This article first appeared on Dividends & Income.

Do you dream of living off of dividends at a young age?

Want to know what that looks like for someone who’s actually doing it?

Would you like to find out how much dividend income I earned last month?

I’ve been producing content about dividend growth investing, achieving financial independence, and living off of dividends since 2011. That’s almost 10 years.

I had two big goals in mind when I first started.

My main goal was to achieve financial freedom by putting myself in a position to live off of dividends at a young age.

And I accomplished that goal in 2016 at the age of 33.

My second goal, which was almost as important to me, was to inspire others to do the same for themselves.

And inspiring YOU is what it’s all about!

I’m going to reveal to you viewers today exactly how much dividend income I earned last month, in June 2020.

Either way, keep something in mind.

I built this passive dividend income after growing up on welfare in Detroit, and without a college degree or a high-paying job. And I didn’t even get started until I was already in my late 20s.

Yet here I am, in my 30s, living off of dividends.

If I can do this, anyone can do it. That includes you.

There’s no hype here. Just real money from a real guy who’s navigated real challenges.

Let’s get into it.

Before I give you the number, let me say that I started building my portfolio in early 2010.

After getting laid off during the depths of the Great Recession, finding myself unemployed and broke, I was determined to never be in that kind of position again.

I needed financial independence in my life so that I wasn’t reliant on fickle employers.

So I developed a plan to get a new job, live below my means, and start investing.

Once I found a job, I was only making about $40,000 per year. But I was living super frugally so that I could leverage that income.

I had to then invest the savings. And I chose as the BEST strategy to accomplish my goal.

This strategy involves buying and holding shares in world-class enterprises that are paying reliable and rising cash dividends to shareholders.

These rising dividends are funded by rising profit, because these are the businesses that are keeping the world turning.

Think companies that provide electricity, produce toothpaste, sell food, and make medicine.

After a number of years of intelligently investing in high-quality businesses at attractive prices, I built a portfolio large enough to support my living expenses.

I call that portfolio the FIRE Fund, because it provides me with the ability to be financially independent and retire early.

And I’m very proud of this fine collection of businesses.

And I’m very proud of this fine collection of businesses.

How much dividend income did the FIRE Fund generate on my behalf in June 2020?

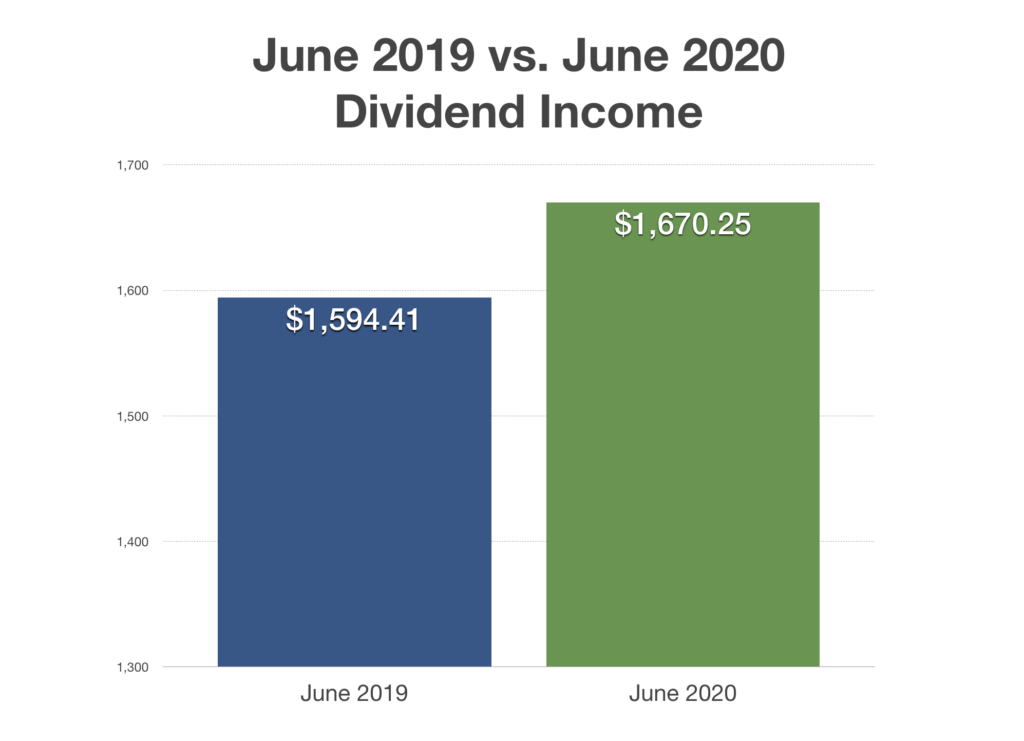

$1,670.25.

That total was made up of 62 different businesses paying me a dividend.

Sure beats relying on ONE paycheck from ONE employer .

I feel incredibly grateful to collect that kind of income without lifting a finger. I’m very fortunate.

Again, this kind of passive dividend income doesn’t come about overnight.

It does take patience and persistence. If you save and invest with diligence and discipline, you WILL become wealthy and free.

And I’ll say this: All of the hard work is worth the result. Long-term freedom is worth any kind of short-term, so-called “sacrifice”.

Being able to do WHAT you want, WHEN you want, WHERE you want is priceless.

Notably, and perhaps surprisingly, this June’s dividend income is actually HIGHER than the dividend income tally for last June.

In June 2019, I earned $1,594.41 in dividend income.

So that’s 4.8% YOY growth.

Sure, not massive growth. But with 2020 being so difficult with a lot of dividend cuts and temporary dividend suspensions in the wake of the global pandemic, I’ll take inflation-beating dividend income growth any day of the week.

Of course, I did buy some stocks over the last year.

But the portfolio is at a size now to where its organic dividend growth really does a lot of the heavy lifting.

This is how a dividend growth snowball works.

You gather a small pile of capital as your initial snow, then you roll that up and start to roll it downhill with additional capital and dividend reinvestment along the way. Before you know it, you’ve got a massive snowball rolling – and ACCELERATING – all by itself.

Then you can sit back, let that money work for you as the snowball rolls, and go about your life as you please.

That’s the beauty of compounding. That’s the beauty of financial freedom.

I hope you found inspiration and value in the revealing of my real-life dividend income result from June 2020.

— Jason Fieber

P.S. My six-figure portfolio, which I call the FIRE Fund, generates enough passive dividend income for me to live off of. It allowed me to retire in my early 30s. I’ve made my portfolio entirely accessible over at Patreon – and I post alerts there whenever I buy or sell a stock. I put my money where my mouth is and am often invested in the same high-quality dividend growth stocks that I write about.

Over the years, I’ve heard from thousands of investors who have been profiting from many of the same exact stocks I own. So if this sounds like something you think you could benefit from as well, check out this link to see my portfolio and start getting my buy and sell alerts.

The goal? To build a reliable, growing income stream by making regular investments in high-quality dividend-paying companies. Click here to access our Income Builder Portfolio and see what we’re buying this month.

Source: Dividends and Income