This article first appeared on Dividends and Income.

Tens of millions of Americans are unemployed due to the COVID-19 pandemic … and things were bad enough for those folks even before the Senate went on vacation without extending the now-expired financial stimulus plan.

As a result, far too many U.S. residents can’t afford essentials such as food, health care, gasoline, clothing, child care and rent.

That goes for landlords who rent a single apartment all the way up to corporations that own, develop and/or manage thousands of multi-family units.

With that as a backdrop, my most recent selection for our Income Builder Portfolio was Essex Property Trust (ESS) — a real estate investment trust that specializes in high-end, West Coast apartment buildings.

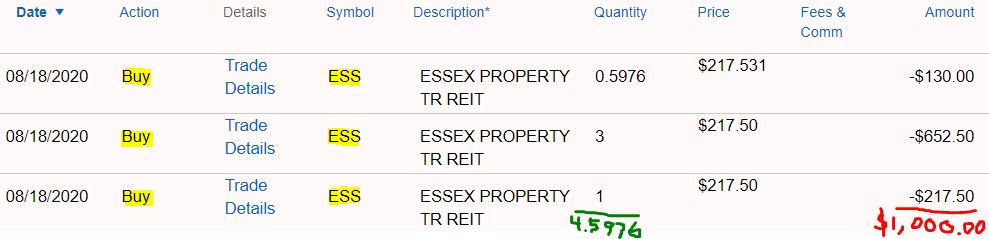

On Tuesday, Aug. 18, I executed purchase orders on Daily Trade Alert’s behalf for $1,000 worth of ESS stock.

I used a limit order to buy the first 4 shares at $217.50 apiece. (That order was executed in two parts, a split-second apart, as sometimes happens with limit orders.) I then used Schwab Stock Slices to purchase the rest of the stake.

As I explained in my previous article, the second quarter was rough for those in the apartment-renting business. For Essex, delinquencies accounted for nearly a $10 million decline in second-quarter revenues compared to Q2 2019.

So why did I choose ESS now, instead of when COVID-19 is under control (whenever that might be)?

Well, if I wait until then, shares figure to be much more expensive.

Essex still could face more pain ahead, or maybe things already are on the upswing.

Trying to find a bottom is folly, so I’m content having found an attractive entry point for a company I consider well-run and likely to have a strong recovery when conditions improve.

Valuation Station

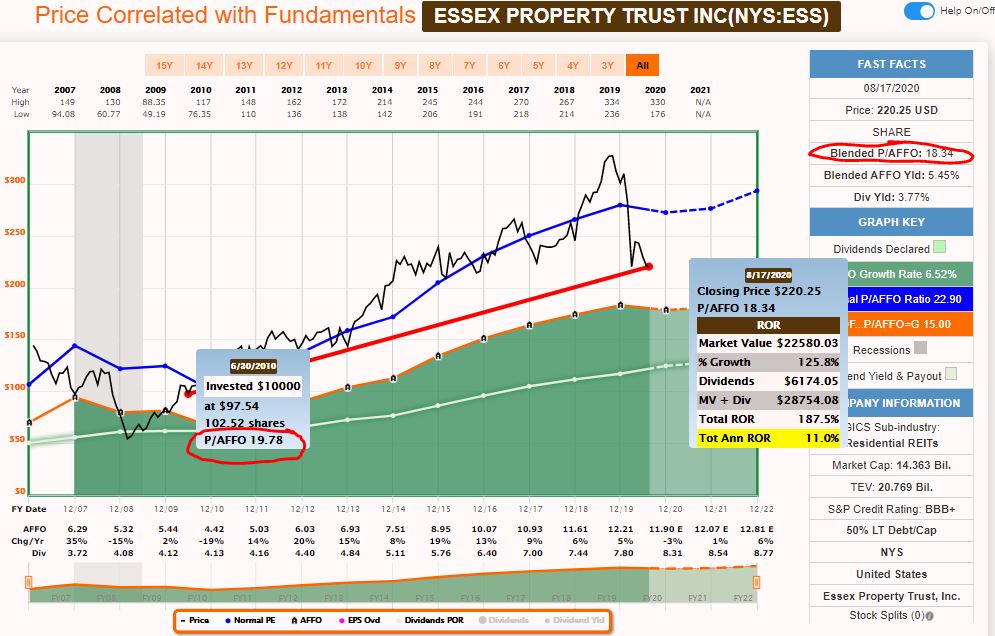

The following image from FAST Graphs tells an interesting story: The blended price-to-adjusted-funds-from-operations ratio was 18.34; before the pandemic arrived, Essex Property Trust’s P/AFFO ratio had not been under 20 since June 2010.

So we’re talking about a company that is quite cheap compared to its own outstanding history.

Despite the troubles for landlords (and their renters), Morningstar Investment Research Center decided after Essex’s Aug. 3 earnings call to maintain its fair-value estimate at $307/share — meaning ESS is trading at a steep discount.

