Its return on investment (ROI) jumps with each additional tenant per tower—from 3% with just one tenant, to 24% with three tenants sharing the same tower!

And since the company is structured as a REIT, the bulk of its extra profits flow directly into our pockets in the form of higher payouts. We’re collecting a dividend today that’s 39% higher than the one we bought less than two years ago, and the cash is really starting to roll in with each additional tenant…

So…Would I add new money to UnitedHealth today?

Or buy the cell phone tower landlord for 100% upside?

Or both?

Ask me this Friday, when we deliver our full Hidden Yields best buy list to subscribers’ inboxes. At that time, we’ll also discuss one of this country’s finest unknown entrepreneurs. His obscurity is our benefit, because his dividend growth stock is simply too cheap! I wish Don would buy it—perhaps you can tip him off.

If you’re reading this, you are not a current Hidden Yields subscriber. But I have good news for you—it’s not necessary to wait until Friday to get my seven best buys! Click here to read my seven favorite recession-proof dividend growth buys, including stock names, tickers and target prices.

Source: Contrarian Outlook