I get to interact with hundreds to thousands of individual investors, and I have observed that many investors are not aware that shares of closed-end funds (CEFs) are not the same as common stock shares. CEFs are risky in a separate and distinct way from common stock risks.

Many don’t understand that these are funds that trade on the stock exchanges, and not shares of individual companies. Investors buy or sell CEF shares through the stock exchanges, the same as with common stock shares. Yet, these are not stock shares!

A CEF is a fund, similar to a mutual fund, except that after shares are issued, the fund sponsor will not redeem them for investors.

Here are some of the CEF dangers to be aware of before you invest in one of these funds.

Many CEFs use leverage to boost returns.

The problem is that leverage cuts both ways, and when the market crashes as it did earlier this year, the leverage can destroy investor capital.

The problem is that leverage cuts both ways, and when the market crashes as it did earlier this year, the leverage can destroy investor capital.

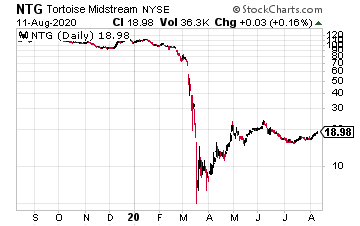

The Tortoise MLP Fund (NTG) shows how much leverage can hurt.

This fund was about 40% leveraged in January 2020, with a split-adjusted share price of $115. The NTG shares now trade for $18.66—an 85% loss—and the leverage has skyrocketed to 75%.

For comparison, the Alerian MLP ETF (AMLP), which doesn’t use leverage, is down 40%, or half as much due to the pandemic-caused stock market crash.

CEF shares can trade at a premium or discount to NAV.

The net asset value (NAV) of a fund’s shares is the true or liquidation value of one share. Because CEF shares trade on the stock exchange, they can sell for more or less than NAV. While buying a CEF at a discount could be a benefit; to purchase shares with a big premium is a guaranteed money loser.

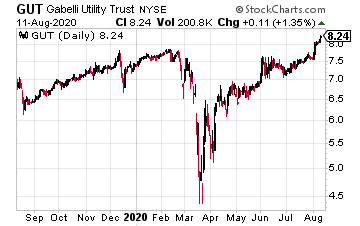

The popularity of the Gabelli Utility Trust (GUT) has this well-managed fund trading at a 99% premium to NAV.

The popularity of the Gabelli Utility Trust (GUT) has this well-managed fund trading at a 99% premium to NAV.

The premium means if you buy shares of GUT, you are paying almost $2.00 for $1.00 of assets.

The only reason someone would pay double for an asset is that they don’t understand what they purchased. Stay away from CEFs trading at significant premiums to NAV.

A CEF may employ a managed distribution policy.

Fund rules allow CEFs to even out dividend payments with a “managed dividend policy.” This feature lets a fund estimate its annual portfolio income and then pay it out as level monthly or quarterly dividends. Problems arise when the portfolio does not pay out as much as was estimated.

The fund manager may choose to continue the dividend rate instead of cutting the dividend to match the actual portfolio income. The policy leads to dividends that actually return investor capital and not earned income. With the return of capital, you are getting your own principal back and not earnings on your investment.

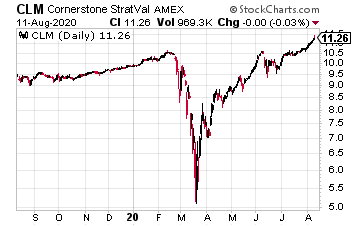

The Cornerstone Strategic Value Fund (CLM) attracts investors with monthly dividends and a 20% annual yield. Unfortunately, out of the current $0.185 per share monthly dividend, $0.1044 has been classified as a return of capital.

The Cornerstone Strategic Value Fund (CLM) attracts investors with monthly dividends and a 20% annual yield. Unfortunately, out of the current $0.185 per share monthly dividend, $0.1044 has been classified as a return of capital.

More than half of that high yield is a return of your own money. The long term results for CLM tell the tale. Over the last ten years, the fund has generated an average annual return of just 1.64%.

If the dividends were reinvested, the yearly return increases to 5.7%. That’s far short of the 20% CLM investors were expecting.

— Tim Plaehn

After researching income stocks for over 30 years, I've come up with a one of a kind dividend portfolio. With the right 20-30 stocks, you can collect a dividend check every single day the market is open. That's over 260 dividend checks per year. Click here for the names of these 20+ stocks.

Source: Investors Alley