Said Morningstar analyst Kevin Brown:

While Essex’s operations were significantly affected by lower occupancy and delinquencies on rent payments, there are signs from July’s results that the third quarter will be better. First, occupancy at the end of July improved to 95.8%, which will contribute to positive third-quarter revenue growth if that holds up for the rest of the quarter. Second, the impact of rent delinquencies is starting to reverse in the third quarter. July delinquencies are down to 2.7% of rent, and management said on the call that 18% of the portfolio is now seeing back payment of rent exceed rent delinquencies. If these trends hold up, we believe that the third quarter will fare much better than the reported second-quarter results.

Value Line has forecast a 3-5 year target range of $280 to $415 for Essex, suggesting significant appreciation ahead.

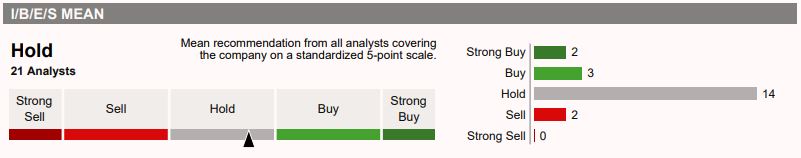

Still, market-watchers tracked by Fidelity believe ESS is a “Hold” right now. That’s understandable, as most analysts don’t get bullish until stocks gain price momentum.

Fidelity.com

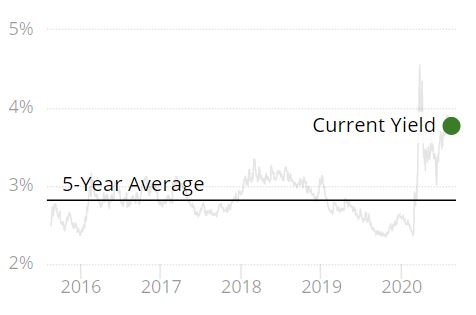

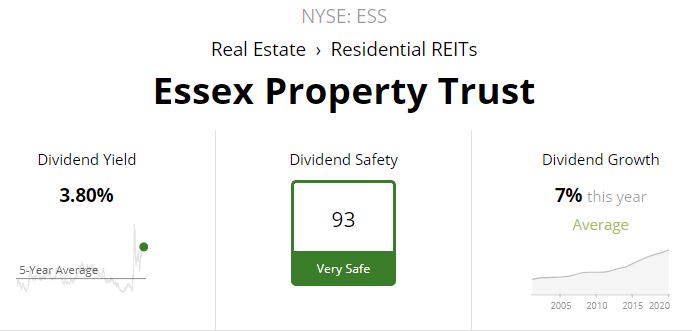

Simply Safe Dividends says Essex appears quite undervalued because its current 3.8% yield is considerably higher than its 5-year average of 2.8%.

Indeed, aside from in March, when the overall market crash saw ESS’s price plummet, that 3.8% yield is the company’s highest since it went public in 1994.

And Speaking Of That Dividend …

Essex is one of only six REITs to receive a “safety” score of 90 or better from Simply Safe Dividends.

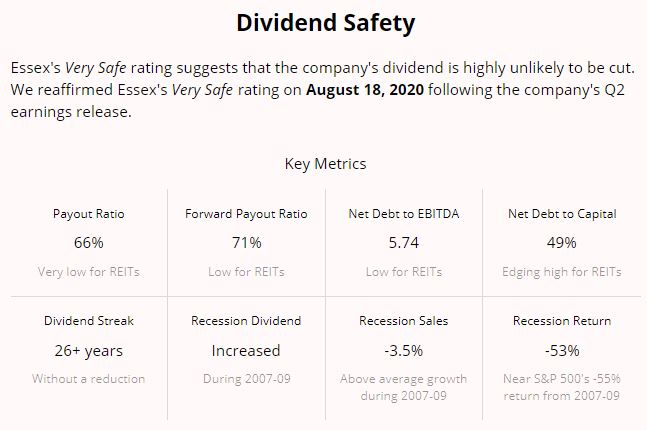

Here are some of the metrics SSD cited in assigning the 93 score to ESS, a Dividend Aristocrat that has raised its payout annually for 26 consecutive years:

Essex will pay its next quarterly dividend of $2.0775/share in mid-October, so the Income Builder Portfolio’s 4.5976-share position will generate $9.55 in income.

As mandated by the IBP Business Plan, that dividend will be reinvested right back into ESS stock and will buy about .044 of a share more. Then, in mid-January, the new 4.64-share position will bring $9.64 in income into the portfolio.

This process will continue for years, not only with ESS but with each of our 35 positions — that’s how an income stream gets built, and that’s how we came up with the name for this endeavor.

Wrapping Things Up

Unfortunately, nobody rings a bell to tell investors when it is the perfect moment to pile into a stock.

So when the market presents buying opportunities for companies I have vetted, I usually am more than happy to take advantage

The coronavirus pandemic has depressed Essex Property Trust’s price enough to make it pretty attractive here.

Could it end up going lower, perhaps even much lower?

Certainly. And if that occurs, and if I still believe the company is fundamentally sound, I might take advantage of that new opportunity to get still more ESS for the Income Builder Portfolio.

— Mike Nadel

Marc Chaikin built the system that isolated NVDA before it became the best-performing stock of 2023. Click here to get his latest buy. More here.

Source: Dividends and Income