With pandemic cases once again in full focus, the market is (once again) trading like its assets. Everything’s up big one day, everything’s down big the next.

We rational, contrarian-minded income investors however know that the stock market is indeed a “market of stocks.” It doesn’t make sense for everything to trade “as one.” We should look to buy the underappreciated, underowned dividends on these dips.

Most investors don’t consider income from small caps.

These companies don’t attract the eyeballs that mega-cap tech firms and well-known consumer brands do, so analysts and the media typically avoid the small-cap space, even in good years.

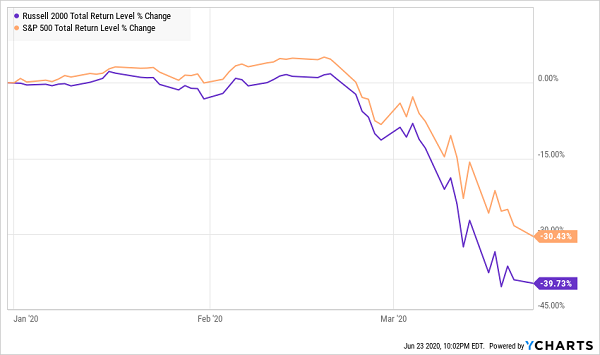

The pandemic bear market crushed small caps. Some of these payouts, however, deserved to be preserved:

The Russell 2000 Lagged on the Way Down

But a lack of analysts and mainstream attention is a good thing. It means it’s easier to find deals! A 2016 study in the Financial Analysts’ Journal confirmed this:

First, high-dividend stocks have the least risk, yet return over 1.5% more per year than non-dividend payers. Second, the benefit of targeting dividend payers is conditional on investment style. Surprisingly, the benefit is largest for growth and small-cap stocks; the very firms that are usually thought to benefit the most from the reinvestment of cash flow.

Yes, there are nearer-term risks to worry about. Small caps are likely to be more volatile in the short term. Dividend cuts are a threat, too. I’ve written previously about the hacking and slashing done in the S&P 500, and small caps are in an even leakier boat, given their scarcer resources and an understandably stingy lending environment.

But by identifying the dividend-growth stories among small firms, like I have, you have a better chance of selecting stocks that can weather the rest of this downturn and come out roaring.

Let’s dig into three well-above-average small-cap dividend yielders to see if any of these under-loved, under-covered plays have legitimate potential.

Community Healthcare Trust (CHCT)

Dividend Yield: 3.8%

Community Healthcare Trust (CHCT) is a diversified healthcare real estate company that hasn’t yet cracked the $1 billion mark. But it’s heading that way, and quickly.

CHCT’s portfolio includes 124 properties across 33 states. The single-largest slice of the portfolio pie is medical offices, at about 30% of annualized rent, but it also owns behavioral facilities, inpatient rehab facilities, surgical centers and several other property types. No single tenant makes up more than 10.5% of rent.

This is a growth dynamo in every conceivable way.

It’s gobbling up other properties, to the tune of seven acquisitions as of its May investor presentation. Adjusted funds from operations (AFFO) have been on the rise for years; Q1 2020 came in at 49 cents per share—versus 40 cents in ’19, 39 cents in ’18 and 38 cents in ’17.

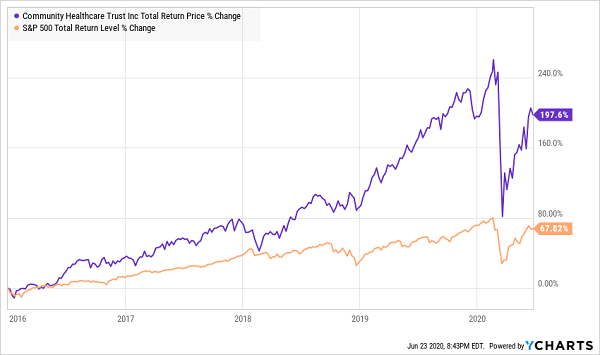

That in turn has resulted in a phenomenal total return that’s roughly triple the S&P 500 since its 2015 initial public offering.

This Little REIT Packs a Mighty Punch

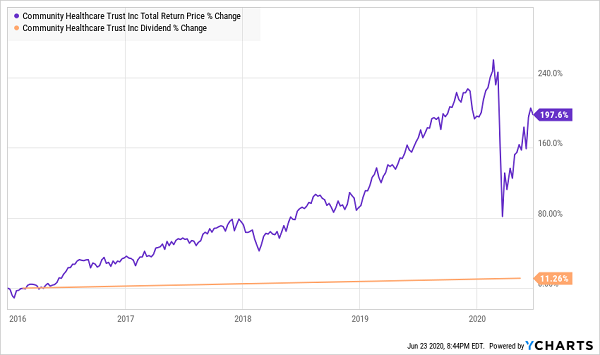

There’s just one “growth” area where CHCT doesn’t yet blow me away: its dividend curve.

But There’s Not Much Dividend Growth to “Catch Up” To

Now I have a great deal of a respect for a company that has raised its dividend every quarter since going public. But the rate has been on the sluggish side—the “hazard” (if you want to call it that) of conservative management that prioritizes dependability over jaw-dropping yields.

That, and the middling yield, make me hesitant to rush into CHCT while it’s trading for nearly 23 times its AFFO. But a dip on a broad-market scare would be a blessing.

P.H. Glatfelter (GLT)

Dividend Yield: 3.6%

Engineered materials supplier P.H. Glatfelter recently announced that it would raise its dividend for the first time since early 2017. It’s a modest 4% uptick, due out in August, but considering the environment, that’s a bull signal asking for a deeper dive.

The company’s roots go back to 1864 as a paper maker, and at one point boasted the world’s largest paper machine. It eventually expanded into packaging and other engineered materials—coffee filters, wipes, feminine hygiene products and even medical face masks.

But this is a case where the ticker really tells the tale.

Optimism for Glatfelter Is Paper-Thin

In 2018, GLT unloaded its increasingly struggling Specialty Papers unit to focus on engineered products. The division’s operating profits had declined in five of the six years preceding the sale.

Since then? Well, the GAAP numbers have been red for three years, primarily because of accounting issues related to the Specialty Papers divestiture.

But if you look at the continuing operations, things start to look up. 2019 adjusted profits jumped to 75 cents per share from 21 cents in 2018. The first quarter of 2020 saw adjusted profits from continuing operations rocket 50% higher to 24 cents per share. And analysts see overall adjusted profits climbing just 3% this year, but accelerating to 20%-plus growth in 2021.

It’s difficult to get overly optimistic about a breakout just given GLT’s flat trading for so long. But given the recent dividend hike, it’s worth keeping an extra eye on the stock for additional signs of positivity that would signal a true breakout.

NexPoint Residential Trust (NXRT)

Dividend Yield: 3.6%

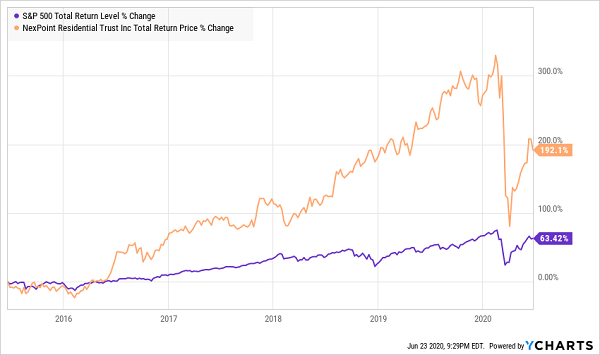

Right off the bat, multifamily REIT NexPoint Residential Trust (NXRT) has a chart similar to CHCT that can’t help but catch one’s attention.

Fortunately, here again we find there’s a real growth story backing this up.

NexPoint owns 38 multifamily properties spanning 14,300 units across seven states in the Southeast and Southwest. As of June, the portfolio (excluding one property, Cutter’s Point), boasted a 94.5% occupancy rate. NXRT targets markets that have attractive job growth, high costs of ownership, elevated or increasing construction or replacement costs for multifamily real property, and other traits that, to put it bluntly, make it worth NXRT’s time to invest.

And invest it does. During Q1, it renovated the interiors of more than 6,900 units and boosted rents 11.1% on average over the prior lease rate. NexPoint says it achieved a 24.6% return on investment. AFFO for the quarter climbed 12% to 59 cents per share.

That continues a multiyear run of profit growth for the company. Full-year AFFO has grown without interruption for years, from $1.41 per share in 2015 to $2.20 per share last year. That has helped fund annual dividend hikes totaling a respectable 52% in that time, and there’s likely more where that came from. Q1 AFFO was nearly twice what the company needed to cover its dividend.

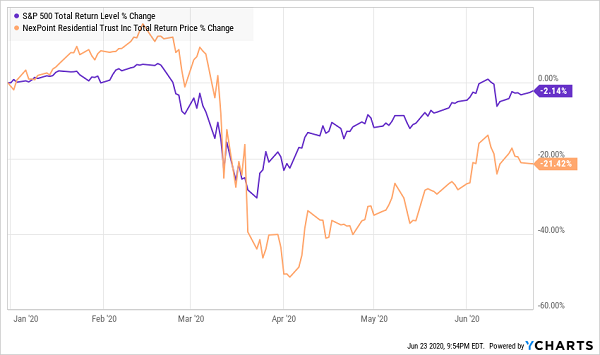

Interestingly, NXRT remains off 21% this year—an understandable underperformance vs. the market given concerns about employment and thus Americans’ ability to pay rent.

NexPoint Is Telling a Familiar Residential REIT Story

The upside for new money, though, is that this otherwise growth-friendly REIT is trading for just 15 times AFFO.

This ultimately becomes a bet on just how quickly you think the American economy will rebound. A slower recovery could start to dog residential REITs of most shapes and sizes, while a rapid snapback could lead NXRT and others to close this performance gap in a hurry.

— Brett Owens

Don’t Let Wall Street Destroy Your Retirement Again [sponsor]

While these dividend growers may not be ready for your investment dollars right away, you can still secure sky-high yields right now—backed by solid financials, so you know they won’t disappear in this recession or the next—by snapping up the stocks that my latest research has revealed:

I call them my “Dream Retirement Picks.”

The steps revealed in this exclusive new briefing will help you clean house and put you ahead of your original retirement timeline. I’ll show you…

- Why you should dump your blue-chip stocks, and which ones to sell.

- 4 Contrarian income plays yielding up to 15%.

- How to REALLY invest like Warren Buffett for safe, stable income.

These three steps, which you can put to work right away, will transform any underperforming, income-light retirement into a perennial cash machine that will deliver the goods in any market cycle.

Imagine collecting $75,000 on a mere half-million nest egg…

…actually, stop. You don’t have to imagine it. It’s real, tangible income that you can expect to collect from one of these dividend dynamos if you jump in at my buy-under price.

Click here to overhaul your portfolio with my “Dream Retirement Picks” — including 4 contrarian income investments yielding up to 15% a year!

Source: Contrarian Outlook